VANCOUVER, British Columbia, Dec. 03, 2024 (GLOBE NEWSWIRE) -- Titan Mining Corporation (TSX: TI, OTCQB: TIMCF) ("Titan" or the "Company") is pleased to announce the successful completion of its maiden mineral resource estimate ("MRE") for the Kilbourne Graphite Project, located within the mining permit boundary at its 100% owned Empire State Mine ("ESM") located in St Lawrence County in New York State.

Highlights:

- An open-pit constrained inferred mineral resource estimate of 22 million US short tons ("tons") at an average grade of 2.91% (Cg) containing 653,000 tons of graphite, based on a cut-off grade of 1.50%

- Maiden mineral resource estimate based on 45 diamond drill holes totaling 29,699 ft completed as Phase I drilling

- The Phase I drilling and maiden mineral resource estimate represents a small subset of the total graphite bearing unit identified through surface mapping and historical drilling

- Maiden mineral resource estimate based on strike length of 7,000 ft of a total strike length of 25,000 ft. Potential for mineral resource expansion along strike and down dip, almost entirely hosted within the existing active use permit, part of the over 80,000 acres of mineral rights controlled by the company in St. Lawrence County, NY

- Kilbourne is targeted to be fast-tracked to commercial production to secure the preferred US domestic supply chain, given its unique advantage of having existing infrastructure and operational talent at ESM

- Metallurgical test work in progress at SGS Lakefield is due for completion in Q4 2024. This will provide product segmentation information and refine the flowsheet for a commercial demonstration plant

- Production of concentrate from a commercial demonstration plant, located within the ESM mill, in 2025. This is expected to be the first commercial demonstration plant in full run-time in the United States capable of delivering to the US supply chain

- Preparations for an NI 43-101 Preliminary Economic Assessment for the Kilbourne Graphite Project will begin in early 2025

Don Taylor, CEO of Titan, commented: The maiden mineral resource estimate at Kilbourne is an excellent result based on limited Phase I drilling and confirms the prospect of a long life, open pit, graphite operation at ESM. There remains significant potential to expand the mineral resource estimate within the ESM mineral tenure, to potentially fully meet US domestic needs, and to secure our supply chain. Kilbourne is located less than 4,000 ft from the existing ESM mill and infrastructure. With significant operational synergies, Titan is targeting being the first US commercial producer of natural flake graphite delivering to a broad spectrum of US based customers.

Rita Adiani, President of Titan, commented: The maiden mineral resource estimate at Kilbourne together with existing infrastructure at ESM allows Titan to fast-track the development of the Kilbourne Project. Our short-term focus is to de-risk the process and end products through the Phase III program currently in progress at SGS Lakefield. Following that test work, Titan will engineer, build and operate a commercial demonstration plant on site during FY 2025. This process will allow Titan to deliver a variety of high value natural flake graphite products to US consumers and build our product offering prior to potentially scaling production, following relevant studies, in the ensuing 18 months. This approach will maximize pricing for our products and ensure we build a facility which matches demand.

Mineral Resource Estimate

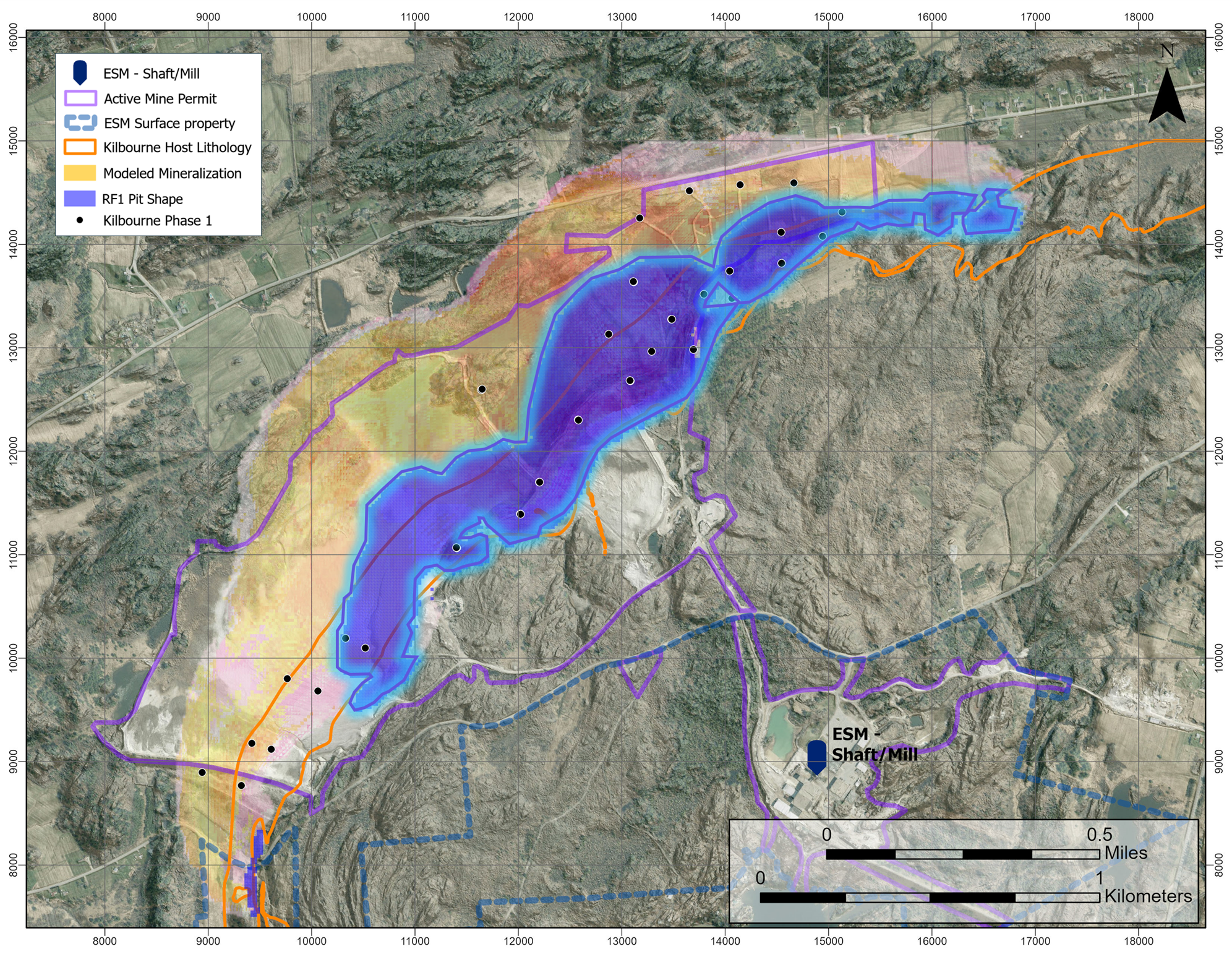

Figure 1: Kilbourne conceptual pit outline with modeled mineralization and Titan Property and permitting outlines

Table 1: Kilbourne Graphite Mineral Resource Summary and in-situ Metal within Pit Shell

| Classification | Deposit | Cut-Off Grade (% Cg) | Tonnage ('000 Ton) | Grade (% Cg) | Contained Graphite ('000 Ton) |

| Inferred | Kilbourne | 1.50 | 22,423 | 2.91 | 653 |

Source: BBA USA Inc., 2024.

Notes to Table 1:

- The independent Qualified Person for the Mineral Resource Estimate, as defined by NI 43-101 is Mr. Todd McCracken (PGO 0631) of BBA USA Inc. The effective date of this Mineral Resource Estimate is December 3, 2024.

- Three-dimensional (3D) wireframe models of mineralization were based on the geological interpretation of the logged lithology and sub-domained based on contiguous grade intervals greater than or less than 0.50% Cg defining two mineralized sub-domains.

- Geological and block models for the Mineral Resource Estimate used data from a total of 45 surface diamond drill holes (core) and 1 surface channel sample. The drill hole database was validated prior to mineral resource estimation and QA/QC checks were made using industry-standard control charts for blanks and commercial certified reference material inserted into assay batches by Empire State Mine personnel.

- Quantities and grades in the Mineral Resource Estimate are rounded to an appropriate number of significant figures to reflect that they are estimations.

- The mineral resource estimate was constrained using the following optimization parameters, as agreed upon by Empire State Mine and the QP. The parameters include mining costs of $4.60/ton for mineralized rock, $3.50/ton for unmineralized rock, and $2.00/ton for overburden and tailings, with a 5.0% dilution and 95.0% mining recovery. Processing costs are $14.00/ton milled, with a 91.0% processing recovery and a concentrate grade of 95.0%. No general and administrative (G&A) costs were applied. The selling price is $1,090/ton of concentrate, with transportation costs of $50/ton and no additional selling costs. The overall slope angles are 23 degrees for overburden and tailings, and 45 degrees for rock.

- Process recovery estimates based on Phase I testing done at SGS Lakefield and Forte Dynamics, open circuit recovery 86.5% with expected increase to 90-91% in closed circuit.

- The reported mineral resource estimate has been tabulated in terms of a pit-constrained cut-off value of 1.50% Cg.

- The block model was prepared using Datamine Studio RM. A 30 ft x 30 ft x 15 ft block model was created, and samples were composited at 5.00 ft intervals. Grade estimation for graphite used data from drill hole data and was carried out using Ordinary Kriging (OK), Inverse Distance Squared (ID2), and Nearest Neighbor (NN) methods. The OK methodology is the method used to report the mineral estimate statement.

- Grade estimation was validated by comparison of the global mean block grades for OK, ID2, and NN by domain and composite mean grades by domain, swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

- The specific gravity (SG) assessment was carried out for all domains using measurements collected during the core logging process. The mean specific gravity value within the mineralized domains is 2.75.

- The Mineral Resource Estimate was prepared following the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019).

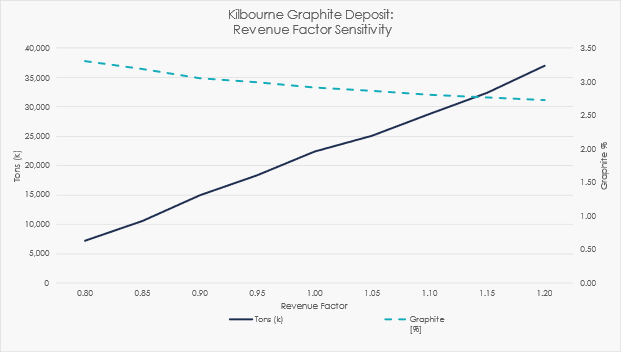

Sensitivity Analysis

The results of grade sensitivity analysis are presented in Figure 2 to illustrate the continuity of the grade estimates at various cut-off increments and the sensitivity of the mineralization to changes in cut-off grade. The reader is cautioned that figures in the following chart should not be misconstrued as Mineral Resources or confused with the Mineral Resource Statement reported above. These figures are only presented to show the sensitivity of the block model estimated grades and tonnages to the selection of cut-off grade. Cut-off at the Kilbourne Graphite Project was set at 1.50% (Cg).

Figure 2: Kilbourne Graphite: Revenue Factor Sensitivity

Source: BBA USA Inc., 2024.

Table 2: Kilbourne Graphite Revenue Factor Sensitivity

| $USD per Ton Concentrate | RF | Graphite (%) | Mill Feed (k Ton) | Contained Graphite (k Ton) | Waste (k Ton) | Overburden (k Ton) |

| 872.00 | 0.80 | 3.30 | 7,198 | 238 | 4,810 | 3,532 |

| 926.50 | 0.85 | 3.19 | 10,627 | 339 | 9,247 | 5,763 |

| 981.00 | 0.90 | 3.05 | 14,987 | 457 | 13,578 | 9,261 |

| 1035.50 | 0.95 | 2.99 | 18,303 | 547 | 18,824 | 11,072 |

| 1090.00 | 1.00 | 2.91 | 22,423 | 653 | 25,278 | 13,425 |

| 1144.50 | 1.05 | 2.86 | 25,109 | 719 | 29,871 | 14,557 |

| 1199.00 | 1.10 | 2.81 | 28,790 | 808 | 36,399 | 16,528 |

| 1253.50 | 1.15 | 2.76 | 32,401 | 895 | 44,365 | 18,400 |

| 1308.00 | 1.20 | 2.73 | 36,959 | 1,009 | 56,969 | 21,433 |

Source: BBA USA Inc., 2024.

Note: RF is a reference to Revenue Factor.

Further Potential for Growth

The Company is planning Phase II drilling at Kilbourne, with a projected start date in H1 2025. The primary goal of the program is to raise mineral resource confidence from Inferred to Measured/Indicated status within the core of the Kilbourne mineral resource area. Drilling will also aim to extend zones of high-grade mineralization, and test the extensions of mineralization along strike, and down dip. Phase II will consist of an additional 12,000 ft of drilling.

Phase I of drilling successfully tested roughly 8,250 ft of Kilbourne strike length. The Company holds mineral rights on over 15,000 ft of additional Unit 2 strike length. This includes 8,000 ft to the east, and 7,500 ft to the south. Historic drilling and surface mapping documents graphite mineralization, however there are no historic assays to confirm these observations. To date, a little over 30% of the Kilbourne trend has been tested with drilling. Exploration planning is underway to further test these extensions.

Next Steps

De-risking Metallurgy: Phase III test program at SGS Lakefield is designed to de-risk metallurgy by defining a flowsheet and conditions that will serve as input into the engineering of the commercial demonstration plant. The metallurgical flowsheet optimization work is conducted on a composite that aims to replicate the overall mineral resource. The robustness of the optimized flowsheet and conditions are verified with a series of variability composites.

The data from the SGS work will then be utilized to develop the mass and water balance, process design criteria, and process flow diagram of the commercial demonstration plant, which are expected to be completed by the end of Q4 2024. These documents will be the building blocks to complete equipment selection and engineering for the commercial demonstration plant. Further metallurgical work programs will be defined based on operating data of the commercial demonstration plant.

Establishing product-segmentation: The Phase III test program will be used for defining market and product segmentation for potential products from the Kilbourne Graphite Project and for refining the scope of a commercial demonstration plant.

Commercial demonstration plant: The Kilbourne Graphite Project has a unique advantage of being hosted within ESM's mine permit boundary, which has an existing mill, established infrastructure and a trained workforce. The Company is targeting production of concentrate from a commercial demonstration plant in 2025 to be co-located within the existing ESM mill facilities and benefiting from the shared infrastructure and operational talent present on site. This is expected to be the first commercial demonstration plant in full run-time in the United States capable of delivering to the US supply chain.

Preliminary Economic Assessment: Titan will begin preparation of an NI 43-101 Preliminary Economic Assessment for the Kilbourne Graphite Project in H1 2025 with the goal of defining project economics and delivering a phased approach to the development of the Kilbourne Graphite Project. Permitting for the expanded scope of operations is subject to a state level process.

An NI 43-101 technical report supporting the mineral resource estimate disclosed herein will be filed on SEDAR+ within 45 days of this press release.

Quality Assurance and Quality Control

Core drilling was completed using ESM owned and operated drills which produced AWJ (1.374 in) size drill core. All core was logged by ESM employees. The core was washed, logged, photographed, and sampled. All core samples were cut in half, lengthwise, using a diamond saw with a diamond-impregnated blade and sampled on 5 ft intervals with adjustments made to match geological contacts. After a sample is cut, one half of the core was returned to the original core box for reference and long-term storage. The second half was placed in a plastic or cloth sample bag, labeled with the corresponding sample identification number, along with a sample tag. All sample bags were secured with staples or a draw string, weighed and packed in shipping boxes. Shipping boxes are placed onto pallets and shipped by freight to SGS Lakefield laboratory in Lakefield, ON, Canada for sample preparation and graphitic carbon analysis. Pulps are forwarded to SGS Burnaby laboratory in Burnaby, BC, Canada for multi-element analysis. SGS Lakefield is a Canadian accredited laboratory (ISO/IEC 17025) and independent of ESM. SGS Lakefield prepares the pulps and analyzes each sample for graphitic carbon (Cg-CSA06V) with a detection limit of >0.01%. Pulps are shipped to SGS Burnaby for multi-element analysis by aqua regia digestion (GE-ICP21B20 for 34 elements) with an ICP - OES finish. All samples in which silver, calcium, manganese, iron, zinc and sulfur exceed their upper limit are re-run using methods of aqua regia digestion (Fe-ICP21B100), four acid digestion (Ag, Ca, Zn, and Mn-ICP42Q100) and infrared combustion (S-CSA06V) with the elements reported in percentage (%). Standards and blanks are inserted during the logging process. The assays for QA/QC samples are reviewed as certificates are received from the laboratory. Failures are identified on a batch basis and followed up as required. The scientific and technical information disclosed herein has been verified by Todd McCracken of BBA USA Inc., using data validation and quality assurance procedures under high industry standards. The verification activities included a search for factual errors, completeness of the lithological and assay data, and suitability of the primary data. As part of the database verification activities, the assay information and certificates obtained directly from the analytical laboratory have been examined as well. Mr. McCracken has not identified any legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources disclosed herein.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Todd McCracken of BBA USA Inc. Mr. McCracken is a Qualified Person as defined by National Instrument 43-101 and is independent of Titan.

About Titan Mining Corporation

Titan is an Augusta Group company which produces zinc concentrate at its 100%-owned Empire State Mine located in New York state. The Company is focused on value creation and operating excellence, with a strong commitment to developing critical mineral assets that enhance the security of the U.S. supply chain, and the Kilbourne Graphite Project is a core part of this strategy. For more information on the Company, please visit our website at www.titanminingcorp.com.

Contact

For further information, please contact: Rita Adiani, President, Email: radiani@titanminingcorp.com, Investor Relations, Email: info@titanminingcorp.com

Cautionary Note Regarding Forward-Looking Information

Certain statements and information contained in this new release constitute "forward-looking statements", and "forward-looking information" within the meaning of applicable securities laws (collectively, "forward-looking statements"). These statements appear in a number of places in this news release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including that potential for mineral resource expansion along strike and down dip, almost entirely hosted within the existing active use permit; Kilbourne is targeted to be fast-tracked to commercial production to secure the preferred US domestic supply chain; metallurgical test work in progress at SGS Lakefield is due for completion in Q4 2024; this will provide product segmentation information and refine the flowsheet for a commercial demonstration plant, producing graphite concentrate at full run-time, to be co-located within the existing mill at ESM; there remains significant potential to expand the mineral resource estimate within the ESM mineral tenure, to potentially fully meet US domestic needs, and to secure our supply chain; with significant operational synergies, Titan is targeting being the first US commercial producer of natural flake graphite delivering to a broad spectrum of US based customers; the maiden mineral resource estimate at Kilbourne together with existing infrastructure at ESM allows Titan to fast-track the development of the Kilbourne Project; our short-term focus is to de-risk the process and end products through the Phase III program currently in progress at SGS Lakefield; following that test work, Titan will engineer, build and operate a commercial demonstration plant on site during FY 2025; this process will allow Titan to deliver a variety of high value natural flake graphite products to US consumers and build our product offering prior to potentially scaling production, following relevant studies, in the ensuing 18 months; this approach will maximize pricing for our products and ensure we build a facility which matches demand; Phase II will consist of an additional 12,000 ft of drilling, in addition to the roughly 8,250 ft tested during Phase I drilling at Kilbourne, and the Company holds the mineral rights on over 15,000 ft of additional Unit 2 strike length; Phase III test program at SGS Lakefield is designed to de-risk metallurgy by defining a flowsheet and conditions that will serve as input into the engineering of the commercial demonstration plant; the metallurgical flowsheet optimization work is conducted on a composite that aims to replicate the overall mineral resource; the robustness of the optimized flowsheet and conditions are verified with a series of variability composites; the data from the SGS work will then be utilized to develop the mass and water balance, process design criteria, and process flow diagram of the commercial demonstration plant, which are expected to be completed by the end of Q4 2024; these documents will be the building blocks to complete equipment selection and engineering for the commercial demonstration plant; further metallurgical work programs will be defined based on operating data of the commercial demonstration plant; the Phase III test program will be used for defining market and product segmentation for potential products from the Kilbourne Graphite Project and for refining the scope of a commercial demonstration plant; the Company is targeting production of concentrate from a commercial demonstration plant in 2025 to be co-located within the existing ESM mill facilities and benefiting from the shared infrastructure and operational talent present on site; this is expected to be the first commercial demonstration plant in full run-time in the United States capable of delivering to the US supply chain; Titan will begin preparation of an NI 43-101 Preliminary Economic Assessment for the Kilbourne Graphite Project in H1 2025 with the goal of defining project economics and delivering a phased approach to the development of the Kilbourne Graphite Project; permitting for the expanded scope of operations is subject to a state level process; an NI 43-101 technical report supporting the mineral resource estimate disclosed herein will be filed on SEDAR+ within 45 days of this press release. When used in this news release words such as "to be", "will", "planned", "expected", "potential", and similar expressions are intended to identify these forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators. Such forward-looking statements are based on various assumptions, including assumptions made with regard to the ability to advance exploration efforts at ESM; the results of such exploration efforts; the ability to secure adequate financing (as needed); the Company maintaining its current strategy and objectives; and the Company's ability to achieve its growth objectives. While the Company considers these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If we update any one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/733ff49b-6bad-4aca-b699-2dbf19457453

https://www.globenewswire.com/NewsRoom/AttachmentNg/82a3f25d-6e7f-41e3-a6cf-9b7c8c23ab3b