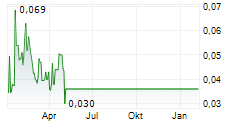

TORONTO, Dec. 02, 2024 (GLOBE NEWSWIRE) -- LNG Energy Group Corp. (TSXV: LNGE) (TSXV: LNGE.WT) (OTCQB: LNGNF) (FRA: E26) (the "Company" or "LNG Energy Group") is pleased announce it has filed its interim unaudited financial results for the quarter ended September 30, 2024. The interim unaudited financial statements and management discussion and analysis for the three and nine months ended September 30, 2024 will be available on SEDAR+ at www.sedarplus.ca and LNG Energy Group's website at www.lngenergygroup.com.

Gas Sales Agreements

As previously disclosed on October 21, 2024 and November 20, 2024, as a result of unexpected production restrictions at certain wells in the Bullerengue natural gas field, the Company has had to limit natural gas deliveries under certain gas sales agreements dedicated to supplying natural gas demand. Lewis Energy Colombia, Inc. ("LEC"), a wholly-owned subsidiary of the Company, entered into amendment to certain gas sales agreements to reduce the applicable volumes by 5.0 MMbtu/d for a period of four months with no significant changes to the average natural gas sales price.

LEC's attempts to address the production disruptions by way of an extensive workover campaign and drilling initiatives have not resulted in production increases. As a result, on November 22, 2024, LEC issued notice to the applicable regulator in Colombia regarding a restriction in the natural gas deliveries under certain supply contracts. The Company expects LEC to issue a notice of force majeure to its gas off-takers in Colombia setting out the technical basis for delivering less natural gas volumes than as set out in the gas sales agreements. LEC continues to receive the proceeds from the natural gas sales and has notified its senior lenders of the foregoing notice.

2024 Guidance

The Company announced today that it is withdrawing the production and capital guidance issued on March 4, 2024.

About LNG Energy Group

The Company is focused on the acquisition and development of oil and gas exploration and production assets in Latin America.

For more information, please see below:

Website:

www.lngenergygroup.com

Investor Relations:

Angel Roa, Chief Financial Officer

Email: investor.relations@lngenergygroup.com

Telephone: 57-321-943-9396

Find us on social media:

LinkedIn: https://www.linkedin.com/company/lng-energy-group-inc/

Instagram: @lngenergygroup

X: @LNGEnergyCorp

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION:

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities laws. All statements other than statements of historical fact are forward-looking statements, and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often using phrases such as "expects", "anticipates", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends", or variations of such words and phrases, or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved, are not statements of historical fact and may be forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include: general business, economic, competitive, political and social uncertainties; delay or failure to receive any necessary board, shareholder or regulatory approvals, factors may occur which impede or prevent LNG Energy Group's future business plans; and other factors beyond the control of LNG Energy Group. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, LNG Energy Group assumes no obligation to update the forward-looking statements, whether they change as a result of new information, future events or otherwise, except as required by law. There can be no guarantee that the Corporation or its subsidiaries shall be able to complete the acquisition terms required to close the transactions related to the blocks in Venezuela.

Please see the Corporation's interim condensed consolidated financial statements and related MD&A for additional disclaimers.