DUBAI, UAE, Jan. 10, 2025 /PRNewswire/ --Bybit, the world's second-largest cryptocurrency exchange by trading volume, has released the latest crypto derivatives report, published weekly with Blocks Scholes. Noting BTC's retreat from the $100k mark a week into the new year, the analysis showed on-risk assets including crypto bore the brunt of broader macro factors. Past week's data indicates heightened uncertainty in market dynamics ahead of Trump's anticipated Jan. 21 inauguration, highlighting shifting investor sentiment during this significant political transition.

Key Insights:

Perpetuals Took a Winter Break: The perpetual swap market experienced a notable decline in liquidity over the holidays, with trading volumes winding down throughout Dec. 2024, leading to decreased realized volatility across the market. Notably, open interest maintained stability compared to levels preceding the great expiration of options contracts in Dec. 2024, indicating conservative positioning and limited hedging activity in perpetual swap markets.

Wide Disparity Between 30-Day Implied Volatility and 7-Day Realized Volatility: ETH's options markets signalled an unmistakable preference for call options. In contrast, BTC's open interest is rebalancing after the expiration in Dec. 2024. Both ETH and BTC have experienced notable changes in their term structures heading into the new year. The sharp divergence between implied and realized volatility is at its largest since the U.S. elections, suggesting that options traders are paying a premium to price in a higher level of risk or volatility despite the calm at the surface.

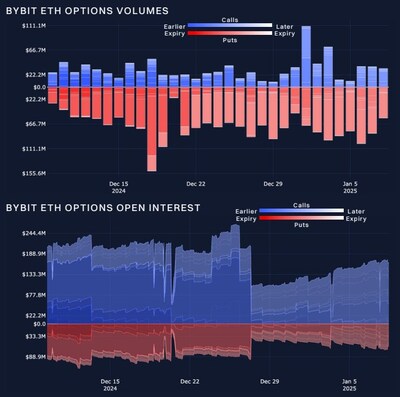

ETH Calls Gaining Traction

There has been a reshuffling in ETH open interest. While put options still hold sway in terms of total volume, call contracts have seen an uptick after Dec. However, the optimism comes with a caveat-the decline in realized volatility in the year so far has given options traders pause. The volatility term structure has steepened further, with short-term volatility (measured at a 30-day tenor) still sitting more than 15 points above its realized counterpart. This gap is the widest since the pre-election period of 2024, when geopolitical uncertainty fueled volatility premiums. Today, however, the premium seems driven more by general speculation than by any specific event. Even as the market settles, investors remain cautious, signaling looming uncertainty.

Access the Full Report here.

Bybit / TheCryptoArk /BybitResearch

About Bybit

Bybit is the world's second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit's Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo - https://mma.prnewswire.com/media/2595392/Sources_Bybit_Block_Scholes.jpg

Logo - https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/market-eyes-crypto-president-inauguration-as-btc-tumbles-at-100k-bybit-and-block-scholes-analysis-302347880.html

View original content:https://www.prnewswire.co.uk/news-releases/market-eyes-crypto-president-inauguration-as-btc-tumbles-at-100k-bybit-and-block-scholes-analysis-302347880.html