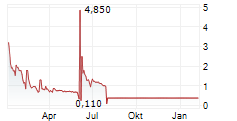

MUNICH, DE / ACCESS Newswire / January 29, 2025 / Mynaric (NASDAQ:MYNA)(FRA:M0YN), a leading provider of industrialized, cost-effective and scalable laser communications products, announces that it received a notification letter dated January 23, 2025 (the "Deficiency Letter") from the Listing Qualifications Department of The Nasdaq Stock Market Inc. (the "Nasdaq") notifying that Mynaric is no longer in compliance with the Nasdaq continued listing criteria, including the Nasdaq Listing Rule 5450(a)(1) due to its failure to meet the minimum closing bid price per share of Mynaric's American Depositary Shares representing its ordinary shares (the "ADS") of $1.00 for a period of 30 consecutive business days (the "Minimum Bid Price Requirement").

The Deficiency Letter has no immediate effect on the listing of Mynaric's ADS, which continue to trade under the symbol "MYNA."

The Deficiency Letter provided that, in accordance with Nasdaq Listing Rule 5810(c)(3)(A), Mynaric has 180 calendar days, or until July 22, 2025 (the "Compliance Period"), to regain compliance with the Minimum Bid Price Requirement. If at any time during the Compliance Period, the closing bid price per share of Mynaric's ADS is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide Mynaric with a written confirmation of compliance and the matter will be closed.

In the event Mynaric does not regain compliance by July 22, 2025, it may be eligible for an additional 180 calendar day grace period. To qualify, Mynaric will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the Minimum Bid Price Requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period, including by effecting a reverse stock split, if necessary. If Mynaric chooses to implement a reverse stock split, it must complete the split no later than 10 business days prior to July 22, 2025, or the expiration of the second compliance period if granted.

In addition, Mynaric has been previously notified by Nasdaq that it is no longer in compliance with (i) the Nasdaq Listing Rule 5450(b)(2)(A) due to its failure to maintain a minimum of $50 million in market value of listed securities (the "MVLS Requirement"), (ii) the Nasdaq Listing Rule 5250(c)(2) due to its failure to file an interim balance sheet and income statement as of the end of its second quarter on Form 6-K no later than six months following the end of the Mynaric's second quarter (the "Interim Reporting Requirement"), and (iii) the Nasdaq Listing Rule 5620(a) due to its failure to hold an annual meeting of shareholders within twelve months of the end of the Mynaric's fiscal year (the "Annual Meeting Requirement").

Mynaric is reviewing its options for regaining compliance with the Minimum Bid Price Requirement, the Interim Reporting Requirement, the Annual Meeting Requirement, and the MVLS Requirement and for remedying other future potential non-compliances with Nasdaq continued listing requirements. Mynaric intends to hold its annual general meeting for the fiscal year 2023 on February 21, 2025. However, there can be no assurance that Mynaric will be able to regain compliance with the Minimum Bid Price Requirement, the Interim Reporting Requirement, the Annual Meeting Requirement, and the MVLS Requirement, or other Nasdaq continued listing requirements in a timely fashion, in which case its securities would be delisted from Nasdaq.

About Mynaric

Mynaric (NASDAQ: MYNA) (FRA: M0YN) is leading the industrial revolution of laser communications by producing optical communications terminals for air, space, and mobile applications. Laser communication networks provide connectivity from the sky, allowing for ultra-high data rates and secure, long-distance data transmission between moving objects for wireless terrestrial, mobility, airborne- and space-based applications. The company is headquartered in Munich, Germany, with additional locations in Los Angeles, California, and Washington, D.C.

For more information, visit mynaric.com.

Forward-Looking Statement

This release includes forward-looking statements. All statements other than statements of historical or current facts contained in this release, including statements regarding our future results of operations and financial position, industry dynamics, business strategy and plans and our objectives for future operations, are forward-looking statements. These statements represent our opinions, expectations, assumptions, beliefs, intentions, estimates or strategies regarding the future, which may not be realized. Forward looking statements are often indicated by terms such as "anticipate," "believe," "could," "estimate," "expect," "forecast," "goal," "intend," "look forward to," "may," "plan," "potential," "predict," "project," "should," "target" "will," "would" and/or the negative of these terms or other similar expressions that are intended to identify forward-looking statements.

The forward-looking statements included in this release are based largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements involve known and unknown risks, uncertainties and assumptions that are difficult to predict or are beyond our control, and actual results may differ materially from those expected or implied as forward-looking statements. These risks, uncertainties and assumptions include, but are not limited to (i) the impact of any geopolitical tensions or the global COVID-19 pandemic on the global economy, our industry and markets as well as our business, (ii) risks related to our limited operating history, our history of significant losses and the execution of our business strategy, (iii) risks related to our ability to successfully manufacture and deploy our products and risks related to serial production of our products, (iv) risks related to our sales cycle which can be long and complicated, (v) risks related to our limited experience with order processing, our dependency on third-party suppliers and external procurement risks, (vi) risks related to defects or performance problems in our products, (vii) effects of competition and the development of the market for laser communication technology in general, (viii) risks related to our ability to manage future growth effectively and to obtain sufficient financing for the operations and ongoing growth of our business, (ix) risks relating to the uncertainty of the projected financial information, (x) risks related to our ability to adequately protect our intellectual property and proprietary rights and (xi) changes in regulatory requirements, governmental incentives and market developments. Moreover, new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements included in this release are made only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Unless required under applicable law, neither we nor any other person undertakes any obligation to update any forward-looking statement to reflect events or circumstances after the date of this release or otherwise. You should read this release with the understanding that our actual future results, levels of activity, performance and events and circumstances may materially differ from what we expect.

Contact:

Mynaric AG

comms@mynaric.com

SOURCE: Mynaric AG

View the original press release on ACCESS Newswire