- Masdar has successfully completed the acquisition of 70% of the outstanding shares of TERNA ENERGY to become majority shareholder of the Greek clean energy champion

- Following the closing of the transaction, Masdar will seek regulatory approvals for launch of an all-cash mandatory tender offer to acquire all the remaining shares

- Masdar will bring long-term capital and global expertise to supercharge TERNA ENERGY's growth plans as it targets 6GW of renewable energy operational capacity by 2029, supporting the energy transition in Greece and Eastern Europe

- The acquisition will play an important role in growing Masdar's portfolio in Europe as it targets 100GW global capacity by 2030

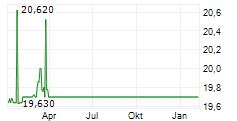

ABU DHABI, UAE and ATHENS, Greece , Nov. 28, 2024 /PRNewswire/ -- Abu Dhabi Future Energy Company PJSC - Masdar ("Masdar"), the UAE's clean energy leader, announced today that it has successfully completed the acquisition of 70% of the outstanding shares of TERNA ENERGY SA (TENERGY.AT) from GEK TERNA SA (GEKTERNA.AT) and other shareholders, and received all regulatory approvals. The deal, agreed at a price of 20 euros per share, valued TERNA ENERGY at an enterprise value of 3.2bn euros, representing the largest ever energy transaction on the Athens Stock Exchange, and one of the largest in the EU renewables industry.

Following the closing of the transaction, Masdar will seek regulatory approvals from the Hellenic Capital Markets Commission (HCNC), for the launch of an all-cash mandatory tender offer ("MTO") to acquire the outstanding shares of TERNA ENERGY.

TERNA ENERGY has been a key player in the renewable energy sector for over two decades, holding the largest and most diversified portfolio in Greece, as well as projects in Bulgaria and Poland. The company owns and operates clean energy projects across wind, solar, biomass and hydro technologies - Greece's renewable energy leader is also building one of the largest pumped hydro projects in Europe, the 680MW Amfilochia project. With TERNA ENERGY currently operating a capacity of 1.2 gigawatts (GW), the acquisition reflects Masdar's confidence in the company's impressive growth potential, targeting 6GW by 2029. TERNA ENERGY will play an important role in enhancing Masdar's portfolio across Europe as it targets 100GW global capacity by 2030 in support of the energy transition.

Mohamed Jameel Al Ramahi, Chief Executive Officer of Masdar, commented: "Masdar is proud to become the majority shareholder of TERNA ENERGY, bringing together two energy champions. Our committed vision and long-term capital will unlock significant opportunities for further growth in TERNA ENERGY's expansion as it executes on its strategy to support Greece's renewable energy goals.

"Masdar's acquisition strategy has focused on acquiring not just assets, but investing in exceptional teams. Our ambition is to establish TERNA ENERGY as one of our core regional platforms that will help us deliver on our ambitious targets. I look forward to working with Executive Chairman, Georgios Peristeris, and Chief Executive Officer, Emmanuel Maragoudakis, in support of the energy transition in Greece and Europe."

Georgios Peristeris, Chairman and CEO of GEK TERNA, and Executive Chairman of TERNA ENERGY, said: "Our agreement with Masdar is a reflection of TERNA ENERGY's unparalleled leading role in the green energy transition in Greece as well as in southeastern Europe, a result of our consistent and tireless efforts over the last 25 years to create the largest and fastest growing clean energy platform in our country. Sharing the same vision with Masdar for clean, affordable and domestically produced energy, we look forward to working together towards a future of endless growth possibilities for TERNA ENERGY".

Masdar has retained Rothschild & Co. as sole financial advisor, and Simmons & Simmons, Bernitsas Law, Latham & Watkins as legal advisors, in connection with the transaction and financing.

GEK TERNA Group was supported by Reed Smith LLP and Potamitis Vekris, who were the international and Greek legal advisors for the transaction respectively, while Morgan Stanley has been acting as sole financial advisor to TERNA ENERGY.

For more information please visit: https://www.masdar.ae and connect: facebook.com/masdar.ae and twitter.com/masdar

About Masdar

Masdar (Abu Dhabi Future Energy Company) is one of the world's fastest-growing renewable energy companies. As a global clean energy pioneer, Masdar is advancing the development and deployment of solar, wind, geothermal, battery storage and green hydrogen technologies to accelerate the energy transition and help the world meet its net-zero ambitions. Established in 2006, Masdar has developed and invested in projects in over 40 countries with a combined capacity of over 31.5 gigawatts (GW), providing affordable clean energy access to those who need it most and helping to power a more sustainable future.

Masdar is jointly owned by TAQA, ADNOC, and Mubadala, and is targeting a renewable energy portfolio capacity of 100GW by 2030 while aiming to be a leading producer of green hydrogen by the same year.

About TERNA ENERGY

TERNA ENERGY, has been a key player in the renewable energy sector for over two decades, holding the largest and most diversified portfolio of projects in Greece, with 2,500 MW in operation, under construction and ready for construction. TERNA ENERGY's installed capacity currently stands at 1,224 MW, while TERNA ENERGY is continuing seamlessly with its investment plan, aiming to approach a total installed capacity of 6 GW by 2029. TERNA ENERGY (www.terna-energy.com) is listed on the Athens Stock Exchange.

Photo - https://mma.prnewswire.com/media/2569464/Masdar_Agios_Georgios_Wind_Farm.jpg

Logo - https://mma.prnewswire.com/media/2514011/4930165/MASDAR_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/masdar-closes-deal-to-acquire-terna-energy-announces-goal-to-supercharge-growth-in-greece-and-eastern-europe-302318386.html

View original content:https://www.prnewswire.co.uk/news-releases/masdar-closes-deal-to-acquire-terna-energy-announces-goal-to-supercharge-growth-in-greece-and-eastern-europe-302318386.html