Discover How Clear Start Tax Turned a Complex Tax Debt Challenge Into a Success Story

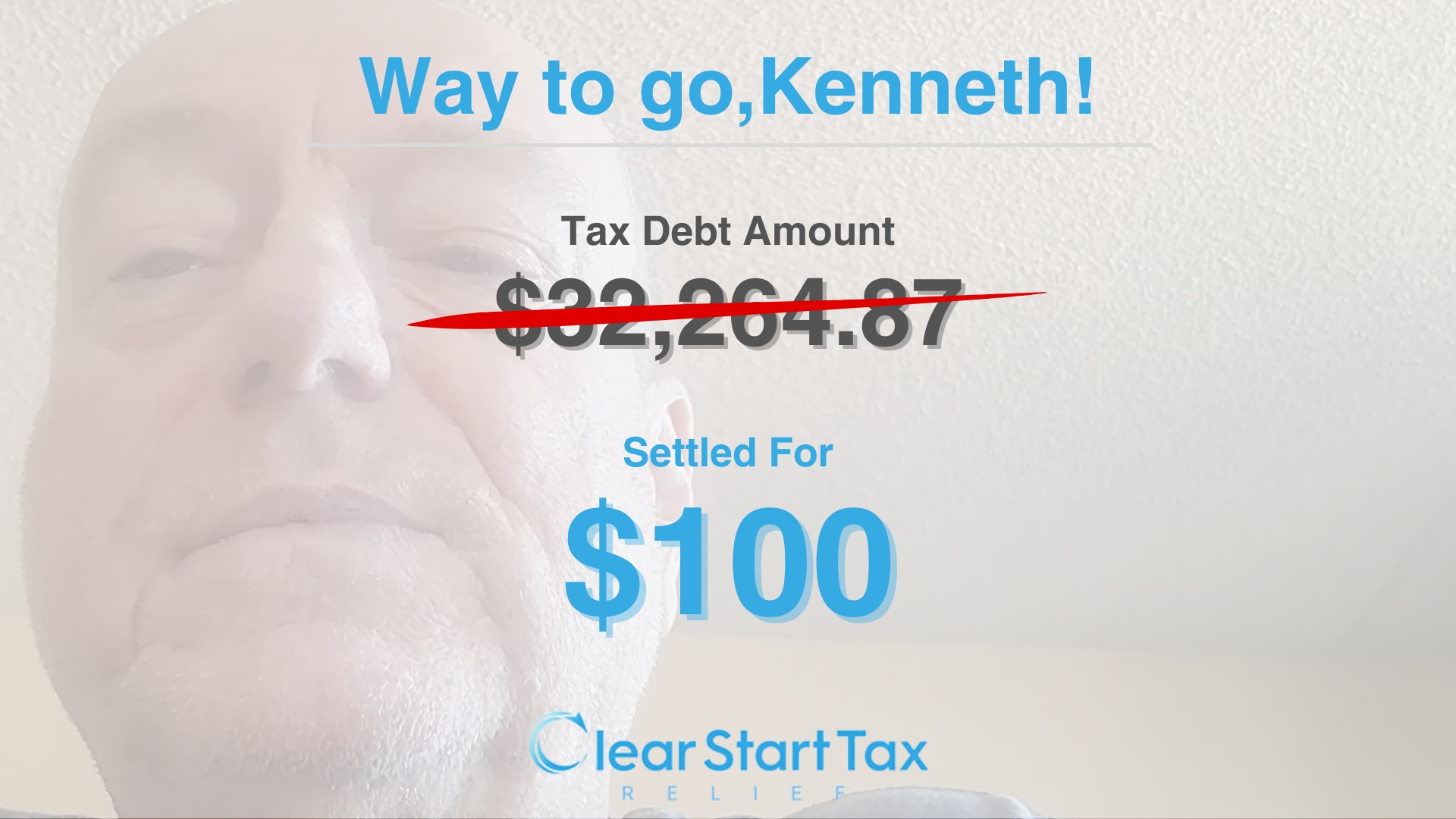

IRVINE, CA / ACCESSWIRE / December 11, 2024 / Clear Start Tax, a recognized leader in tax resolution services, achieved a remarkable outcome for its client, Ken Lambert, who resolved a $32,000 IRS tax debt for just $100. By expertly navigating the IRS Offer in Compromise (OIC) program, Clear Start Tax demonstrated its ability to provide life-changing financial relief for those burdened by tax challenges.

From Financial Chaos to a Fresh Start

Ken Lambert's tax troubles began during the 2008 financial crisis when a layoff and poor advice left him unable to pay taxes, causing his debt to balloon over the years.

"I listened to bad advice and stopped paying taxes. The debt just kept growing," Ken explained. "If I hadn't found Clear Start, I'd still be dealing with endless payments, penalties, or worse-facing legal trouble."

Clear Start Tax stepped in with a personalized and strategic approach, conducting a detailed analysis of Ken's financial situation to establish his eligibility for the IRS Offer in Compromise program. Through expert negotiation and an unwavering commitment to client success, Clear Start Tax reduced Ken's $32,000 tax debt to a mere $100.

Personalized Approach With Exceptional Support

Ken praised Clear Start Tax for their patience and compassion throughout the process.

"What stood out most about Clear Start was their patience," Ken said. "I'm not tech-savvy, but they walked me through every step, never rushing me or giving up on me. They made the process easy and stress-free."

"Every client's situation is unique, and that's why we take the time to create tailored strategies," added the Head of Client Solutions at Clear Start Tax. "Ken's story is a perfect example of how the right approach can turn a financial nightmare into a fresh start."

Turning Debt Challenges Into Success Stories

Ken's experience highlights Clear Start Tax's dedication to delivering exceptional results for clients nationwide.

"After working with Clear Start, I don't owe the $32,000 anymore. I couldn't be happier," Ken said. "It feels like a brand-new beginning, and I've already told friends about Clear Start. If you're struggling, they're the team to call."

With Ken's $32,000 IRS tax debt reduced to just $100, Clear Start Tax underscores its commitment to empowering clients with effective, results-driven solutions that restore financial freedom and peace of mind.

Simplifying Tax Challenges With Proven Solutions

"At Clear Start Tax, we're committed to helping clients navigate the complexities of tax resolution with confidence," said the Head of Client Solutions. "Our focus is on delivering real results that empower our clients to take back control of their financial future."

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

Testimonials Disclaimer

All estimates and statements regarding program performance are based on historical client outcomes. Results for each individual may vary depending on their specific tax situation, financial status, and the timely and accurate submission of information. Among Clear Start Tax clients who enroll in tax resolution services, approximately 30% qualify for an Offer in Compromise (OIC), 40% qualify for Installment Agreements (IA) or Partial Payment Installment Agreements (PPIA), 15% qualify for Installment Agreements (IA) with Penalty Abatement, and 15% are placed in Currently Not Collectible (CNC) status. We do not guarantee that your tax debt will be reduced by a specific amount or percentage, or that your taxes will be paid off within a certain time frame. Interest and penalties will continue to accrue until your tax liability is resolved in full.

Testimonials provided by Clear Start Tax clients reflect their individual experiences and are based on their specific circumstances. Compensation may have been provided for their honest feedback. These are individual results, which will vary depending on the situation. No testimonial should be considered a promise, guarantee, or prediction of the outcome of your case.

Contact Information

Clear Start Tax

Corporate Communications Department

admin@clearstarttax.com

949-800-4044

Related Video

https://www.youtube.com/watch?v=PnB1aJpGAiU

SOURCE: Clear Start Tax

View the original press release on accesswire.com

Related Documents:

- Client Testimonial Ken.jpg