VANCOUVER, BC / ACCESSWIRE / December 10, 2024 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) ("Granite Creek" or the "Company") is pleased to announce drill results from the 2024 drill campaign on at its wholly owned Carmacks copper-gold-silver project located in central Yukon, Canada. As previously mentioned, the Company identified a new zone within the Carmacks project called the Gap Zone (see news release dated October 3, 2024), located between existing high-grade, pit-constrained resources. The exploratory drill program intercepted copper mineralization in all four drill holes, laying the foundation for a follow-up resource definition and expansion drilling campaign. See below for selected drill results.

Table 1 - Selected Assay Results

Drillhole | From (m) | To (m) | Length* (m) | Cu (%) | Au (g/t) | Ag (g/t) |

|---|---|---|---|---|---|---|

CRM24-026 | 172.21 | 180.15 | 7.94 | 0.13 | 0.017 | 0.7 |

CRM24-027 | 250.00 | 253.70 | 3.70 | 0.94 | 0.124 | 5.8 |

and | 258.50 | 279.75 | 21.25 | 0.53 | 0.072 | 3.3 |

Including | 261.30 | 270.30 | 9.00 | 0.70 | 0.090 | 4.4 |

CRM24-028 | 255.04 | 269.99 | 14.95 | 0.40 | 0.037 | 2.7 |

CRM24-029 | 247.00 | 261.85 | 14.85 | 0.51 | 0.059 | 3.4 |

Including | 254.60 | 259.00 | 4.40 | 0.77 | 0.093 | 6.5 |

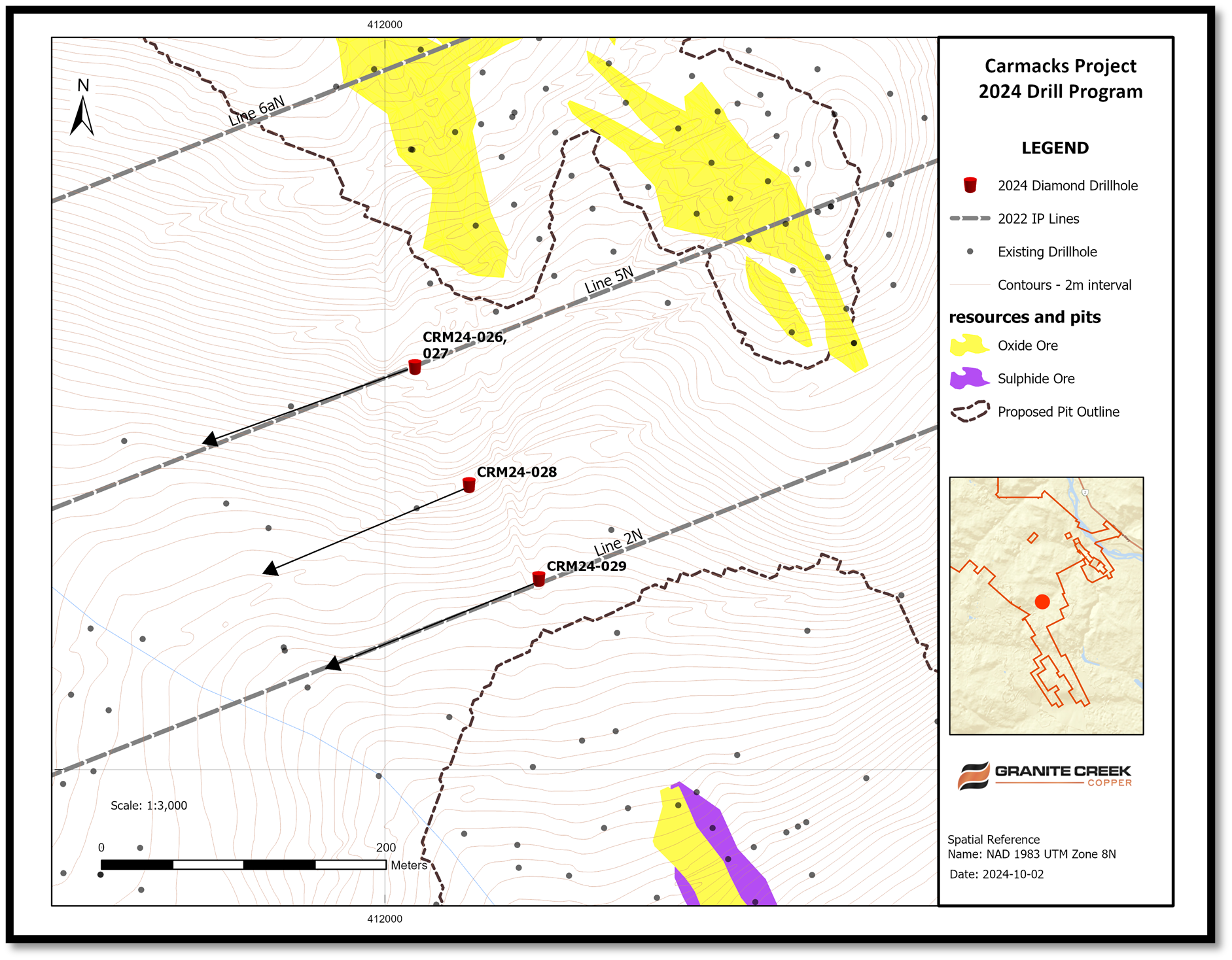

Figure 1 - Gap Zone plan view showing drill locations and traces

The Gap Zone lies between the proposed 147 and 2000S pits and was first identified by a 2022 geophysical IP survey (see news release dated November 21, 2022). Likely representing a fault offset from the main 147 Zone, the Gap Zone has the potential to add significant tonnage and extend the mine life envisioned by the 2023 Preliminary Economic Assessment (see news release dated January 19, 2023)

Granite Creek President and CEO, Timothy Johnson, stated, "The success of this drill program highlights the continued prospectivity of the Carmacks project. There remain multiple untested drill targets on the project, both proximal to the proposed pits as outlined int the 2023 PEA, as well as distal areas and across the northern sector which has seen only modest exploration. The project hosts significant copper-gold-silver resources and has the potential for major expansion across the 177 square kilometre land package in this top mining jurisdiction."

Carmacks Deposit

The 177 sq km, Carmacks project contains over 824 Mlbs Measured and Indicated and 29 Mlbs Inferred copper equivalent ("CuEq") metal within a National Instrument 43-101-compliant, high-grade resource of 36.2 million tonnes grading 1.07 % CuEq (0.81% Cu, 0.31 g/t Au, 3.41 Ag)1. The road accessible project is located along the Freegold Road, a Resource Gateway Road currently being upgraded by the Yukon government and is within 20 km of the Yukon electrical grid. The project is also situated within the Minto Copper Belt, a roughly 80 km long belt of rocks known for high grade occurrences of copper-gold-silver mineralisation.

The 2023 Carmacks Preliminary Economic Assessment ("PEA"), completed by SGS Canada, identified increased resources along with improved recovery as prime means of increasing the Net Present Value ("NPV") of the project. Work completed this year by Kemetco Research (see news release dated January 17, 2024) demonstrated that recoveries exceeding the target outlined in the PEA can be achieved. The just completed drill program was designed to show that significant resource expansion is possible and specifically targeted areas that could lead to an expanded mine life as envisioned by the PEA.

About Granite Creek Copper

Granite Creek Copper is a focused on the exploration and development of critical minerals projects in North America and more recently on geologic hydrogen. The Company's projects consist of its flagship 177 square kilometer Carmacks project in the Minto copper district of Canada's Yukon Territory on trend with the formerly operating, high-grade Minto copper-gold mine and the advanced stage LS molybdenum project and the Star copper-nickel-PGM project, both located in central British Columbia. Recent acquisitions include the Union Bay geologic hydrogen project as well as entering into a letter of intent to acquire the Duke Island ultramafic project for it's geologic hydrogen potential, both projects located in the state of Alaska. More information about Granite Creek Copper can be viewed on the Company's website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Qualified Person

Debbie James P.Geo, has reviewed and approved the technical information contained in this news release. Ms. James is a Qualified Person as defined in NI 43-101 and supervised the 2024 drilling program. She is not independent of the Company because she has received employment income from the Company and holds stock in the Company.

1Mineral Resources are reported within a conceptual constraining pit shell that includes the following input parameters: Metal prices of $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo and pit slope angles that vary from 35° for overburden to 55°for granodiorite host, metal prices are in US$. Metallurgical recoveries reflective of prior test work that averages: 85% Cu, 85% Au, 65% Ag in the oxide domain and 90% Cu, 76% Au, 65% Ag in the sulphide domain. Mo recovery is assumed to be 70% in both oxide and sulphide domain. Totals and Metal content may not sum due to rounding and significant digits used in calculations. Cu Eq calculation is based on 100% recovery of all metals using the same metal prices used in the resource calculation: $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements" or "forward-looking information". All statements in this release, other than statements of historical facts including, without limitation, statements regarding expected use of proceeds from the private placement and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View the original press release on accesswire.com