SALT LAKE CITY, UT / ACCESS Newswire / January 28, 2025 / With Revenues 19% lower, Net Income 17% lower and Earnings Per Share (EPS) 13% lower than in 2023, Utah Medical Products, Inc. (NASDAQ:UTMD) concluded a year of contraction. UTMD's stock price declined 27%, more than twice the EPS decline, which allowed the Company an opportunity to repurchase more than 8% of its shares in the open market.

Currencies in this release are denoted as $ or USD = U.S. Dollars; AUD = Australia Dollars; £ or GBP = UK Pound Sterling; C$ or CAD = Canadian Dollars; and € or EUR = Euros. Currency amounts throughout this report are in thousands, except per share amounts and where noted.

Overview of Results

A summary comparison of 4Q and calendar year 2024 income statement category declines relative to the same periods of 2023 follows:

2024 to 2023 Comparison |

|

| 4Q |

| Year | |||

Revenues (Sales): |

|

| (26 | %) |

|

| (19 | %) |

Gross Profit (GP): |

|

| (25 | %) |

|

| (20 | %) |

Operating Income (OI): |

|

| (26 | %) |

|

| (19 | %) |

Income Before Tax (EBT): Net Income (NI): |

|

| (28 | %) |

|

| (16 | %) |

Earnings Per Share (EPS): |

|

| (27 | %) |

|

| (13 | %) |

Despite the lower sales, profit margins in 4Q and year 2024 held up well compared to 4Q and year 2023, for reasons described later in this report:

| 4Q 2024 (Oct - Dec) |

|

| 4Q 2023 (Oct-Dec) |

|

| 2024 (Jan-Dec) |

|

| 2023 (Jan-Dec) |

| |||||

Gross Profit Margin (GP/ sales): |

|

| 58.1 | % |

|

| 57.6 | % |

|

| 59.0 | % |

|

| 59.8 | % |

Operating Income Margin (OI/ sales): |

|

| 32.0 | % |

|

| 32.0 | % |

|

| 33.2 | % |

|

| 33.4 | % |

Income Before Tax Margin (EBT/ sales): |

|

| 39.5 | % |

|

| 40.7 | % |

|

| 41.1 | % |

|

| 40.0 | % |

Net Income Margin (NI/ sales): |

|

| 31.7 | % |

|

| 34.8 | % |

|

| 33.9 | % |

|

| 33.1 | % |

Because revenue results for any given three-month period in comparison with a previous three-month period are not indicative of comparative results for the year as a whole, investors should focus on the annual results described later in this release. Focusing on the causes of the $9.3 million consolidated worldwide (WW) decline in annual revenues in 2024, the lower sales can be explained in the three following categories:

Revenue Category: |

| 2024 Sales [million $] |

|

| 2023 Sales [million $] |

|

| Decline [million $] |

|

| Portion of |

| ||||

|

|

| 2.7 |

|

|

| 8.6 |

|

|

| (5.9 | ) |

|

| 64 | % |

2. OUS Distributors (excluding Filshie) |

|

| 8.7 |

|

|

| 10.8 |

|

|

| (2.1 | ) |

|

| 22 | % |

3. WW Filshie |

|

| 10.8 |

|

|

| 12.3 |

|

|

| (1.5 | ) |

|

| 16 | % |

Total Above: |

|

| 22.2 |

|

|

| 31.7 |

|

|

| (9.5 | ) |

|

| 102 | % |

Above % of Total Below: |

|

| 54 | % |

|

| 63 | % |

|

| 102 | % |

|

|

|

|

Total Consolidated WW Revenues: |

|

| 40.9 |

|

|

| 50.2 |

|

|

| (9.3 | ) |

|

| 100 | % |

The OUS (Outside the U.S.) Distributor category (item 2 above) included UTMD's China distributor for blood pressure monitoring kits for which 2024 shipments were $2.4 million compared to $4.0 million in 2023, representing $1.6 million (75%) of the $2.1 million decline in OUS Distributor revenue (excluding Filshie OUS distributors).

The decline in WW Filshie device revenues (item 3 above) can be divided into three parts:

Filshie Device Sales |

| 2024 Sales |

|

| 2023 Sales |

|

| Revenue Decline [million $] |

|

| 2024 Revenue Decline from 2023 |

| ||||

Domestic Direct (to U.S. medical facilities) |

|

| 4.0 |

|

|

| 4.8 |

|

|

| (0.8 | ) |

|

| (15 | %) |

OUS Direct (to medical facilities outside the U.S.) |

|

| 5.3 |

|

|

| 5.8 |

|

|

| (0.5 | ) |

|

| ( 9 | %) |

OUS distributors |

|

| 1.5 |

|

|

| 1.7 |

|

|

| (0.2 | ) |

|

| (14 | %) |

Total Filshie Revenues: |

|

| 10.8 |

|

|

| 12.3 |

|

|

| (1.5 | ) |

|

| (12 | %) |

OUS Direct Filshie revenues were sales by UTMD subsidiaries directly to medical facilities in the UK, France, Ireland, Canada, Australia and New Zealand. Foreign currency exchange (FX) rate changes had a minimally positive impact on 2024 USD revenues compared to 2023.

Despite additional cost-of-living adjustments for employees in 2024 and continued inflation in raw material costs, UTMD was nevertheless able to maintain its GP margin in 2024 by reducing manufacturing personnel, including closing down the second production shift in Utah. The $1.6 million lower sales to UTMD's China distributor for blood pressure monitoring kits, $1.3 million of which decline occurred just in 4Q 2024, actually helped UTMD's average GP margin as that sales category has the lowest GP margin in UTMD's business by quite a bit.

UTMD's Operating Income margin was essentially the same in both years, despite retaining its critical mass of sales and marketing (S&M), product development (R&D) and general and administrative (G&A) resources at a higher cost. This occurred because the final 2023 $3,684 G&A expense from amortization of the $21 million identifiable intangible asset (IIA) associated with UTMD's 2019 purchase of CooperSurgical Inc's (CSI's) exclusive right to distribute the Filshie Clip System in the U.S., which was zero in 2024, offset the slightly lower GP margin and higher litigation expenses also captured in G&A expense.

On the other hand, non-operating income was lower as a result of a new excise tax levied on share repurchases in the U.S. and the fact that UTMD Ltd in Ireland did not enjoy the previous significant 2023 income from renting unused warehouse space in 2024. EPS benefited from UTMD repurchasing over 8% of its shares during the year.

UTMD's December 31, 2024 Balance Sheet, in the continued absence of debt, remained strong. After using over $24 million of its cash, specifically $19,968 to repurchase shares, $4,260 to pay stockholder dividends and $231 for new manufacturing equipment and tooling during 2024, ending Cash and Investments declined just $9.9 million to $83.0 million on December 31, 2024 compared to $92.9 million on December 31, 2023. Profitable operations also funded a $907 increase in non-cash working capital despite a $770 reduction in inventories after the previous accumulation as a hedge against supply chain disruption. Stockholders' Equity (SE) declined $10.9 million as of December 31, 2024 from December 31, 2023 despite an increase of $13.9 million from 2024 Net Income which was offset from the fact that $24.2 million in share repurchases and stockholder dividends reduce SE.

Foreign currency exchange (FX) rates for Balance Sheet purposes are the applicable rates at the end of each reporting period. The FX rates from the applicable foreign currency to USD for assets and liabilities at the end of calendar year 2024 compared to the end of 2023 and the end of 3Q 2024 follow:

|

| 12-31-24 |

| 12-31-23 |

| Change |

|

| 9-30-24 |

| Change |

| |

GBP |

|

| 1.25209 |

| 1.27386 |

| (1.7 | %) |

| 1.33958 |

| (6.5 | %) |

EUR |

|

| 1.03505 |

| 1.10593 |

| (6.4 | %) |

| 1.11429 |

| (7.1 | %) |

AUD |

|

| 0.61834 |

| 0.68248 |

| (9.4 | %) |

| 0.69312 |

| (10.8 | %) |

CAD |

|

| 0.69428 |

| 0.75733 |

| (8.3 | %) |

| 0.73987 |

| (6.2 | %) |

Revenues (sales) - 4Q 2024

Total consolidated 4Q 2024 UTMD worldwide (WW) sales were $9,157 compared to $12,333 in 4Q 2023, $3,176 (25.8%) lower than in 4Q 2023. "Constant currency" sales are defined as USD-denominated sales at the same foreign currency exchange rates as in the prior applicable period of time. Total constant currency 4Q 2024 sales were negligibly different. U.S. domestic sales were 14.9% lower, and OUS sales were 38.9% lower in USD terms, than in 4Q 2023.

Domestic U.S. sales in 4Q 2024 were $5,735 compared to $6,736 in 4Q 2023. Domestic sales are invoiced in USD and are not subject to FX rate fluctuations. The components of domestic sales include 1) "direct other device sales" of UTMD's medical devices to user facilities (and med/surg stocking distributors for hospitals), excluding Filshie device sales, 2) "OEM sales" of components and other products manufactured by UTMD for other medical device and non-medical device companies, and 3) "direct Filshie device sales". UTMD separates Filshie device sales from other medical device sales direct to medical facilities because of their significance, and the acquisition history. Direct non-Filshie device sales, representing 68% of total domestic sales, were $286 (+7.9%) higher in 4Q 2024 than in 4Q 2023. OEM sales, representing 16% of total domestic sales, were $1,042 (53.5%) lower. Direct Filshie device sales, also representing 16% of total domestic sales, were $245 (20.6%) lower in 4Q 2024 compared to 4Q 2023.

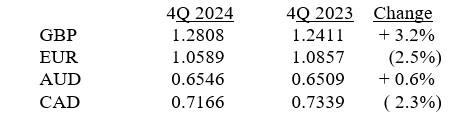

OUS sales in 4Q 2024 were $3,422 compared to $5,597 in 4Q 2023. Although the GBP was stronger than in the same quarter in 2023, the EUR and CAD were weaker. The net FX constant currency impact resulted in a negligible increase in USD-denominated 4Q 2024 sales. FX rates for income statement purposes are transaction-weighted averages. The average FX rates from the applicable foreign currency to USD during 4Q 2024 and 4Q 2023 for revenue purposes follow:

The combined weighted-average positive FX impact on 4Q 2024 foreign currency sales was less than 0.1%. The portion of OUS sales which were invoiced in foreign currencies, in USD terms, were 25% of total consolidated 4Q 2024 sales compared to 32% in 4Q 2023.

OUS sales invoiced in foreign currencies are to direct end-users in Ireland, the UK, France, Canada, Australia and New Zealand, and to OUS distributors of devices manufactured by UTMD subsidiaries in Ireland and the UK. Direct to end-user OUS sales in USD terms in 4Q 2024 which were 48% of all OUS sales, were lower by 11.5%, 4.3%, 18.5%, 23.6% and 15.7% for Ireland, the UK, France, Canada and Australia/New Zealand respectively compared to 4Q 2023. In addition to the FX rate differences in EUR and CAD, these lower numbers primarily reflected lower Filshie device sales. In USD terms, export sales to OUS distributors, which were 52% of OUS sales, were 52% lower than in 4Q 2023. This was primarily because there were no shipments of pressure monitoring kits to UTMD's China distributor in 4Q 2024, which are manufactured by UTMD Ltd in Ireland, resulting in $1,587 lower Ireland revenues compared to 4Q 2023. Sales from Ireland to OUS distributors in 4Q 2024 represented 38% of total OUS distributor sales compared to 67% in 4Q 2023. Export sales from the U.S. to OUS distributors are invoiced in USD. Sales to OUS distributors from the U.S. were 11% lower in 4Q 2024 than in 4Q 2023 due in part to a delay in required foreign regulatory approval renewals.

Sales -2024 Year

Total consolidated 2024 UTMD WW USD-denominated sales were $40,903 compared to $50,224 in 2023, which were $9,322 (18.6%) lower than in 2023. The decline resulted from three sales categories highlighted in the summary at the beginning of this release: 1) a $5,938 (69%) decline in OEM sales of biopharma pressure sensors and accessories to PendoTECH, reducing Ireland OUS sales $1,781 and U.S. OEM sales $4,157; 2) excluding Filshie device OUS distributor sales, a $2,124 (20%) decline in OUS distributor sales, including $1,587 lower UTMD Ltd (Ireland) sales to UTMD's China distributor of blood pressure monitoring kits; and 3) $1,471 (12%) lower WW sales of Filshie Clip System devices.

Looking forward to 2025 in those three revenue categories, even though PendoTECH sales were $5.9 million lower in 2024, they were still a reasonably significant $2.7 million. Given the existing year-end PendoTECH open order backlog, and expecting orders for ancillary accessories to remain consistent, but with no additional 2025 pressure sensor orders, UTMD expects PendoTECH revenues may be about $2.0 million lower in 2025. UTMD's China distributor for blood pressure monitoring kits has placed a fixed annual order for 2025 which is slightly higher than 2024. With expected regulatory approvals, OUS distributor orders should bounce back in 2025. The Company is projecting OUS Filshie device sales to be higher.

OUS USD-denominated sales in 2024 were $4,562 (20.7%) lower at $17,458 compared to $22,020 in 2023. UTMD Ltd (Ireland) 2024 sales to PendoTECH were $1,781 lower, and to its China distributor for pressure monitoring kits $1,587 lower, than in 2023. Ireland PendoTECH sales, which were $429 in 2024 are expected to be zero in 2025. Based on current order backlog from a fixed annual order, UTMD expects Ireland sales to its China distributor to be slightly higher in 2025 than in 2024. OUS Filshie device sales, both direct to foreign medical facilities and to distributors combined, which are shipped from Ireland or the UK, were $742 lower. UTMD expects the reverse to occur in 2025. Sales of other UTMD devices from the U.S. to OUS distributors were $531 lower in 2024. UTMD also expects this to reverse in 2025.

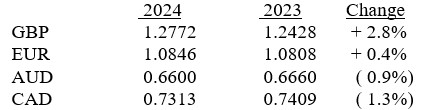

Sales invoiced in foreign currencies, which were $12,911 when converted to USD, represented 74% of OUS sales and 32% of consolidated total sales. A slightly weaker USD added $113 in OUS foreign currency sales compared to constant currency terms. FX rates for income statement purposes are transaction-weighted averages. The weighted-average FX rates from the applicable foreign currency to USD during 2024 and 2023 for revenue purposes follow:

The combined weighted-average favorable FX impact on 2024 foreign currency OUS sales was 0.3%, increasing reported 2024 USD sales by $113 relative to the same foreign currency sales in 2023. In constant currency terms, OUS sales in 2024 were 21.2% lower than OUS sales in 2023. The portion of OUS sales invoiced in foreign currencies in USD terms was 32% of total consolidated 2024 USD sales compared to 30% in 2023. Including the impact of changed FX rates, OUS 2024 direct to end-user sales in USD terms were 7% higher in Ireland, 13% lower in Canada, 17% lower in France and 3% higher in the UK. Direct to end-user sales in Australia, which included New Zealand, were 18% lower.

Domestic U.S. sales in 2024 were $23,444 compared to $28,204 in 2023, which was $4,759 (16.9%) lower than in 2023. All three categories of domestic sales were lower, led by U.S. OEM sales which were $3,857 (45.7%) lower than in 2023. Since U.S. PendoTECH sales in this category were $4,157 lower, all other U.S.OEM sales in 2024 were actually $300 higher than in 2023. Since U.S. sales to PendoTECH in 2024 were $2,266, this trend is expected to continue in 2025. Domestic Filshie device sales, representing 17% of total domestic sales, were $729 (15.3%) lower in 2024 compared to 2023. The Company is anticipating a smaller decline in 2025. Direct device sales other than Filshie, representing 63% of total domestic sales, were $173 (1.2%) lower in 2024 than in 2023. In this last category, domestic neonatal device sales were higher but electrosurgery device sales lower. The Company expects domestic sales in this category to be higher in 2025 by a low single digit percentage.

Looking forward to 2025, in summary, UTMD expects total WW consolidated revenues are likely to be lower again, in the low to mid-single percentage digits relative to 2024. UTMD's Form SEC 10-K 2024 annual report to be filed in March will provide management's projected 2025 financial performance.

Gross Profit (GP)

GP results from subtracting the costs of manufacturing, quality assurance and receiving materials from suppliers. With an 18.6% decline in 2024 sales, UTMD's GP was $5,895 (19.6%) lower than in 2023, and with a 25.8% decline in 4Q 2024 sales, 4Q 2024 GP was $1,775 (25.0%) lower than in 4Q 2023. Despite the facts that supplier costs for raw materials continued to increase and the Company implemented further employee cost-of-living adjustments during 2024, UTMD was able to limit dilution of its GP margin. The 2024 GP margin was 59.0% compared to 59.8% in 2023, and 58.1% in 4Q 2024 compared to 57.6% in 4Q 2023.

Operating Income (OI)

OI results from subtracting Operating Expenses (OE) from GP. For the year 2024, OI was $13,594 compared to $16,777 in 2023, a 19.0% decrease. The $3,183 decrease in OI was from the combination of $5,895 lower GP offset by $2,712 lower OE. OI in 4Q 2024 was $2,930 compared to $3,944 in 4Q 2023. The $1,014 lower 4Q 2024 OI was a combination of $1,775 lower GP and $761 lower OE.

OE are comprised of Sales and Marketing (S&M) expenses, G&A expenses and Product Development (R&D) expenses. The following table summarizes OE in 4Q and year 2024 compared to the same periods in 2023 by OE category:

OE Category |

| 4Q 2024 |

| % of |

|

| 4Q 2023 |

| % of |

|

| 2024 |

| % of |

|

| 2023 |

| % of | |||||

S&M: |

| $ | 505 |

|

| 5.5 |

| $ | 475 |

|

| 3.9 |

| $ | 1,901 |

|

| 4.6 |

| $ | 1,685 |

|

| 3.4 |

G&A: |

|

| 1,767 |

|

| 19.3 |

|

| 2,533 |

|

| 20.5 |

|

| 7,835 |

|

| 19.2 |

|

| 11,016 |

|

| 21.9 |

R&D: |

|

| 121 |

|

| 1.3 |

|

| 146 |

|

| 1.2 |

|

| 813 |

|

| 2.0 |

|

| 560 |

|

| 1.1 |

Total OE: |

|

| 2,393 |

|

| 26.1 |

|

| 3,154 |

|

| 25.6 |

|

| 10,549 |

|

| 25.8 |

|

| 13,261 |

|

| 26.4 |

The following table summarizes "constant currency" OE in 4Q and year 2024 by OE category:

OE Category |

| 4Q 2024 |

|

| 2024 | ||

S&M: |

| $ | 505 |

|

| $ | 1,899 |

G&A: |

|

| 1,749 |

|

|

| 7,765 |

R&D: |

|

| 121 |

|

|

| 813 |

Total OE: |

|

| 2,375 |

|

|

| 10,477 |

The FX rate change impact on OE in both periods was minor. A stronger GBP increased the Femcare IIA amortization expense included in G&A expense in USD terms by $16 in 4Q 2024 and by $53 for the year 2024, representing most of the full FX rate change impact on OE in both periods.

S&M expenses increased in 2024 primarily as a result of cost-of-living salary increases, and an increase in U.S. medical benefits. Constant currency S&M expenses were the same in the 4Q, and $2 lower for the year due to a stronger GBP. R&D increased primarily as a result of validation testing for materials used in biopharma pressure sensors, but also cost-of-living increases. There was no FX rate impact on R&D expenses, as they were solely carried out in the U.S.

With the exception of salary increases in all departments, the major changes in OE were in the G&A expense category. The main two G&A expense changes were in litigation expense and in the amortization of the $21 million identifiable intangible asset (IIA) associated with UTMD's 2019 purchase of CooperSurgical Inc's (CSI's) exclusive right to distribute the Filshie Clip System in the U.S. The CSI IIA amortization expense, which had been $1,105 per quarter since February 2019, ended in 4Q 2023. The CSI IIA amortization expense was zero in 2024 compared to $368 in 4Q 2023 and $3,684 for the 2023 year.

Litigation expenses in 2024 were $2,139 (5.2% of sales) compared to $1,660 (3.3% of sales) in 2023. Litigation expenses in 4Q 2024 were $326 (3.6% of sales) compared to $662 (5.4% of sales) in 4Q 2023. Litigation expenses were $479 higher for the 2024 year, and $336 lower in 4Q 2024 compared to the same periods in 2023. Litigation expenses were lower in 4Q 2024 because several still open U.S. Filshie cases have finished with discovery and active motion practice, and are awaiting court decisions on UTMD summary judgment motions. Two cases filed in Florida and Alabama have been won on summary judgment, and others were dismissed prior to the summary judgment phase. If a summary judgment motion is denied, the case would go to trial. No case has gone to trial as yet. While there are currently fewer active cases, and thus less discovery and motion work anticipated in 2025, any cases that must go to trial could drive up litigation expense significantly.

A division of G&A expenses by location follows:

G&A Exp Category |

| 4Q 2024 |

| % of |

| 4Q 2023 |

| % of |

| 2024 |

| % of |

| 2023 |

| % of | ||||||||

IIA Amort - UK: |

| $ | 509 |

|

| 5.6 |

| $ | 493 |

|

| 4 |

| $ | 2,031 |

|

| 5 |

| $ | 1,977 |

|

| 3.9 |

IIA Amort- CSI: |

|

| - |

|

| - |

|

| 368 |

|

| 3 |

|

| - |

|

| - |

|

| 3,684 |

|

| 7.3 |

UK: |

|

| 175 |

|

|

|

|

| 179 |

|

|

|

|

| 724 |

|

|

|

|

| 678 |

|

|

|

US: |

|

| 949 |

|

|

|

|

| 1,339 |

|

|

|

|

| 4,477 |

|

|

|

|

| 4,091 |

|

|

|

IRE: |

|

| 91 |

|

|

|

|

| 95 |

|

|

|

|

| 364 |

|

|

|

|

| 322 |

|

|

|

AUS: |

|

| 17 |

|

|

|

|

| 28 |

|

|

|

|

| 115 |

|

|

|

|

| 134 |

|

|

|

CAN: |

|

| 26 |

|

|

|

|

| 31 |

|

|

|

|

| 124 |

|

|

|

|

| 130 |

|

|

|

Total G&A: |

|

| 1,767 |

|

| 19.3 |

|

| 2,533 |

|

| 20.5 |

|

| 7,835 |

|

| 19.2 |

|

| 11,016 |

|

| 21.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Although the GBP-denominated IIA Amort-UK expense was the same in both years' periods, the USD increase was due to a stronger GBP FX rate. Looking forward, the approximate $2 million/ year IIA Amort-UK G&A expense will be fully amortized in 1Q 2026.

Income Before Tax (EBT)

EBT results from subtracting net non-operating expense (NOE) or adding net non-operating income (NOI) from or to, as applicable, OI. Consolidated 2024 EBT was $16,802 (41.1% of sales) compared to $20,089 (40.0% of sales) in 2023. Consolidated 4Q 2024 EBT was $3,614 (39.5% of sales) compared to $5,017 (40.7% of sales) in 4Q 2023.

NOE/NOI includes the combination of 1) expenses from loan interest and bank fees; 2) U.S. excise taxes on share repurchases; 3) expenses or income from losses or gains from remeasuring the value of EUR cash bank balances in the UK, and GBP cash balances in Ireland, in USD terms; and 4) income from rent of underutilized property, investment income and royalties received from licensing the Company's technology. Negative NOE is NOI. Net NOI in 2024 was $3,208 compared to $3,312 NOI in 2023. Net NOI in 4Q 2024 was $684 compared to $1,073 NOI in 4Q 2023. The decrease in 2024 NOI was due primarily to a $200 excise tax on share repurchases and $232 lower rent income in Ireland, offset by $331 higher interest on cash balances despite the use of $20 million in cash to repurchase shares. NOI in 2024 as a percent of sales was 7.8% compared to 6.6% in 2023.

EBITDA is a non-US GAAP metric that measures profitability performance without factoring in effects of financing, accounting decisions regarding non-cash expenses, capital expenditures or tax environments. Consolidated EBT excluding the remeasured bank balance currency gain or loss, interest expense, noncash effects of depreciation, amortization of intangible assets and stock option expense ("adjusted consolidated EBITDA") were $19,852 for the year 2024 compared to $26,635 in 2023. Adjusted consolidated EBITDA in 4Q 2024 was $4,405 compared to $6,115 in 4Q 2023.

UTMD's adjusted consolidated EBITDA as a percentage of sales was 48.5% for the year 2024 compared to 53.0% in 2023. UTMD's adjusted consolidated EBITDA as a percentage of sales was 48.1% in 4Q 2024 compared to 49.6% in 4Q 2023.

Management believes that this operating performance metric provides meaningful supplemental information to both management and investors and confirms UTMD's ongoing excellent financial performance.

UTMD's non-US GAAP adjusted consolidated EBITDA is the sum of the elements in the following table, each element of which is a US GAAP number:

|

| 4Q 2024 |

|

|

| 4Q 2023 |

|

|

| 2024 |

|

|

| 2023 | |

EBT |

| $ | 3,614 |

|

| $ | 5,017 |

|

| $ | 16,802 |

|

| $ | 20,089 |

Depreciation Expense |

|

| 201 |

|

|

| 158 |

|

|

| 730 |

|

|

| 624 |

Femcare IIA Amortization Expense |

|

| 509 |

|

|

| 493 |

|

|

| 2,030 |

|

|

| 1,977 |

CSI IIA Amortization Expense |

|

|

|

|

|

| 368 |

|

|

|

|

|

|

| 3,684 |

Other Non-Cash Amortization Expense |

|

| 8 |

|

|

| 7 |

|

|

| 35 |

|

|

| 31 |

Stock Option Compensation Expense Interest Expense |

|

| 72 |

|

|

| 73 |

|

|

| 256 |

|

|

| 225 |

Remeasured Foreign Currency Balances |

|

| 1 |

|

|

| (1 | ) |

|

| (1 | ) |

|

| 5 |

UTMD non-US GAAP EBITDA: |

| $ | 4,405 |

|

| $ | 6,115 |

|

| $ | 19,852 |

|

| $ | 26,635 |

Net Income (NI)

NI for the year 2024 of $13,874 (33.9% of sales) was 16.6% lower than NI of $16,635 (33.1% of sales) in 2023. NI in 4Q 2024 of $2,902 (31.7% of sales) was 32.3% lower than NI of $4,287 (34.8% of sales) in 4Q 2023. The average consolidated income tax provisions (as a % of the same period EBT) for the year 2024 and 2023 were 17.4% and 17.2% respectively, and were 19.7% and 14.6% in 4Q 2024 and 4Q 2023 respectively. The consolidated income tax provision rate varies as the mix in taxable income among U.S. and foreign subsidiaries with differing income tax rates differs from period to period. UTMD has consistently paid millions of dollars in income taxes annually. The UK increased its corporate income tax rate from 19% to 25% effective on April 1, 2023. Otherwise, the basic 2024 corporate income tax rates in each of the sovereignties were the same as in the prior year.

Earnings per share (EPS).

Despite 19.0% lower OI for the 2024 year, diluted 2024 EPS of $3.961 compared to $4.574 in 2023 were just 13.4% lower. Diluted EPS in 4Q 2024 were $0.857 compared to $1.180 in 4Q 2023. The smaller decrease in EPS for the 2024 year compared to the decline in OI and a slightly higher income tax rate was due to higher NOI as a percentage of sales and fewer diluted shares. Diluted shares were 3,503,165 for the 2024 year compared to 3,637,071 in 2023. Diluted shares were 3,387,932 in 4Q 2024 compared to 3,632,064 in 4Q 2023.

The number of shares used for calculating 4Q 2024 and year 2024 EPS were higher than the December 31, 2024 outstanding shares balance of 3,335,156 because of a time-weighted calculation of average outstanding shares plus dilution from unexercised employee options. Outstanding shares at the end of calendar year 2024 of 3,335,156 compared to 3,629,525 at the end of 2023, a decline of 8.1%. The difference was due to share repurchases of 301,961 offset by 7,592 shares in employee option exercises during 2024. The total number of outstanding unexercised employee and outside director options at December 31, 2024 was 97,985 at an average exercise price of $73.77, including shares awarded but not yet vested. This compares to 84,301 unexercised option shares at the end of 2023 at an average exercise price of $74.56/ share, including shares awarded but not vested.

The number of shares added as a dilution factor for the year 2024 was zero compared to 8,303 in 2023. The number of shares added as a dilution factor for 4Q 2024 was zero compared to 2,539 in 4Q 2023. The number of shares added as dilution factors in 2024 was zero because the average exercise price was higher than the applicable period-ending market price. In November 2024, 24,600 non-qualified option shares were awarded to 47 employees and one new outside director at an exercise price of $64.09 per share. In October 2023, 19,000 non-qualified option shares were awarded to 48 employees at an exercise price of $77.07 per share. UTMD's stock option plans continue to be an integral part of attracting and retaining productive employees. Over time, option plans have not been dilutive to stockholders, as the Company has consistently repurchased substantially more shares in the open market at lower prices than it has awarded in options.

UTMD paid $1,038 ($0.300/share) in dividends to stockholders in 4Q 2024 compared to $1,071 ($0.295/share) paid in 4Q 2023. UTMD paid $4,260 ($1.20/share) in dividends to stockholders in 2024 compared to $4,282 ($1.18/ share) in dividends in 2023. Payments in 2024 were lower than in 2023 despite higher dividends per share as a result of share repurchases. As declared in November 2024, UTMD's regular quarterly dividend was increased to $0.305 per share starting with a January 2025 payment.

No shares were repurchased in 2023. In 2024, the following quarterly repurchases were made:

|

| # Shares Repurchased |

| Average Cost/ Share |

| Total Cost [$K] | ||

1Q 2024 |

| 43,108 |

| $ | 69.37 |

| $ | 2,990 |

2Q 2024 |

| 95,107 |

| $ | 67.33 |

|

| 6,403 |

3Q 2024 |

| 58,377 |

| $ | 66.22 |

|

| 3,866 |

4Q 2024 |

| 105,369 |

| $ | 63.67 |

|

| 6,709 |

|

| 301,961 |

| $ | 66.13 |

| $ | 19,968 |

The Company retains the strong desire and financial ability for repurchasing its shares at a price it believes is attractive for remaining stockholders. UTMD's closing share price at the end of 2024 was $61.47, down 27.0% from the closing price of $84.22 at the end of 2023, and down 8.1% from the end of the prior calendar quarter. In comparison, the major stock market indices were all substantially higher for the year 2024: the Dow Jones Industrial Average was up 12.9%, the S&P 500 Index up 23.3% and the NASDAQ Composite, in which UTMD shares are traded, up 28.6%.

Balance Sheet

Please see the December 31, 2024 Balance Sheet at the end of this report. At the end of 2024, UTMD's cash and investments at $83.0 million were $9.9 million lower than at the end of 2023 as a result of $19.9 million operating EBITDA minus $4.6 million paid in taxes, $4.3 million paid in cash dividends paid to stockholders, $20.0 million used to repurchase shares and a $0.9 million increase in non-cash working capital. The higher non-cash working capital was in spite of a $0.8 million decrease in inventories previously set as a hedge against supply chain disruptions. At December 31, 2024, Net Intangible Assets decreased $2.2 million to 13.4% of total consolidated assets from 13.8% on December 31, 2023. UTMD's consolidated Property, Plant and Equipment (PPE) net asset value declined $790 despite just $499 in 2024 depreciation minus new PPE purchases as a result of year-end weakness in OUS FX rates translating OUS asset values to USD.

Financial ratios as of December 31, 2024 which may be of interest to stockholders follow:

1) Current Ratio = 25.6

2) Days in Trade Receivables (based on 4Q 2024 sales activity) = 40.3

3) Average Inventory Turns in 2024 (based on 2024 CGS) = 1.8

4) 2024 ROE (before dividends) = 11.3%

Investors are cautioned that this press release contains forward looking statements and that actual events may differ from those projected. Risk factors that could cause results to differ materially from those projected include global economic conditions, market acceptance of UTMD's products, regulatory approvals of products, regulatory intervention in current operations, government intervention in healthcare in general, tax reforms, the Company's ability to efficiently manufacture, market and sell products, cybersecurity and foreign currency exchange rates, among other factors that have been and will be outlined in UTMD's public disclosure filings with the SEC. UTMD's 2024 SEC Form 10-K will be filed on or before March 29, 2025, and can be accessed on www.utahmed.com.

Utah Medical Products, Inc., with particular interest in health care for women and their babies, develops, manufactures and markets a broad range of disposable and reusable specialty medical devices recognized by clinicians in over one hundred countries around the world as the standard for obtaining optimal long-term outcomes for their patients. For more information about Utah Medical Products, Inc., visit UTMD's website at www.utahmed.com.

Utah Medical Products, Inc.

INCOME STATEMENT, Fourth Quarter (three months ended December 31)

(in thousands except earnings per share):

|

| 4Q 2024 |

|

|

| 4Q 2023 |

|

| Percent |

| ||

Net Sales |

| $ | 9,157 |

|

| $ | 12,333 |

|

|

| (25.8 | %) |

Gross Profit |

|

| 5,323 |

|

|

| 7,098 |

|

|

| (25.0 | %) |

Operating Income |

|

| 2,930 |

|

|

| 3,944 |

|

|

| (25.7 | %) |

Income Before Tax |

|

| 3,614 |

|

|

| 5,017 |

|

|

| (28.0 | %) |

Net Income |

|

| 2,902 |

|

|

| 4,287 |

|

|

| (32.3 | %) |

Diluted EPS |

| $ | 0.857 |

|

| $ | 1.180 |

|

|

| (27.4 | %) |

Shares Outstanding (diluted) |

|

| 3,388 |

|

|

| 3,632 |

|

|

|

|

|

INCOME STATEMENT, Twelve Months (Calendar Year ended December 31)

(in thousands except earnings per share):

| 2024 |

|

| 2023 |

|

| Percent Change |

| ||||

Net Sales |

| $ | 40,903 |

|

| $ | 50,224 |

|

|

| (18.6 | %) |

Gross Profit |

|

| 24,143 |

|

|

| 30,038 |

|

|

| (19.6 | %) |

Operating Income |

|

| 13,594 |

|

|

| 16,777 |

|

|

| (19.0 | %) |

Income Before Tax |

|

| 16,802 |

|

|

| 20,089 |

|

|

| (16.4 | %) |

Net Income |

|

| 13,874 |

|

|

| 16,635 |

|

|

| (16.6 | %) |

Diluted EPS |

| $ | 3.961 |

|

| $ | 4.574 |

|

|

| (13.4 | %) |

Shares Outstanding (diluted) |

|

| 3,503 |

|

|

| 3,637 |

|

|

|

|

|

BALANCE SHEET

(in thousands) |

| DEC 31, 2024 |

|

| SEP 30, 2024 |

|

| DEC 31, 2023 | |||

Assets |

|

|

|

|

|

|

|

| |||

Cash & Investments |

| $ | 82,976 |

|

| $ | 88,452 |

|

| $ | 92,868 |

Accounts & Other Receivables, Net |

|

| 4,095 |

|

|

| 3,720 |

|

|

| 3,391 |

Inventories |

|

| 8,812 |

|

|

| 9,107 |

|

|

| 9,582 |

Other Current Assets |

|

| 448 |

|

|

| 377 |

|

|

| 428 |

Total Current Assets |

|

| 96,331 |

|

|

| 101,656 |

|

|

| 106,269 |

Property & Equipment, Net |

|

| 9,762 |

|

|

| 10,419 |

|

|

| 10,552 |

Intangible Assets, Net |

|

| 16,445 |

|

|

| 17,619 |

|

|

| 18,637 |

Total Assets |

| $ | 122,538 |

|

| $ | 129,694 |

|

| $ | 135,458 |

Liabilities & Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable |

| $ | 696 |

|

| $ | 999 |

|

| $ | 769 |

REPAT Tax Payable |

|

| 698 |

|

|

| 558 |

|

|

| 558 |

Other Accrued Liabilities |

|

| 2,363 |

|

|

| 1,878 |

|

|

| 3,383 |

Total Current Liabilities |

| $ | 3,757 |

|

| $ | 3,435 |

|

| $ | 4,710 |

Deferred Tax Liability - Intangible Assets |

|

| 604 |

|

|

| 779 |

|

|

| 1,120 |

Long Term Lease Liability Long Term REPAT Tax Payable |

|

| 282- |

|

|

| 299698 |

|

|

| 295698 |

Deferred Revenue and Income Taxes |

|

| 468 |

|

|

| 286 |

|

|

| 322 |

Stockholders' Equity |

|

| 117,427 |

|

|

| 124,197 |

|

|

| 128,313 |

Total Liabilities & Stockholders' Equity |

| $ | 122,538 |

|

| $ | 129,694 |

|

| $ | 135,458 |

CONTACT: Brian Koopman (801) 566-1200

SOURCE: Utah Medical Products, Inc.