This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated November 28, 2024 to its short form base shelf prospectus dated August 21, 2024

VANCOUVER, BC / ACCESSWIRE / December 19, 2024 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce a new mineral resource estimate (the "2024 MRE") for GSilver's 100% owned El Cubo mine complex ("El Cubo") located in Guanajuato, Mexico.

The new El Cubo mineral resource estimate is part of a scheduled program to update GSilver's NI 43-101 technical reports and resource estimates for all of its producing mines in Mexico, which includes the El Cubo Mine complex, the Valenciana Mines Complex, and the San Ignacio mine, all located within the state of Guanajuato, and the Topia mine located in northwestern Durango.

James Anderson, Chairman and CEO, said, "The sizable expansion of total mineral resources at El Cubo, after several years of mining depletion, is a testament to the resilience and durability of the mines of Guanajuato. We believe that El Cubo will remain the centerpiece of our hub-and-spoke mining strategy for many years."

Highlights of the El Cubo Mineral Resource Estimate

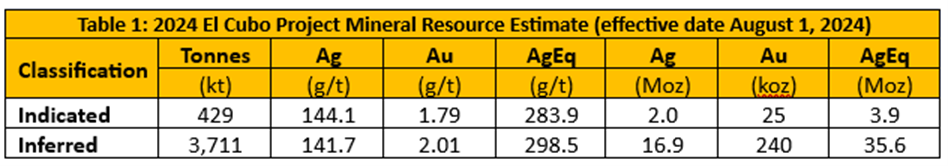

Inferred mineral resources increase 85% over previous resource estimate* to 35.6 million silver-equivalent9 ounces ("AgEq"). See table below for assumptions regarding the calculation of AgEq.

Inferred mineral resource tonnes of 3,711 kt represents a 179% increase over the previous resource estimate*.

Indicated mineral resources of 3.9M AgEq9; after three years of substantial mining activity at El Cubo, the resources within the Indicated Resource category have declined by just 23% from the previous estimate*.

Exploration expansion potential remains high; drilling to convert Inferred resources to Indicated Resources planned for January, 2025.

The 2024 MRE was prepared by APEX Geoscience Ltd. ("APEX"), with an effective date of August 1, 2024. The resource update report (the "Updated Technical Report") will be filed under the Company's SEDAR+ profile within 45 days of this news release, in accordance with disclosure and reporting requirement set forth in the National Instrument 43-101 ("NI 43-101"). The 2024 MRE supersedes and updates the previous mineral resource estimate for the El Cubo mine, disclosed previously by the Company in the technical report entitled "Technical Report - El Cubo/El Pinguico Silver Gold Complex Project" with an effective date of December 31, 2023 (the "Prior Technical Report")*. The Updated Technical Report will replace the Prior Technical Report as the current NI 43-101 technical report on El Cubo.

2024 Mineral Resource Estimate

Mineralization at El Cubo consists of silver and gold occurring in several stratigraphic formations, with the middle Tertiary La Bufa, Guanajuato, and Calderones formations being the most important hosts. Mineralization at El Cubo is typical of classic high-grade silver-gold banded epithermal vein deposits, with the most productive veins being sub-parallel to the Veta Madre system as north-northwest striking veins and local stockwork style mineralization. Several transverse, northeast striking veins with high-grade gold mineralization also occur. The 2024 MRE includes 44 vein domain models based on underground mapping and sampling, drillhole geological logging, along with the silver and gold assays. The updated El Cubo database now includes a total of 43,919 underground channel samples and 24,602 drillhole samples. Included in these totals, GSilver has collected a total of 26,806 underground channel samples totaling 16,824 m and 4,157 drillhole samples from 129 drillholes since they took over the Project in 2021. As of the Effective Date of the 2024 MRE, the Company has collected a total of 17,402 underground chip channel samples from 4,863 channels, totalling 11,076 m of channel length, that are from the Villalpando and Santa Cecilia areas of El Cubo and are within the mineral estimation domains. A total of 445 drillhole samples collected by the Company are from within the mineral estimation domains.

The 2024 MRE comprises Indicated Mineral Resources of 3.9 million troy ounces (Moz) AgEq9 at 283.9 g/t AgEq9 within 429 thousand tonnes (kt), and Inferred Mineral Resources of 35.6 Moz AgEq9 at 298.5 g/t AgEq9 within 3,711 kt. Table 1 presents the complete 2024 El Cubo MRE statement.

Notes:

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The author is unaware of any other significant material risks to the 2024 MRE besides the risks inherent to mineral exploration and development. Potential risk factors include changes in metal prices, increases in operating costs, fluctuations in labour costs and availability, availability of investment capital, infrastructure failures, changes in government regulations, community engagement and socio-economic community relations, civil disobedience and protest, permitting and legal challenges, and general environmental concerns. The mining industry in Mexico is also prone to incursions by illegal miners, or "lupios", who gain access to mines or exploration areas to steal mineralized material. These incursions pose a safety, security and financial risk and can potentially compromise underground structures, equipment, and operations.

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

The 2024 MRE was estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

The 2024 MRE was completed by Warren Black, M.Sc., P.Geo., Senior Consultant: Mineral Resources with APEX Geoscience Ltd. Mr. Black is the independent Qualified Person ("QP"). Tyler Acorn, M.Sc., Senior Geostatistician with APEX completed a peer review.

Historically mined areas were removed from the block-modelled Mineral Resources.

The 2024 MRE includes the main El Cubo resource area and the El Nayal/Cabrestantes area.

Specific gravity of 2.58 g/cm3 is used for the 2024 MRE.

Economic assumptions used include US$25/oz Ag, US$1,950 /oz Au, process recoveries of 85% for both Ag and Au, a US$15/t processing cost, and a G&A cost of US$15/t. The resulting gold equivalency ratio of Au:Ag ratio was 1:78 and is used for the purposes of the AgEq calculation

The Underground 2024 MRE includes blocks within potential underground mining shapes. A mining cost of US$63/t, in addition to the economic assumptions above, results in an underground AgEq9 lower cutoff of 135 g/t. Mining shapes are generated using stope optimization with the objective of maximizing the total metal above the cutoff with a minimum dimension of 1.0 m (W) by 10 m (H) by 20 m (L). All "take all" material within the mining shapes is reported, regardless of whether the estimated grades are above the optimized cutoff grade.

Mineral Resource Estimate Methodology

APEX personnel used Ordinary Kriging with locally varying anisotropy to estimate silver and gold grades in a 1.5 m (X) by 1.5 m (Y) by 1.5 m (Z) parent block model. This model is sub-blocked to 0.5 m by 0.5 m by 0.5 m for stope optimization and resource reporting. Kriging considers capped drillhole and underground channel composites.

Three types of material were identified during the calculation of the MRE: 1. In Situ, 2. Remnant, and 3. Mined Out. Blocks within, in contact with, or adjacent to underground workings were flagged as Mined Out using a 10 m by 5 m by 1 m search ellipse, aligned along the dip direction of the domain's trend at 0° dip with no third-axis rotation. Blocks within 10 m of the underground workings wireframe in any direction were classified as Remnant material, which is under evaluation but not included in the 2024 MRE. Only In Situ material, unaffected by mining, is included in the 2024 MRE.

For Indicated resources, blocks require a minimum of three drillholes within a search ellipse measuring 30 m by 30 m by 15 m. For Inferred resources, blocks need at least one drillhole or underground channel within a search ellipse of 60 m by 50 m by 15 m, based primarily on the second variogram structure. Only channel composites with centroids within the workings wireframe and all core composites are considered for Indicated classification. All channel and composites are considered for Inferred classification.

Measured resources are currently not defined. The MRE relies heavily on underground channel samples, often in areas flagged as mined out or remnant, limiting their ability to inform domain locations for in-situ material. Additional underground or surface drilling is needed away from the channel samples to assist in better defining the estimation domains.

Sampling and quality assurance/quality control

The El Cubo underground channel samples were analyzed at Corporación Química Platinum S.A de C.V. (QPSV) in Silao, Guanajuato, until the establishment of the on-site El Cubo laboratory in December 2021. Corporación Química Platinum is independent of GSilver and is accredited by Entidad Mexicana de Acreditación, A.C. ("EMA"), which is part of the International Accreditation Forum ("IAF"). EMA also works in conjunction with the International Organization for Standardization ("ISO") Committee for Conformity Assessment ("CASCO"). The El Cubo laboratory remains under GSilver management and is not independent of the Company.

Drill core was first reviewed by a Company geologist, who identified and marked intervals for sampling. The marked sample intervals were then cut in half with a diamond saw; half of the core was left in the core box and the other half was removed, placed in plastic bags, sealed and labeled. Intervals and unique sample numbers are recorded on the drill logs and the samples are sequenced with standards and blanks inserted according to a predefined QA/QC procedure. The samples are maintained under security on site until they are shipped to the analytical lab.

The El Cubo drill core samples were submitted to the QPSV., Silao, Guanajuato, Mexico, for preparation and analysis. To validate assay results and preparation procedures, GSilver systematically sent additional random samples representing approximately 20% of all analytical samples to Bureau Veritas (BV) in Hermosillo, Sonora, Mexico, and approximately 10% of all analytical samples to SGS Mexico, S.A de C.V, Durango, Mexico. BV and SGS are ISO/IEC geo-analytical laboratories and are independent of GSilver.

At QPSV and El Cubo laboratory, gold and silver determination was via standard atomic absorption (AA) finish 30-gram fire assay (FA) analysis. Overlimit results were re-run with a gravimetric finish. Multi-element analysis of 33-elements (including silver) of select samples was via multi-acid digestion followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES).

At BV and SGS, gold determination was via standard AA finish 30-gram FA analysis. Silver was analyzed via four acid digestion followed by ICP-AES or by FA with a gravimetric finish and 34-element analysis was performed by four acid digestion followed by ICP-AES.

GSilver's QA-QC protocol for underground channel and drill core sampling programs at El Cubo consisted of an insertion rate of approximately one QA-QC sample in every batch of 20 samples.

Qualified Person

The 2024 MRE was completed by Warren Black, M.Sc., P.Geo., Senior Consultant: Mineral Resources with APEX Geoscience Ltd. Mr. Black is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects and he is independent of the Company. Mr. Black has reviewed and verified technical data disclosed in this news release related to the 2024 MRE.

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed and verified technical data disclosed in this news release and detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. Verified data underlying the disclosed information includes reviewing compiled assay data; QAQC performance of blank samples, duplicates and certified reference materials; and grade calculation formulas.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

GSilver.com

Guanajuato Silver Bullion Store

Please visit our Bullion Store, where Guanajuato Silver coins and bars can be purchased.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, GSilver's growth, that El Cubo will remain the centerpiece of its hub-and-spoke mining strategy, that exploration expansion potential remains high, the details of planned drilling to convert Inferred resources to Indicated Resources, the interpretation of drill results, the potential for further exploration and development of GSilver's mineral properties, GSilver's status as one of the fasting growing silver mining Company in Mexico.

Such forward-looking statements and information reflect management's current beliefs and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: the potential quantity, grade and metal content of the mineralized material at El Cubo and San Ignacio, the geotechnical and metallurgical characteristics of such material conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, currency rate fluctuations, high inflation and interest rates, geopolitical conflicts including wars, actual results of exploration, development and production activities, actual grades and recoveries of silver, gold and other metals from the Company's existing mines including El Cubo, San Ignacio, VMC and Topia, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to continue to increase production, tonnage milled and recoveries rates, improve grades and reduce costs at El Cubo, San Ignacio, VMC and/or Topia to process mineralized materials to produce silver, gold and other concentrates in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, San Ignacio, VMC and Topia is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected grades of gold and silver at El Cubo and San Ignacio and the anticipated level of production therefrom will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about impact of any resurgence of COVID-19, the ongoing war in Ukraine and conflict in Gaza, elevated inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR+ at www.sedarplus.ca including the Company's most recently filed annual information form. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

View the original press release on accesswire.com