TORONTO, Dec. 20, 2024 (GLOBE NEWSWIRE) -- Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V: ELBM) ("Electra" or the "Company") is pleased to announce the results of its special meeting of shareholders held today in Toronto.

A total of 13,792,275 common shares in the capital of the Company ("Common Shares"), or 24% of Electra's issued and outstanding Common Shares were represented in person or by proxy at the meeting. Shareholders voted in favour of all items of business put forth at the meeting, being (i) an amendment to the articles of the Company to complete a reverse stock split (the "Reverse Split") of the issued and outstanding common shares (the "Common Shares") of the Company at a ratio of one (1) post-Reverse Split Common Share for between three (3) to five (5) pre-Reverse Split Common Shares, as determined by the Board of Directors of the Company and (ii) the 2024 Employee Share Purchase Plan for the Company (the "2024 ESP Plan"). The Company's full voting results at the meeting are available on SEDAR+ at www.sedarplus.com.

Following receipt of shareholder approval, the Company's Board of Directors has concluded that the Reverse Split of the issued and outstanding Common Shares of the Company is in the best interests of the shareholders. The Company is proceeding with the Reverse Split on the basis of four (4) pre-Reverse Split Common Shares to one (1) post-Reverse Split Common Share.

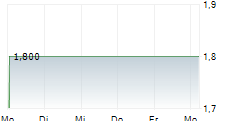

The Reverse Split will not affect the total shareholders' equity; however, the conclusion of the Reverse Split will support the Company's efforts to regain compliance with the Minimum Bid Requirement. Following receipt of notice, received September 17, 2024, from The Nasdaq Stock Market LLC ("Nasdaq") of noncompliance with the minimum bid price requirement ("Minimum Bid Requirement") of US$1.00 per share under Nasdaq Listing Rule 5550(a)(2), the Company submitted an appeal of Nasdaq's determination. A hearing on the appeal was held on November 5, 2024, and the Company was notified it has been granted until January 15, 2025, to regain compliance with the Minimum Bid Requirement, subject to certain conditions. This matter does not impact the listing of the shares on the TSX Venture Exchange. Failure to regain compliance will result in delisting from the Nasdaq.

Heather Smiles, Vice President, Investor Relations & Corporate Development commented, "We recognize the significant visibility and access to the U.S. market that our Nasdaq listing offers Electra and are committed to taking the necessary actions to preserve this listing. We are grateful for the support of our shareholders as we navigate this process."

The 2024 ESP Plan was conditionally approved by the TSX Venture Exchange (the "TSXV") on November 4, 2024, and remains subject to final acceptance of the TSXV. The Reverse Split remains subject to TSXV approval.

Corporate Update

The Company also confirms the former engagement with Epstein Research, a research and analysis firm owned by Peter Epstein, based in Montebello, NY and active in the metals and mining industry. Epstein Research increases awareness of the Company through social media platforms, and produces management interviews and written, visual and video content. The engagement commenced on September 1, 2024, and ended on November 30, 2024, during which time Epstein Research was paid an aggregate of US$6,000, representing a monthly cash fee of US$2,000. The Company is at arms-length from Epstein Research, and Peter Epstein, and the compensation paid to Epstein Research did not include any securities of the Company.

About Electra Battery Materials

Electra is a processor of low-carbon, ethically-sourced battery materials. Currently focused on developing North America's only cobalt sulfate refinery, Electra is executing a phased strategy to onshore the electric vehicle supply chain and provide a North American solution for EV battery materials refining. In addition to building North America's only cobalt sulfate refinery, its strategy includes integrating black mass recycling, potential cobalt sulfate processing in Bécancour, Quebec, and exploring nickel sulfate production potential within North America. For more information, please visit www.ElectraBMC.com.

Contact

Heather Smiles

Vice President, Investor Relations & Corporate Development

Electra Battery Materials

info@ElectraBMC.com

1.416.900.3891

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects', "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance, and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements are set forth in the management discussion and analysis and other disclosures of risk factors for Electra Battery Materials Corporation, filed on SEDAR at www.sedar.com. Although Electra Battery Materials Corporation believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, Electra Battery Materials Corporation disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.