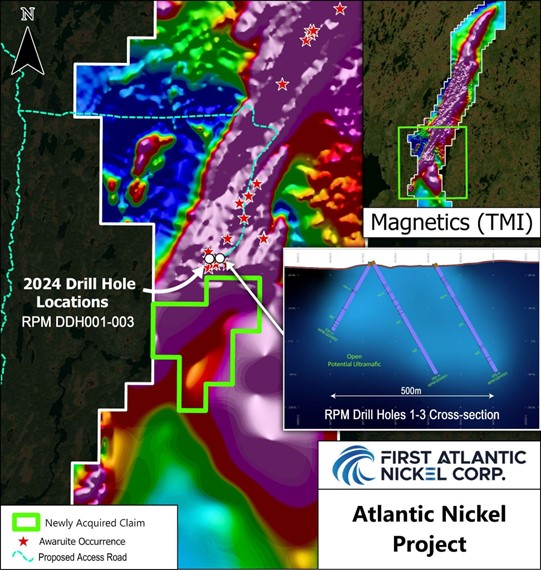

VANCOUVER, British Columbia, Jan. 13, 2025 (GLOBE NEWSWIRE) -- First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) ("First Atlantic" or the "Company") advises that it has closed the previously announced asset purchase agreement (the "Purchase Agreement") to acquire a 100% interest in and to mining licence 038152M, consisting of 12 mineral claims located in central Newfoundland, known as the the RPM South claims (the "Claims"). The Claims are situated immediately south of the recent discovery at the RPM Zone (See Figure 1), which is part of the 30 kilometer nickel trend within the Atlantic Nickel project (the "Atlantic Nickel Project" or the "Project") in Newfoundland. Future drill programs will aim to test for mineralization in all directions, including at depth, from the new discovery at the RPM Zone, which is no longer constrained by proximity to project boundaries. The Claims are strategically important for future project infrastructure and development, while also being prospective as they have the potential to host awaruite nickel mineralization extending southward from the RPM Zone at depth.

Highlights:

- Strategic Acquisition: The Company has successfully closed the acquisition of mining licence #038152M, which consists of 12 mineral claims located immediately south of the RPM Zone. This acquisition is a strategic step to support future project infrastructure and development. Additionally, the new licence provides the Company with an opportunity to investigate the potential southward continuation of awaruite nickel mineralization at depth within the RPM Zone.

- Drill-core Assays: Whole rock assays are in progress to determine the total grades of nickel and other metals including iron, chromium, and cobalt. Initial Phase 1 assay results are expected over the coming weeks.

- Metallurgical Testing: Preliminary metallurgical testing of Phase 1 drill core samples is underway. Davis Tube Recovery (DTR) testing measures the percentage of nickel that is magnetically recoverable to estimate potential recovery through commercial magnetic separation processes.

- Phase 2 Drilling Plans: The Company anticipates providing updates soon.

- Mineralization Expansion Potential: The RPM Zone remains open for drilling in all directions, with mineralization appearing more substantial towards the east while depth offers potential for further expansion along strike.

For further information, questions, or investor inquiries, please contact Rob Guzman at First Atlantic Nickel by phone at +1 844 592 6337 or via email at rob@fanickel.com

Adrian Smith, CEO of First Atlantic, provided an update on the company's recent progress and future plans:

"First Atlantic Nickel has successfully secured 100% ownership of the 30km Pipestone Ultramafic Belt, a large-scale district nickel system with the potential to host multiple nickel deposits. The company's Phase 1 drilling program and historical work on the property have revealed widespread nickel mineralization in various zones along the trend, highlighting the significant potential of the Atlantic Nickel Project.

The company eagerly anticipates the release of assay results from its initial drilling in the coming weeks and is preparing to launch a Phase 2 drill program aimed at delineating a larger footprint at the RPM zone, with the goal of defining more than a billion tonnes of mineralization. In addition to being on track to release Phase 1 assay results, First Atlantic Nickel has initiated metallurgical testing of the Phase 1 drill core and is currently planning a larger-scale metallurgical development process to demonstrate the feasibility of processing awaruite-bearing ore into a final nickel concentrate. The company expects to provide further updates on its progress in the near future as it continues to advance this exciting project."

Davis Tube Recovery Metallurgical Test

Davis Tube Recovery (DTR) is a metallurgical test used to determine potential commercial mining recoveries through magnetic separation. In this test, a prepared sample is placed in a glass tube positioned at a 45° angle between two powerful electromagnets. The sample is mixed with water to form a slurry, which is slowly poured through the tube while being rinsed with water. This process isolates the magnetic material, leaving it as a concentrate1. Once the concentrate is obtained from the Davis Tube, a second geochemical assay is conducted to determine the amounts of nickel and iron in the concentrate, providing a measurement of the nickel that was recovered magnetically.

The DTR test is a method used to analyze potential recovery using magnetic separation, which separates and concentrates magnetic minerals such as magnetite and awaruite. Awaruite is a naturally occurring, sulfur-free nickel-iron alloy (Ni3Fe or Ni2Fe) that contains approximately 75% nickel. It possesses magnetic properties 10 times stronger than magnetite2, making it amenable to magnetic separation processes used in commercial mining operations.

RPM-South Claims

The Claims provide First Atlantic with a contiguous land package adjacent to the RPM Zone. The RPM Zone, which extends southward to the previous claim boundary, could potentially continue south into the newly acquired Claims, making this acquisition a key asset for future project development and infrastructure. The new Claims proximity to known mineralization boundaries enhances their strategic importance. Further expansion drilling will focus on defining the full extent of mineralization and testing for depth, as well as east, north and south extensions of the recent discovery at the RPM target zone. This strategic acquisition enables comprehensive exploration and development planning as the Project advances. The Company remains dedicated to realizing the full potential of the Atlantic Nickel Project through robust exploration and aggressive drilling campaigns.

Figure 1: Claim location map showing RPM-South claims, which have been fully acquired by First Atlantic. The Claims are located adjacent to recent discoveries at the RPM Zone and form a critical piece of the Company's long term Atlantic Nickel development plans.

RPM Zone Geology: The RPM Zone is situated within the expansive 30 km highly magnetic ultramafic ophiolite belt, approximately 10 km south of the Super Gulp target and 25 km south of the historic drilling at Atlantic Lake, where significant mineralization was previously encountered in drill core. This zone is characterized by wide intervals of heavily sheared and serpentinized peridotite ultramafic rock. The serpentinized peridotite within the drilled areas is heavily broken due to extensive shearing and faulting, resulting from its vertical position within a subduction zone and vertical emplacement rather than being displaced and preserved as a massif. The vertical orientation of the crustal-scale ophiolite is highly favorable, absorbing additional structural breakage and increasing fluid porosity for serpentinization. This vertical orientation also provides significant depth potential for mineralized zones, where the nickel mineralization could extend to depths of 1 km or more, allowing ample room for depth extensions.

Awaruite (Nickel-iron alloy Ni2Fe, Ni3Fe)

Awaruite, a naturally occurring sulfur-free nickel-iron alloy composed of Ni3Fe or Ni2Fe with approximately ~75% nickel content, offers a proven and environmentally safer solution to enhance the resilience and security of North America's domestic critical minerals supply chain. Unlike conventional nickel sources, awaruite can be processed into high-grade concentrates exceeding 60% nickel content through magnetic processing and simple floatation without the need for smelting, roasting, or high-pressure acid leaching3. Beginning in 2025, the US Inflation Reduction Act's (IRA) $7,500 electric vehicle (EV) tax credit mandates that eligible clean vehicles must not contain any critical minerals processed by foreign entities of concern (FEOC)4. These entities include Russia and China, which currently dominate the global nickel smelting industry. Awaruite's smelter-free processing approach could potentially help North American manufacturers meet the IRA's stringent critical mineral requirements and reduce dependence on FEOCs for nickel processing.

The U.S. Geological Survey (USGS) highlighted awaruite's potential, stating, "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel"5. Awaruite's unique properties enable cleaner and safer processing compared to conventional sulfide and laterite nickel sources, which often involve smelting, roasting, or high-pressure acid leaching that can release toxic sulfur dioxide, generate hazardous waste, and lead to acid mine drainage. Awaruite's simpler processing, facilitated by its amenability to magnetic processing and lack of sulfur, eliminates these harmful methods, reducing greenhouse gas emissions and risks associated with toxic chemical release, addressing concerns about the large carbon footprint and toxic emissions linked to nickel refining.

Figure 2: Quote from USGS on Awaruite Deposits in Canada.

The development of awaruite resources is crucial, given China's control in the global nickel market. Chinese companies refine and smelt 68% to 80% of the world's nickel6 and control an estimated 84% of Indonesia's nickel output, the largest worldwide supply7. Awaruite is a cleaner source of nickel that reduces dependence on foreign processing controlled by China, leading to a more secure and reliable supply for North America's stainless steel and electric vehicle industries.

Acquisition Closing Terms

The Company paid cash consideration of $20,000 and it issued an aggregate of 750,000 common shares at a deemed price of $0.1425 to the arm's length vendors. The consideration shares are subject to a voluntary escrow and will be released to the vendors over a period of 30 months from issuance. In Addition, the consideration shares are subject to a statutory holder period which expires on May 11, 2025.

The Claims are subject to a 2.0-per-cent net smelter return (NSR) royalty. Prior to commercial production, the Company can purchase up to a 1.0-per-cent royalty for $1-million.

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol "FAN", the American OTCQB Exchange under the symbol "FANCF" and on several German exchanges, including Frankfurt and Tradegate, under the symbol "P21".

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at www.fanickel.com. Stay connected and learn more by following us on these social media platforms:

https://x.com/FirstAtlanticNi

https://www.facebook.com/firstatlanticnickel

https://www.linkedin.com/company/firstatlanticnickel/

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

rob@fanickel.com

Disclosure

Adrian Smith, P.Geo., is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company developing the 100%-owned Atlantic Nickel Project, a large-scale nickel project strategically located near existing infrastructure in Newfoundland, Canada. The Project's nickel occurs as awaruite, a natural nickel-iron alloy containing approximately 75% nickel with no-sulfur and no-sulfides. Awaruite's properties allow for smelter-free magnetic separation and concentration, which could strengthen North America's critical minerals supply chain by reducing foreign dependence on nickel smelting. This aligns with new US Electric Vehicle US IRA requirements, which stipulate that beginning in 2025, an eligible clean vehicle may not contain any critical minerals processed by a FEOC (Foreign Entities Of Concern)8.

First Atlantic aims to be a key input of a secure and reliable North American critical minerals supply chain for the stainless steel and electric vehicle industries in the USA and Canada. The company is positioned to meet the growing demand for responsibly sourced nickel that complies with the critical mineral requirements for eligible clean vehicles under the US IRA. With its commitment to responsible practices and experienced team, First Atlantic is poised to contribute significantly to the nickel industry's future, supporting the transition to a cleaner energy landscape. This mission gained importance when the US added nickel to its critical minerals list in 2022, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, expectations regarding the timing, scope, and results from the 2024 work and drilling program; future project developments; the Company's objectives, goals or future plans, statements, and estimates of market conditions. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. Additional factors and risks including various risk factors discussed in the Company's disclosure documents which can be found under the Company's profile on http://www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/40ba63c4-360f-45ee-90ef-334baaf959a4

https://www.globenewswire.com/NewsRoom/AttachmentNg/46da5fff-e95a-4094-91a2-62be22fb3abf

____________________________

1 https://www.sgs.com/en/-/media/sgscorp/documents/corporate/brochures/sgs-min-wa117-geochemical-analysis-of-iron-ore-en-11.cdn.en.pdf

2 https://fpxnickel.com/projects-overview/what-is-awaruite/

3 https://fpxnickel.com/projects-overview/what-is-awaruite/

4 https://home.treasury.gov/news/press-releases/jy1939

5 https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/mineral-pubs/nickel/mcs-2012-nicke.pdf

6 https://www.brookings.edu/wp-content/uploads/2022/08/LTRC_ChinaSupplyChain.pdf

7 https://www.airuniversity.af.edu/JIPA/Display/Article/3703867/the-rise-of-great-mineral-powers/

8 https://home.treasury.gov/news/press-releases/jy1939