KELLOG, Idaho, Jan. 13, 2025 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. ("Bunker Hill" or the "Company") (TSX-V: BNKR | OTCQX:BHLL) is pleased to provide an update on operational and corporate activity. The Company is actively engaged in discussions with strategic financing partners while continuing to advance the mine restart.

Highlights include:

- Safety milestone: Achievement of an entire year without injuries in 2024

- Optimization of environmental bonding commitments

- Processing plant construction: Ongoing development of the processing facility

- Underground infrastructure: Continued rehabilitation efforts to improve underground operations

- Program to issue a new mineral estimate report during Q1 2025 is on track

"Following a demanding but safe 2024, the Bunker team and valued partners begin 2025 determined to restart operations in the second quarter, creating new American mining jobs within the Silver Valley and providing critical metal into the North American supply chain", said Sam Ash, President and CEO. "The long-term supply of Bunker Hill's zinc and lead-silver concentrates to Teck's Trail Smelter in British Columbia will strengthen American industrial resilience at this increasingly competitive time."

The sustainable restart of profitable mining operations at Bunker Hill will represent a significant economic and environmental milestone, locally and nationally. It will create 250 new long-term jobs within Shoshone County, Idaho - designated as a "Disadvantaged Community" by the US Department of Energy Justice40 Initiative of 2021, based on economic, environmental and energy transition criteria. It will also mark the first instance of a mining operation resuming within a Superfund Site since that program's inception in 1980.

This restart demonstrates the potential for responsible resource extraction within the USA in previously contaminated areas, showcasing industry advancements in environmental management, partnership and remediation techniques. Aside from delivering significant returns on investment, this project will contribute to the rejuvenation of a region historically dependent on mining, balancing economic development with modern environmental stewardship.

Figure 1: Refurbished floatation tanks from Teck's Pend Oreille Mine being inserted on their mezzanine floor

PROCESSING PLANT

When complete and operating, Bunker Hill's 1,800 tons per day processing plant will have the largest capacity of any such facility within the Silver Valley. Plans are being developed to expand this capacity to 2,500 tons per day, potentially supported by the US Export-Import Bank ("US EXIM") from 2026.

The mechanical installation of the fully refurbished floatation circuit, moved from Teck's closed Pend Oreille Mine, continues inside the Processing Plant Building. This is being conducted concurrent with the final installation work on the adjacent conveyor systems, concentrate load-out bays and the crusher tower, all located within the Kellogg yard. The next stage of the construction will be the installation of all remaining equipment along with associated piping, pumping and electrical infrastructure. Phased commissioning plans are in place and are ready to be initiated through H1 2025.

The two refurbished mills - the main mill from Barrick's Golden Sunlight mine in Montana, and the smaller regrind mill from Teck's Pend Oreille mine in Washington, will start their phased commissioning once the final upgrade to their lubrication systems has been completed.

The processing facility, along with its associated tailings filter plant, has been designed to remain within the footprint of the previous industrial site built upon the waste rock extracted during the 1898-1902 construction of the Kellogg Tunnel. This deliberately compact layout ensures no disturbance of any rehabilitated or greenfield ground. However, it did require the new buildings to be underset by deep piers to bind their foundations to the bedrock below the Kellogg Tunnel's waste rock.

Figure 2 below shows the nature of the compact site, the safe removal of old mine buildings and the construction of the new facilities over the last 12 months.

Figure 2: Progress in the main Kellogg yard from January 10, 2024, to January 10, 2025

UNDERGROUND

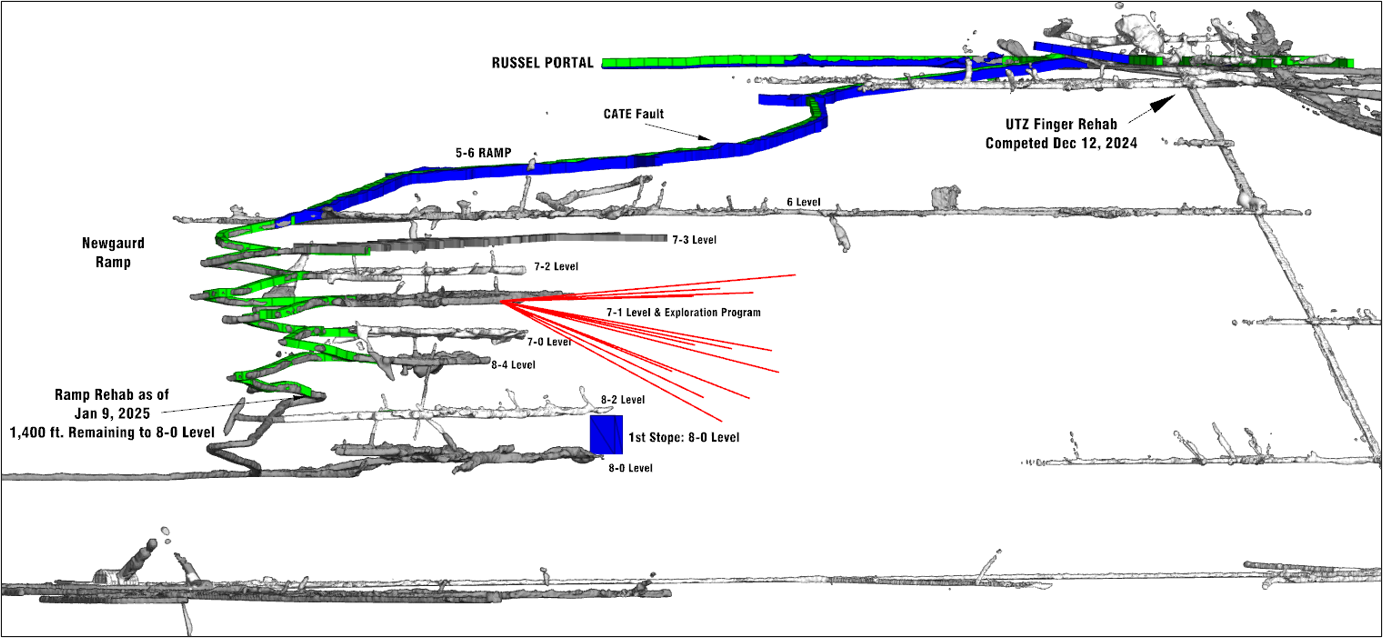

Once operational, Bunker Hill will be the only mine in the Silver Valley with portal access to the underground mining areas. This replaces the old Kellogg Tunnel tracked access and internal shafts used by the mine before it was closed in 1981. The upgrade to the 40-meter section of the new ramp that cuts the central Cate Fault, built by the Bunker Hill team between mine levels 5 and 6 in 2023, has been successfully upgraded, completed, and is now fully operational. Mining areas in the underground area close to the Russell Portal have also been prepared for operations, and an upgraded, modern mine ventilation system has been installed.

These advancements significantly improve accessibility to the mining areas and set the stage for efficient production as Bunker Hill progresses toward its restart goals.

The refurbishment of the old Newgard ramp constructed in 1979 between levels 6 and 8 continues on schedule. Our in-house mining teams are doing this to ensure sufficient space for the safe movement of modern mechanized mining equipment and the installation of modern ventilation and power systems. There is currently less than 1,400 feet of refurbishment to be completed to ensure full access to the first mining stope. This will ramp-connect the mining zones to the Wardner operating base via the fully refurbished Russell Portal. The construction and commissioning of the paste plant at the Wardner operating base is on track to be completed during the second quarter and will be ready to support operations starting in June 2025.

All water that exits the mine will continue to be pumped via the Kellogg Tunnel to the Central Treatment Plant adjacent to the Kellogg Yard for treatment by that Idaho Department of Environmental Quality facility before onward discharge into the South Fork of the Coeur D'Alene River.

The first mining stope, to be mined using long-hole transverse stoping with paste backfill will be located on the 8-0 Level as shown in Figure 3 below.

Figure 3: Rehabilitation of the Newgard ramp advances towards the mining levels 8-0 and 8-2

RESERVE AND RESOURCE UPDATE

The Company remains on track to issue an updated mineral estimate in Q1 2025, with a full report expected to be published in April 2025.

OPTIMIZING ENVIRONMENTAL PERFORMANCE BONDS

The Company has successfully rearranged the costs of the collateral bonds placed to secure the outstanding US$14 million due to the US Environmental Protection Agency ("US EPA") for water treatment services levied against the previous owners of the Bunker Hill Mine. As previously reported, the Company negotiated with the US EPA a revision to the terms of the 2017 Consent Decree, setting a new payment schedule and thereby enabling the Company to settle this claim from cash flow earned from mining operations. This rearrangement is expected to return approximately C$0.6 million to the Company this month, which will be used to support the ongoing mine restart plan.

SHARE ISSUANCE

Bunker Hill announces that pursuant to the terms of an agreement re financing cooperation dated September 27, 2022 (the "Cooperation Agreement") entered into by and among the Company, its wholly owned subsidiary Silver Valley Metals Corp. ("Silver Valley"), a certain service provider of the Company (the "Service Provider") and the Service Provider's affiliates, the Company has elected to issue 621,500 shares of common stock of the Company (the "Common Shares") at a deemed price of C$0.14 per Common Share to the Service Provider in full satisfaction of the aggregate US$60,000 financing cooperation fee owing to the Service Provider for the three (3) month period ending on December 31, 2024 (the "Q4 Cooperation Fee").

The Cooperation Agreement provides for, among other things, the Service Provider and its affiliates providing certain collateral security for the Company and Silver Valley to obtain certain surety bonds with respect to the Bunker Hill Mine (the "Collateral Security"). In consideration for the Collateral Security, the Company is required to pay the Service Provider a financing cooperation fee of US$20,000 per month, payable quarterly in Common Shares and/or cash at the Company's election, during the term of the Cooperation Agreement. The Service Provider is arm's length to the Company, its affiliates and associates. The Company has elected to issue the Common Shares in lieu of paying cash for the Q4 Cooperation Fee to preserve its cash for the potential restart and ongoing development of the Bunker Hill Mine.

This transaction remains subject to the receipt of all regulatory approvals, including, without limitation, the approval of the TSX Venture Exchange (the "TSX-V"). Once issued, the Common Shares will be subject to a four (4) month and one (1) day hold period from the applicable date of issuance in accordance with applicable Canadian securities laws. The Common Shares have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any U.S. state securities laws, and may not be offered or sold in the United States without registration under the U.S. Securities Act and all applicable state securities laws or in compliance with the requirements of an applicable exemption therefrom.

QUALIFIED PERSON

Mr. Scott Wilson is an independent "qualified person" as defined by NI 43-101 and is acting as the qualified person for the Company. He has reviewed, verified and approved the technical information summarized in this news release, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT BUNKER HILL MINING CORP.

Bunker Hill Mining Corp. is an American mineral exploration and development company focused on revitalizing our historic mining asset: the renowned zinc, lead, and silver deposit in northern Idaho's prolific Coeur d'Alene mining district. This strategic initiative aims to breathe new life into a once-productive mine, leveraging modern exploration techniques and sustainable development practices to unlock the potential of this mineral-rich region. Bunker Hill Mining Corp. aims to maximize shareholder value while responsibly harnessing the mineral wealth in the Silver Valley mining district by concentrating our efforts on this single, high-potential asset. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill

Sam Ash

President, Chief Executive Officer and Director

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the U.S. Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase 'forward-looking information' in the Canadian Securities Administrators' National Instrument 51-102 - Continuous Disclosure Obligations (collectively, "forward-looking statements"). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", "plan" or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company's objectives, goals or future plans, including the restart and development of the Bunker Hill Mine by Q2 2025; the achievement and expected timing of future short-term, medium-term and long-term operational strategies, including the completion and expected benefits resulting from upgrades to the processing facility, underground mining areas, and water treatment initiatives; the achievement of economic and environmental milestones once the planned restart is completed, including job creation, economic development and the supply of critical metals; the Company raising the required funds for the planned mine restart through its project finance initiatives, including by way of debt, equity, offtake or similar financings from its strategic financing partners, US EXIM or other parties; the expected cash savings from the renegotiated payment schedule with the US EPA; the completion and expected timing for the release of an updated mineral estimate and related report; the terms and completion of the share transaction described herein, including the number and deemed pricing of the Common Shares issuable in connection therewith; and the Company receiving all regulatory and stock exchange approvals for the share transaction described herein. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: Bunker Hill's ability to receive sufficient project financing for the restart and ongoing development of the Bunker Hill Mine on acceptable terms or at all; the forecast, capital requirements and timeline for the project restart resulting in planned operations in Q2 2024; the future price of metals; and the stability of the financial and capital markets. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the "SEC") and with applicable Canadian securities regulatory authorities, and the following: the Company's inability to raise additional capital for project activities, including through equity financings, concentrate offtake financings or otherwise; capital market conditions; the Company requiring more capital expenditures than expected for the planned project restart, resulting in delays or the inability to complete the restart; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company's ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company's operations or financial results are included in the Company's annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov).

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/74ed73e0-f359-4cac-b28d-1cab45ef4380

https://www.globenewswire.com/NewsRoom/AttachmentNg/99d6b841-ea9f-4cf3-aa18-0b99e6f0ca07

https://www.globenewswire.com/NewsRoom/AttachmentNg/08e75d7f-8ac1-48c6-9a2e-adea138f0fb9