Pilot Mountain - Drilling Update

Desert Scheelite - Further Very High-Grade Tungsten Results

LONDON, UNITED KINGDOM / ACCESSWIRE / December 30, 2024 / Guardian Metal Resources plc (LON:GMET)(OTCQX:GMTLF), a strategic mineral exploration and development company focused in Nevada, USA, is pleased to announce further drillhole assay results from the Company's ongoing drilling campaign at its 100% owned Pilot Mountain tungsten project ("Pilot Mountain" or the "Project) located in Nevada, USA.

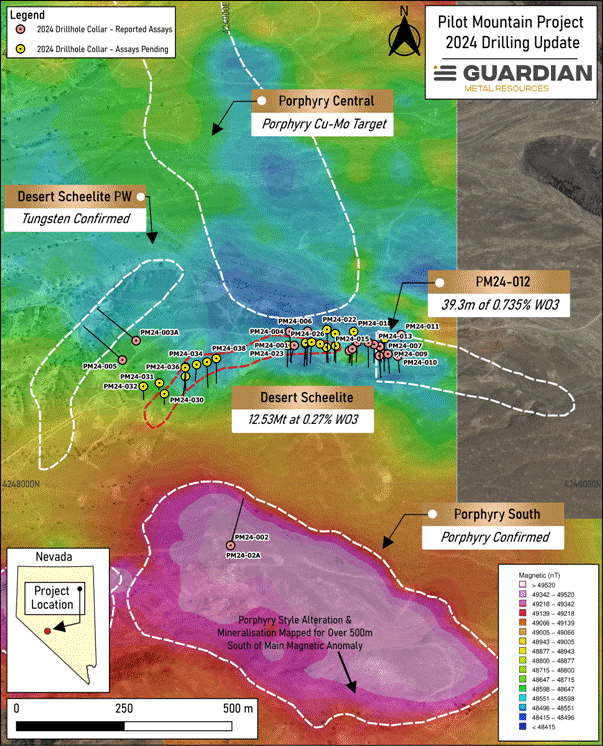

Laboratory assay results from drill core samples have been received from the next batch of drillholes covering PM24-018 to PM24-028 with some further very high-grade tungsten results being intersected. To date, 39 drillholes have been completed. The drill pad for the 40th hole is prepared and drilling is expected to recommence on 6 January 2025 (Fig. 1). The Company is also preparing a separate notice permit which will facilitate the preparation of up to 20 drill pads at the Project's 'Garnet' tungsten-copper-silver-zinc zone.

The Company is also now in receipt of the phase I garnet metallurgical results and is in the process of compiling those and will release to the market as soon as it is possible to do so.

The Company previously announced an earlier set of assay results from the Project on 26 November 2024. The assay results included in the database supplied to the Company incorrectly overstated some of the WO3 assay results for three drillholes. The relevant sections of the announcement of 26 November 2024 are restated below with the corrected and restated WO3 assay results highlighted in bold in Table 3.

Oliver Friesen, CEO of Guardian Metal, commented:

"This batch of results takes us another step closer to the updated resource estimate which feeds into the updated mine plan and eventual pre-feasibility study for our flagship Pilot Mountain Project. We are also very pleased to have intercepted the two single highest drilled tungsten assays from across the Project, including 3.04% and 3.01% WO3, highlighting the tremendous upside potential that continues to exist as we advance exploration and development of our flagship asset.

"In tandem, we continue to push forward the due diligence process for the Tempiute Mine & Mill Project which, together with Pilot Mountain, represents a significant portfolio of USA-based tungsten assets which strategically position Guardian Metal to benefit from the resurgence of USA-focused critical metals mining that we expect will gain significant momentum over the next several years."

Desert Scheelite Highlights:

Laboratory assay results confirm multiple tungsten, copper, silver and zinc rich intervals from the latest batch of results, including the two highest tungsten intersections to date from the Project, 3.04% WO3 (from 122.6m - 123.4m in drillhole PM24-022) and 3.01% WO3 (from 62.3m - 63.1m in drillhole PM24-023).

Drillhole PM24-022 highlight downhole intersections:

44.2m @ 0.234% W03, 17.0g/t Ag,1,413ppm Cu & 0.74% Zn from 119.5 - 163.7m (44.2m @ 0.39% WO3Eq* or 1.45% CuEq**); including

3.7m @ 1.448% W03, 21.0g/t Ag, 5,016ppm Cu & 3.33% Zn from 122.6 - 126.3m (3.7m @ 1.94% WO3Eq* or 7.27% CuEq**); and

8.3m @ 0.359% W03,7.1g/t Ag, 3,987ppm Cu & 0.34% Zn from 155.4 - 163.7m (8.3m @ 0.52% WO3Eq* or 1.93% CuEq**).

Drillhole PM24-018 highlight downhole intersection :

20.4 @ 0.514% W03, 28.5g/t Ag,5,578ppm Cu & 0.45% Zn from 119.3 - 139.7m (20.4m @ 0.78% WO3Eq* or 2.93% CuEq**).

Drillhole PM24-023 highlight downhole intersection :

3.8m @ 1.861% W03, 52.6g/t Ag, 6874ppm Cu & 0.59% Zn from 59.3 - 63.1m (3.8m @ 2.25% WO3Eq* or 8.41% CuEq**).

*,**Copper and W03 Equivalent ("WO3Eq") are calculated using a tungsten price of US $332.5/MTU, a zinc price of US$1.3448/lb, a copper price of US3.9965/lb and a silver price of US$28.72/Oz.

Cautionary note: The metal equivalent calculations do not consider any metallurgical factors and assume 100% recovery and 100% payability of all metals, as a result the stated equivalents are provided for illustrative purposes only.

Results

Table 1: 2024 Drillhole collar table (this RNS)

Hole ID | Zone | UTM Easting# | UTM Northing# | Azimuth (deg.) | Dip (deg.) | Down hole Depth (m) |

PM24-018 | Desert Scheelite | 424297 | 4248353 | 187 | -65 | 169.8 |

PM24-019 | Desert Scheelite | 424234 | 4248317 | 178 | -59 | 65.4 |

PM24-020 | Desert Scheelite | 424255 | 4248320 | 179 | -54 | 66.2 |

PM24-021 | Desert Scheelite | 424254 | 4248348 | 182 | -54 | 107.4 |

PM24-022 | Desert Scheelite | 424234 | 4248358 | 178 | -64 | 174.0 |

PM24-023 | Desert Scheelite | 424144 | 4248321 | 181 | -48 | 74.1 |

PM24-024 | Desert Scheelite | 424369 | 4248337 | 180 | -64 | 119.8 |

PM24-025 | Desert Scheelite | 424358 | 4248318 | 175 | -75 | 130.1 |

PM24-026 | Desert Scheelite | 424219 | 4248325 | 180 | -65 | 9.1 |

PM24-027 | Desert Scheelite | 424185 | 4248325 | 180 | -55 | 60.0 |

PM24-028 | Desert Scheelite | 424185 | 4248327 | 184 | -53 | 90.4 |

#UTM Zone 11 North NAD83 datum

Table 2: Significant Diamond Drillhole Assay Results1

Hole ID | Downhole Depth (m) | Interval (m) | W | WO3 | Zn | Ag | Cu | Intersection Composites | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

From | To | (ppm) a | (%) b | (%) c | (g/t) a | (ppm) a | (weighted averages) c | |||||

PM24-018 | 103.2 | 104.6 | 1.40 | 670 | 0.08 |

| 2.60 |

| 25.4 | 317 | 4.4m @ 0.08% WO3, 0.02% Cu, 2.15% Zn & 39.3 g/t Ag | |

104.6 | 106.1 | 1.50 | 690 | 0.09 |

| 1.75 |

| 25.9 | 225 | |||

106.1 | 107.6 | 1.50 | 520 | 0.07 |

| 2.13 |

| 65.8 | 204 | |||

PM24-018 | 119.3 | 120.8 | 1.50 | 1,250 | 0.16 |

| 1.65 |

| 28.4 | 212 | 20.4m @ 0.51% WO3, 0.56% Cu, 0.45% Zn & 28.5 g/t Ag | |

120.8 | 122.2 | 1.40 | 2,960 | 0.40 | ? | 3.38 |

| 135.0 | 566 | |||

122.2 | 123.9 | 1.70 | 1,930 | 0.24 |

| 0.27 | F | 46.9 | 191 | |||

123.9 | 125.3 | 1.40 | 960 | 0.12 |

| 0.29 | F | 9.6 | 613 | |||

125.3 | 126.8 | 1.50 | 3,710 | 0.73 | ? | 0.07 | F | 6.8 | 2,630 | |||

126.8 | 127.6 | 0.80 | 2,710 | 0.41 | ? | 0.06 | F | 11.2 | 4,880 | |||

127.6 | 129.0 | 1.40 | 2,340 | 0.33 | ? | 0.03 | F | 4.4 | 2,170 | |||

129.0 | 130.1 | 1.10 | 2,950 | 2.08 | ? | 0.06 | F | 15.6 | 8,180 | |||

130.1 | 131.6 | 1.50 | 3,660 | 1.32 | ? | 0.05 | F | 13.3 | 6,990 | |||

131.6 | 133.1 | 1.50 | 2,260 | 0.64 | ? | 0.07 | F | 19.2 | 9,560 | |||

133.1 | 134.4 | 1.30 | 810 | 0.10 |

| 0.08 | F | 21.0 | 11,250 | |||

134.4 | 135.9 | 1.50 | 1,750 | 0.22 |

| 0.05 | F | 18.0 | 9,580 | |||

135.9 | 137.3 | 1.40 | 750 | 0.09 |

| 0.07 | F | 24.3 | 12,400 | |||

137.3 | 138.8 | 1.50 | 3,510 | 0.65 | ? | 0.10 | F | 23.6 | 9,670 | |||

138.8 | 139.7 | 0.90 | 2,980 | 0.47 | ? | 0.26 | F | 47.1 | 6,590 | |||

PM24-019 | 27.4 | 28.5 | 1.10 | 1,200 | 0.15 |

| 0.11 | F | 1.0 | 109 | 17.7m @ 0.18% WO3, 0.06% Cu, 0.36% Zn & 4.3 g/t Ag | |

28.5 | 29.5 | 1.00 | 1,870 | 0.24 |

| 0.14 | F | 1.6 | 119 | |||

29.5 | 30.8 | 1.30 | 420 | 0.05 |

| 0.11 | F | 1.1 | 69 | |||

30.8 | 32.4 | 1.60 | 980 | 0.12 |

| 0.12 | F | 3.8 | 167 | |||

32.4 | 34.1 | 1.70 | 770 | 0.10 |

| 0.09 | F | 4.4 | 103 | |||

34.1 | 35.6 | 1.50 | 570 | 0.07 |

| 0.23 | F | 5.6 | 347 | |||

35.6 | 37.0 | 1.40 | 2,610 | 0.35 | ? | 0.88 | F | 7.3 | 755 | |||

37.0 | 38.7 | 1.70 | 2,630 | 0.35 | ? | 1.48 |

| 5.8 | 1,365 | |||

38.7 | 40.2 | 1.50 | 1,650 | 0.21 |

| 0.41 | F | 6.0 | 1,695 | |||

40.2 | 41.7 | 1.50 | 1,790 | 0.23 |

| 0.27 | F | 7.8 | 1,440 | |||

41.7 | 43.2 | 1.50 | 860 | 0.11 |

| 0.12 | F | 2.5 | 421 | |||

43.2 | 44.7 | 1.50 | 1,650 | 0.21 |

| 0.19 | F | 2.7 | 843 | |||

44.7 | 45.1 | 0.40 | 1,220 | 0.15 |

| 0.05 | F | 1.8 | 308 | |||

PM24-020 | 29.1 | 30.6 | 1.50 | 1,710 | 0.22 |

| 0.11 | F | 2.0 | 865 | 13.9m @ 0.26% WO3, 0.06% Cu, 0.08% Zn & 2.4 g/t Ag | |

30.6 | 32.1 | 1.50 | 2,700 | 0.37 | ? | 0.22 | F | 4.4 | 841 | |||

32.1 | 33.6 | 1.50 | 2,480 | 0.33 | ? | 0.04 | F | 1.0 | 235 | |||

33.6 | 35.1 | 1.50 | 2,970 | 0.61 | ? | 0.08 | F | 2.3 | 286 | |||

35.1 | 36.6 | 1.50 | 1,080 | 0.14 |

| 0.07 | F | 1.6 | 303 | |||

36.6 | 38.1 | 1.50 | 1,630 | 0.21 |

| 0.07 | F | 2.7 | 1,005 | |||

38.1 | 39.6 | 1.50 | 1,550 | 0.20 |

| 0.05 | F | 5.7 | 1,785 | |||

39.6 | 40.8 | 1.20 | 1,650 | 0.21 |

| 0.07 | F | 1.4 | 116 | |||

40.8 | 43.0 | 2.20 | 1,080 | 0.14 |

| 0.04 | F | 1.1 | 159 | |||

PM24-020 | 56.2 | 57.7 | 1.50 | 1,520 | 0.19 |

| 0.12 | F | 2.8 | 484 | 3.8m @ 0.24% WO3, 0.04% Cu, 0.09% Zn & 2.5 g/t Ag | |

57.7 | 58.8 | 1.10 | 880 | 0.11 |

| 0.09 | F | 3.3 | 307 | |||

58.8 | 60.0 | 1.20 | 2,800 | 0.43 | ? | 0.05 | F | 1.3 | 245 | |||

PM24-022 | 106.4 | 107.9 | 1.50 | 330 | 0.04 |

| 0.99 |

| 6.0 | 438 | 3.40m @ 0.05% WO3, 0.07% Cu, 2.19% Zn & 56.3 g/t Ag | |

107.9 | 109.8 | 1.90 | 440 | 0.06 |

| 3.14 |

| 96.0 | 878 | |||

PM24-022 | 119.5 | 121.0 | 1.50 | 1,250 | 0.16 |

| 3.94 |

| 6.8 | 1,065 |

| 44.2m @ 0.23% WO3, 0.14% Cu, 0.74% Zn & 17.0 g/t Ag |

121.0 | 122.6 | 1.60 | 880 | 0.11 |

| 2.41 |

| 90.8 | 3,280 | |||

122.6 | 123.4 | 0.80 | 4,970 | 3.04 | ? | 0.65 | F | 16.1 | 3,180 | 3.7m @ 1.45% WO3, 0.50% Cu, 3.33% Zn & 21.0 g/t Ag | ||

123.4 | 124.6 | 1.20 | 3,100 | 1.63 | ? | 4.23 |

| 23.6 | 11,350 | |||

124.6 | 126.3 | 1.70 | 4,340 | 0.57 | ? | 3.96 |

| 21.5 | 1,410 | |||

126.3 | 127.7 | 1.40 | 1,590 | 0.20 |

| 0.94 | F | 112.0 | 121 |

| ||

127.7 | 129.2 | 1.50 | 580 | 0.07 |

| 0.12 | F | 10.8 | 25 | |||

129.2 | 132.2 | 3.00 | 210 | 0.03 |

| 0.07 | F | - | 30 | |||

132.2 | 135.2 | 3.00 | 840 | 0.11 |

| 0.11 | F | 17.2 | 160 | |||

135.2 | 136.7 | 1.50 | 260 | 0.03 |

| 0.03 | F | - | 73 | |||

136.7 | 138.1 | 1.40 | 230 | 0.03 |

| 0.03 | F | 0.5 | 204 | |||

138.1 | 139.6 | 1.50 | 1,160 | 0.15 |

| 2.89 |

| 69.7 | 786 | |||

139.6 | 141.0 | 1.40 | 890 | 0.11 |

| 0.24 | F | 89.0 | 136 | |||

141.0 | 142.7 | 1.70 | 500 | 0.06 |

| 0.04 | F | - | 46 | |||

142.7 | 145.4 | 2.70 | 180 | 0.02 |

| 0.12 | F | 0.8 | 70 | |||

145.4 | 148.4 | 3.00 | 80 | 0.01 |

| 0.09 | F | - | 94 | |||

148.4 | 151.5 | 3.10 | 250 | 0.03 |

| 0.06 | F | 0.9 | 175 | |||

151.5 | 153.0 | 1.50 | 100 | 0.01 |

| 0.04 | F | - | 69 | |||

153.0 | 154.2 | 1.20 | 100 | 0.01 |

| 0.04 | F | - | 88 | |||

154.2 | 155.4 | 1.20 | 150 | 0.02 |

| 0.05 | F | 1.5 | 114 | |||

155.4 | 156.5 | 1.10 | 3,120 | 0.41 | ? | 1.48 |

| 28.9 | 17,450 | 8.3m @ 0.36% WO3, 0.40% Cu, 0.34% Zn & 7.1 g/t Ag | ||

156.5 | 158.0 | 1.50 | 4,170 | 0.56 | ? | 0.28 | F | 8.3 | 4,560 | |||

158.0 | 159.2 | 1.20 | 650 | 0.08 |

| 0.06 | F | 1.3 | 867 | |||

159.2 | 160.3 | 1.10 | 3,470 | 0.46 | ? | 0.37 | F | 4.6 | 2,760 | |||

160.3 | 161.8 | 1.50 | 70 | 0.01 |

| 0.02 | F | - | 116 | |||

161.8 | 163.0 | 1.20 | 760 | 0.10 |

| 0.13 | F | 3.7 | 564 | |||

163.0 | 163.7 | 0.70 | 8,560 | 1.37 | ? | 0.22 | F | 4.6 | 3,040 | |||

PM24-023 | 40.9 | 42.4 | 1.50 | 2,470 | 0.31 | ? | 1.46 |

| 2.0 | 769 | 7.5m @ 0.19 % WO3, 0.05% Cu, 0.75% Zn & 2.0 g/t Ag | |

42.4 | 43.9 | 1.50 | 3,010 | 0.41 | ? | 1.58 |

| 6.3 | 1,560 | |||

43.9 | 45.4 | 1.50 | 1,070 | 0.13 |

| 0.23 | F | 1.6 | 110 | |||

45.4 | 46.9 | 1.50 | 250 | 0.03 |

| 0.16 | F | - | 103 | |||

46.9 | 48.4 | 1.50 | 420 | 0.05 |

| 0.32 | F | - | 70 | |||

PM24-023 | 59.3 | 60.8 | 1.50 | 4,680 | 0.67 | ? | 1.11 |

| 11.4 | 10,850 | 3.8m @ 1.86% WO3, 0.69% Cu, 0.59% Zn & 52.6 g/t Ag | |

60.8 | 62.3 | 1.50 | 2,950 | 2.44 | ? | 0.25 | F | 72.4 | 4,880 | |||

62.3 | 63.1 | 0.80 | 2,760 | 3.01 | ? | 0.27 | F | 92.8 | 3,160 | |||

PM24-024 | 90.2 | 91.6 | 1.40 | 2,240 | 0.30 | ? | 0.86 | F | 64.6 | 807 | 1.4m @ 0.30% WO3, 0.08% Cu, 0.86% Zn & 64.6 g/t Ag | |

PM24-025 | 76.7 | 78.2 | 1.50 | 2,340 | 0.30 | ? | 0.59 | F | 42.9 | 113 | 1.5m @ 0.30% WO3, 0.01% Cu, 0.59% Zn & 42.9 g/t Ag | |

PM24-025 | 82.7 | 84.2 | 1.50 | 4,000 | 0.53 | ? | 0.12 | F | - | 111 | 5.9m @ 0.30% WO3, 0.07% Cu, 0.36% Zn & 3.2 g/t Ag | |

84.2 | 85.6 | 1.40 | 1,770 | 0.22 |

| 0.16 | F | 2.5 | 390 | |||

85.6 | 87.1 | 1.50 | 860 | 0.11 |

| 0.65 | F | 9.7 | 1,940 | |||

87.1 | 88.6 | 1.50 | 2,600 | 0.34 | ? | 0.49 | F | 0.6 | 279 | |||

PM24-025 | 96.1 | 97.6 | 1.50 | 1,560 | 0.20 |

| 0.56 | F | 4.2 | 308 | 3.0m @ 0.25% WO3, 0.05% Cu, 0.88% Zn & 2.7 g/t Ag | |

97.6 | 99.1 | 1.50 | 2,380 | 0.31 | ? | 1.20 |

| 1.2 | 741 | |||

PM24-027 | 51.3 | 52.8 | 1.50 | 1,520 | 0.19 |

| 0.21 | F | 44.3 | 244 | 6.0m @ 0.28% WO3, 0.02% Cu, 1.35% Zn & 17.8 g/t Ag | |

52.8 | 54.3 | 1.50 | 1,690 | 0.21 |

| 0.77 | F | 20.2 | 159 | |||

54.3 | 55.8 | 1.50 | 2,620 | 0.35 | ? | 4.10 |

| 5.3 | 202 | |||

55.8 | 57.3 | 1.50 | 2,800 | 0.38 | ? | 0.31 | F | 1.5 | 65 | |||

PM24-028 | 53.9 | 55.4 | 1.50 | 2,570 | 0.33 | ? | 3.90 |

| 28.0 | 1,205 | 4.1m @ 0.31% WO3, 0.06% Cu, 2.66% Zn & 11.3 g/t Ag | |

55.4 | 57.0 | 1.60 | 1,820 | 0.23 |

| 3.11 |

| 2.4 | 350 | |||

57.0 | 58.0 | 1.00 | 3,050 | 0.41 | ? | 0.10 | F | 0.5 | 21 | |||

PM24-028 | 63.2 | 65.5 | 2.30 | 1,520 | 0.19 |

| 0.97 | F | 14.3 | 914 | 2.3m @ 0.19% WO3, 0.09% Cu, 0.97% Zn & g/t 14.3 g/t Ag | |

PM24-028 | 70.7 | 71.9 | 1.20 | 1,670 | 0.21 |

| 0.06 | F | 0.6 | 44 | 1.2m @ 0.21% WO3, 0.06% Zn & 0.6 g/t Ag | |

PM24-028 | 74.9 | 76.4 | 1.50 | 2,100 | 0.28 | ? | 0.39 | F | 23.2 | 1,190 | 1.5m @ 0.28% WO3, 0.12% Cu, 0.39% Zn & 23.2 g/t Ag | |

Table 2 notes:

Summary of certificated assay results provided by accredited laboratory ALS USA Inc

ppm: parts per million, 10,000 ppm = 1%

a: ALS method ME-ICP61;

b: WO3 % calculated as W % multiplied by 1.2611

c: ALS method Zn-OG62

?: denotesWO3 % calculated using W ppm (method ME-XRF15c)

F: denotes Zn % calculated using Zn ppm (method ME-ICP61)

A review of the Pilot Mountain assay database identified a change in the laboratory assay method for overlimit tungsten (W-XRF10) to overlimit WO3 (ME-XRF15c) that was previously not flagged for drill holes PM24-014, PM24-016 & PM24-017, meaning that the overlimit samples for those holes were stated as calculated WO3 (W % multiplied by 1.2611) as opposed to assayed WO3. The WO3 grades in bold type below and in the corresponding Table 3 are corrected and restated from the announcement dated 26 November 2024.2 All zinc, silver, copper, and W (analysed via ME-ICP61) results remain unchanged.

PM24-017 downhole highlight drill intersections comprise:

o 46m @ 0.345% W03, 12.2g/t Ag, 2,476ppm Cu & 0.37% Zn from 66.4 - 112.4m (46m @ 0.48% WO3Eq* or 1.79% CuEq**); including

- 10.8m @ 0.558% W03, 1.2g/t Ag, 684ppm Cu & 0.18% Zn from 66.4 - 77.2m (10.8m @ 0.60% WO3Eq* or 2.21% CuEq**); and

- 7.6m @ 0.727% W03, 29.2g/t Ag, 10,982ppm Cu (1.098%) & 0.64% Zn from 101.2 - 108.8m (7.6m @ 1.17% WO3Eq* or 4.33% CuEq**).

PM24-014 downhole highlight drill intersection comprises:

o 15.1m @ 0.133% W03, 45.2g/t Ag, 12,923ppm Cu (1.292%) & 0.65% Zn from 20.4 - 35.5m (15.1m @ 0.67% WO3Eq* or 2.49% CuEq**).

Table 3: 26 November 2024 Restated Assay Results

Hole ID | Downhole Depth (m) | Interval (m) | W | WO3 |

| Zn |

| Ag | Cu | Intersection Composites | ||

From | To | (ppm) a | (%) b |

| (%) c |

| (g/t) a | (ppm) a | (weighted averages) c | |||

PM24-014 | 20.4 | 23.5 | 3.1 | 1,380 | 0.17 |

| 0.62 |

| 17.3 | 8,230 | 15.1m @ 0.133% WO3, 45.2g/t Ag, 0.65 % Zn & 1.29 % Cu | |

23.5 | 25 | 1.5 | 1,260 | 0.16 |

| 0.49 |

| 30.7 | 9,940 | |||

25 | 26.5 | 1.5 | 2,210 | 0.31 | ? | 0.86 |

| 105 | 50,200 | |||

26.5 | 27.8 | 1.3 | 860 | 0.11 |

| 0.67 |

| 48.2 | 11,950 | |||

27.8 | 30 | 2.2 | 600 | 0.08 |

| 0.97 |

| 142 | 3,480 | |||

30 | 31.5 | 1.5 | 140 | 0.02 |

| 0.53 |

| 5.9 | 468 | |||

31.5 | 32.8 | 1.3 | 130 | 0.02 |

| 0.64 |

| 5.7 | 782 | |||

32.8 | 34.3 | 1.5 | 1,570 | 0.20 |

| 0.41 |

| 7.6 | 30,600 | |||

34.3 | 35.5 | 1.2 | 720 | 0.09 |

| 0.49 |

| 18.3 | 7,180 | |||

| ||||||||||||

PM24-015 | 25.3 | 26.8 | 1.5 | 1,750 | 0.22 |

| 0.58 |

| 5.8 | 1,315 | 7.0m @ 0.200% WO3, 6.2 g/t Ag, 0.79% Zn & 0.18% Cu | |

26.8 | 28.3 | 1.5 | 1,860 | 0.23 |

| 1.21 F |

| 8.9 | 2,880 | |||

28.3 | 29.3 | 1 | 1,730 | 0.22 |

| 0.42 |

| 4 | 1,110 | |||

29.3 | 32.3 | 3 | 1,320 | 0.17 |

| 0.81 |

| 5.8 | 1,700 | |||

33.8 | 34.8 | 1 | 1,070 | 0.13 |

| 0.71 |

| 18.2 | 10,350 | 2.5m @ 0.069% WO3, 10.8 g/t Ag, 0.66% Zn & 0.97% Cu | ||

34.8 | 36.3 | 1.5 | 200 | 0.03 |

| 0.62 |

| 5.9 | 9,300 | |||

| ||||||||||||

PM24-016 | 78.3 | 79.8 | 1.5 | 1,700 | 0.21 |

| 0.04 |

| 1 | 336 | 4.6m @ 0.292% WO3, 42.7 g/t Ag, 0.92% Zn & 0.05% Cu | |

79.8 | 81.4 | 1.6 | 2,210 | 0.30 | ? | 1.16 | F | 1.7 | 366 | |||

81.4 | 82.9 | 1.5 | 2,800 | 0.36 | ? | 1.56 | F | 128 | 802 | |||

| ||||||||||||

PM24-017 | 66.4 | 68.1 | 1.7 | 5,290 | 1.50 | ? | 0.16 |

| 4.3 | 2,030 | 10.8m @ 0.558% WO3, 1.23 g/t Ag, 0.18% Zn & 0.07% Cu | 46.0m @ 0.345% WO3, 12.2 g/t Ag, 0.37% Zn & 0.25% Cu |

68.1 | 69.6 | 1.5 | 2,770 | 0.82 | ? | 0.52 |

| 2.3 | 832 | |||

69.6 | 71.1 | 1.5 | 1,870 | 0.24 |

| 0.04 |

| - | 75 | |||

71.1 | 72.7 | 1.6 | 3,260 | 0.42 | ? | 0.05 |

| - | 446 | |||

72.7 | 74.2 | 1.5 | 1,770 | 0.22 |

| 0.16 |

| 1.2 | 359 | |||

74.2 | 75.7 | 1.5 | 1,460 | 0.18 |

| 0.11 |

| - | 169 | |||

75.7 | 77.2 | 1.5 | 3,080 | 0.41 | ? | 0.23 |

| 0.5 | 711 | |||

77.2 | 78.7 | 1.5 | 1,570 | 0.20 |

| 0.2 |

| - | 130 |

| ||

78.7 | 80.6 | 1.9 | 1,290 | 0.16 |

| 0.37 |

| - | 99 | |||

80.6 | 82.1 | 1.5 | 150 | 0.02 |

| 0.06 |

| 2 | 29 | |||

82.1 | 83.5 | 1.4 | 110 | 0.01 |

| 0.03 |

| - | 32 | |||

83.5 | 85 | 1.5 | 1,240 | 0.16 |

| 0.18 |

| 0.6 | 65 | |||

85 | 86.5 | 1.5 | 670 | 0.08 |

| 0.07 |

| - | 81 | |||

86.5 | 88 | 1.5 | 1,490 | 0.19 |

| 0.64 |

| 14.9 | 633 | |||

88 | 91 | 3 | 1,660 | 0.21 |

| 0.09 |

| 1.2 | 163 | |||

91 | 92.5 | 1.5 | 1,290 | 0.16 |

| 0.38 |

| 1.6 | 83 | |||

92.5 | 93.7 | 1.2 | 2,530 | 0.33 | ? | 1.86 | F | 4.9 | 273 | |||

93.7 | 95.2 | 1.5 | 240 | 0.03 |

| 0.07 |

| 2.6 | 27 | |||

95.2 | 96.6 | 1.4 | 20 | 0.00 |

| 0.04 |

| - | 24 | |||

96.6 | 98.1 | 1.5 | 550 | 0.07 |

| 0.7 |

| 32.1 | 354 | |||

98.1 | 99.7 | 1.6 | 2,310 | 0.32 | ? | 1.3 | F | 124 | 225 | |||

99.7 | 101.2 | 1.5 | 1,170 | 0.15 |

| 0.57 |

| 5.6 | 2,220 | |||

101.2 | 102.7 | 1.5 | 2,490 | 0.32 | ? | 0.27 |

| 7.9 | 992 | 7.6m @ 0.727% WO3, 29.15 g/t Ag, 0.64% Zn & 1.10% Cu | ||

102.7 | 103.6 | 0.9 | 3,340 | 1.51 | ? | 0.74 |

| 13.6 | 5,040 | |||

103.6 | 104.7 | 1.1 | 2,640 | 0.66 | ? | 0.25 |

| 4.8 | 2,000 | |||

104.7 | 105.9 | 1.2 | 2,690 | 1.58 | ? | 1.78 | F | 31.9 | 16,950 | |||

105.9 | 107.3 | 1.4 | 3,210 | 0.47 | ? | 0.75 |

| 19.3 | 8,680 | |||

107.3 | 108.8 | 1.5 | 2,160 | 0.27 | ? | 0.23 |

| 84.6 | 28,500 | |||

108.8 | 109.4 | 0.6 | 240 | 0.03 |

| 0.12 |

| 24.4 | 12,050 |

| ||

109.4 | 111.1 | 1.7 | 1,780 | 0.22 |

| 0.07 |

| 1.9 | 880 | |||

111.1 | 112.4 | 1.3 | 2,650 | 0.35 | ? | 0.1 |

| 10.2 | 5,730 | |||

Table 3 notes:

Summary of certificated assay results provided by accredited laboratory ALS USA Inc

ppm: parts per million, 10,000 ppm = 1%

a: ALS method ME-ICP61;

b: WO3 % calculated as W % multiplied by 1.2611

c: ALS method Zn-OG62

?: denotesWO3 % calculated using W ppm (method ME-XRF15c)

F: denotes Zn % calculated using Zn ppm (method ME-ICP61)

Figure 1:2024 drillhole plan map showing the location of all holes drilled to date. Red drill collars represent holes for which assays have been reported, yellow collars are holes still to be reported.

References

1: ALS USA Inc. analytical method utilised: ME-ICP61 for all samples, with ME-ICP61 overlimit samples also analysed using Ore Grade packages Ag-OG62, Cu-OG62, Pb-OG62, Zn-OG62, and W-XRF15c for high-grade tungsten.

2: https://www.londonstockexchange.com/news-article/GMET/pilot-mountain-significant-drill-results/16781172

This announcement contains inside information for the purposes of Article 7 of EU Regulation 596/2014 (which forms part of domestic UK law pursuant to the European Union (Withdrawal) Act 2018). The Directors of the Company are responsible for the contents of this announcement.

COMPETENT PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O'Reilly (MSc, DIC, MIMMM QMR, MAusIMM, FGS), who is a qualified geologist and acts as the Competent Person under the AIM Rules - Note for Mining and Oil & Gas Companies. Mr O'Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Guardian Metal Resources plc to provide technical support.

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the timing and granting of regulatory and other third party consents and approvals, uncertainties regarding the Company's or any third party's ability to execute and implement future plans, and the occurrence of unexpected events.

Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

For further information visitwww.Guardianmetalresources.comor contact the following:

Guardian Metal Resources plc Oliver Friesen (CEO) | Tel:+44 (0) 20 7583 8304 |

Cairn Financial Advisers LLP Nominated Adviser Sandy Jamieson/Jo Turner/Louise O'Driscoll | Tel: +44 20 7213 0880 |

Shard Capital Partners LLP Broker Damon Heath/Erik Woolgar | Tel: +44 (0) 20 7186 9000 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Guardian Metal Resources PLC

View the original press release on accesswire.com