WHITE SULPHUR SPRINGS, Mont., Dec. 18, 2024 (GLOBE NEWSWIRE) -- Sandfire Resources America Inc. ("Sandfire America" or the "Company") is pleased to announce additional drill results from its 2024 exploration drilling program since the Company's news release dated July 24, 2024. The ongoing drilling program aims to upgrade and expand the Johnny Lee Lower Copper Zone resource of 1.2Mt at 6.8% Cu (Measured and Indicated) and 0.5Mt at 5.9% Cu (Inferred).

HIGHLIGHTS

- Continued exploration success at the Johnny Lee Copper deposit at the Black Butte Copper Project in Montana, USA.

- Sandfire America has completed thirty-two drill holes in the current drill program. This update highlights results from eleven holes, with the significant results from the Johnny Lee Lower Copper Zone including:

- Drillhole SC24-296 3.19m at 19.46% Cu from 471.86m

- Drillhole SC24-302 2.84m at 8.98% Cu from 357.36m

- Drillhole SC24-303 2.79m at 11.82% Cu from 364.93m

See Table 1 below.

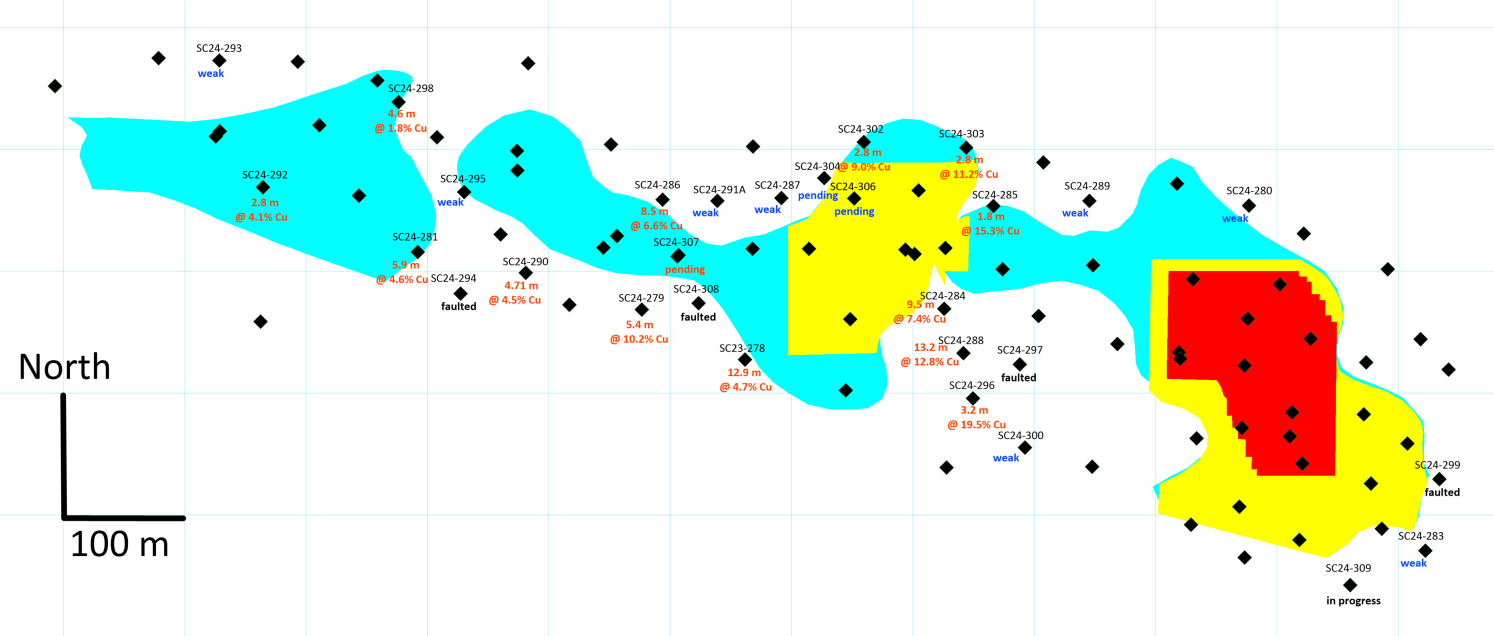

The ongoing 2024 drill program focuses on upgrading and expanding the Johnny Lee Lower Copper Zone resource which at last estimate consists of a measured and indicated resource of 1.2 million tonnes grading 6.8% Cu and an inferred resource of 0.5 million tonnes of 5.9% Cu (2020 Technical Report authored by GR Engineering*). Recent holes were designed to both infill and better define the outer boundaries of the Lower Copper Zone resource. Ongoing drilling includes gathering sample material for geotechnical and metallurgical testing. Since December 2023, the Company has drilled approximately 13,800 meters.

VP of Exploration, Jerry Zieg shared, "We are pleased with our additional drilling results. Our drilling is achieving consistent high-grade intersections in and around the resource as well as clearly defining its boundaries. This much improves the integrity of the resource model and adds significant value to the Black Butte project."

The current drill program is planned to extend into mid-summer of 2025 and is expected to lead to expansion and increased definition of the Johnny Lee Lower Copper Zone. The drill program will also provide sample material from both the Johnny Lee Upper and Lower Copper Zones for metallurgical testing and geotechnical testing; all with the expectation to better understand the economics of the project. The Company added a second drill in late November and plans to add a third drill in January 2025. Geological and geochemical results from the drilling program and from metallurgical and geotechnical testing will provide information for an updated Feasibility Study for the Johnny Lee deposit with an expected completion in 2026.

CEO Lincoln Greenidge closed stating, "We continue working diligently with this positive forward momentum to improve the permitted resource. This will ensure a robust Feasibility Study which will lead to an informed final investment decision related to building the project."

Table 1. Black Butte Copper 2024 Exploration Drilling Program Results

| Drill hole ID | collar x | collar y | collar z | azimuth | dip | total depth | From (m) | To (m) | Width (m) | Cu % | Resource |

| SC23-278 | 506700.0 | 5180717.0 | 1741.0 | 16.6 | -67.9 | 489.29 | 64.98 | 81.36 | 16.38 | 1.42 | Upper Copper Zone |

| SC23-278 | 433.46 | 446.37 | 12.91 | 4.7 | Lower Copper Zone | ||||||

| SC24-279 | 506628.0 | 5180702.0 | 1748.0 | 36.8 | -70.2 | 502.31 | 62.86 | 76.25 | 13.39 | 2.3 | Upper Copper Zone |

| SC24-279 | 461.73 | 467.10 | 5.37 | 10.2 | Lower Copper Zone | ||||||

| SC24-280 | 507100.0 | 5180848.7 | 1709.4 | 36.8 | -70.2 | 442.48 | weakly mineralized | Lower Copper Zone | |||

| SC24-281 | 506441.5 | 5180834.2 | 1767.5 | 31.8 | -77.5 | 486.61 | 94.98 | 100.58 | 5.60 | 1.84 | Upper Copper Zone |

| SC24-281 | 431.66 | 437.54 | 5.88 | 4.60 | Lower Copper Zone | ||||||

| SC24-282 | 507650.0 | 5180746.0 | 1735.0 | 194.2 | -86.5 | 494.57 | weakly mineralized | Lower Copper Zone | |||

| SC24-283 | 507213.0 | 5180540.0 | 1713.0 | 43.0 | -71.5 | 560.98 | 471.44 | 477.93 | 6.49 | 2.45 | Lower Copper Zone |

| SC24-284 | 506900.0 | 5180832.0 | 1721.2 | 35.2 | -83.0 | 426.11 | 383.44 | 392.98 | 9.54 | 7.42 | Lower Copper Zone |

| with | 386.72 | 392.98 | 6.26 | 10.68 | |||||||

| SC24-285 | 506900.0 | 5180832.0 | 1721.2 | 28.9 | -67.6 | 392.03 | 363.65 | 365.45 | 1.8 | 15.30 | Lower Copper Zone |

| SC24-286 | 506609.0 | 5180868.0 | 1779.0 | 45.4 | -73.9 | 495.67 | 77.23 | 80.77 | 3.54 | 4.67 | Upper Copper Zone |

| SC24-286 | 438.25 | 446.78 | 8.53 | 6.60 | Lower Copper Zone | ||||||

| SC24-287 | 506850.0 | 5180852.0 | 1731.1 | 336.0 | -71.5 | 431.9 | weakly mineralized | Lower Copper Zone | |||

| SC24-288 | 506850.0 | 5180852.0 | 1731.0 | 110.0 | -78.8 | 460.25 | 396.15 | 409.34 | 13.19 | 12.77 | Lower Copper Zone |

| SC24-289 | 506900.0 | 5180832.0 | 1721.0 | 51.0 | -63.0 | 444.09 | weakly mineralized | Lower Copper Zone | |||

| SC24-290 | 506425.0 | 5180870.0 | 1767.0 | 82.0 | -71.0 | 90.5 | 96.16 | 5.66 | 1.63 | Upper Copper Zone | |

| SC24-290 | 506425.0 | 5180870.0 | 1767.0 | 82.0 | -71.0 | 513.31 | 476.68 | 481.39 | 4.71 | 4.54 | Lower Copper Zone |

| SC24-291A | 506622.0 | 5180877.0 | 1741.0 | 58.0 | -68.5 | 507.03 | 67.25 | 70.37 | 3.12 | 3.67 | Upper Copper Zone |

| 80.9 | 82.9 | 2.00 | 5.36 | Upper Copper Zone | |||||||

| SC24-291A | weakly mineralized | Lower Copper Zone | |||||||||

| SC24-292 | 506361.5 | 5180939.0 | 1771.0 | 0.0 | -84.5 | 453.54 | 120.21 | 125.89 | 5.68 | 2.32 | Upper Copper Zone |

| SC24-292 | 369.02 | 371.81 | 2.79 | 4.08 | Lower Copper Zone | ||||||

| SC24-293 | 506354.0 | 5180981.0 | 1773.0 | 346.0 | -76.5 | 362.1 | 126.39 | 134.92 | 8.53 | 4.01 | Upper Copper Zone |

| SC24-293 | weakly mineralized | Lower Copper Zone | |||||||||

| SC24-294 | 506441.5 | 5180834.0 | 1768.0 | 64.0 | -80.0 | 511.45 | 94.72 | 101.35 | 6.63 | 3.29 | Upper Copper Zone |

| SC24-294 | Zone faulted away | Lower Copper Zone | |||||||||

| SC24-295 | 506441.5 | 5180834.0 | 1767.55 | 38 | -68 | 461.95 | weakly mineralized | Upper Copper Zone | |||

| SC24-295 | weakly mineralized | Lower Copper Zone | |||||||||

| SC24-296 | 507052.4 | 5180697.0 | 1711 | 315° | -72.5° | 498.96 | 471.86 | 475.05 | 3.19 | 19.46 | Lower Copper Zone |

| SC24-297 | 507061.5 | 5180693.0 | 1712.6 | 332° | -71.5° | 514.2 | Faulted away | Lower Copper Zone | |||

| SC24-298 | 506454.0 | 5181004.0 | 1784 | 035° | -86° | 395.63 | 104.14 | 115.74 | 11.6 | 1.61 | Upper Copper Zone |

| with | 104.14 | 109.22 | 5.08 | 3.35 | Upper Copper Zone | ||||||

| SC24-298 | 368.31 | 372.95 | 4.64 | 1.81 | Lower Copper Zone | ||||||

| SC24-299 | 507222.4 | 5180646.0 | 1715 | 54.5° | -74° | 518.6 | Faulted away | Lower Copper Zone | |||

| SC24-300 | 507052.4 | 5180697.0 | 1711 | 319° | -79° | 501.3 | weakly mineralized | Lower Copper Zone | |||

| SC24-301 | 506899.0 | 5180826.0 | 1721 | 350° | -59.5° | 174.65 | 27.67 | 36.79 | 9.12 | 1.72 | Upper Copper Zone |

| SC24-302 | 506899.0 | 5180826.0 | 1721 | 350° | -59.5° | 383.74 | 30.8 | 35.72 | 4.92 | 2.21 | Upper Copper Zone |

| 357.36 | 360.2 | 2.84 | 8.98 | Lower Copper Zone | |||||||

| SC24-303 | 506899.0 | 5180826.0 | 1721 | 17° | -60° | 398.37 | 364.93 | 367.72 | 2.79 | 11.82 | Lower Copper Zone |

| SC24-304 | 506852.0 | 5180856.0 | 1731 | 350° | -70.5° | 441.84 | Assays pending | Upper Copper Zone | |||

| Assays pending | Lower Copper Zone | ||||||||||

| SC24-306 | 506852.0 | 5180856.0 | 1731 | 003° | -76° | 412.94 | Assays pending | Upper Copper Zone | |||

| Assays pending | Lower Copper Zone | ||||||||||

| SC24-307 | 506700.0 | 5180717.0 | 1741 | 004° | -63.5° | 492.92 | Assays pending | Upper Copper Zone | |||

| Assays pending | Lower Copper Zone | ||||||||||

| SC24-307A | 506703.7 | 5180888.5 | 1385.15 | 007° | -65° | 77.69 | Assays pending | Lower Copper Zone | |||

| SC24-308 | 506700.0 | 5180717.0 | 1741 | 010° | -68.5° | 523.34 | Faulted away | Upper Copper Zone | |||

| Assays pending | Lower Copper Zone |

Intercept calculations included a minimum of 2 samples above a 1% copper cutoff grade.

1) Drilling conducted by Ruen Drilling of Hope, Idaho. HQ3-sized core was collected. Drill holes were oriented with dips varying between -80 to -70 degrees in relatively variably dipping mineral zones. Intercepts may be slightly longer than true thickness.

2) After being logged and photographed in White Sulphur Springs, Montana, all mineralized zones were sampled by cutting half-core splits which were delivered to ALS labs in Reno Nevada for processing. ALS crushed the entire sample to 85% passing 2mm then split off 1kg, which was ground to 85% passing 75 micron and wet-sieved the split to ensure grinding passed specifications and then assayed for gold by fire assay with AA finish. Base metals were analyzed using a 4-acid digestion and ICP-OES analysis. Various other trace and major elements were also analyzed utilizing ICP procedures. Sandfire America utilized a QA/QC protocol which included inserting Certified Reference Materials (CRM) on a minimum of 1 CRM in 20 samples insertion rate. Assays of duplicates, and blanks were also included as part of the QA/QC program.

3) ALS Labs are accredited by ISO/IEC 170205:2017 methods for North America.

4) Drillhole collars are surveyed conforming to UTM NAD83 Zone 12.

5) The Company is aware of no drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to above.

Figure 1: Drilling completed at the Black Butte Project from mid-December 2023 to December 2024. Black diamonds show pierce points in Johnny Lee Lower Copper Zone. Assay results are light brown for high grade and blue for low grade. Colored areas show Measured (red), Indicated (yellow), and Inferred (blue) resource areas from the 2020 Technical Report.

Johnny Lee Copper Deposit

The Johnny Lee deposit has a Measured and Indicated Mineral Resource of 10.9 million tonnes (Mt) at an average copper grade of 2.9% for 311 thousand tonnes (kt) of contained copper (Cu) at a 1.0% Cu cut-off grade, and an Inferred Mineral Resource of 2.7 Mt at an average copper grade of 3.0% for 80 kt of contained Cu at a 1.0% Cu cut-off grade (2020 Technical Report*). The Company has received a Mine Operating Permit from the Montana Department of Environmental Quality for mine development of this deposit and has completed a majority of Phase I construction on surface construction facilities. The Company received a decision from the Montana Supreme Court on February 26, 2024, to re-instate the mine operating permit and allow construction to move forward.

Qualified Person

Jerry Zieg, Sr. Vice President of Exploration for the Company, is a Qualified Person for the purposes of NI?43-101 and has also reviewed and approved the information of a scientific or technical nature contained in this news release. Mr. Zieg verified the data disclosed in this news release, including sampling, analytical, and test data underlying the information, or opinions contained in this news release.

*(2020 Technical Report) - "Feasibility Study (Johnny Lee Deposit) and Mineral Resource Estimate Update (Lowry Deposit) - Technical Report NI 43-101" dated October 19, 2020, and news release "Sandfire Resources America Achieves Major Milestones with Completion of Black Butte Copper Project Feasibility Study and Updated Mineral Resource for Lowry Deposit" October 27, 2020, authored by GR Engineering.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact Information:

Sandfire Resources America Inc.

Nancy Schlepp, VP of Communications and Government Relations

Mobile: 406-224-8180

Office: 406-547-3466

Email: nschlepp@sandfireamerica.com

www.sandfireamerica.com

Cautionary Note Regarding Forward-Looking Statements:

Certain disclosures in this document constitute "forward looking information" within the meaning of Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "expects", or variations of such words and phrases or statements that certain actions, events, or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward-looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding the Company's drilling program and the expected timing and results thereof; the expansion and increased definition of the Johnny Lee Lower Copper Zone; the Company's plans to add a third drill and the expected timing thereof; and the completion of an updated Feasibility Study for the Johnny Lee deposit and the expected timing thereof.

In making these forward-looking statements, the Company has applied certain factors and assumptions that the Company believes are reasonable, including that the Company will be able to complete its drilling program as planned or at all; that the Company's planned drilling program will achieve expected results; that the Company will be able to achieve further expansion and increased definition of the Johnny Lee Lower Copper Zone; that the Company will be able to complete any environmental review, permitting process, or engineering and economic studies required for resource development of the Johnny Lee Lower Copper Zone; that the Company will be able to add a third drill to the Johnny Lee Lower Copper Zone by January 2025, or at all; and that the Company will be able to complete an updated Feasibility Study for the Johnny Lee deposit in 2026 or at all.

These forward-looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, that results of exploration and development activities will not be consistent with management's expectations, delays in obtaining or inability to obtain required government or other regulatory approvals or financing, failure of plant, equipment or processes to operate as anticipated, the risk of accidents, labor disputes, inclement or hazardous weather conditions, unusual or unexpected geological conditions, ground control problems, earthquakes, flooding and all of the other risks generally associated with the development of mining facilities.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. We seek safe harbor.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ae30ac75-e859-4852-9c08-deb88a8a5601