VANCOUVER, BC / ACCESSWIRE / December 19, 2024 / Sun Peak Metals Corp. (the "Company" or "Sun Peak") (TSXV:PEAK)(OTCQB:SUNPF) is pleased to provide an update on its Shire Project in Ethiopia, highlighting recent exploration results and outlining key targets for its 2025 drilling program.

Greg Davis, President and CEO commented, "We are excited to advance exploration on the Shire Project, particularly at the Meli and Anguda North trends. Our recent mapping and surveying efforts have revealed significant new targets that reinforce the Shire Project's exceptional copper-gold potential. As we prepare to launch drilling in early 2025, we remain focused on unlocking the value of this promising VMS system."

Key Highlights of the Shire Project

2025 Exploration Program:

Drilling to commence in Q1 at the Meli Trend and the Anguda North Target.

Detailed Ground Deep Time Domain Electromagnetic (DTEM) surveys scheduled for January to refine drill location targeting.

Proven VMS Belt:

Located in a district-scale VMS belt with high-priority copper-gold targets.

Previous Sun Peak drilling has intercepted significant copper-gold mineralization at the Meli, Argo, and Keel targets - all remain open for expansion. Intercepts include:

Meli

ML-001 - 15.30m @ 3.18 g/t Au, 25.0 g/t Ag and 2.2% Cu

ML-002 - 37.23m @ 2.45 g/t Au, 29.4 g/t Ag and 2.4% Cu

ML-003 - 35.43m @ 2.52 g/t Au, 22.3 g/t Ag and 1.8% Cu

Keel

KL-006 - 17.85m @ 3.95 g/t Au, 45.5g/t Ag, 1.4% Cu, and 1.6% Zn

Argo

AR-001 - 6.57m @ 1.34 g/t Au, 54.3g/t Ag, 6.3% Cu, and 1.7% Zn

All targets drilled by Sun Peak to date have intercepted VMS style mineralization, confirming the effectiveness of the team's exploration methodology.

Numerous new high-quality targets are currently being developed showing strong copper and gold potential.

2025 Exploration

The exploration team has been conducting extensive detailed geological mapping and prospecting in the field as part of the Company's preparations for the upcoming drilling program on the Shire Project, which will target the Meli Trend and Anguda North.

Ground Deep Electromagnetic Time Domain ("DTEM") surveys on both the Meli Trend and Anguda North targets will begin in early January and drilling is planned to begin late January. The results from the DTEM work will be used to enhance targeting drill locations.

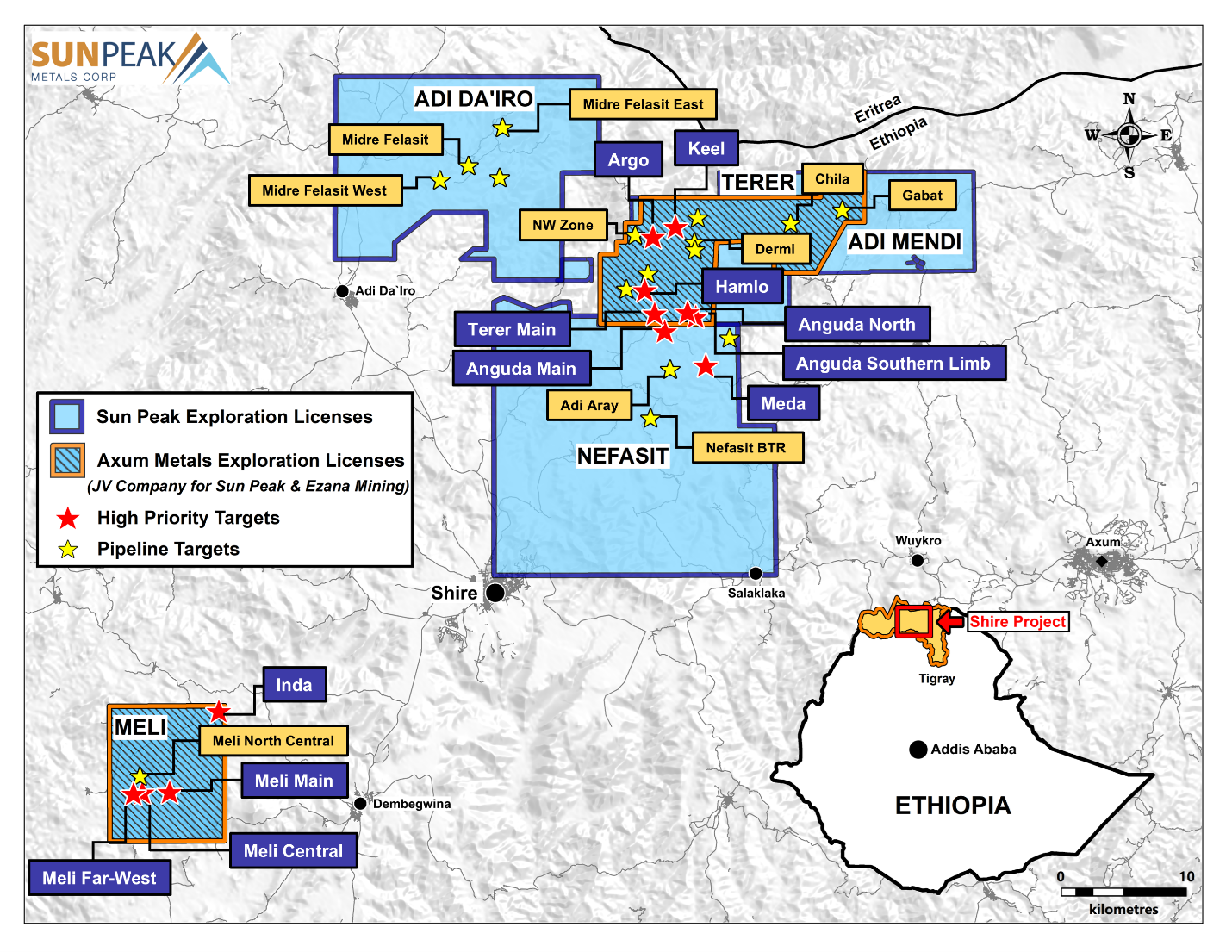

Figure 1: Map of Shire Project exploration licenses and key targets

Meli VMS Trend

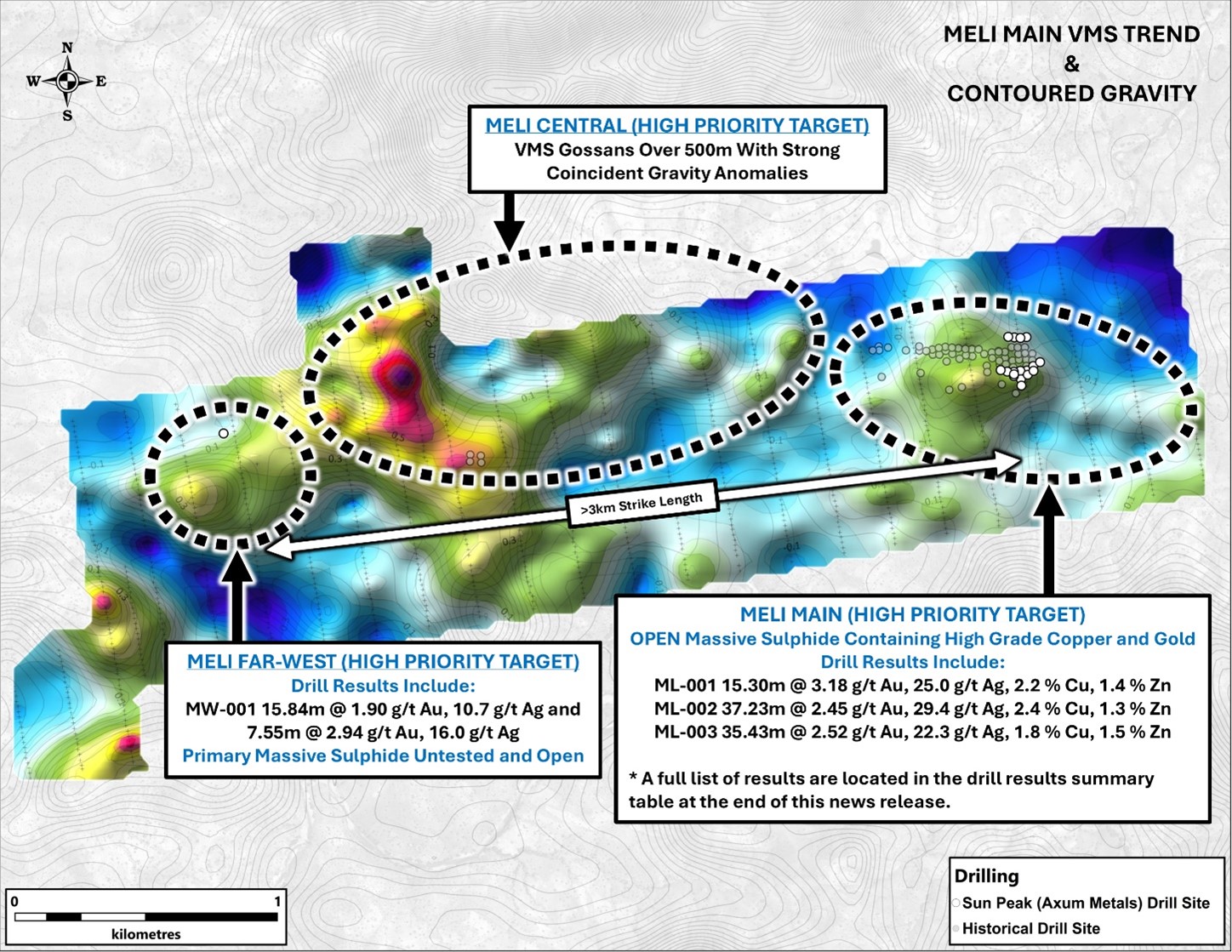

Exploration work at Meli has primarily focused on a greater than 3km long, east-west oriented VMS trend, containing targets such as Meli Main, Meli Central, and Meli Far-West (Figure 2). The trend is anchored at each end by strong gold and copper drill intercepts (Meli Main and Meli Far West), which are part of an extensive VMS system containing intermittent gossans and hydrothermally altered zones. Detailed gravity surveys have revealed strong anomalies and are largely untested by diamond drilling. These strong anomalies will be a key focus of the upcoming drill program.

Figure 2: Key VMS Targets on the Meli License

Meli Main Target

The Meli Main Target is located at the east end of the Meli trend and has been the focus of previous successful drill programs by the Company, resulting in some of the best copper-gold VMS intercepts on the Project. The target includes an area of massive sulphides below an exposed 600m long gold-rich VMS gossan (some of which has been mined to a depth of averaging 20 meters), with additional intermittent gossans along trend to the east and west.

Drilling by the Company at Meli Main in 2020 demonstrated the potential of the Meli trend. Highlights from the 2020 drilling at Meli include (full results in table at end of this news release):

ML-002 - 37.23m @ 2.45g/t Au, 29.4g/t Ag, 2.4% Cu, and 1.3% Zn

ML-003 - 35.43m @ 2.52g/t Au, 22.3g/t Ag, 1.8% Cu, and 1.5% Zn

ML-013 - 8.89m @ 2.76g/t Au, 31.8g/t Ag, 2.22% Cu, and 1.75% Zn

ML-014 - 11.48m @ 3.57g/t Au, 31.2g/t Ag, 2.38% Cu, and 0.65% Zn

ML-018 - 9.61m @ 3.18g/t Au, 32.3g/t Ag, 2.21% Cu, and 0.56% Zn

The Meli Main Target remains open to depth and along trend.

Meli Central

The large Meli Central Target has a very strong gravity anomaly located within the Meli VMS Trend. The target is untested, and the signature of the gravity anomaly has strong similarities in size and magnitude to the signatures from the Emba Derho and Bisha VMS Deposits in the same region.

The target is located only 2 kilometers west of Meli Main and the trend is defined by smaller gravity anomalies along the trend over known mineralization.

Meli Far-West Target

The Meli Far-West Target is located approximately 3 km west of Meli Main within the Meli VMS trend. In November 2020, two shallow drill holes for a total of 108 meters, were drilled at the target and designed to test the gold oxide gossan. MW-001 intercepted 15.84 meters averaging 1.90 g/t gold.

Drilling confirms the presence of significant gold mineralization in the gossan and demonstrates the potential for the Meli Far-West Target to host gold and copper VMS sulphide below the gossan. The mineralization is open to depth and along strike, and future drilling at the Meli Far-West target will test the massive sulfide potential beneath the gossan.

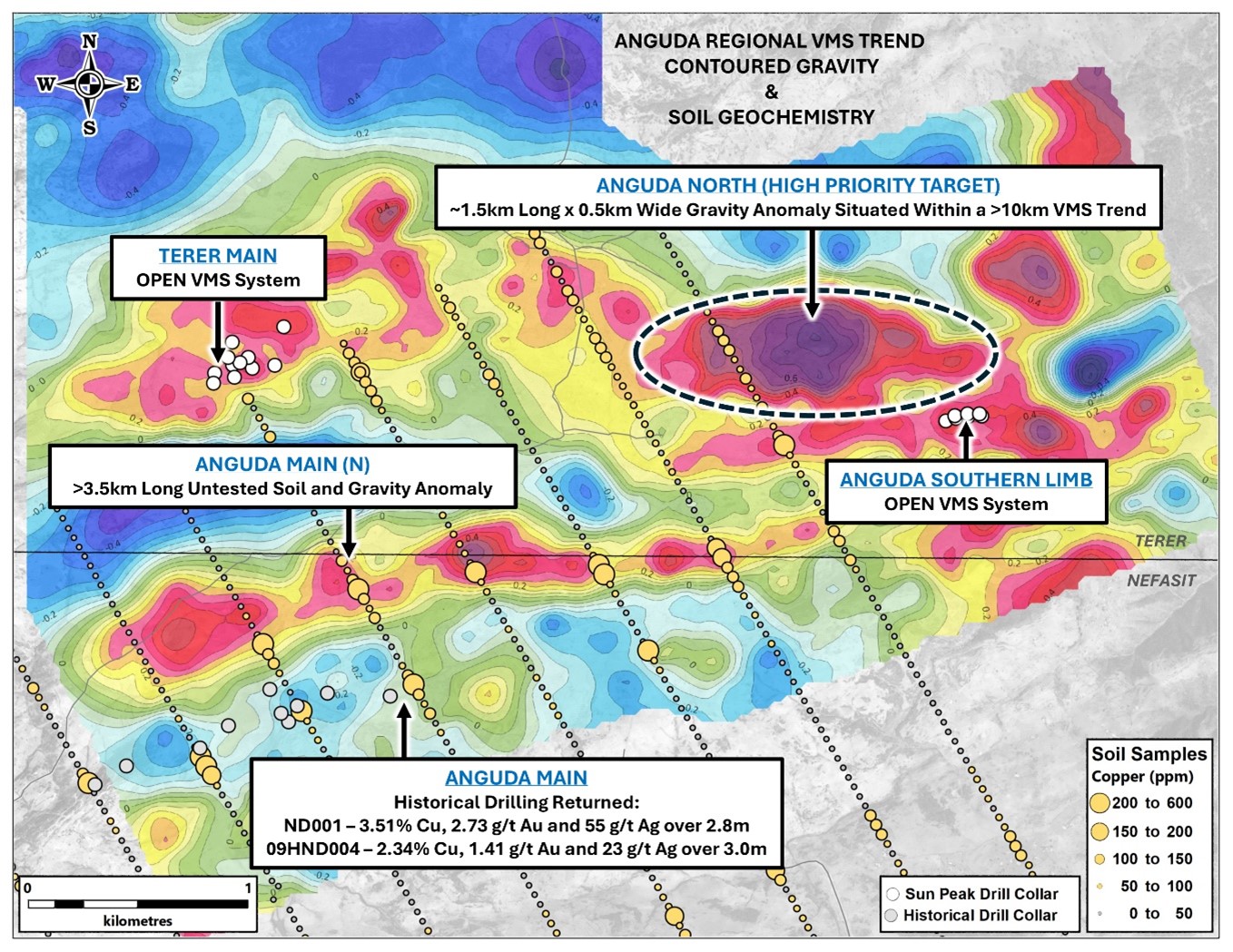

Anguda VMS System/Trend

The Anguda VMS Trend, situated within the Terer exploration license, is a prominent VMS system extending for over 10 kilometers. Key targets along this trend include the Anguda North Target, Anguda Main Target, Anguda Main (N), Anguda Southern Limb Target, and the Terer VMS Target (Figure 3).

Recent drilling activities at the Hamlo and Terer VMS Targets, alongside limited drilling at the Anguda Southern Limb in 2020, have revealed typical VMS metal zoning patterns - see Sun Peak news release, dated July 25, 2024. The data suggests a potential increase in precious and base metal concentrations in other VMS zones within the Anguda trend.

The drill results at the Terer Target, outlined a VMS system along the trend of the Anguda North gravity high anomaly located approximately 2 kilometers east. Final drill results from Hamlo and Terer drilling can be found in table at the end of this release.

Anguda North VMS Target: Defined by a strong soil geochemistry anomaly, detailed ground gravity high anomalies, airborne VTEM conductor, and 800 meters long gossan outcrops. The gossan outcrops were defined in recent geological mapping work which was following up on the anomalies identified by the geophysical and geochemistry surveys.

Ground DTEM survey is scheduled in Q1 2025 which will be immediately followed by drilling at Anguda North.

Anguda Main (N) VMS Target: Defined by a greater than 1.5-kilometer-long mineralized zone of gossans and hydrothermal alteration horizons, plunging and increasing in size to the east. The target is identified by a copper and zinc soil geochemistry anomaly and a gravity high coincident with VTEM conductors.

The upcoming work program in Q1 2025 will include ground DTEM surveys over the Anguda North and Anguda Main Targets, with drilling to follow.

Figure 3: Anguda regional VMS trends underlain by gravity surveys and soil geochemistry

High Priority Targets

The main focus of the upcoming drill program in early 2025 will begin with the Meli Trend and the Anguda North Target, however exploration work will also include other high priority targets throughout the year. A summary of these other key targets is as follows.

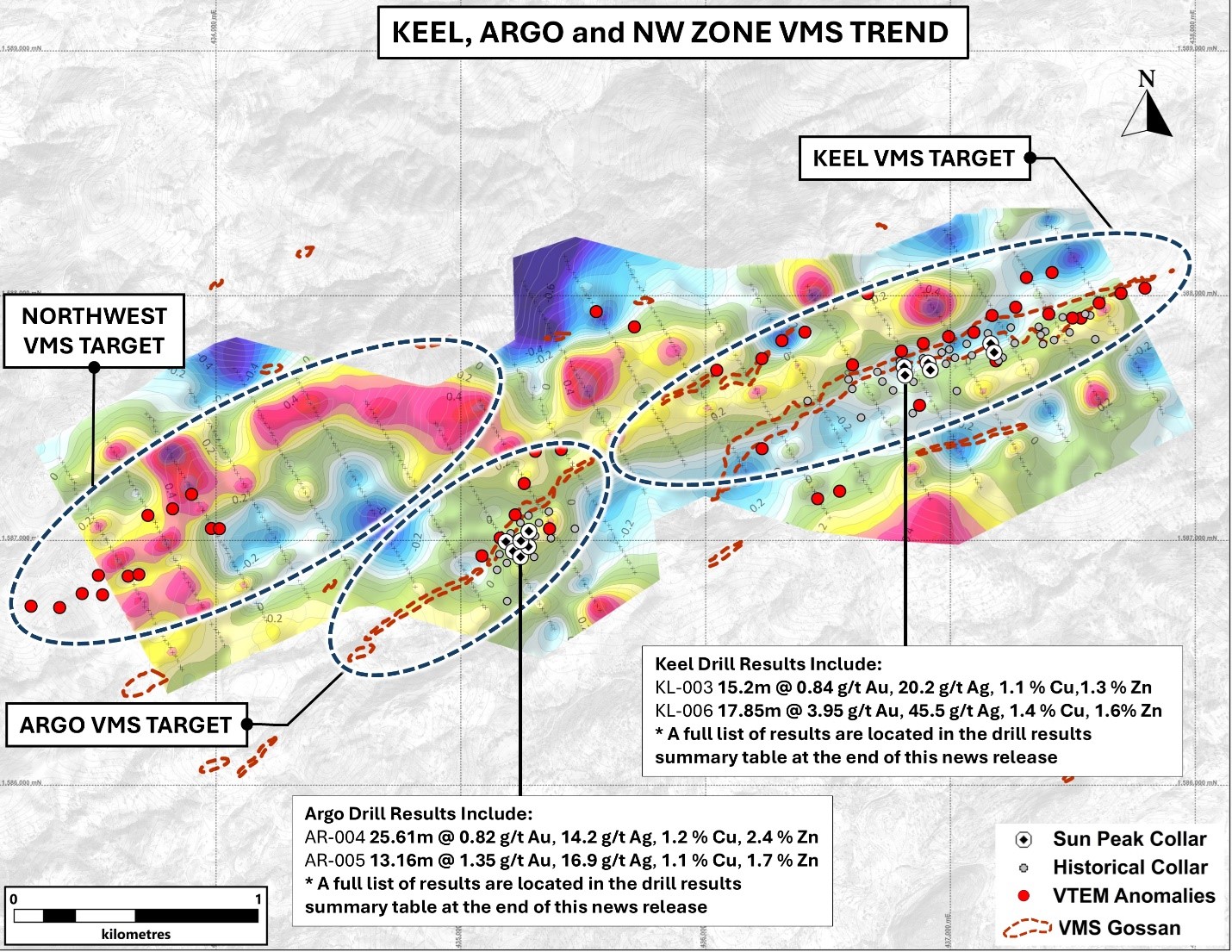

Keel and Argo VMS Trend

The Keel and Argo Targets are part of a significant VMS system that extends over 6 kilometers and includes several other highly prospective targets such as the Northwest Zone (Figure 4).

During the Company's initial drill program in 2020, Sun Peak drilled 12 holes and intercepted high-grade copper-gold VMS mineralization at both Keel and Argo targets. The VMS zones remain open in all directions with untested gossans and gravity anomalies directly on strike from Keel and Argo.

Future work will focus on extending these zones laterally and testing new zones along the trend.

Figure 4: Keel-Argo VMS Trend

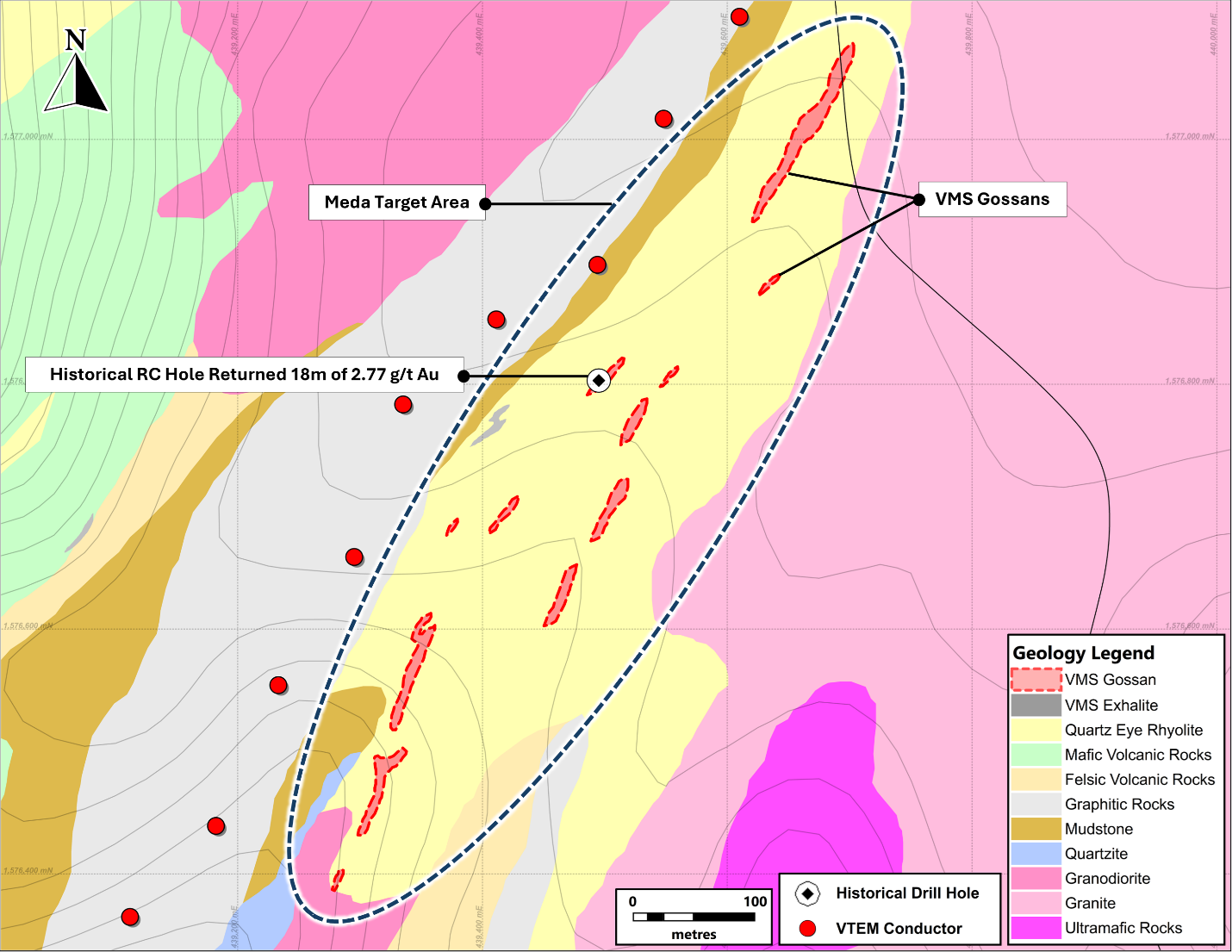

Meda VMS Target: Defined by a 1.2 kilometers long gold, silver, copper, and zinc soil geochemistry anomaly, several gossan outcrops, and a gravity high anomaly. A single historic vertical RC hole was drilled in 2004 into the gossan which assayed 18 meters of 2.77 g/t gold from surface (Figure 5).

Future drilling will attempt to define the VMS Zone laterally along strike and to depth.

Figure 5: Meda VMS target underlain by geology

Target Development Work

Sun Peak's Shire Project has approximately two dozen VMS and gold prospects currently being developed by the Company. The Sun Peak exploration team has been in the field in Q4 2024 to follow-up on some of these prospects including prospecting, sampling, and detailed and structural mapping. The Sun Peak team is encouraged by the findings and several of these prospects showing strong potential for VMS and gold drill targets. The Company will provide further details of these "pipeline" targets in a subsequent news release in the new year.

Drill Results Summary

The following table summarizes all Sun Peak drill results since 2020 on the Shire Project over 7 targets.

Meli Main (2020) | Date Reported | |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

ML-001 | 7.86 | 17.2 | 9.34 | 0.07 | 2.2 | 0.5 | 0.1 | Aug 10, 2020 |

ML-001 | 55.6 | 70.9 | 15.3 | 3.18 | 25 | 2.2 | 1.4 | Aug 10, 2020 |

ML-002 | 47.37 | 84.6 | 37.23 | 2.45 | 29.4 | 2.4 | 1.3 | Aug 10, 2020 |

ML-003 | 87.74 | 123.17 | 35.43 | 2.52 | 22.3 | 1.8 | 1.5 | Aug 10, 2020 |

ML-004 | 72.46 | 83.2 | 10.74 | 3.34 | 27.3 | 1.8 | 1 | Aug 10, 2020 |

ML-005 | 90.26 | 101.25 | 10.99 | 3.01 | 26.8 | 1.8 | 0.8 | Aug 10, 2020 |

ML-006 | 70.95 | 74.79 | 3.84 | 2.57 | 30.3 | 1.9 | 0.7 | Aug 10, 2020 |

ML-007 | 18.05 | 23.3 | 5.25 | <0.01 | 3.3 | 2.3 | <0.1 | Aug 10, 2020 |

ML-007 | 34.05 | 35.17 | 1.12 | 3.07 | 45.2 | 5.7 | <0.1 | Aug 10, 2020 |

ML-007 | 39.32 | 40.82 | 1.5 | 1.19 | 12.9 | 0.1 | <0.1 | Aug 10, 2020 |

ML-007 | 52.55 | 53.53 | 0.98 | 4.34 | 38.9 | 5.4 | <0.1 | Aug 10, 2020 |

ML-007 | 61.03 | 63.32 | 2.29 | 2.97 | 24.2 | 1.5 | 0.65 | Aug 10, 2020 |

ML-009 | 68.8 | 71.16 | 2.36 | 1.6 | 7.4 | 1.42 | 0.74 | May 28, 2024 |

ML-010 | 13.65 | 17.5 | 3.85 | 0.01 | 1.9 | 0.66 | 0.1 | May 28, 2024 |

ML-013 | 142.23 | 151.12 | 8.89 | 2.76 | 31.8 | 2.22 | 1.75 | May 28, 2024 |

ML-014 | 162.6 | 174.08 | 11.48 | 3.57 | 31.2 | 2.38 | 0.65 | May 28, 2024 |

ML-018 | 108.64 | 118.25 | 9.61 | 3.18 | 32.3 | 2.21 | 0.56 | May 28, 2024 |

Meli Far West (2020) |

| |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

MW-001 | 5.5 | 21.34 | 15.84 | 1.9 | 10.7 | 0.04 | 0.01 | May 28, 2024 |

including | 5.5 | 7 | 1.5 | 2.34 | 0.6 | 0.04 | <0.01 | May 28, 2024 |

including | 11.05 | 21.34 | 10.26 | 2.51 | 15.6 | 0.036 | 0.01 | May 28, 2024 |

including | 11.05 | 18.6 | 7.55 | 2.94 | 16 | 0.04 | 0.01 | May 28, 2024 |

Keel (2020) |

| |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

KL-001 | 52.78 | 58.7 | 5.92 | 5.01 | 176.2 | <0.1 | <0.1 | Aug 10, 2020 |

KL-001 | 59.44 | 79.6 | 20.16 | 0.78 | 18.4 | 0.6 | 2.3 | Aug 10, 2020 |

KL-002 | 100.25 | 133.91 | 33.66 | 0.92 | 22.6 | 0.9 | 2.7 | Aug 10, 2020 |

KL-003 | 63.15 | 78.35 | 15.2 | 0.84 | 20.2 | 1.1 | 1.3 | Aug 10, 2020 |

KL-004 | 113.13 | 122.05 | 8.9 | 0.58 | 16 | 0.4 | <0.1 | Aug 10, 2020 |

KL-004 | 132.7 | 134.63 | 1.93 | 0.88 | 10.9 | 0.2 | 0.4 | Aug 10, 2020 |

KL-005 | 106.71 | 110.36 | 3.65 | 3.11 | 23.2 | 0.6 | 0.8 | Aug 10, 2020 |

KL-006 | 89.68 | 92.68 | 3 | 0.08 | 1.1 | 0.8 | <0.1 | Aug 10, 2020 |

KL-006 | 160.45 | 178.3 | 17.85 | 3.95 | 45.5 | 1.4 | 1.6 | Aug 10, 2020 |

Argo (2020) |

| |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

AR-001 | 7.62 | 10.67 | 3.05 | 1 | 16.9 | 0.2 | 0.3 | Aug 10, 2020 |

AR-001 | 10.67 | 17.24 | 6.57 | 1.34 | 54.3 | 6.3 | 1.7 | Aug 10, 2020 |

AR-002 | 64.05 | 69.66 | 5.61 | 1.04 | 25.7 | 1.2 | 5.2 | Aug 10, 2020 |

AR-003 | 95.15 | 129.72 | 34.57 | 0.33 | 3.4 | 0.5 | 0.2 | Aug 10, 2020 |

including | 101.06 | 114.8 | 13.74 | 0.49 | 7.1 | 1.1 | 0.3 | Aug 10, 2020 |

AR-004 | 86.24 | 111.85 | 25.61 | 0.82 | 14.2 | 1.2 | 2.4 | Aug 10, 2020 |

including | 86.24 | 100.44 | 14.2 | 1.07 | 23.9 | 1.7 | 4.2 | Aug 10, 2020 |

AR-005 | 49.08 | 62.24 | 13.16 | 1.35 | 16.9 | 1.1 | 1.7 | Aug 10, 2020 |

including | 49.08 | 59.9 | 10.82 | 1.55 | 19.8 | 1.3 | 2 | Aug 10, 2020 |

AR-006 | 44.76 | 64.58 | 19.82 | 0.63 | 15.9 | 0.4 | 2.5 | Aug 10, 2020 |

including | 44.76 | 51.58 | 6.82 | 0.68 | 25.3 | 0.6 | 4.6 | Aug 10, 2020 |

Anguda Southern Limb (2020) |

| |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

AN-002 | 25.95 | 29.09 | 3.14 | 0.35 | 4.67 | 0.45 | 0.33 | May 28, 2024 |

AN-003 | 44.07 | 46.23 | 2.16 | 0.27 | 3.5 | 0.5 | 1.22 | May 28, 2024 |

AN-004 | 70.9 | 72.35 | 1.45 | 0.25 | 4.12 | 0.46 | 1.25 | May 28, 2024 |

AN-006 | 63.75 | 66.75 | 3 | 0.21 | 3.33 | 0.48 | 0.64 | May 28, 2024 |

AN-007 | 99.9 | 107.35 | 7.45 | 1.29 | 2.95 | 0.42 | 0.81 | May 28, 2024 |

AN-008 | 42.51 | 44.06 | 1.55 | 0.54 | 2.49 | 0.02 | 0.53 | May 28, 2024 |

AN-008 | 47.46 | 54.46 | 7 | 0.2 | 4.15 | 0.33 | 1.76 | May 28, 2024 |

AN-009 | 63.46 | 67.23 | 3.77 | 0.22 | 4.46 | 0.27 | 1.59 | May 28, 2024 |

AN-009 | 69 | 71.61 | 2.61 | 0.2 | 5.6 | 0.64 | 0.99 | May 28, 2024 |

AN-010 | 99.06 | 99.36 | 0.3 | 1.12 | 8.8 | 0.03 | 1.54 | May 28, 2024 |

AN-010 | 107.87 | 116.14 | 8.27 | 0.18 | 4.95 | 0.36 | 0.87 | May 28, 2024 |

including | 107.87 | 110.75 | 2.88 | 0.2 | 6.29 | 0.28 | 1.17 | May 28, 2024 |

including | 111.55 | 116.14 | 4.59 | 0.19 | 4.95 | 0.47 | 0.82 | May 28, 2024 |

Terer Main (2024) |

| |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

TR-001 | 102.65 | 104.22 | 1.57 | 0.349 | 7.3 | 0.05 | 0.25 | July 25, 2024 |

TR-001 | 119.02 | 120.35 | 1.33 | 0.177 | 3.9 | 0.14 | 0.6 | July 25, 2024 |

TR-001 | 126.24 | 132.84 | 6.6 | 0.366 | 6.7 | 0.47 | 1.46 | July 25, 2024 |

TR-002 | 168.65 | 169.66 | 1.01 | 0.634 | 9.2 | 0.32 | 1.32 | July 25, 2024 |

TR-002 | 172.14 | 190.6 | 18.46 | 0.316 | 7.2 | 0.47 | 1.85 | July 25, 2024 |

including | 172.14 | 181.94 | 9.8 | 0.385 | 10.2 | 0.81 | 3.11 | July 25, 2024 |

including | 172.14 | 173.98 | 1.84 | 0.497 | 12.3 | 0.87 | 9.24 | July 25, 2024 |

including | 175.17 | 176.86 | 1.69 | 0.254 | 5.2 | 0.17 | 6.97 | July 25, 2024 |

including | 178.53 | 181.94 | 3.41 | 0.573 | 17.7 | 1.65 | 0.32 | July 25, 2024 |

including | 185 | 190.6 | 5.6 | 0.356 | 5.8 | 0.14 | 0.63 | July 25, 2024 |

and | 196.44 | 205.15 | 8.71 | 0.29 | 5.1 | 0.56 | 0.65 | July 25, 2024 |

including | 196.44 | 202.12 | 5.68 | 0.429 | 7.1 | 0.84 | 0.98 | July 25, 2024 |

including | 202.12 | 205.15 | 3.03 | 0.031 | 1.4 | 0.03 | 0.03 | July 25, 2024 |

*TR-003 | 208.19 | 210.27 | 2.08 | 0.154 | 2.4 | 0.08 | 1.45 | Dec 19, 2024 |

including | 209.77 | 210.27 | 0.5 | 0.264 | 4.9 | 0.21 | 5.65 | Dec 19, 2024 |

and | 228.6 | 231.44 | 2.84 | 0.459 | 8.7 | 0.98 | 0.24 | Dec 19, 2024 |

*TR-004 | 162.48 | 167.93 | 5.45 | 0.28 | 5 | 1.06 | 0.25 | Dec 19, 2024 |

and | 198 | 201.36 | 3.36 | 0.184 | 3.8 | 0.41 | 0.43 | Dec 19, 2024 |

*TR-005 | 188.52 | 192.56 | 4.04 | 0.447 | 3.3 | 0.276 | 0.094 | Dec 19, 2024 |

*TR-006 | 97.57 | 102.39 | 4.82 | 0.38 | 5.72 | 1.37 | 0.47 | Dec 19, 2024 |

including | 99.49 | 100.45 | 0.96 | 0.254 | 4.3 | 1.31 | 1.36 | Dec 19, 2024 |

*TR-008 | 72.87 | 73.93 | 0.96 | 0.185 | 6.6 | 1.6 | 0.22 | Dec 19, 2024 |

*TR-010 | 264.48 | 271 | 6.52 | 0.263 | 4.3 | 0.42 | 0.92 | Dec 19, 2024 |

including | 264.48 | 266.97 | 2.49 | 0.439 | 6.7 | 0.6 | 1.77 | Dec 19, 2024 |

and | 288.36 | 295.53 | 7.17 | 0.38 | 6.14 | 1.4 | 0.25 | Dec 19, 2024 |

including | 291.85 | 295.53 | 3.68 | 0.51 | 7.6 | 1.85 | 0.26 | Dec 19, 2024 |

*TR-012 | 149.78 | 152.32 | 2.54 | 0.587 | 7.6 | 0.98 | 4 | Dec 19, 2024 |

and | 155.68 | 162.7 | 7.02 | 0.167 | 2.5 | 0.33 | 0.99 | Dec 19, 2024 |

including | 155.68 | 159.25 | 3.57 | 0.273 | 4.2 | 0.44 | 1.36 | Dec 19,2024 |

and | 169.6 | 178.9 | 9.3 | 0.24 | 4.88 | 0.86 | 0.94 | Dec 19,2024 |

including | 176.38 | 178.9 | 2.52 | 0.27 | 5.9 | 1.25 | 0.97 | Dec 19,2024 |

Hamlo (2024) |

| |||||||

Hole ID | From | To | Interval | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) |

|

HM-002 | 0 | 23.3 | 23.3 | 0.137 | 1 | 0.029 | <0.01 | July 25, 2024 |

HM-002 | 104.54 | 108.45 | 3.91 | 0.085 | 1.1 | 0.023 | 1.15 | July 25, 2024 |

HM-003 | 197.11 | 209.86 | 12.75 | 0.155 | 0.9 | 0.13 | 0.41 | July 25, 2024 |

HM-006 | 288.3 | 303.05 | 14.75 | 0.228 | 3.3 | 0.035 | 1.01 | July 25, 2024 |

*HM-009 | 118.5 | 125.08 | 6.58 | 0.18 | 1.3 | 0.049 | <0.01 | Dec 19, 2024 |

*HM-010 | 158.74 | 165.75 | 7.01 | 0.15 | 4.7 | 0.047 | 1.08 | Dec 19, 2024 |

including | 161.64 | 165.75 | 4.11 | 0.18 | 6.6 | 0.054 | 1.54 | Dec 19, 2024 |

*HM-011 | 345.25 | 346.75 | 1.5 | 6.32 | 4.5 | 0.012 | 0.014 | Dec 19, 2024 |

*HM-012 | 181.5 | 186 | 4.5 | 0.21 | 4.3 | 0.011 | 0.36 | Dec 19, 2024 |

* New drill results from Terer and Hamlo Targets in this news release | ||||||||

No significant intercepts in the following holes:

Meli - ML-008, ML-011, ML-012, ML-015, ML-016, and ML-017, reported May 28, 2024

Meli Far West - MW-002, reported May 28, 2024

Anguda Southern Limb - AN-001 and AN-005, reported May 28, 2024

Terer - TR-007, TR-009, TR-011, new drill results reported in this news release

Hamlo - HM-001, reported July 25, 2024 and HM-008, new drill result reported in this news release

QUALIFIED PERSON'S STATEMENT

David K. Daoud, P. Geo, Vice President Exploration is the Qualified Person overseeing Sun Peak's exploration projects in Ethiopia and has reviewed and approved this press release.

All drill holes reported are diamond drill core holes.

A Quality Assurance/Quality Control program was part of the sampling program on the Hamlo and Terer prospects. This program includes the systematic submittals of standards, duplicates, and blank samples into the flow of samples produced by the sampling.

Samples were prepared at ALS Laboratory in Addis Ababa, Ethiopia and analyzed at ALS Laboratory in Dublin, Ireland. Gold is assayed using a 50-gram of -75 micron-size pulp is fire assayed and finished by ICP-AES analysis to detect content between 0.01 and 10.0 ppm. Gold returning over limit values are re-assayed with higher detection limits using a gravimetric finish. As well, a 0.5 gram cut from the pulp of each rock sample is dissolved by aqua regia acid digestion and analyzed by mass spectrometry for a suite of 51 additional elements. Analytical values for silver, copper, zinc, and lead over detection limits are re-assayed with higher detection limits, using aqua regia digestion. Drilling intercept lengths and estimated true thicknesses are reported in the tabulations.

ABOUT SUN PEAK METALS CORP.

Sun Peak is exploring the district-scale Shire VMS Project in the Tigray Region of northern Ethiopia. The Shire Project is comprised of six exploration licenses and covers approximately 1,450 square kilometers in the prospective Arabian Nubian Shield. The licenses are in the same geological environment as both the Bisha Mine and the Asmara Projects. The Meli and Terer Licenses are part of a joint-venture agreement with Ezana Mining, a private Ethiopian Company and the other four are 100% owned by Sun Peak. The Sun Peak team have worked in East Africa for more than two decades and the Company's strategy is to apply exploration techniques that have worked successfully in the region before, to build assets through major copper-gold VMS discoveries.

ON BEHALF OF THE BOARD OF DIRECTORS OF SUN PEAK METALS CORP.

Greg Davis,

President, CEO & Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Greg Davis

(T): +1 (604) 999 1099

(E): info@sunpeakmetals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

Certain information and statements in this news release may be considered forward-looking information or forward-looking statements for purposes of applicable securities laws (collectively, "forward-looking statements"), which reflect the expectations of management regarding its disclosure and amendments thereto. Forward-looking statements consist of information or statements that are not purely historical, including any information or statements regarding beliefs, plans, expectations or intentions regarding the future. Such information or statements may include, but are not limited to, statements with respect to the goal of making a significant discovery and the development of a large-scale project in Ethiopia and identifying other potential properties and opportunities both in Ethiopia and globally. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits Sun Peak will obtain from them. These forward-looking statements reflect management's current views and are based on certain expectations, estimates and assumptions, which may prove to be incorrect. A number of risks and uncertainties could cause actual results to differ materially from those expressed or implied by the forward-looking statements, including without limitation: the risk that the results of the planned drilling and exploration programs at the Shire Project do not meet expected results. These forward-looking statements are made as of the date of this news release and, except as required by applicable securities laws, Sun Peak assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements. Additional information about these and other assumptions, risks and uncertainties are set out in the "Risks and Uncertainties" section in the Prospectus filed with Canadian security regulators.

SOURCE: Sun Peak Metals Corp.

View the original press release on accesswire.com