Transaction advances iAnthus' commitment to brand innovation, while providing multi-state expansion for Cheetah's product portfolio

Michael Piermont, Co-Founder and CEO of Cheetah, and former CRO of Leaf Trade, will join iAnthus' Executive Team

NEW YORK and TORONTO, Dec. 30, 2024 /PRNewswire/ - iAnthus Capital Holdings, Inc. ("iAnthus" or the "Company") (CSE: IAN) (OTCQB: ITHUF), which owns, operates and partners with regulated cannabis operations across the United States, today announced that it has entered into an asset purchase agreement (the "Purchase Agreement") with Cheetah Enterprises Inc. (the "Seller"), pursuant to which iAnthus will acquire the Cheetah vape brand, a fast-growing brand known for its premium quality and disruptive presence in the Illinois' cannabis market. (the "Acquisition").

This Acquisition marks a key milestone in iAnthus' ongoing strategy to elevate its portfolio of consumer-focused cannabis brands and drive long-term growth. The Cheetah brand has become synonymous with innovation and quality, offering premium live resin vape products that have captured the attention of cannabis enthusiasts. By bringing Cheetah into its brand portfolio, iAnthus expands its presence in the Illinois & Pennsylvania cannabis markets - with further expansion planned throughout 2025. The Acquisition is expected to bolster iAnthus' revenue growth, while giving Cheetah the resources and distribution network to increase its market penetration in Illinois and other key states. With iAnthus' expansive footprint, this transaction creates a path for Cheetah to become a national leader in the vape category, offering a new level of excitement and choice for cannabis consumers. Together, iAnthus and Cheetah will leverage shared resources, operational efficiencies, and a unified brand strategy to capitalize on growth opportunities across the country.

As part of the Acquisition, Michael Piermont, Co-Founder and CEO of Cheetah, will join iAnthus as Chief Commercial Officer. Piermont's experience in driving growth, brand development, and technology innovation - including his tenure as CRO of Leaf Trade, which was successfully acquired by LeafLink in November 2024 - will be instrumental in maximizing the potential of Cheetah and iAnthus' broader brand portfolio.

"We are building a platform where bold brands can thrive, and Cheetah fits that mold perfectly," said Richard Proud, CEO of iAnthus. "Cheetah's innovative approach to the vape market mirrors the agility, precision, and speed with which we're building iAnthus. This Acquisition gives us the momentum to win with consumers, expand into new markets, and bring top-industry talent into our organization."

Michael Piermont, CEO and Co-Founder of Cheetah commented, "From day one, Cheetah's mission has been about being fearless, fast, and innovative to our consumers - qualities that clearly align with iAnthus' vision for the future of cannabis. We're thrilled to join forces with a team that recognizes the power of brand authenticity, the impact of thinking outside the box, and the importance of staying ahead of the curve in this industry."

Transaction Details

Pursuant to the Purchase Agreement, iAnthus will acquire substantially all of the assets of Seller that relate to and are used in connection with the Seller's cannabis wholesale business, including the manufacture, marketing, and sale of cannabis distillate vaporizer products in the states of Illinois and Pennsylvania under the "Cheetah" brand (the "Brand"), but excluding certain excluded assets (collectively, the "Purchased Assets"), together with certain assumed liabilities related to the Purchased Assets.

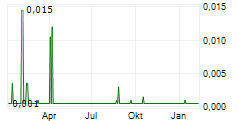

The purchase price (the "Purchase Price") for the Purchased Assets includes: common shares in the capital of the Company ("Shares") at an aggregate deemed value of approximately US$1.5 million (the "Share Consideration"), to be issued in three (3) tranches. The Shares are issued at a deemed price of US$0.012, which is a premium to the current market price for the Shares. The Shares will be issued post-closing in three tranches and are subject to Canadian Securities Exchange approval. The Purchase Price also includes non-material cash payments in four (4) installments payable upon completion of certain performance benchmarks and additional earnout consideration based on EBITDA generated by the Brand after closing and certain other performance metrics, payable in cash at various intervals until April 1, 2028.

The Shares to be issued as the Share Consideration will be issued pursuant to a prospectus exemption under Canadian securities law and will be subject to a Canadian holding period expiring four months and a day from the date(s) of issuance. The Shares will be issued pursuant to an exemption from the registration requirements under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") provided by Rule 903 of Regulation S promulgated under the U.S. Securities Act. The Shares have not been, nor will they be, registered under the U.S. Securities Act, and may not be offered or sold in the United States or to, or for the account or benefit of, "U.S. persons" (as such term is defined in Regulation S under the U.S. Securities Act) absent registration or an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. The Shares will be issued as "restricted securities" as defined in Rule 144(a)(3) under the U.S. Securities Act. This news release will not constitute an offer to sell or the solicitation of an offer to buy the Shares or any other securities, nor shall there be any sale of the Shares, in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About iAnthus

iAnthus owns and operates licensed cannabis cultivation, processing and dispensary facilities throughout the United States. For more information, visit www.iAnthus.com.

Forward Looking Statements

Statements in this news release contain forward-looking statements. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in Company's reports that it files from time to time with the SEC and the Canadian securities regulators which you should review including, but not limited to, the Company's Annual Report on Form 10-K filed with the SEC. When used in this news release, words such as "will", "could", "plan", "estimate", "expect", "intend", "may", "potential", "believe", "should" and similar expressions, are forward-looking statements. Forward-looking statements may include, without limitation, statements relating to the Acquisition, including the anticipated closing date thereof, the payment of the Purchase Price and the addition of Mr. Piermont to the Company's executive team, and other statements relating to the Company's financial performance, business plans and development and results of operations.

These forward-looking statements should not be relied upon as predictions of future events, and the Company cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur. If such forward- looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard these statements as a representation or warranty by the Company or any other person that it will achieve its objectives and plans in any specified timeframe, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release. The Company disclaims any obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this news release or to reflect the occurrence of unanticipated events, except as required by law.

Neither the Canadian Securities Exchange nor the United States Securities and Exchange Commission has reviewed, approved or disapproved the content of this news release.

SOURCE iAnthus Capital Holdings Inc.