VANCOUVER, BC / ACCESS Newswire / January 16, 2025 / Skeena Resources Limited (TSX:SKE)(NYSE:SKE) ("Skeena Gold & Silver", "Skeena" or the "Company") is pleased to announce drill results from the 2024 exploratory drilling program at the KSP Property in the Golden Triangle of British Columbia. The KSP Property is situated 24 kilometers southwest of Eskay Creek and 5 kilometers southeast of the Snip Project, positioned within a highly prospective region of the Company's expansive 178,901-hectare land package in the Golden Triangle. During the 2024 season, 22 drillholes totaling 9,182 metres were completed across various targets on the project, highlighted by the drill discovery of wide intervals of previously undocumented Au-Cu porphyry mineralization. Analytical results and reference images can be found at the end of this news release.

Paul Geddes, Skeena's Senior Vice President of Exploration & Resource Development, commented "We are very encouraged that our first drill program at KSP has yielded the discovery of a new Gold-Copper Porphyry system on the property. The headline intercept of 0.71 grams per tonne gold over 380 metres, is among many strong results and demonstrates a substantial volume of mineralized material in a potentially very large, essentially unexplored mineralized system."

2024 KSP Drilling Highlights 1,2

0.62 gpt Au, 2.84 gpt Ag, 0.14 % Cu over 121.50 metres ETW (CP-24-001)

4.56 gpt Au, 1.34 gpt Ag, 0.06 % Cu over 11.00 metres ETW, including 19.30 gpt Au, 2.30 gpt Ag, 0.08 % Cu over 2.50 metres ETW (CP-24-001)

0.71 gpt Au, 0.69 gpt Ag, 0.03 % Cu over 381.47 metres ETW, including 0.50 gpt Au, 0.78 gpt Ag, 0.03 % Cu over 117.47 metres ETW and 1.07 gpt Au, 0.68 gpt Ag, 0.03 % Cu over 139.00 metres ETW (CP-24-004)

6.44 gpt Au, 3.40 gpt Ag, 0.23 % Cu over 7.61 metres ETW (CP-24-008)

1.82 gpt Au, 2.85 gpt Ag, 0.11 % Cu over 25.00 metres ETW including: 9.79 gpt Au, 7.50 gpt Ag, 0.21 % Cu over 2.50 metres ETW (CP-24-008)

0.49 gpt Au, 2.15 gpt Ag, 0.02 % Cu over 75.15 metres ETW (CP-24-011)

0.72 gpt Au, 1.86 gpt Ag, 0.05 % Cu over 41.69 metres ETW (KP-24-004)

Notes:

Abbreviations include: gpt: grams per tonne; Au: gold; Ag: silver; Cu: copper; m: metre

ETW: True widths cannot be estimated with any certainty at this time, as such, core lengths have been reported.

New Gold-Copper Porphyry Mineralization Discovered

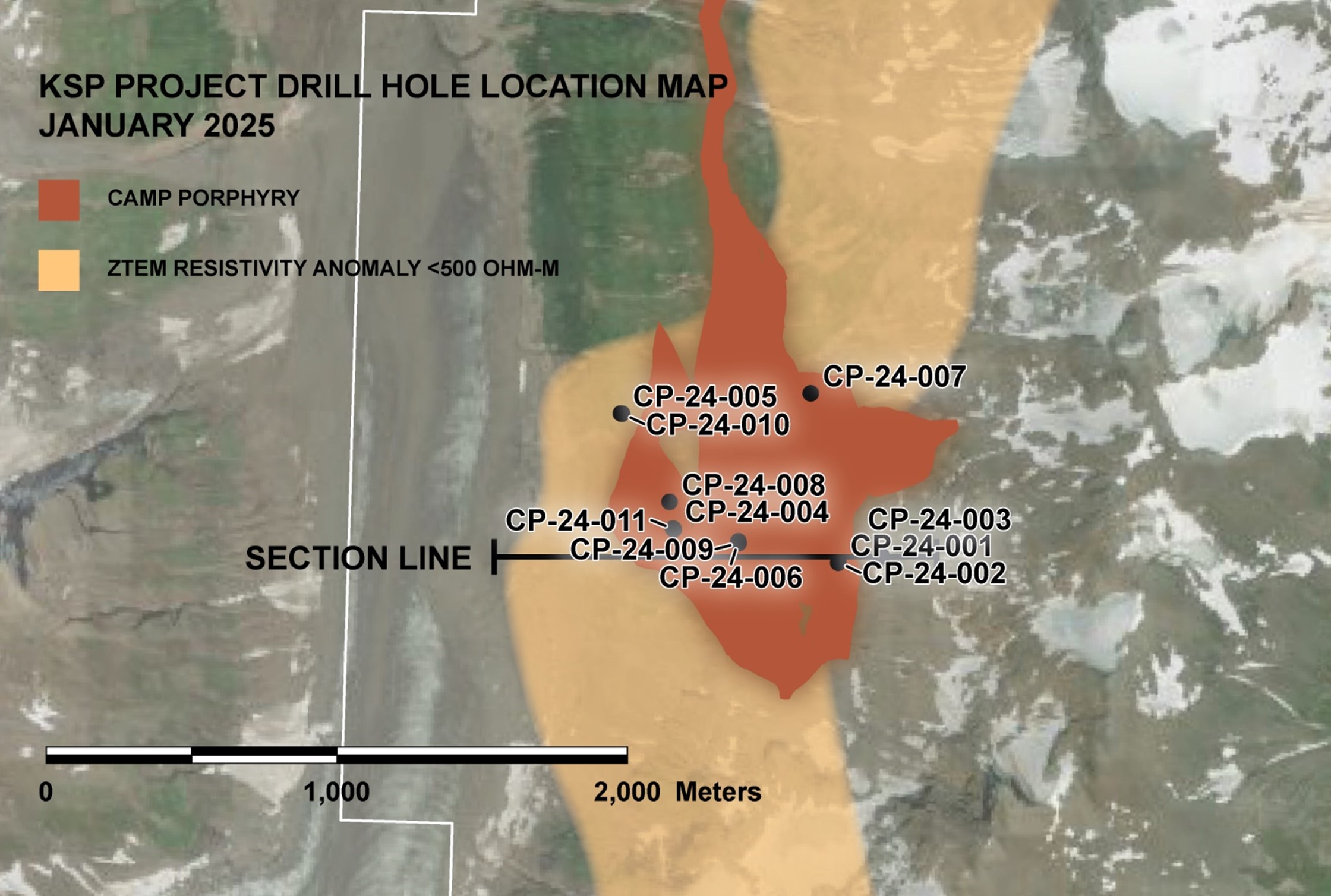

Situated on the northwestern portion of the KSP Project and approximately 5 kilometers southeast of the Company's Snip Gold Project, the Camp Porphyry area is host to a large, previously unexplored porphyry body. Drilling by the Company in 2024 has intersected broad intervals of previously unrecognized Au-Cu porphyry mineralization featured by 381.47 metres averaging 0.71 gpt Au, 0.69 gpt Ag, 0.03 % Cu beginning at 50 metres below surface. This initial phase of widely spaced exploratory drilling has traced the new mineralization along a strike length of approximately 1,000 meters, with potential for further expansion through additional drilling. Reference images are available at the end of this release.

Although recognized by previous operators, this large porphyry body was never the focus of historical exploration programs as other areas of the KSP Project took priority at the time. During the 2024 surface mapping program however, a new, widespread gold and copper geochemical anomaly was delineated over this intrusion at surface. This new anomaly, corroborated by a resistivity target defined from the 2024 deep penetrating airborne ZTEM resistivity survey, prompted the Company to test this target with eleven widely spaced exploration drill holes totaling 4,235 metres.

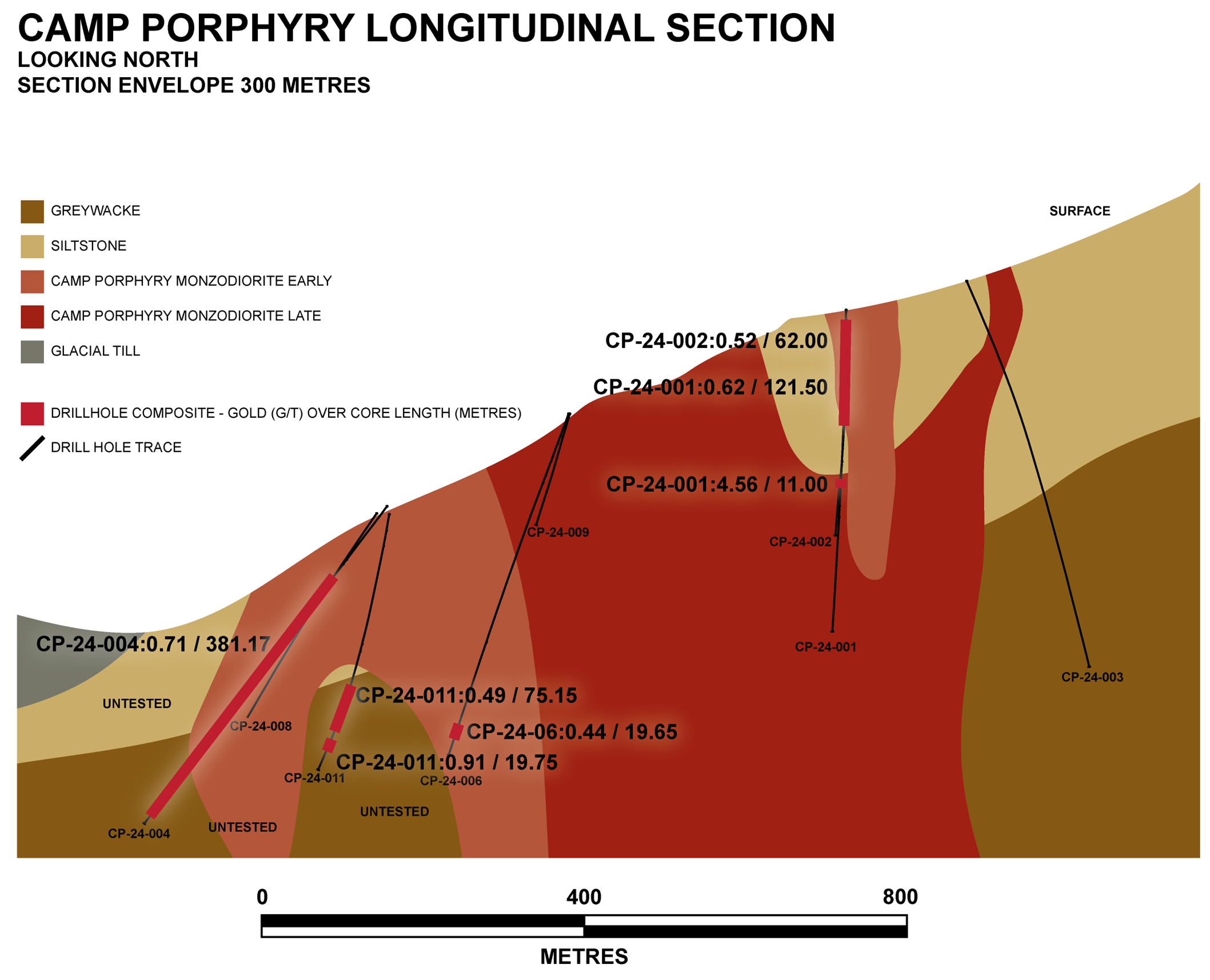

Numerous Au-Cu intervals were intersected in discovery drill hole CP-24-004 on the western flank of the intrusion which is coincident with the margin of a very large and discrete ZTEM resistivity anomaly. The extensive distribution of Au-Cu mineralization begins at 50 metres below surface over a drilled length of 381.47 metres averaging 0.71 gpt Au, 0.69 gpt Ag, 0.03 % Cu with subintervals grading 0.50 gpt Au, 0.78 gpt Ag, 0.03 % Cu over 117.47 metres and 1.07 gpt Au, 0.68 gpt Ag, 0.03 % Cu over 139.00 metres. These intersections display classical porphyry system alteration assemblages and elevated Au-Cu tenor is associated with potassic (biotite) alteration signatures.

The Camp Porphyry is a polyphase intrusion in that at least two significant intrusive events have occurred during emplacement. Most importantly, the first intrusive pulse, which also interacted with the surrounding sediment package and deposited Au-Cu mineralization, has been partially digested by a second unmineralized pulse within the core of body. As such, mineralization at the Camp Porphyry is associated with the outermost first intrusive pulse particularly where it has interacted with the porous sediments (wackes), as opposed to the less porous siltstone horizons.

Additional mineralization situated 140 metres along strike to the east was intersected by 2024 drill hole

CP-24-011 in a broad interval averaging 0.49 gpt Au, 2.15 gpt Ag, 0.02 % Cu over 75.15 metres beginning at 273.35 metres downhole. The upper portion of this drill hole was dominated by the secondary unmineralized intrusive. discussed previously.

Located 675 metres further to the east, drill holes CP-24-001 and CP-24-002 intersected 0.62 gpt Au, 2.84 gpt Ag, 0.14 % Cu over 121.50 metres and 0.52 gpt Au, 2.00 gpt Ag, 0.08 % Cu over 62.00 metres respectively with the same styles and controls of mineralization.

Camp Porphyry ZTEM Resistivity Anomaly

The 2024 drilling program was supplemented by an airborne ZTEM survey that covered the northern portion of the KSP Project. An airborne electromagnetic platform, the ZTEM system is deep penetrating and used to discriminate resistivity contrasts in the subsurface. The Camp Porphyry and associated mineralization possess a close spatial association and geometric similarity with a large ZTEM anomaly that occurs underneath the porphyry with a strike length in excess of ~6,000 metres.

Khyber Pass

Depth limited, small scale drill programs investigating porphyry style Au-Cu mineralization in the Khyber Pass area have been performed by previous operators since 1985. Historical 2017 drill hole KBDDH17-097 ended in Au-Cu mineralization but averaged 0.63 gpt Au, 2.08 gpt Ag, 0.08 % Cu over 34.00 metres. In 2024, a re-evaluation of the historic core from the Khyber Pass area prompted a program of exploratory drilling to follow up on the historic drilling that may not have completely tested this prospective area.

Highlighted by 2024 drill hole KP-24-004, which averaged 0.72 gpt Au, 1.86 gpt Ag, 0.05 % Cu over 41.69 metres, drilling indicates that the Khyber Pass area may represent a higher-level expression of a larger porphyry system as evidenced by the volumetrically lower percentage of intrusive monzodiorites. The Khyber Pass mineralization is situated ~600 metres vertically above the Camp Porphyry and may represent a higher-level expression of the system.

Tami Area

Previous operators outlined low grade Cu-Au porphyry mineralization in the Tami area of the KSP Project via drilling in 2017. Occurring at surface with a flat dipping tabular geometry, Tami mineralization has been drill defined over an area measuring ~600 metres by ~150 metres.

In 2024, the Company drilled three drill holes totaling 1,226 metres in this and the surrounding area to investigate untested geophysical targets with coincident geochemical anomalies. No significant results were returned from this drilling.

About Skeena

Skeena is a leading precious metals developer that is focused on advancing the Eskay Creek Gold-Silver Project - a past producing mine located in the renowned Golden Triangle in British Columbia, Canada. Eskay Creek will be one of the highest-grade and lowest cost open-pit precious metals mines in the world, with substantial silver by-product production that surpasses many primary silver mines. Skeena is committed to sustainable mining practices and maximizing the potential of its mineral resources. In partnership with the Tahltan Nation, Skeena strives to foster positive relationships with Indigenous communities while delivering long-term value and sustainable growth for its stakeholders.

On behalf of the Board of Directors of Skeena Gold & Silver,

Walter Coles | Randy Reichert |

Contact Information

Investor Inquiries: info@skeenagold.com

Office Phone: +1 604 684 8725

Company Website: www.skeenagoldsilver.com

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo., Senior Vice President, Exploration & Resource Development, is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific statements and information contained or incorporated by reference in the news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Quality Assurance - Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently securely stored on site. Numbered security tags are applied to lab shipments for chain of custody requirements. The Company inserts quality control (QC) samples at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd., and is overseen by the Company's Qualified Person, Paul Geddes, P.Geo, Senior Vice President Exploration and Resource Development.

Drill core samples are submitted to ALS Geochemistry's analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed and 1 kg is pulverized. Analysis for gold is by 50 g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 50 g fire assay fusion with gravimetric finish. Analysis for silver is by 50 g fire assay fusion with gravimetric finish with a lower limit of 5ppm and upper limit of 10,000 ppm. Samples with silver assays greater than 10,000 ppm are re-analyzed using a gravimetric silver concentrate method. A selected number of samples are also analyzed using a 48 multi-element geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS) and also for mercury using an aqua regia digest with Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) finish. Samples with sulfur reporting greater than 10% from the multi-element analysis are re-analyzed for total sulfur by Leco furnace and infrared spectroscopy.

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this news release constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation (collectively, "forward-looking statements"). These statements relate to future events or our future performance. The use of words such as "anticipates", "believes", "proposes", "contemplates", "generates", "targets", "is projected", "is planned", "considers", "estimates", "expects", "is expected", "potential" and similar expressions, or statements that certain actions, events or results "may", "might", "will", "could", or "would" be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the progress of development at Eskay, including the construction budget, schedule and required funding in respect thereof; the timing for and the Company's progress towards commencement of commercial production; the Company's capital structure; the Company's ability to buy back the gold stream in the future; amounts drawn and the timing of and completion of conditions precedent in respect of the Senior Secured Loan, gold stream agreement, additional equity investment and the cost over-run facility, the availability of the Senior Secured Loan as a source of future liquidity; and the results of the Definitive Feasibility Study, processing capacity of the mine, anticipated mine life, probable reserves, estimated project capital and operating costs, sustaining costs, results of test work and studies, planned environmental assessments, the future price of metals, metal concentrate, and future exploration and development. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company's MD&A for the year ended December 31, 2023, its most recently filed interim MD&A, and the Company's Annual Information Form ("AIF") dated March 28, 2024. Such forward-looking statements represent the Company's management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this news release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company's MD&A for the year ended December 31, 2023, its most recently filed interim MD&A, the AIF dated March 28, 2024, the Company's short form base shelf prospectus dated January 31, 2023, and in the Company's other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

Readers should not place undue reliance on such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Table 1: Drill Hole Composites From the 2024 Exploratory Drilling Program at the KSP Property

Hole ID | From (m) | To (m) | Core Length (m) | Au (gpt) | Ag (gpt) | Cu (%) | Area |

|---|---|---|---|---|---|---|---|

CP-24-001 | 22.50 | 144.00 | 121.50 | 0.62 | 2.84 | 0.14 | CAMP PORPHYRY |

INCLUDING | 22.50 | 25.00 | 2.50 | 1.46 | 6.80 | 0.34 | CAMP PORPHYRY |

AND | 52.50 | 55.00 | 2.50 | 1.35 | 7.10 | 0.36 | CAMP PORPHYRY |

CP-24-001 | 170.50 | 188.00 | 17.50 | 0.63 | 2.07 | 0.09 | CAMP PORPHYRY |

CP-24-001 | 209.50 | 220.50 | 11.00 | 4.56 | 1.34 | 0.06 | CAMP PORPHYRY |

INCLUDING | 218.00 | 220.50 | 2.50 | 19.30 | 2.30 | 0.08 | CAMP PORPHYRY |

CP-24-001 | 243.00 | 257.00 | 14.00 | 0.55 | 1.75 | 0.10 | CAMP PORPHYRY |

CP-24-002 | 15.00 | 77.00 | 62.00 | 0.52 | 2.00 | 0.08 | CAMP PORPHYRY |

CP-24-002 | 237.00 | 242.00 | 5 | 0.73 | 2.75 | 0.08 | CAMP PORPHYRY |

CP-24-002 | 293.50 | 301.00 | 7.50 | 1.00 | 1.43 | 0.10 | CAMP PORPHYRY |

CP-24-003 | 130.00 | 132.00 | 2.00 | 0.10 | 3.00 | 0.31 | CAMP PORPHYRY |

CP-24-003 | 134.00 | 135.00 | 1.00 | 0.12 | 3.40 | 0.34 | CAMP PORPHYRY |

CP-24-003 | 139.00 | 141.00 | 2.00 | 0.11 | 2.70 | 0.33 | CAMP PORPHYRY |

CP-24-004 | 87.00 | 94.50 | 7.50 | 0.43 | 0.33 | 0.02 | CAMP PORPHYRY |

CP-24-004 | 116.53 | 498.00 | 381.47 | 0.71 | 0.69 | 0.03 | CAMP PORPHYRY |

INCLUDING | 116.53 | 234.00 | 117.47 | 0.50 | 0.78 | 0.03 | CAMP PORPHYRY |

AND | 277.47 | 294.50 | 17.03 | 1.32 | 1.41 | 0.05 | CAMP PORPHYRY |

INCLUDING | 277.47 | 279.85 | 2.38 | 7.73 | 4.70 | 0.13 | CAMP PORPHYRY |

AND | 305.00 | 444.00 | 139.00 | 1.07 | 0.68 | 0.03 | CAMP PORPHYRY |

INCLUDING | 392.90 | 394.10 | 1.20 | 3.71 | 1.20 | 0.06 | CAMP PORPHYRY |

AND | 394.10 | 395.15 | 1.05 | 21.10 | 3.40 | 0.06 | CAMP PORPHYRY |

AND | 395.15 | 397.65 | 2.50 | 5.77 | 0.90 | 0.04 | CAMP PORPHYRY |

AND | 402.18 | 404.60 | 2.42 | 3.66 | 0.50 | 0.03 | CAMP PORPHYRY |

CP-24-004 | 456.50 | 495.50 | 39.00 | 0.77 | 0.25 | 0.02 | CAMP PORPHYRY |

CP-24-005 | 48.00 | 71.50 | 23.50 | 0.34 | 0.64 | 0.03 | CAMP PORPHYRY |

CP-24-005 | 200.50 | 201.88 | 1.38 | 0.51 | 1.40 | 0.33 | CAMP PORPHYRY |

CP-24-005 | 304.50 | 309.50 | 5.00 | 0.68 | 0.50 | 0.06 | CAMP PORPHYRY |

CP-24-006 | 29.30 | 38.40 | 9.10 | 0.58 | 28.32 | 0.06 | CAMP PORPHYRY |

INCLUDING | 29.30 | 29.87 | 0.57 | 1.87 | 269.00 | 0.86 | CAMP PORPHYRY |

CP-24-006 | 56.60 | 63.00 | 6.40 | 0.64 | 5.83 | 0.00 | CAMP PORPHYRY |

CP-24-006 | 81.20 | 91.20 | 10.00 | 0.45 | 1.15 | 0.02 | CAMP PORPHYRY |

CP-24-006 | 300.80 | 302.42 | 1.62 | 1.55 | 14.40 | 0.44 | CAMP PORPHYRY |

CP-24-006 | 409.50 | 429.15 | 19.65 | 0.44 | 1.15 | 0.08 | CAMP PORPHYRY |

CP-24-007 | 9.00 | 38.50 | 29.50 | 0.46 | 1.10 | 0.01 | CAMP PORPHYRY |

CP-24-007 | 87.50 | 101.50 | 14.00 | 0.42 | 8.90 | 0.00 | CAMP PORPHYRY |

CP-24-007 | 291.75 | 301.45 | 9.70 | 0.21 | 2.14 | 0.02 | CAMP PORPHYRY |

CP-24-008 | 79.40 | 87.01 | 7.61 | 6.44 | 3.40 | 0.23 | CAMP PORPHYRY |

INCLUDING | 80.47 | 82.00 | 1.53 | 12.90 | 5.70 | 0.62 | CAMP PORPHYRY |

AND | 82.00 | 83.00 | 1.00 | 22.00 | 7.00 | 0.36 | CAMP PORPHYRY |

AND | 85.34 | 87.01 | 1.67 | 3.46 | 4.50 | 0.18 | CAMP PORPHYRY |

CP-24-008 | 394.50 | 419.50 | 25.00 | 1.82 | 2.85 | 0.11 | CAMP PORPHYRY |

INCLUDING | 394.50 | 397.00 | 2.50 | 0.81 | 6.50 | 0.52 | CAMP PORPHYRY |

AND | 407.00 | 409.50 | 2.50 | 9.79 | 7.50 | 0.21 | CAMP PORPHYRY |

AND | 417.00 | 419.50 | 2.50 | 5.08 | 8.70 | 0.14 | CAMP PORPHYRY |

CP-24-011 | 26.00 | 51.00 | 25.00 | 0.32 | 0.28 | 0.03 | CAMP PORPHYRY |

CP-24-011 | 206.90 | 218.70 | 11.80 | 1.98 | 4.86 | 0.03 | CAMP PORPHYRY |

INCLUDING | 214.00 | 216.35 | 2.35 | 5.47 | 3.60 | 0.03 | CAMP PORPHYRY |

CP-24-011 | 273.35 | 348.50 | 75.15 | 0.49 | 2.15 | 0.02 | CAMP PORPHYRY |

CP-24-011 | 363.00 | 382.75 | 19.75 | 0.91 | 0.48 | 0.01 | CAMP PORPHYRY |

INCLUDING | 375.50 | 377.60 | 2.10 | 5.51 | 0.70 | 0.01 | CAMP PORPHYRY |

KP-24-001 | 46.00 | 51.00 | 5.00 | 0.46 | 2.35 | 0.10 | KHYBER PASS |

KP-24-002 | 160.00 | 170.00 | 10.00 | 0.44 | 1.45 | 0.08 | KHYBER PASS |

KP-24-002 | 200.00 | 206.00 | 6.00 | 0.65 | 2.18 | 0.12 | KHYBER PASS |

KP-24-003 | 191.00 | 217.00 | 26.00 | 0.35 | 2.01 | 0.04 | KHYBER PASS |

KP-24-003 | 241.99 | 257.00 | 15.01 | 0.29 | 1.38 | 0.09 | KHYBER PASS |

KP-24-003 | 299.20 | 313.00 | 13.80 | 0.98 | 9.12 | 0.17 | KHYBER PASS |

INCLUDING | 310.30 | 311.60 | 1.30 | 3.00 | 46.10 | 0.58 | KHYBER PASS |

AND | 311.60 | 313.00 | 1.40 | 4.47 | 26.00 | 0.37 | KHYBER PASS |

AND | 364.44 | 365.94 | 1.50 | 3.63 | 2.30 | 0.22 | KHYBER PASS |

KP-24-004 | 23.60 | 32.00 | 8.40 | 0.53 | 2.05 | 0.10 | KHYBER PASS |

KP-24-004 | 54.00 | 95.69 | 41.69 | 0.72 | 1.86 | 0.05 | KHYBER PASS |

INCLUDING | 54.00 | 55.75 | 1.75 | 7.43 | 3.40 | 0.05 | KHYBER PASS |

KP-24-005 | 17.00 | 52.00 | 35.00 | 0.71 | 1.67 | 0.05 | KHYBER PASS |

INCLUDING | 17.00 | 19.50 | 2.50 | 3.45 | 5.60 | 0.05 | KHYBER PASS |

KP-24-005 | 100.50 | 128.50 | 28.00 | 0.51 | 2.66 | 0.06 | KHYBER PASS |

INCLUDING | 118.20 | 120.50 | 2.30 | 2.21 | 10.80 | 0.35 | KHYBER PASS |

KP-24-005 | 141.00 | 155.00 | 14.00 | 2.32 | 5.39 | 0.05 | KHYBER PASS |

INCLUDING | 151.25 | 153.00 | 1.75 | 13.60 | 10.90 | 0.11 | KHYBER PASS |

KP-24-006 | 28.00 | 30.50 | 2.50 | 0.65 | 2.40 | 0.42 | KHYBER PASS |

KP-24-006 | 45.00 | 47.50 | 2.50 | 0.09 | 1.40 | 0.34 | KHYBER PASS |

KP-24-006 | 159.28 | 160.10 | 0.82 | 0.13 | 3.80 | 0.31 | KHYBER PASS |

KP-24-008 | 307.00 | 309.50 | 2.50 | 0.34 | 4.20 | 0.31 | KHYBER PASS |

KP-24-008 | 309.50 | 314.50 | 5.00 | 0.52 | 7.31 | 0.56 | KHYBER PASS |

INCLUDING | 309.50 | 311.00 | 1.50 | 0.77 | 9.10 | 0.72 | KHYBER PASS |

AND | 311.00 | 312.30 | 1.30 | 0.49 | 6.80 | 0.50 | KHYBER PASS |

AND | 312.30 | 314.50 | 2.20 | 0.37 | 6.40 | 0.49 | KHYBER PASS |

KP-24-008 | 325.65 | 327.20 | 1.55 | 0.60 | 9.20 | 0.81 | KHYBER PASS |

KP-24-008 | 334.50 | 337.00 | 2.50 | 0.27 | 6.10 | 0.49 | KHYBER PASS |

KP-24-008 | 354.50 | 357.00 | 2.50 | 0.25 | 4.40 | 0.34 | KHYBER PASS |

TM-24-003 | 12.85 | 40.90 | 28.05 | 0.77 | 1.23 | 0.16 | TAMI |

TM-24-003 | 56.00 | 61.00 | 5.00 | 0.59 | 1.10 | 0.11 | TAMI |

TM-24-003 | 108.50 | 116.00 | 7.50 | 0.58 | 1.00 | 0.09 | TAMI |

Table 2: KSP Property 2024 Drillhole Collar Locations and Orientation

Hole ID | Easting | Northing | Elevation (mASL) | Final Depth (m) | Azimuth (?) | Dip (?) |

|---|---|---|---|---|---|---|

CP-24-001 | 379566 | 6275497 | 1386 | 399 | 296 | -90 |

CP-24-002 | 379566 | 6275498 | 1386 | 345 | 360 | -50 |

CP-24-003 | 379716 | 6275519 | 1422 | 507 | 110 | -65 |

CP-24-004 | 378998 | 6275614 | 1143 | 510 | 240 | -50 |

CP-24-005 | 378819 | 6276010 | 1053 | 342 | 320 | -50 |

CP-24-006 | 379223 | 6275570 | 1257 | 450 | 276 | -70 |

CP-24-007 | 379472 | 6276079 | 1346 | 309 | 85 | -50 |

CP-24-008 | 378986 | 6275706 | 1134 | 439 | 305 | -50 |

CP-24-009 | 379224 | 6275564 | 1257 | 171 | 200 | -50 |

CP-24-010 | 378823 | 6276009 | 1029 | 348 | 55 | -50 |

CP-24-011 | 379001 | 6275611 | 1133 | 415 | 193 | -50 |

KP-24-001 | 379143 | 6273619 | 1770 | 600 | 240 | -47 |

KP-24-002 | 379144 | 6273618 | 1770 | 621 | 208 | -50 |

KP-24-003 | 379142 | 6273621 | 1770 | 478 | 290 | -50 |

KP-24-004 | 378606 | 6273774 | 1447 | 423 | 80 | -46 |

KP-24-005 | 378602 | 6273775 | 1447 | 508 | 293 | -88 |

KP-24-006 | 379384 | 6273233 | 1453 | 414 | 240 | -45 |

KP-24-008 | 379242 | 6273687 | 1769 | 456 | 225 | -55 |

KP-24-009 | 379242 | 6273687 | 1769 | 225 | 180 | -45 |

TM-24-001 | 385827 | 6274900 | 1160 | 558 | 160 | -50 |

TM-24-002 | 385822 | 6274903 | 1160 | 282 | 257 | -50 |

TM-24-003 | 384585 | 6272656 | 1448 | 383 | 330 | -50 |

Figure 1 - Surface View of KSP Drill Hole Location Map in Camp Porphyry & Resistivity Anomaly

Figure 2: Camp Porphyry Longitudinal Section

SOURCE: Skeena Resources Limited

View the original press release on ACCESS Newswire