Acquisition Adds $33.1 Million in Revenue and $10.4 Million in Net Income

Transaction Highlights 1847's Proven Business Model and Positions the Company for Sustained Profitability and Strong Cash Flow

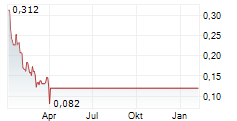

NEW YORK, NY / ACCESSWIRE / December 17, 2024 / 1847 Holdings LLC (NYSE American:EFSH) ("1847 Holdings" or the "Company"), today announced the successful closing of its acquisition of CMD Inc. ("CMD"), a Las Vegas-based cabinetry, millwork and door manufacturer, with trailing twelve-month (TTM) revenues of $33.1 million and net income of $10.4 million as of October 31, 2024. The acquisition was completed for approximately $18.75 million, representing a highly accretive transaction for 1847.

Ellery W. Roberts, CEO of 1847 Holdings, commented, "We believe this marks a transformative moment for 1847 Holdings. The acquisition of CMD further illustrates our ability to identify and acquire undervalued businesses with strong profitability at attractive valuations. With its historical revenue growth and profitability, this acquisition aligns with our strategic arbitrage model, which we believe will allow us to create substantial shareholder value by enhancing operational performance and leveraging synergies."

With strong demand for residential and commercial construction in Arizona and Utah-areas in close proximity to CMD's Las Vegas operations-the company has expanded its reach by obtaining licenses in both states. CMD is actively bidding on projects slated to begin in 2025, enhancing its market presence and capitalizing on the region's construction boom.

To further support growth in the Las Vegas area, CMD has established a dedicated division focused on tract home projects. Targeting both local and national builders, this initiative positions CMD to benefit from Northern Las Vegas' rapid residential expansion. This division has already begun bidding on multiple projects, which are expected to contribute incremental growth to CMD's portfolio.

Research conducted in collaboration with CMD identified a significant gap in the supply of Ready-To-Assemble (RTA) cabinetry for Las Vegas' multi-family housing market. To meet this demand, 1847 Holdings intends to leverage the capabilities of its subsidiary, Innovative Cabinets and Design, enabling CMD to tap into this underserved market and drive growth through 2025 and beyond.

Mr. Roberts added, "The strategic initiatives we're implementing, including CMD's expansion into high-demand areas and the launch of its tract home division, underscore our commitment to driving significant revenue growth. By addressing unmet market needs, particularly in RTA cabinetry, and leveraging synergies with our subsidiaries, we aim to deliver substantial incremental growth while strengthening CMD's market presence."

"We believe CMD's addition to our portfolio will drive sustained profitability, strong cash flow, and robust financial performance across 1847 Holdings. This acquisition reflects our commitment to unlocking value in overlooked middle-market businesses, positioning us for continued growth and creating long-term value for our shareholders," concluded Mr. Roberts.

About 1847 Holdings

1847 Holdings LLC (NYSE American: EFSH), a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings' ability to pay regular and special dividends to shareholders. For more information, visit www.1847holdings.com.

For the latest insights, follow 1847 on Twitter.

Forward Looking Statements

This press release may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: EFSH@crescendo-ir.com

SOURCE: 1847 Holdings LLC

View the original press release on accesswire.com