The new division aims to redefine institutional bitcoin adoption with secure, multi-institution custody and bespoke advisory services.

DALLAS, TEXAS / ACCESS Newswire / January 16, 2025 / Onramp is pleased to announce the formal launch of Onramp Institutional, a pioneering platform dedicated to delivering secure and innovative bitcoin custody and advisory solutions tailored to institutional investors. With renowned investment expert Glenn Cameron, CFA, FMVA, at the helm as Global Head, this initiative represents a bold step in bridging the gap between traditional finance and bitcoin's transformative potential.

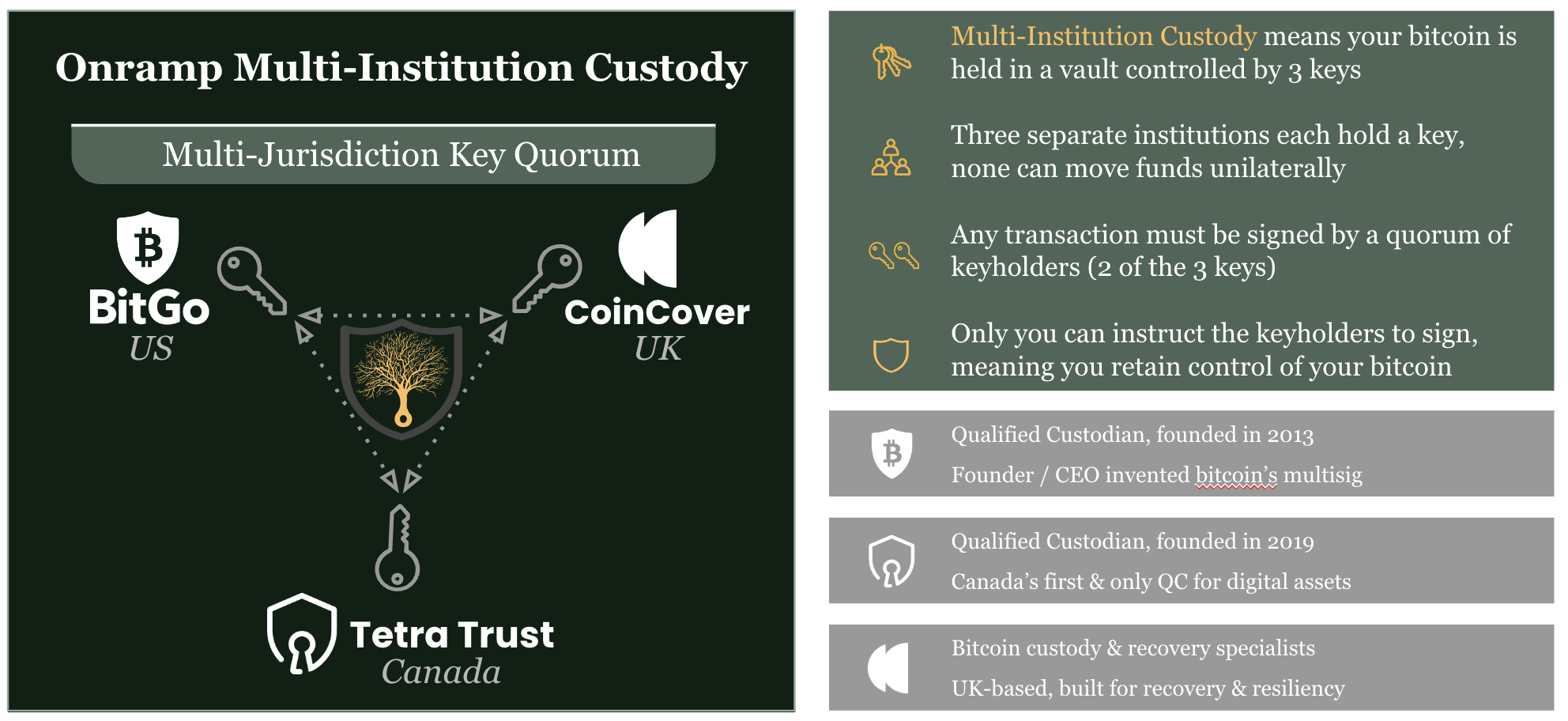

Onramp Multi-Institution Custody

With over 25 years of experience in institutional investment consulting, portfolio management, and bitcoin-focused innovation, Glenn brings unparalleled expertise to the Onramp team. His career highlights include advising institutional investors on asset allocation, risk management, and integrating bitcoin into traditional portfolios. Notably, he led the first bitcoin allocation by a UK pension scheme and developed pioneering treasury solutions for corporates, bridging the gap between traditional finance and emerging bitcoin opportunities.

"Joining Onramp is a thrilling opportunity to advance institutional bitcoin adoption," said Glenn Cameron, Global Head of Onramp Institutional. "By combining secure custody, innovative products and services, and expert advice and guidance, we aim to empower institutions to confidently integrate bitcoin into their portfolios and shape the future of finance."

Under Glenn's leadership, Onramp Institutional will offer a comprehensive suite of services tailored to meet the unique needs of institutions, including:

Onramp Advisory

Delivers a unique level of expert education and bespoke guidance for investors of all types, regardless of their level of sophistication.

Covers essential aspects of bitcoin investing-from portfolio integration to risk management-delivered in a customized, consultative manner.

Serves as a trusted partner, helping institutions confidently navigate the rapidly evolving bitcoin landscape.

Onramp Bitcoin Trust (OBT)

A superior alternative to spot bitcoin ETFs, providing security-like exposure underpinned by fault-tolerant, redundant, multi-institution, multi-jurisdictional custody.

Allows for in-kind subscriptions & redemptions of the underlying asset, avoiding taxable events often associated with other vehicles; Domestic (US) & International (Cayman) vehicles available.

Ideal for RIAs, pension funds, endowments, family offices & sovereign wealth funds seeking a direct yet streamlined approach to bitcoin investing, with no single point of failure.

Multiple Qualified Custodians

Partners with an expanding network of regulated custodians which are SOC2 compliant, ensuring robust operational resilience and regulatory compliance.

Reduces single points of failure through distributed custody arrangements, enhancing overall security for institutional bitcoin holdings.

Provides flexible options that align with each institution's jurisdictional, governance, and operational requirements.

Global Presence and Reach

Maintains an extensive international network of partners and service providers, offering coverage across multiple jurisdictions.

Actively expanding to new markets in 2025, enabling institutions worldwide to benefit from Onramp's secure and compliant solutions.

Ensures that clients receive localized support and expertise, regardless of geographic location.

Multi-Jurisdictional Quorums

Delivering the world's first multi-institution, multi-jurisdiction custody key quorums for bitcoin.

Ensures robust security with no single point of failure, meeting diverse regulatory and operational requirements across jurisdictions.

Actively seeking to add additional key partners in new locations globally in 2025, expanding the depth and reach of our custody network.

"We are thrilled to welcome Glenn Cameron to lead our enhanced focus on Onramp Institutional," said Michael Tanguma, CEO of Onramp Bitcoin. "His visionary approach and extensive expertise will drive our mission to deliver world-class bitcoin solutions for institutional investors of all types."

Glenn's prior experience includes managing multi-asset portfolios, co-leading private markets funds, and spearheading tactical asset allocation strategies that generated significant alpha. His entrepreneurial spirit and track record of thought leadership have positioned him as a trusted voice in the investment community.

As Global Head of Onramp Institutional, Glenn will focus on advancing Onramp's secure custody framework, advisory offerings, and innovative strategies that facilitate institutional bitcoin adoption across diverse jurisdictions.

About Onramp Institutional

Onramp Institutional is dedicated to providing world-class bitcoin custody and advisory services tailored to the needs of institutional investors. With secure, multi-jurisdictional custody, bespoke advisory offerings, and innovative products like the Onramp Bitcoin Trust, we help institutions confidently navigate the future of finance.

For inquiries, please contact:

Michael Tanguma, CEO of Onramp Bitcoin

michael@onrampbitcoin.com

SOURCE: Onramp Bitcoin

Related Images

Global Head of Onramp Institutional

View the original press release on ACCESS Newswire