Sales growth and reallocation of resources to high-performing areas.

The third quarter is a pivotal period for us, encompassing summer break, preparations for a new school term, and the start of the academic year. I am pleased to report that our invoiced sales grew by 11% compared to the same quarter last year. This increase in invoiced sales is not recognised in our quarterly earnings as some is deferred and will be recognised in future quarters At the same time, higher marketing expenses have already impacted our results, leading to a temporary decline in profitability. All of this is in line with our plan to profitability.

Already early on this summer, our B2C performance indicators showed strong potential. Our summer campaign achieved the best results in over 18 months, delivering high volumes, lower customer acquisition costs, higher average prices, and steady initial churn rates. B2C invoiced sales, in terms of deferred revenues, increased by 10% year-over-year, with Albert Junior leading growth with a 12% rise.

The B2B segment also showed solid sales performance during the back-to-school sales period. Both new business and renewals performed well and combined drove a 11% increase in B2B sales compared to 2023, with maths product Sumdog contributing significantly with 17% growth.

In financial terms, however, annual subscriptions are recognised over time, meaning the positive sales impact will not yet appear in the third quarter results. Recognised revenues reached 42 million SEK, a 5% decrease year-over-year, affecting our quarterly earnings.

Operationally, there were key advancements this quarter. In B2B, we restructured our Customer Success team, which helped boost subscription renewals in Sumdog. We have increased the investments in marketing and sales in order to capture the good momentum in the UK and the US. We also conducted our first roadshow in the UK to promote B2B sales synergies, connecting Sumdog clients in Scotland with Strawbees offerings. This efficient initiative has already resulted in our first contract with a big local authority. Additionally, our partnership with school distributor YPO for Sumdog's inclusion in the "Learning Box" bundle on the English market has launched, though slightly delayed, and schools are now able to purchase our products.

In B2C, Albert Junior was successfully launched in Romania with promising initial customer acquisition volumes comparable to our Tier 3 markets (UK and Poland), and not far behind Tier 2 (Norway and Denmark). As this initial campaign concludes, we will gain more insights into customer lifetime value. Encouraged by these early results, we have decided to continue Albert Junior's market expansion, with further launches planned in 2025. We have also increased the marketing investments in B2C since the customer acquisition has been favourable.

As part of our ongoing profitability programme, we conducted a strategic review across the Group this summer, leading to a restructuring in our French subsidiary, Kids MBA SAS. Actions taken include staff reductions and cuts in marketing expenses. While these changes will not significantly impact 2024 EBITDA, we expect a 5 million SEK reduction in net revenue and 13 million SEK in reduced personnel and external costs for 2025, leading to an 8 million SEK EBITDA improvement. These measures are set to positively affect the cash flow for the Albert Group.

In summary, our sales are on an upward trajectory, although it will take some time until it shows in the recognised revenues. Marketing expenses have been higher due to increased B2C and B2B investments and the Romanian launch. At the same time, we have taken cost measures in other parts of the business in order to re-allocate resources to the areas that perform well. Some of the mentioned effects will continue through year-end, but during 2025, cost reductions and recognised revenues are expected to fully contribute to achieving positive EBITDA, in line with our profitability plan.

In connection with the Q3 reporting, we have introduced a new KPI: Invoiced Sales. Previously, we only reported net revenue, where all long-term contracts were recognised over their full contract period. Due to this periodisation effect, there is a significant delay, making it difficult to understand the sales performance for the reported quarter. Invoiced Sales serves as a more leading indicator of sales activity.

Finally, I would like to extend my heartfelt thanks to our dedicated employees, customers, partners, and shareholders. I look forward to our continued journey towards profitability and sustainable growth, while helping children worldwide reach their full potential by making learning engaging and personalised.

Best regards,

Jonas Mårtensson, CEO

1 July - 30 September

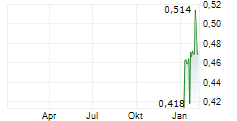

- Invoiced sales for the quarter were 44,803k (40,457k) SEK, representing an improvement of 11% compared to the previous year.

- Net revenue amounted to 41,949k (44,004k) SEK, which corresponds to a decrease of 5% compared to the same period last year.

- EBITDA amounted to -8,373k (-2,969k) SEK.

- EBITA amounted to -12,277k (-6,884k) SEK.

- The result after financial items amounted to -34,886k (-20,034k) SEK.

- The result for the period amounted to -29,370k (-17,832k) SEK.

- Earnings per share amounted to -1.17 (-0.71) SEK, before and after dilution.

- Cash flow from current operations amounted to -3,220k (-10,020k) SEK.

- Cash and cash equivalents at the end of the period amounted to 59,384k (94,465k) SEK.

1 January - 30 September

- Invoiced sales for the period were 148,716k (151,375k) SEK, representing a decrease of 2% compared to the previous year

- Net revenue amounted to 133,051k (133,874k) SEK, which corresponds to a decrease of 1% compared to the same period last year.

- EBITDA amounted to -22,292k (-13,163k) SEK.

- EBITA amounted to -33,546k (-24,005k) SEK. Items affecting comparability affected EBITA by -2,889k SEK.

- The result after financial items amounted to -81,102k (-62,546k) SEK.

- The result for the period amounted to -73,058k (-56,299k) SEK.

- Earnings per share amounted to -2.91 (-2.24) SEK, before and after dilution.

- Cash flow from current operations amounted to -14,075k (-12,790k) SEK.

- Cash and cash equivalents at the end of the period amounted to 59,384k (94,465k) SEK.

Significant events in the third quarter of 2024

Albert Junior was launched in Romania following a successful pilot project during the spring.

Significant events after the end of the period

Albert announced that a strategic decision had been made to restructure and reduce the resource allocation to the subsidiary Kids MBA as part of the company's ongoing efforts to improve the group's profitability.

For additional information, please contact:

Jonas Mårtensson, CEO

Mobile: +46 (0) 729 70 70 84

Email: jonas@hejalbert.se

For additional information, please contact:

Katarina Strivall, CFO

Mobile: +46 (0) 706 840074

Email: katarina.strivall@hejalbert.se

About eEducation Albert AB (publ)

The Albert Group develops and sells edtech products for schools and consumers. The company was founded in 2015 with the goal of democratizing education and providing every child the opportunity to reach their full potential. The product portfolio includes educational apps, educational videos, and physical learning products under the brands Albert, Jaramba, Holy Owly, Film & Skola, Strawbees, and Sumdog. Since the products were launched, they have helped more than ten million children make learning engaging and personalized. The company is headquartered in Gothenburg, Sweden, and operates actively in several countries in Europe, the USA, and Asia. Albert is listed on Nasdaq First North Growth Market with the ticker symbol ALBERT. The company's certified adviser is Carnegie Investment Bank AB (publ), +46 (0) 73 856 42 65, certifiedadviser@carnegie.se.

Read more at investors.hejalbert.se

This information is information that eEducation Albert is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-11-22 07:30 CET.