Kaufman Kapital believes that outright sales of the Pekin Campus and Alto's other assets would yield vastly superior returns to Alto's shareholders than pursuing partnerships

SAN JUAN, PUERTO RICO / ACCESSWIRE / December 30, 2024 / Kaufman Kapital, which along with its principal, Daniel Kaufman, are the largest stockholders of Alto Ingredients (NASDAQ:ALTO) ("Alto" or the "Company") with a beneficial ownership position of approximately 4.9% of the Company's outstanding shares, today issued the letter below to the Company's board of directors (the "Board") regarding its concerns with the Company's current business strategy. In the letter, Kaufman Kapital explains why the Company should make an expedited effort to sell off its Pekin Campus versus the current risky strategy of pursuing "partnerships", which are unlikely to maximize shareholder value on a risk-adjusted basis.

Douglas L. Kieta, Chairman of The Board of Directors

Alto Ingredients, Inc.

1300 South Second Street

Pekin, Illinois 61554

December 30, 2024

Dear Mr. Kieta,

My name is Daniel Kaufman, and I'm the founder and principal of Kaufman Kapital, a Family Office with a focus on small cap equities. Based on Alto's September 30, 2024 filings, I believe that we (myself and my firm, Kaufman Kapital) are now the largest shareholder of Alto Ingredients, owning ~4.9% of the company as of December 30, 2024. We deploy a number of value-based strategies grounded in bottoms up and fundamental analyses, including peer group evaluation. In the case of Alto, we see a company trading at a steep discount to BOTH its peer group AND its tangible net asset value, due to three reasons: mis-allocated capital expenditures, poor operational performance versus peers, and market disappointment with the Company hiring Guggenheim to "explore partnerships" as opposed to simply selling off Alto's assets, most importantly, its Pekin Campus.

The purpose of our open letter is twofold: 1) to reset and restore a sense of urgency at Alto's Board of Directors and C-Suite, reminding all parties that, as a publicly traded company, they have fiduciary responsibilities to be good stewards of shareholders' capital, as they, ultimately, work for shareholders and 2) to ensure that agency bias does not cause the Board of Directors and management to focus their efforts on "partnerships" that benefit management and the Board versus the asset sales that we believe would maximize shareholder value. We urge that this requires actively exploring the sale of all its assets in a formal M&A process, most importantly its Pekin Campus, which constitutes the vast majority of Alto's value and far more than the company's current enterprise value.

Based on synthesizing the year-to-date FY 2024 conference calls of Alto's peer group, including Green Plains Inc., REX American Resources Corporation, and The Anderson, Inc. combined with our conversation with industry insiders, as well as our initial (one hour plus in duration) early December 2024 conference call with Alto's CEO and CFO, it is our view that the collective value of Alto's ethanol plants, Magic Valley, Columbia, and its Pekin Campus could exceed $550 million, which net of debt, equates to approximately $6 per share in value compared to its current stock price of ~$1.68. The reasons that Alto's Pekin Campus would be so valuable to an acquirer are its large scale, nameplate capacity of 250 million gallons per year, significant SG&A savings in a roll-up, and close proximity to (<10 miles) to the Mount Simon sandstone formation, which is widely considered ideal for a carbon sequestration project, based on its unique geological attributes.

Moreover, as a proxy for the replacement value of a scaled ethanol plant, such as Alto's Pekin Campus, on May 3, 2024, the CEO of Green Plains, Todd Becker, a larger and more sophisticated peer, publicly stated the current replacement value of a new ethanol plant could be as high as $2.50 per gallon.

"By the way, we were just checking, but to build a new ethanol plant in the United States in our view could be as high as $2.50 a gallon because we have priced them to see the economics related to when alcohol to jet becomes a reality and that's a minimum price at this point."

While Alto's management might attribute the current wide disconnect between its stock price and its intrinsic value to the worsening ethanol environment (i.e. the trough of the cycle, meaning its EBITDA power is temporarily depressed), we would argue that poor operational execution and lack of sustainable and meaningful free cash flow generation, since the beginning of FY 2023, are the real culprits.

ALTO has failed to reach its financial goals since their 2022 transformation

In November 2022, the company raised capital and invested nearly $40M to "accelerate its transformation" with the growth-focused capital expenditures expected to generate $65M in incremental adjusted EBITDA by 2025 and $125M by 2026.

Specifically, enclosed below is a direct quote, located on page 28, of Alto's FY 2022 10-K:

"As we progressed into 2022, the need to accelerate these initiatives became clear, therefore last November, we entered into a six-year term loan for up to $125 million. We are staging our capital improvement projects and drawing loan proceeds in tranches to minimize carrying costs while maximizing return. We spent $12.5 million in the fourth quarter and $37.7 million for all of 2022 on our capital improvement projects. Our efforts will position us to add substantial additional streams of earnings before interest, taxes, depreciation and amortization, or EBITDA, to our business, all of which will increase under an improved operating environment. We expect additional annualized EBITDA of $65 million from current projects by the end of 2025 and total additional annualized EBITDA of $125 million in 2026 when our carbon capture and sequestration, cogeneration and other current initiatives are fully realized."

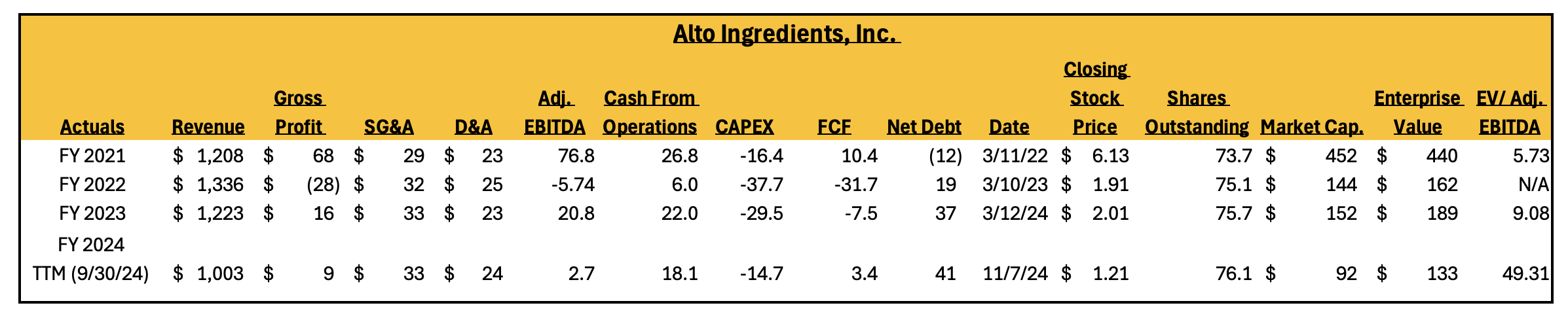

This transformation has so far been a failure. See the table below:

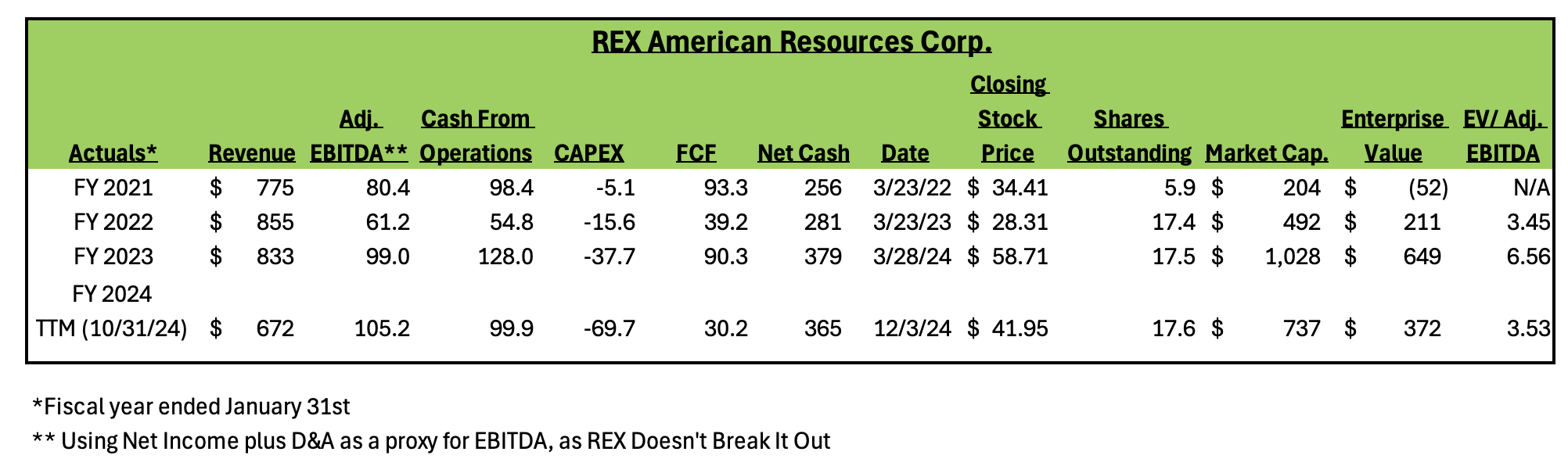

ALTO's most comparable, publicly-traded peer, is REX American Resources Corporation. Both Alto and REX operate similar sized plants based on nameplate capacity, and yet, their financial performance, measured from January 2021 - October 31, 2024, paints a dramatically different picture. Please note, REX's fiscal year ends on January 31st whereas Alto follow the traditional calendar year, ending December 31st.

Empirically, as we are simply highlighting the same financial metrics, over very similar time frames, and based on that data, REX has posted dramatically better results. Moreover, it is also crystal clear, barring a miracle in 'crush margins' in FY 2025 and FY 2026, that Alto will not meet its incremental Adj. EBITDA uplift goals, based on its past capital expenditure programs.

Alto Ingredients New Transformation Plan is financially implausible

In our view, Alto has neither the capital, nor the expertise needed to implement its carbon capture sequestration project (CCS) at its Pekin Campus, without sacrificing its attractive economics or significantly diluting shareholders. Based on reviewing public commentary by Alto's management along with third-party analyst assumptions for building a new Cogeneration plant, it is our understanding that $110 to $150 million of fresh capital would be required to bring the CCS project to fruition. Further complicating matters, we are aware of the current moratorium for building CCS pipelines in the state of Illinois. However, in our view, the incoming Trump administration should be more pro carbon capture as it is considered favorable for the midstream oil and gas industry, creates well-paying American jobs, and plays a role in decarbonizing the environment. Secondly, our understanding is that the new Trump administration could provide clarification on CCS permitting at the Federal level, which would supersede Illinois' moratorium. Given these factors, we believe that any well-capitalized partner would only provide capital to Alto on terms where they would capture the majority of the upside if and when CCS bears fruit, while Alto would bear the risk and downside of delays or other problems.

Our Ask of the Board and Management

We ask Alto's Board of Directors to immediately and formally expand the scope of its Strategic Review with Guggenheim partners to include a thorough evaluation of selling its Pekin Campus.

We expect to see meaningful actions taken in the near term, as time is of the essence, and we look forward to expeditiously reaching an outcome that benefits all stakeholders.

Sincerely,

Daniel Kaufman

Kaufman Kapital

About Kaufman Kapital

Founded by entrepreneur and investor Daniel Kaufman, Kaufman Kapital seeks to generate attractive, long-term risk adjusted returns. Kaufman focuses on identifying misunderstood small cap businesses trading at significant discounts to comparable companies in both the public and private markets. By positioning themselves as not only long-term investors, but also partners, they are able to provide their portfolio companies with the guidance they need to successfully complete their transformation.

Contacts:

Daniel Kaufman

info@kaufmankapital.com

SOURCE: Kaufman Kapital

View the original press release on accesswire.com