THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

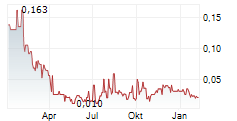

VANCOUVER, BC / ACCESSWIRE / December 23, 2024 / Armory Mining Corp. (CSE:ARMY)(OTC PINK:RMRYF)(FRA:2JS) (the "Company") is pleased to announce a non-brokered private placement LIFE offering (the "Offering") for total gross proceeds of a minimum of $500,000 and up to a maximum of $680,000, consisting of a minimum of 3,703,703 common shares of the Company (each a "Common Share") and up to a maximum of 5,037,037 Common Shares at a price of $0.135 per Common Share (the "Offering Price").

In connection with the Offering, the Company may pay finder's fees consisting of: (i) cash finder's fees of up to 10.0% of the gross proceeds raised in respect of the Offering from subscribers introduced by such finders to the Company; (ii) finder shares in an amount equal to up to 10.0% of the number of Common Shares issued pursuant to the Offering; and (iii) finder warrants in an amount equal to up to 10.0% of the number of Common Shares issued pursuant to the Offering from subscribers introduced by such finders to the Company, exercisable at the Offering Price for a period of 48 months following the closing date of the Offering.

The proceeds raised from the Offering are expected to be used for exploration work on the Kaslo Silver project and the Nova Scotia Ammo Project, working capital and general corporate purposes.

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 - Prospectus Exemptions ("NI 45-106"), the Offering is being made to purchasers resident in each of the Provinces of Canada, except Quebec, pursuant to the listed issuer financing exemption under Part 5A of NI 45-106 (the "Exemption"). The securities offered to Canadian resident subscribers under the Exemption will not be subject to a hold period in accordance with applicable Canadian securities laws.

There is an offering document related to this Offering that can be accessed under the Company's profile at www.sedarplus.ca and at the Company's website www.armorymining.com. Prospective investors should read this offering document before making an investment decision.

The Offering is expected to close on or about January 10, 2025, or such other date that is within 45 days from December 23, 2024, as the Company may agree. The Offering remains subject to certain conditions customary for transactions of this nature, including, but not limited to, the receipt of all necessary approvals, including the approval of the CSE.

The Company is also pleased to announce the appointment of Arjun Grewal as a director of the Company and Chairman of the board of directors.

Mr. Grewal is an experienced leader with over two decades of experience in the military and defence technology sectors. His career includes 20 years of service in the Canadian Armed Forces, with 13 years dedicated to the Canadian Special Operations Command. During this time, he deployed on numerous global intelligence-led operations and high-value counter-terrorism missions as part of the Global War on Terror. He also enabled sensitive national security capabilities and collaborated with Five-eyes, NATO, and Allied nations. After retiring from the military in 2018, Arjun held leadership roles at IBM in the IBM Cloud and Business Analytics divisions. In 2021, Arjun was appointed CEO of Ventus Respiratory Technologies, which focuses on developing advanced respiratory protection for military and public safety personnel.

Nader Vatanchi, CEO of the Company, stated, "We are very proud to have Mr. Grewal join our board of directors. Mr. Grewal has the ability to leverage his extensive military, national security, and technology experience to guide the company in its pursuit of securing critical minerals essential given the uncertainty in today's world".

About Armory Mining Corp.

Armory Mining Corp. is a diversified mineral exploration company which has an 80% interest in the Candela II lithium brine project located in the Incahuasi Salar, Salta Province, Argentina. Armory also holds a 100% interest in the Kaslo Silver project, west of Kaslo, British Columbia, a 100% interest in certain mineral claims located in Haida Gwaii, British Columbia and an option to acquire a 100% interest in certain mineral claims located in Nova Scotia known as the Ammo Project.

FOR FURTHER INFORMATION CONTACT:

Nader Vatanchi

CEO, Director

e:nader@armorymining.com

p: 778-881-4631

Neither the Canadian Securities Exchange nor its Market Regulator (as the term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy of accuracy of this news release.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to: the Offering, completion of the Offering, the expected closing date of the Offering, the payment of the finder's fees, the use of proceeds of the Offering and the Company securing critical minerals. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "anticipates", "anticipated" "expected" "intends" "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are from those expressed or implied by such forward-looking statements or forward-looking information subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different, including receipt of all necessary regulatory approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the Company's securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The Company's securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

SOURCE: Armory Mining Corp.

View the original press release on accesswire.com