LOS ANGELES, CA / ACCESSWIRE / December 3, 2024 / IntelligenceBank, the leading intelligent content operations platform, has released a first-in-market innovation that empowers marketing and compliance teams to automate compliance reviews of live Google Ads.

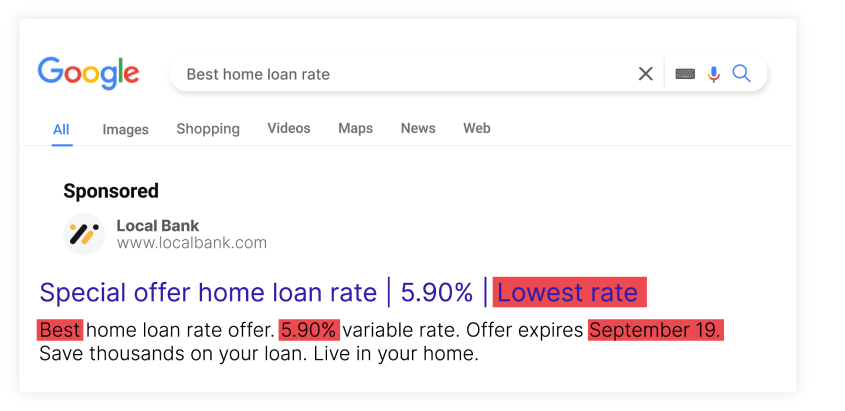

Screenshot of IntelligenceBank's new software that can detect risk in Google Ads

More than $237 billion is spent on Google Ads each year, with $175 billion invested in text-based paid search ads. At a time when companies are increasingly held to higher industry and government regulatory standards, government agencies such as the U.K.'s Advertising Standards Authority (ASA) are using AI to monitor millions of ads each year. For highly regulated industries such as financial services, banking, insurance, healthcare, transportation and others, the cost of compliance errors can result in hundreds of millions of dollars in fines.

The new ad compliance software rollout helps solve the issue of non-compliant advertising running unchecked by automating the tedious, time-consuming process of manually reviewing live ad copy. Even when legal and compliance teams are given ad copy reviews before publication, changes can happen during the go-live process that may put brands at risk. "This is a marketing compliance game-changer," said Tessa Court, CEO of IntelligenceBank. "Whether companies are outsourcing ad management to an outside agency or doing it in-house, a lot can happen between ad approval and publication. Our ad compliance solution can easily detect outdated offers, incorrect links to terms or incorrect language across thousands of live Google Ads to help companies avoid misleading customers and the crippling fines associated with non-compliance."

How The Solution Works

The solution analyzes key elements of ad copy-such as headlines, descriptions, and calls to action-against customizable compliance rules.

Some examples of risks detected include:

Expired Promotions: Detects ads promoting offers that have expired to avoid inadvertently misleading consumers.

Risky Phrases: Flags words such as "free," "best offer," or "lowest price" that may cause compliance issues without proper terms, as well as terms that may run afoul of more nuanced legislation, such as greenwashing rules

Missing Terms and Conditions: Identifies ads that lack the necessary legal disclaimers, avoiding potential non-compliance penalties.

The new ad compliance software rollout further strengthens IntelligenceBank's mission to simplify compliance and provide advanced tools to help marketers maintain brand and legal approved content.

For more information or to book a demo of the company's ad compliance capabilities, visit https://intelligencebank.com/features/google-ads-risk-scanning or contact us.

Media enquiries: marketingteam@intelligencebank.com

About IntelligenceBank

IntelligenceBank is the leading intelligent content operations platform, accelerating the creation, management and distribution of approved content for marketing and compliance teams. The end-to-end platform uses AI and automation to ensure legal and brand compliance both during development and after it has gone live. Loved by customers in 55 countries, IntelligenceBank has offices in Australia, Canada, the U.K. and the US. For more information visit http://www.intelligencebank.com.

Contact Information

William Tyree

Chief Marketing Officer

marketing@intelligencebank.com

Source: IntelligenceBank