VANCOUVER, BC / ACCESSWIRE / December 9, 2024 / Q Precious and Battery Metals Corp. ("QMET" or the "Company") (CSE:QMET) is pleased announce recommencement of diamond drilling over the 2024-2025 winter at their La Corne South project located north of Val d'Or, Quebec. The winter drilling will continue testing geophysical anomalies similar to those tested by the three drill holes completed to date.

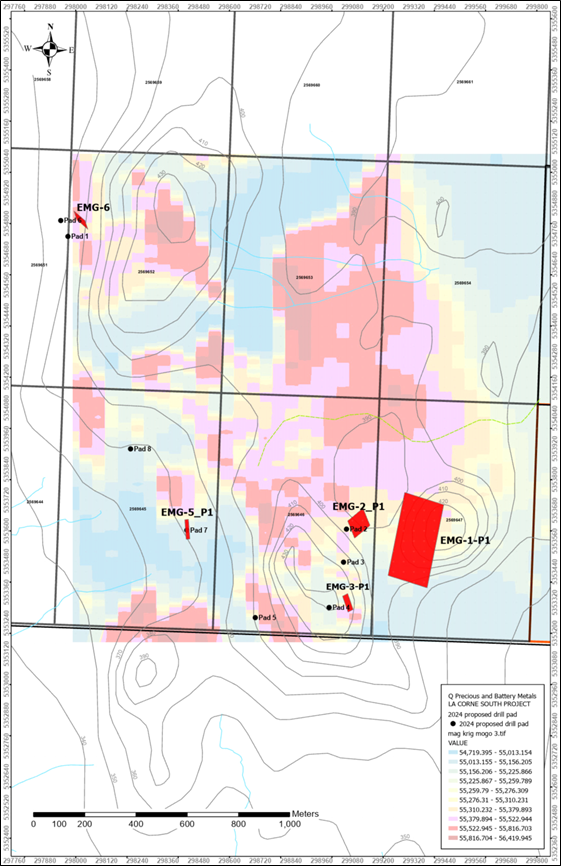

Three drill holes that have been completed to date were designed to test coincident TDEM conductors with magnetic highs (attached figure EMG-6). As reported in previous news releases, results from hole 24LCS-01 indicate robust VMS-style mineralization containing elevated copper, zinc, silver, and gold. Results from core samples submitted from holes 24LCS-02 and 24LCS-03 are expected to be released soon.

Using weighted averages combined with copper equivalents, the following has been calculated for the massive sulphide zone intercepted in hole 24LCS-01 (previously released September 8, 2024):

1.8 % copperequivalent** over 6.1 metres* (122.75-127.6), including,

2.56% copperequivalent over 3.95 metres (122.75-126.7)

The weighted average for the total mineralized zone from 102.15 metres to 127.6 metres is calculated at:

0.83% copper equivalent over 25.45 metres

*True widths of mineralization have not yet been determined

**Copper equivalents utilize USA $80 per gram gold, $0.95 per gram silver, $1.30 per pound zinc, and $4.2 per pound copper.

The successful drilling of the TDEM anomaly at holes 24LCS-01 to 24LCS-03 indicates that these targets are of primary interest for further testing. The geophysics shows a cluster of TDEM anomalies further to the south, with the largest of the anomalies located approximately 215 m below surface. This anomaly (attached figure EMG-1) has potentially significant thickness as modelled by TMC (Maxwell plates). This will be the primary target for continued drilling at La Corne South.

The geophysics indicates a possible corridor of magnetic and electromagnetic anomalies over a two kilometer strike. The corridor is open to the northwest where surveying has yet to be completed, and the company plans to extend the geophysical surveying in that direction once exploration resumes.

The company is looking forward to receiving results from holes 24LCS-02 and 24LCS-03 which will aid in exploration planning.

Explo-Logik Inc, located in Val d'Or, is managing exploration including core logging and sampling at their facility. A total of 278 samples of core from the first three holes were directly delivered by Explo-Logik staff to the ALS laboratory in Val d'Or, Quebec. The samples underwent ALS ME-MS61L process that uses 4-acid digestion of pulverized samples followed by mass spectrometer detection for 48 elements, and process Au-ICP21 that analyzes for gold, platinum, and palladium using fire assay. For quality assurance and control Explo-Logik inserted blanks, standards, and duplicates at one insert every 10 samples.

Q PRECIOUS & BATTERY METALS CORP

QMET exploration programs undertaken in Quebec are supervised by Dr. Mathieu Piché, OGQ, with office located north of Val d'Or. He is also a Q Battery Metals company director. The company has 100% interest in mineral claims within Quebec, targeting critical and precious metals. Projects include the La Corne SouthVMS Project, McKenzie East Gold property, Lorrain Hydrogen Property and the recently acquired Pontax Lithium and Versant rare earth elements (REE) properties.

Cautionary Statement

This press release contains forward-looking statements based on assumptions as of that date. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. The Company cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to exploration and development; the ability of the Company to obtain additional financing; the Company's limited operating history; the need to comply with environmental and governmental regulations; fluctuations in the prices of commodities; operating hazards and risks; competition and other risks and uncertainties, including those described in the Company's Prospectus dated September 8, 2017 available on www.sedar.com. Accordingly, actual and future events, conditions, and results may differ materially from the estimates, beliefs, intentions, and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information.

On behalf of the Board of Directors

Richard Penn

CEO

(778) 384-8923

SOURCE: Q Precious & Battery Metals Corp.

View the original press release on accesswire.com