VANCOUVER, BC / ACCESSWIRE / November 21, 2024 / Ibero Mining Corp., (TSX.V:IMC)(OTCQB:AUCCF) (the "Company" or "Ibero") formerly known as EuroPacific Metals Inc., is pleased to report that the a deep undercut drill hole number 11 drilled at Miguel Vacas has confirmed the depth extensions of the known mineralization having intercepted 19.9 m grading 0.89 % Cu, including 5.0 m grading 1.35% Cu and 6.2 m grading 1.11% Cu. This will open new frontiers to the existing resource basis.

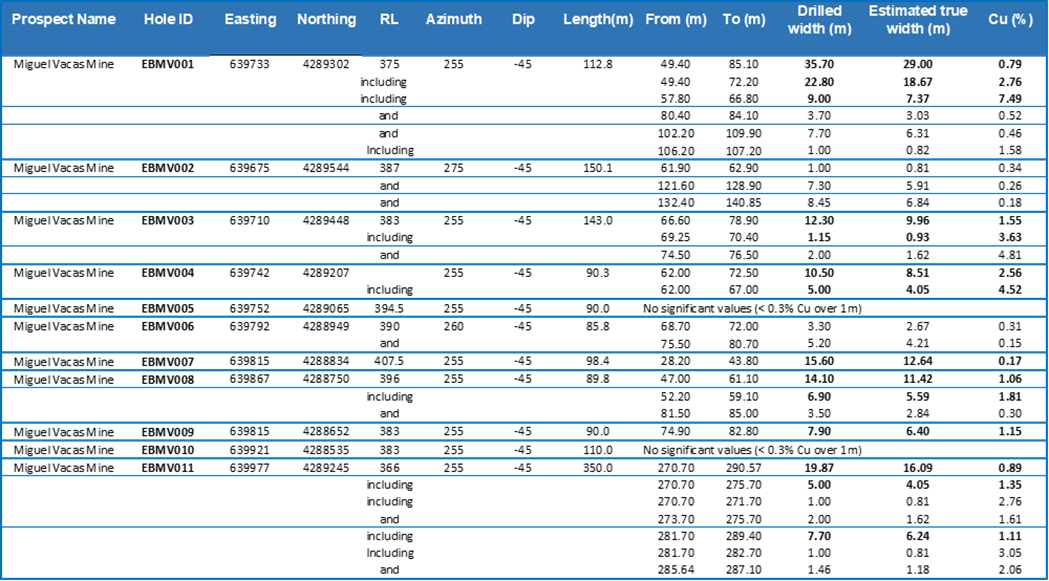

Highlights of the drill campaign to date are listed below (see table 1 for complete listing):

Hole # 1 - 22.8m grading 2.76 % Cu, from 49.4m with 9.0m grading 7.49% Cu from 57.8m

Hole # 3 - 12.3m grading 1.55% Cu, from 66.6m.

Hole #4 - 10.5m grading 2.56 % Cu, from 62.0m, with 5.0m grading 4.52% Cu, from 62.0m

Hole #8 - 14.1 m grading 1.06% Cu from 47.0m, with 6.9m grading 1.81% Cu, from 52.2m

Hole #9 : 7.9m grading 1.15% Cu from 74.9m

Hole #11 - 19.9m grading 0.89% Cu from 270.7m, with 5.0m grading 1.35% Cu from 270.7m and 7.7m grading 1.11% Cu from 281.7m

Karim Rayani Chief Executive Officer commented: "Now that we have all the data in we are aggressively working towards the immediate start of our second phase of drilling planned for early year at the Miguel Vacas Copper Mine. This last deep undercut hole signifies potential of the Zone all while adding 2km of strike to focus in on. We now have a general idea of the depth extension and have added thickness on zone from 5 meters to 30 meters. This is partly due to modern core recovery methods, namely by using the triple tube Triplex system. We look forward to reporting back once we have confirmed the start date for phase 2 drilling."

Highlights from hole 11 included 19.9m grading 0.89% copper starting at a hole depth of 270.7m. Of considerable interest are the high-grade sulphide zones within this interval which are summarized and highlighted in the table below. These high-grade zones of 2.76% and 3.05% Cu may remain open along strike and at depth and further delineation to further define the extents remain a priority exploration objective.

Jose Mario VP of Exploration comments, "We are very pleased with the deep undercut hole which confirmed the depth extensions of known mineralization. Field observations confirm extensions of the system to more than 2kms, and only a fraction of this total strike length has been drilled. We are diligently planning our next drilling program to complete a more formal calculation of the known resources. Given the consistency of the mineralized grades, we are targeting a deposit potential of more than 20Mt from near surface to approximately 200m in depth."

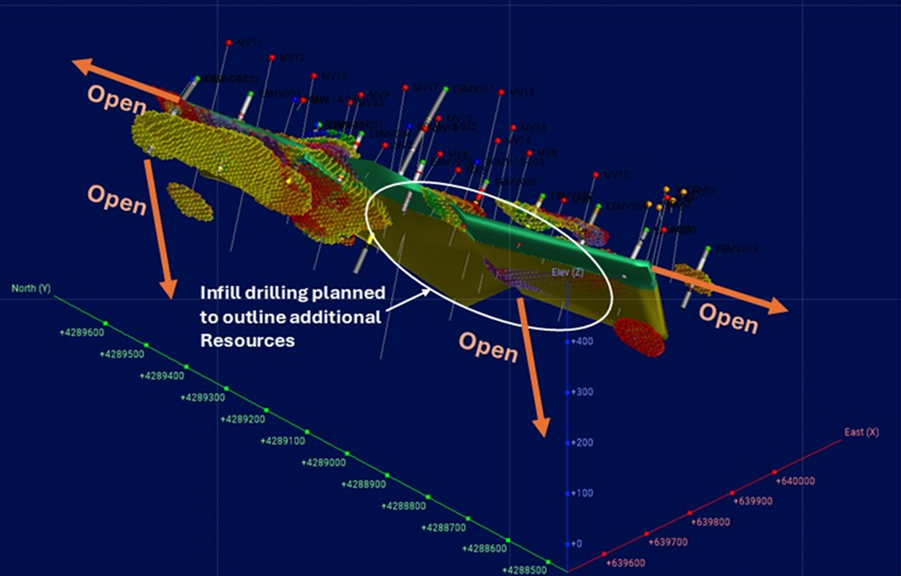

Results have been received for all eleven holes drilled to date. All holes have successfully intersected a wide breccia zone over a total strike length of 1.1km and this new drilling has expanded the known mineralized horizon considerably and confirmed it is open at depth and along strike both to the north and south.

The Company is planning further ground IP to assist with mapping and further delineation of these zones at depth and to help to further define the lens below the oxidative blanket at 150-300 meters.

To date the mineralized system has been mapped for over 2km, and only a fraction of this total strike length has been drilled. Given the consistency of the mineralized grades, the company looks forward to announcing our second phase of exploration drilling for the new year. We are diligently working towards an upgraded target potential of 20Mt.

Miguel Vacas, Prospect - Borba Property, Portugal

This tenement includes a folded sequence dated from the Precambrian to the Devonian. A large anticlinorium occupies the central area with the Precambrian core flanked by Ordovician metavolcanic and metasedimentary rocks including high-quality marble that is being mined extensively in the area. This sequence is covered by Silurian metasediments with shales, graphitic pellites and siltstones. A Devonian turbidite unit made up of grey shales with interbedded fine to coarse grained greywackes occurs in the W part of the exploration block.

The Miguel Vacas mineralization occurs within the Silurian rocks and consist of a wide quartz-carbonate vein/breccia system oriented N-S, with satellite steeply dipping tabular bodies hosted in altered black -grey shales and black cherts (silicious lutites). The main mineralized zones consist of a shallow (< 80m deep) oxidized blanket with secondary copper minerals, including Malachite [(CuCO3Cu(OH)], Libethenite (Cu2OHPO4), Crisocola (CuSiO3,2H2O), Atacamite (Cu2OHCl), Covelite (CuS) and rare Azurite[Cu (CO3)2(OH)2].

Below the oxidized blanket at approximately 80m the paragenesis changes to a primary assemblage which includes essentially chalcopyrite, pyrite and chalcocite and minor sulphosalts that is open at depth.

Recent exploration results have indicated a potential > 2km strike extension of the Cu-bearing shear corridor in a zone of strongly brecciated and deformed quartz-veined black shales and cherts.

A preliminary evaluation of the Miguel Vacas copper mine was made based on data that was found from the old files from the Mines Department. This mine was closed in 1986 due to bankruptcy after having produced 464,100 t of ore with an average grade of 2.1% Cu.

Rio Narcea made an in-house resource exercise based on a 100 x 100m drilling campaign (20 holes in total), using the basic Tysson Polygon method. Results point out to a resource of 5.54 Mt with a total of 68,186 tonnes Cu metal. This exercise was done on a section of ca. 1km of the total recognized strike extension to the mineralization which exceeds 2km.

Ibero Mining has completed a 1,060 meters drilling campaign at Miguel Vacas copper mine with a total of 11 holes in 2024 with assays reported. Most of the holes intercepted a wide quartz-breccia zone varying from approximately 5 meters up to more than 30 meters thick. Assay results improved significantly from previous drilling in part due to better recoveries obtained using the TRIPLEX system.

Highlights of these results are included below.

The strike extensions of this mineralized zone have only been partially drill-tested within a mineralized area encompassing over 1100m x 250m. Preliminary deposit modeling which has been undertaken by Spanish contractor Astur Mining and is not considered 43-101 compliant suggests an inferred resource of 4.9MT @0.9% Cu within an extensive mineralized target zone of over 12.8Mt. Detailed in-fill drilling within this target zone is planned for 2025 and it is anticipated the entire area will move into the inferred category.

Ibero Mining is targeting a > 20 million ton resource with a potential mining operation made up of a combination of open pit and underground selective mining. An aggressive drilling campaign is budgeted for 2025 aiming at the expansion of the actual resource basis initially concentrated in the central part of the deposit and on its depth extensions and on a second phase extending the drilling to investigate the strike extensions both to the north and to the south of the drilled section to date. This will be partly supported by ground geophysics (IP/Resistivity) to help on target prioritization.

About Ibero Mining Corp.

Ibero Mining Corp. is a Canadian public company listed on TSXV and in US on OTCQB. The Company holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in European jurisdictions. Ibero Mining Corp. (IMC) owns a total of 100% equity interest in EVX Portugal, a private Portugal based company, that holds the legal exploration rights from the Portugal Government on the Borba exploration property, covering approximately 328 square kilometers in the Alentejo region in Southern Portugal. Miguel Vacas is the most advanced prospect within the Borba license.

Qualified Person

Technical information in this PR has been prepared in accordance with National Instrument 43-101 and approved for inclusion by Mr. José Mario Castelo Branco, EuroGeol, who is a "Qualified Person" with over 35 years' experience in the Exploration and Mining Geology industry. Mr. Castelo Branco holds a B.Sc. in Geology from the University of Porto in Portugal. He is also a member of the Portuguese Association of Geologists, the European Federation of Geologists, Member of the Prospectors and Developers of Canada, the Society of Economic Geologists and the Society for Geology Applied to Mineral Deposits.

On behalf of the Board of Directors

Ibero Mining Corp.

Mr. Karim Rayani, Chair & Chief Executive Officer

11th Floor - 1111 Melville Street

Vancouver, BC V6E 3V6

E: k@r7.capital

www.iberomining.ca

About Ibero Mining Corp.

Ibero Mining Corp. is a Canadian public company listed on TSXV and in US on OTCQB. The Company holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in European jurisdictions. Ibero Mining Corp. (IMC) owns a total of 100% equity interest in EVX Portugal, a private Portugal based company, that holds the legal exploration rights from the Portugal Government on the Borba 2 ("Borba 2") exploration properties, covering approximately 328 square kilometers in the Alentejo region in Southern Portugal. Miguel Vacas is the most advanced prospect within the Borba 2 license.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Language and Forward-Looking Statements

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

SOURCE: Ibero Mining Corp.

View the original press release on accesswire.com