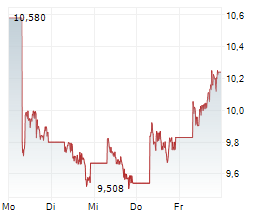

BYD's stock experienced a notable decline of 3.4% during Thursday's trading session in Hong Kong, reflecting ongoing volatility in the Chinese automotive sector. This downturn comes despite the company's impressive financial performance, with quarterly revenue surging 24.65% to reach 214.39 billion Hong Kong dollars and earnings per share climbing to 4.35 HKD. The market's cautious stance primarily stems from uncertainties surrounding potential US tariffs in 2025, with analysts suggesting that Chinese authorities may defer additional economic stimulus measures until trade policy clarity emerges.

Technology Leadership Strengthens Market Position

The company continues to reinforce its position as a leading manufacturer of electrified vehicles through significant advancements in battery technology. Since 2020, BYD has distinguished itself with its innovative Blade Battery technology, attracting prominent customers including major automotive manufacturers. Looking ahead to 2025, the company's planned introduction of a next-generation Blade Battery is expected to further cement its dominance in battery technology and strengthen its role as a key supplier in the automotive industry.

Ad

BYD Stock: New Analysis - 28 NovemberFresh BYD information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated BYD analysis...