TORONTO, ON / ACCESSWIRE / November 22, 2024 / AmeriTrust Financial Technologies Inc. (TSXV:AMT)(OTC PINK:PWWBF)(Frankfurt:1ZVA) ("AmeriTrust", "AMT"or the"Company"), a fintech platform targeting automotive finance and specializing in used vehicle lease originations for the automotive industry, is announcing that it has filed its Interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three and nine-month periods ended September 30, 2024. These documents may be viewed under the Company's profile at www.sedarplus.ca.

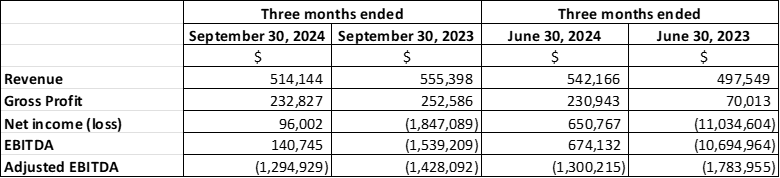

Revenue for the third quarter of 2024 was relatively consistent at $514,144 in comparison to Q2/2024 revenue of $542,166 and Q3/2023 revenue of $555,398. The revenue for the quarter is primarily from the servicing of the existing lease portfolio. Adjusted EBITDA loss for the third quarter of 2024 decreased relative to the decrease in revenue for Q3/2024. The operating expenses have decreased over the period which is the result of cost management initiatives by the Company to maintain the operating expenses at a minimal base as required for planned growth.

Cash on hand as at September 30, 2024 was $1,679,738 compared to $2,220,567 as at June 30, 2024.The cash balance includes cash collected from lease holders on leases that are serviced by the Company and reported as accounts payable.

About AmeriTrust Financial Technologies Inc.

AmeriTrust Financial Technologies Inc., listed on the TSX Venture Exchange and the OTC Pink, and Frankfurt markets, is a finance solution and fintech provider disrupting the automotive industry. AmeriTrust's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, and funders. AmeriTrust's platform is being made available across the United States of America.

For further information, please visit the AmeriTrust website or contact:

Shibu Abraham

Chief Financial Officer and Director

E: info@ameritrust.com

P: 1-800-600-6872

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments there to provided herein have an actual effect on the Company's operating results.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: AmeriTrust Financial Technologies Inc.

View the original press release on accesswire.com