Detailed Metallurgical test work is ongoing and reaffirms production of DRI grade, 67%+ or better iron concentrate with combined Silica and Alumina below 2.5%

Work Programs initiated and DRA Global appointed to deliver NI 43-101 Bankable Feasibility Study by end of Q1 2026

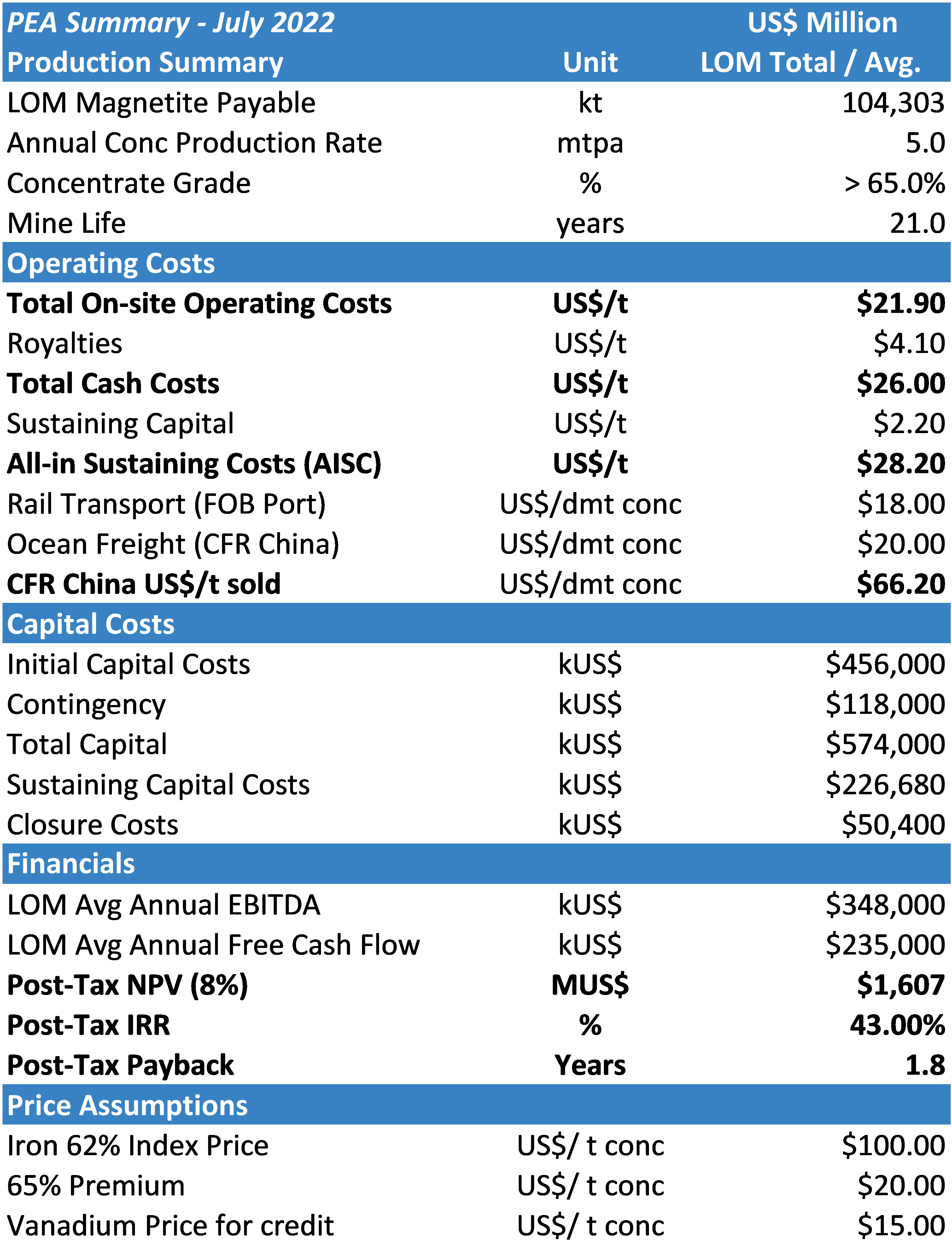

2022 PEA on Mont Sorcier provided an NPV8% of US$1.6 Billion for a 21-year mine life producing 5MT of Iron Concentrate per year (300,000 oz/Au equiv.) generating US$348M per annum in cash flow based upon initial capex of US$574M

UKEF and TD Bank have agreed to sponsor 70% of project capital required subject to customary conditions of Export Credit Agency funding

(All numbers reported in US dollars)

TORONTO, ON / ACCESSWIRE / December 4, 2024 / (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to provide an update on its ongoing work programs to complete a NI 43-101 Bankable Feasibility Study("BFS") by end of Q1 2026 on its High Purity, DRI Grade, +67% iron Mont Sorcier magnetite iron ore project located near Chibougamau, Quebec.

Metallurgical Program Focused on Delivering Premium Product

Detailed metallurgical testwork programs are currently being undertaken by Soutex Inc, to build on the previous metallurgical test results announced in March 2024. Previous testing has confirmed the ability to produce High Purity, DRI Grade, iron concentrates grading over 67%+ iron and less than 2.5% silica and alumina combined. Current testwork is focused on flotation testing, more detailed variability tests, grind size and reagent optimization programs and equipment sizing. Current testwork and overall process design are to be at the core of the NI 43-101 Bankable Feasibility Study ("BFS") which is targeted to be completed by end Q1 2026. While ongoing, results to date are encouraging and indicate the potential for further improvement in iron grade, purity and potentially grind size.

The design and analysis of the metallurgical test work program is being completed by Soutex Inc., a consultancy firm specializing in ore processing and metallurgical processes based in Quebec City, Quebec, with testwork completed by SGS Canada, one of the world's leading testing, inspection and certification companies based in Quebec City.

Bankable Feasibility Program

In addition to the current testwork, the Company has selected various consultants to undertake the key work programs in 2025 to deliver a NI 43-101 Compliant Bankable Feasibility study ("BFS") for the Mont Sorcier High Purity iron project. The lead consultant and study integrator will be DRA Global who will also be responsible for the updated Mineral Resource estimate, mine design and planning, geotech and hydrogeology. In addition, the company has retained Soutex (process design), LDV Consultants (site infrastructure, capital and operating Cost estimation) and WSP (environmental and permitting). Additional specialized consultants will be added as needed.

The Bankable Feasibility Study will look to provide greater detail into the potential of the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV8% of US$1.6 Billion. With a higher quality, 67%+ iron concentrate product now expected, we anticipate any cost inflation to be largely offset by premium pricing. The PEA outlined a project producing 5.0 million tonnes of high-grade iron concentrates per annum (equivalent to producing 300,000 Au ounces per year at long term consensus prices) over a 21-year mine life. This material would then be rail hauled on existing railways to the Port of Saguenay for export to global markets. Given the scale of the existing resource, future expansion remains a likely possibility. The table below provides the summary of the PEA results.

Figure 1 - Summary Of 2022 PEA Results

A Premium Product for the Transition Economy

The Mont Sorcier project is uniquely positioned to be at the centre of the Green Steel transition. As the global demand for Green Steel increases, it is expected that the demand and overall price premium paid for higher grade products and DRI, will continue to increase and replace demand for lower grade materials. The ability to produce High Purity iron concentrates places Mont Sorcier as a project capable of delivering Critical and Strategic High Purity Iron as outlined by the Quebec and Canadian Governments, as it aspires to become a leader to support energy transition through the development of critical and strategic minerals and reduce overall global emissions.

The ability to produce a high purity iron concentrate grading 67%+ iron with low silica and alumina; making it suitable to be classified as a Direct Reduction Iron ("DRI") grade product, significantly reduces the overall emission of greenhouse gases in steel production compared to other lower grade concentrates. It has the potential to be used in electric arc furnaces to produce steel products, further reducing emissions. Also, as the Mont Sorcier resource is a magnetite material, reducing the use of coal in the steel making process combined with the availability of hydroelectric power in Quebec lowers overall emission levels for steel producers.

Mark Brennan, CEO and Chairman, stated: "We are very excited to be ramping up our work programs for the high purity 67%+ iron project at Mont Sorcier, which will highlight the robust value we see in the project. Metallurgical testwork to date remains encouraging and we are likely to improve on previous results to be incorporated into our BFS scheduled for completion by end of Q1 2026. We continue to expect that Mont Sorcier will be a robust and an economically strong project positioned to deliver the exact product desired by the future Green Steel industry. As the global steel markets continue to aim to reduce overall emissions in the steel production process, concentrates such as those from Mont Sorcier are expected to be in high demand to support this transition and replace lower grade materials."

Review of Technical Information

The technical information contained in this news release with respect to the Mont Sorcier Project has been reviewed and approved on behalf of Voyager by Pierre-Jean Lafleur of Voyager Metals, who is a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to predictions about the future demand for higher grade iron concentrates and the Company's ability to produce this type of produce from the Mont Sorcier Project, Project, the expected timing of completion of the BFS, all of the assumptions and qualifications set out in the PEA, the assumption that demand and overall price premium paid for higher grade products and that DRI will continue to increase and replace demand for lower grade materials, the ability of the Mont Sorcier Project to produce high purity iron concentrates, the assumption that Mont Sorcier may be capable of delivering critical and strategic high purity iron in the form of 67%+ iron concentrate and the possibility of future expansion of the resource at the Mont Sorcier Project. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com