Quarter 1, September 2024 - November 2024

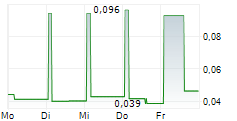

- Net revenue was 6 538 (11 185) tkr.

- EBITDA was -3 759 (-2 734) tkr.

- Operating cash flow was 4 792 (-5 678) tkr.

- Cash position in the end of period was 19 431 (15 897) tkr.

- Licensed products at the end of period were 31 (31).

- Products with distribution rights at the end of the period were 12 (12).

- Products with marketing authorization in the end of the period were 23 (19).

- Products launched in Nordics at end of the period 13 (4).

Significant events during the quarter

- Newbury has through one of its partners initiated a DCP filing for Teduglutide.

- Newbury Secures Approval for Varenicline in Sweden.

- Newbury announce higher than expected sales growth in Quarter 4 reaching sales of approximately 20 MSEK for the period.

- Newbury has agreed to extend the existing 15 MSEK loan agreement, or a new maturity date of December 31st of 2025.

- Newbury Pharmaceuticals Secures Generic Approval for Buspiron.

Significant events after the end of the quarter

- The annual general meeting of Newbury Pharmaceuticals was held on 15 January 2025. The Board was re-elected with Karl Karlsson as chairman.

- Newbury Pharmaceuticals Secures Generic Approval for Azelastine + Fluticasone nasal spray.

- Newbury Pharmaceuticals Secures Generic Approval for Bosutinib tablets.

A word from the CEO

Our first financial quarter has started positively with a number of newly approved product registrations and solid sales across the Nordic markets.

Nordic sales dominate in Q1

We continue to see strong sales development in the Nordic markets with strong sales from among others Desmopressin Newbury. In quarter one we deliver a strong turnover in the Nordic markets with the second highest quarterly sales and 137% above same period last year. Unfortunately, we did not invoice any shipments outside of the Nordics and we there cannot match the strong combined Nordics and International sales from previous quarter nor same period last year. However, timing of orders in the international segment is always fluctuating and we do have orders on hand for 2025.

The increasing sales trend in the Nordics is a result of more products having been launched - and a sales trend we expect to continue with more products being launched in 2025.

We will continue to pursue sales growth while we acknowledge that tender sales and international sales orders by nature will fluctuate quarter by quarter.

Sales growth translates to positive cash-flow for the period

The cash-flow for the period was positive with 4.1 MSEK and mainly driven by a positive cash-flow from operating activities amounting to 4.8 MSEK. Additionally, we also recently secured a one year prolongation of the debt financing.

Albeit the strong sales in the Nordic markets, we are not able to continue delivering a quarterly positive EBITDA. However, costs are in control and the increase is attributed to sales related profit share arrangements with our partners.

Continuing to obtain registrations and launch new products

We continue to obtain more product approvals in the Nordics with 23 products approved and more expected in 2025. We are therefore confident to launch additional products during 2025. We see the advantage of having more products on the market which is generating sales opportunities while it also provides a balanced portfolio to minimize the impact from tender competition and regulatory delays.

It is too early to anticipate the sales uptake for the new launches, but in general, we are moving in the right direction with more products on the market and thereby more opportunities to win tenders. International sales orders will always fluctuate over the year and similarly the monthly sales across the Nordics are to a large extend dependent on winning tenders and having enough inventory to supply the market. For that reason, fluctuating turnover will also occur in the Nordics while we maintain an ambition of continued annual sales growth.

We are pleased with our quarter one, and we continue focusing on executing our growth plans by launching additional products and building a stronger company for the future.

Audit

This report has not been reviewed by Newbury Pharmaceuticals auditor.

The report is publised on Newbury Pharmaceuticals website:

https://www.newburypharma.com/investors/financial-information/

For more information, contact:

Lars Minor, CEO

lars.minor@newburypharma.com

Mobile: +46 72-377 3005

www.newburypharma.com

About Newbury Pharmaceuticals

Newbury Pharmaceuticals is building a pipeline of proprietary and licensed products with focus on specialty and branded products in the Nordics. Newbury aims to make a difference by offering treatment solutions within areas like oncology, rare diseases and neurology. The portfolio is built by leveraging experience and extensive international network. Newbury offers strategic partnerships of innovation for the benefit of the Nordic healthcare market.

Västra Hamnen Corporate Finance is the Company's Certified Adviser on Nasdaq First North and can be reached at ca@vhcorp.se or +46 (0) 40 200 250.

This information is information that Newbury Pharmaceuticals is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-01-24 08:00 CET.