Full Year Sales excluding licenses of €5.6m, down 9% YoY amid delayed capital sales and no revenue from JV in China

Two specialized investment banks RM Global and Bucephale Finance mandated to assess all strategic options for the Company

Sustained volume of PPU procedures in ASC vs. 2023 and +48% growth vs. 2022 despite the impact of temporary Medicare reimbursement decrease

CellTolerance Q4 2024 launch yielding pipeline of more than 40 commercial opportunities

Thanks to significant reduction in operating expenses, the Group anticipates an EBITDA loss between €4.7m and €4.9m1 in 2024

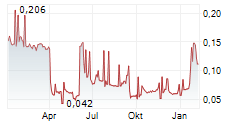

Estimated cash runway through early April 2025, supported by continued cost-cutting initiatives. Ongoing discussions with shareholders and investors to extend horizon

Regulatory News:

Mauna Kea Technologies (Euronext: ALMKT), inventor of Cellvizio, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today announces its unaudited sales for the fourth quarter and full year 2024 and an update on the review of its ongoing strategic options.

"Our technology continues to address significant unmet medical needs and is attracting growing interest from several strategic partners. However, the Company's current financial situation remains a significant hurdle. To address this, we have engaged two highly qualified investment banks to evaluate all possible strategic alternatives to ensure the Company has the appropriate environment and resources to support its development and the expansion of its technology", statedSacha Loiseau, Ph.D., Chairman and CEO of Mauna Kea Technologies. "The focus and dedication of our team in 2024 produced important progress on several fronts. With CellTolerance®, we are tapping into a significant diagnostic gap for those with IBS (irritable bowel syndrome), a condition responsible for half of all consultations with gastroenterologists, and we believe we can significantly expand our impact in this area. In parallel, advancements in our AI capabilities are positioning Cellvizio® as a leader in innovative algorithms, setting the stage for expanded clinical adoption and increased platform differentiation. Despite the near-term challenges we face, I remain optimistic about the important role Cellvizio® is playing in improving outcomes for patients."

Update on the strategic options review

As announced on November 19, 2024, the Group has mandated Bucephale Finance as a financial advisor to assist in exploring strategic options, particularly with financial stakeholders. To broaden the spectrum of potential partners and amplify the chances of securing a successful transaction that will maximize Mauna Kea's shareholder value, the Group has also retained the services of RM Global, a leading U.S.-based investment advisory firm specializing in the healthcare sector.

At the date of this press release, the strategic options under consideration are broad, ranging from an M&A transaction to a licensing and/or commercialization agreement. The Groupand its advisors are pleased with the level of interest expressed to date andanticipate an intensification of discussions in the coming weeks. Additionally, the Group is participating in the J.P. Morgan Healthcare Conference gathering in San Francisco from January 13 to 16, 2025, where management is engaging with a variety of stakeholders.

Discussions are also underway with shareholders and strategic investors to extend the cash horizon and obtain the resources to bring these strategic options to a successful conclusion.

Activity update

United States

The Pay-Per-Use (PPU) activity remained robust throughout 2024, with quarterly volumes comparable to 2023, averaging close to 1,000 procedures per quarter. This represents a significant increase of nearly 50% compared to 2022 and prior years.

However, the positive impact of this volume growth was offset by a negative price effect stemming from reduced Medicare reimbursement rates by the Centers for Medicare Medicaid Services (CMS). This reduction was caused by erroneous cost reporting from hospitals, and also impacts the reimbursement rates for Ambulatory Surgery Centers (ASCs). The Group has undertaken substantial efforts to rectify these discrepancies, successfully engaging with 80% of the hospitals submitting erroneous data.

Looking ahead to 2025, reimbursement rates are expected to remain in the same APC classification, as CMS relies on 2023 data for its 2025 rate setting. However, a favorable adjustment is anticipated at the latest in January 2026, when CMS incorporates the corrected 2024 data, plus considers the interim data provided via direct engagement from the Group. This adjustment is expected to restore reimbursement levels to the higher APC level, representing an increase of over 50% in reimbursement rates for Medicare covered beneficiaries.

PPU invoiced | FY 2022 | FY 2023 | FY2024 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

Number of procedures | 2,566 | 3,954 | 3,798 | 1,017 | 1,062 | 888 | 831 |

Capital sales amounted to three Cellvizio® systems in 2024, including one sold to The Ohio State University in Q4, compared to four systems in 2023. This represented a significant shortfall in Q4 as the Company was in active negotiations for seven Cellvizio® sales, 3 of which should close in January.

If capital sales cycles have lengthened, the pipeline is still significant representing a total of 13 active opportunities in the United States.

CellTolerance®

In the second half of 2024, the Group launched CellTolerance®, a new brand and multi-disciplinary program, focused on the treatment of food intolerances through a B2B2C cash-pay business model. This strategic initiative enables the Group to address a very significant and fast-growing market and overcome reimbursement barriers.

To support this new strategy, a dedicated pilot center was inaugurated in Q4 2024 to validate the operational model and accelerate the rollout into complementary networks from 2025.

The launch was very well received, and the pipeline of active opportunities is already substantial, with 42 identified activatable accounts and expectations for continuous growth in the coming months. The Group achieved approximately €0.5m in revenue in 2024 and is targeting at least a threefold increase in sales in 2025.

China JV update

Commercial activity in China through the Group's joint venture with Tasly Pharmaceutical has so far been very limited despite the Chinese market's strong interest in endomicroscopy. With differences of interpretation encountered as to the financial obligations to be met by Tasly Pharmaceutical and the JV, the loss in revenue opportunity is estimated to nearly €2m. Mauna Kea is currently evaluating all options to resolve ongoing issues.

Strategic outlook

In 2025, Mauna Kea Technologies aims to deliver on several high-value creation initiatives:

- Accelerate the commercial momentum of CellTolerance, supported by a robust active pipeline of 42 commercial opportunities;

- Secure favorable outcomes for the pancreatic cyst indication, including integration into EU clinical guidelines in 2025 and the results of the 500 patient CLIMB study in the U.S.;

- Advance patents and AI applications for Cellvizio®, particularly the development of a multi-modal image database with annotation capabilities;

- Close one or more strategic transactions by mid-2025.

Fourth Quarter Full Year 2024 Sales by Category and Geography*

(in €k) IFRS | Q4 2024 | Q4 2023 | Change

| FY 2024 | FY 2023 | Change

|

Systems | 384 | 83 | +365% | 1,301 | 1,171 | +11% |

Consumables | 556 | 1,344 | -59% | 2,917 | 3,900 | -25% |

Services | 574 | 222 | +158% | 1,415 | 1,134 | +25% |

Total sales excl. license | 1,514 | 1,649 | -8% | 5,633 | 6,205 | -9% |

License fees | 511 | 498 | +3% | 2,006 | 4,299 | -53% |

Total sales | 2,025 | 2,147 | -6% | 7,639 | 10,504 | -27% |

(in €k) IFRS | Q4 2024 | Q4 2023 | Change

| FY 2024 | FY 2023 | Change

|

United States | 905 | 1,136 | -20% | 3,456 | 4,480 | -23% |

EMEA ROW | 609 | 500 | +22% | 1,968 | 1,622 | +21% |

Asia Pacific | 14 |

| 210 | 103 | +104% | |

Total sales | 1,514 | 1,649 | -8% | 5,633 | 6,205 | -9% |

License fees | 511 | 498 | +3% | 2,006 | 4,299 | -53% |

Total sales | 2,025 | 2,147 | -6% | 7,639 | 10,504 | -27% |

*Unaudited figures

During the fourth quarter of 2024, total sales amounted to €2.0m, representing a decline of 6% compared to the prior year. This decrease is primarily attributed to lower Pay-Per-Use (PPU) sales in the consumables category, due to the temporary decrease of Medicare reimbursement in the United States, which impacted both price and volume, as well as delayed capital sales.

Nevertheless, system sales saw an increase of +365%, supported by the sale of a Cellvizio® system to The Ohio State University. Furthermore, three additional deals were in active negotiations at the end of the year and are expected to close in the coming weeks.

For the full year 2024, total sales amounted to €7.6m, compared to €10.5m in 2023. This year-on-year decline also reflects the absence of non-recurring revenues recorded in 2023 from the JV in China and the absence of payments from the JV in 2024, representing an estimated loss of revenue opportunity of nearly €2m.

Fourth Quarter 2024 Sales in Units*

Units (#) | Q4 2024 | Q4 2023 | Change |

New systems sold** | 3 | 2 | +1 |

New systems placed*** | 3 | 5 | -2 |

Total systems | 6 | 7 | -1 |

Consumables delivered | 73 | 109 | -36 |

Unaudited figures

** The change in the number of new systems sold over the period may differ from that in reported sales, due to inventory adjustments and product mix variation

*** The reference date is the contract signature date, which may differ from the system installation date

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio®, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio® platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer

This press release contains forward-looking statements about Mauna Kea Technologies and its business. All statements other than statements of historical fact included in this press release, including, but not limited to, statements regarding Mauna Kea Technologies' financial condition, business, strategies, plans and objectives for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given that the expectations expressed in these forward-looking statements will be achieved. These forward-looking statements are subject to numerous risks and uncertainties, including those described in Chapter 2 of Mauna Kea Technologies' 2023 Annual Report filed with the Autorité des marchés financiers (AMF) on April 30, 2024, which is available on the Company's website (www.maunakeatech.fr), as well as the risks associated with changes in economic conditions, financial markets and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release are also subject to risks that are unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not currently consider material. The occurrence of some or all of these risks could cause the actual results, financial condition, performance or achievements of Mauna Kea Technologies to differ materially from those expressed in the forward-looking statements. This press release and the information contained herein do not constitute an offer to sell or subscribe for, or the solicitation of an order to buy or subscribe for, shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The distribution of this press release may be restricted in certain jurisdictions by local law. Persons into whose possession this document comes are required to comply with all local regulations applicable to this document.

1 In 2023, the EBITDA loss was €4.1m.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250115981643/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu