Ethereum war für viele eine der größten Enttäuschungen am Kryptomarkt im letzten Jahr. Der Kurs der zweitgrößten Kryptowährung hätte laut Analysten nach der Zulassung der Spot Ethereum ETFs in den USA schnell ein neues Allzeithoch erreichen sollen. Gekommen ist es ganz anders. Aktuell notiert $ETH bei rund 1.600 Dollar und müsste seinen Kurs damit noch verdreifachen, um an das Allzeithoch anzuknüpfen. Während die schwache Performance von $ETH viele Anleger dazu animiert, auf andere Coins zu setzen, erwarten Großinvestoren scheinbar eine Rallye.

Wal setzt mit Hebel auf Ethereum-Anstieg

Krypto-Wale sind Großinvestoren, die erhebliche Mengen eines Coins kaufen und entsprechend große Summen investieren. Da auf der Blockchain jede Transaktion öffentlich einsehbar ist, werden Wal-Käufe oft genau getrackt und auch oft kopiert. Dabei wird angenommen, dass die Millionäre und Milliardäre der Welt über ein tieferes Marktverständnis oder sogar über Insiderwissen verfügen könnten. Nun zeigt sich, dass ein Wal mit über 6 Millionen Dollar auf eine Kurssteigerung von Ethereum setzt.

Bei einem 6 Millionen Dollar Investment könnte man ohnehin schon davon ausgehen, dass der Investor sich seiner Sache sicher ist. Allerdings setzt er noch einen drauf und hat einen 5-fachen Hebel auf seiner Position. Das bedeutet, dass 1 % Kurssteigerung bereits eine Rendite von 5 % einbringt. Natürlich funktioniert das auch in die andere Richtung und 1 % Verlust bringt auch bereits 5 % Verlust. Gehebelte Positionen sind daher Werkzeuge, die man nicht allzu oft einsetzen sollte.

Trendwende bei Ethereum in Sicht?

Bis jetzt liegt der Investor mit seiner Position leicht im Plus. Der Einstiegspreis lag bei 1.624 Dollar, beim Verfassen dieses Artikels notiert $ETH bei 1.640 Dollar. Allerdings dürfte das wohl kaum die Kurssteigerung sein, auf die der Wal aus ist. Wahrscheinlich ist er der Überzeugung, dass der Kurs noch deutlich höher steigt.

Tatsächlich spricht aktuell einiges dafür, dass es für Ethereum bald wieder steil bergauf gehen könnte. Immerhin hat Eric Trump nicht nur geraten, $ETH schon bei einem Kurs von 3.400 Dollar zu kaufen, er hat sich auch selbst an diesen Rat gehalten und mit dem Unternehmen World Liberty Financial groß in Ethereum investiert. Die Trump-Familie erwartet also vermutlich auch einen starken Kursanstieg. Viele Analysten erwarten sogar, dass Ethereum seinen Wert im Laufe des Jahres noch auf ein neues Allzeithoch verdreifachen könnte.

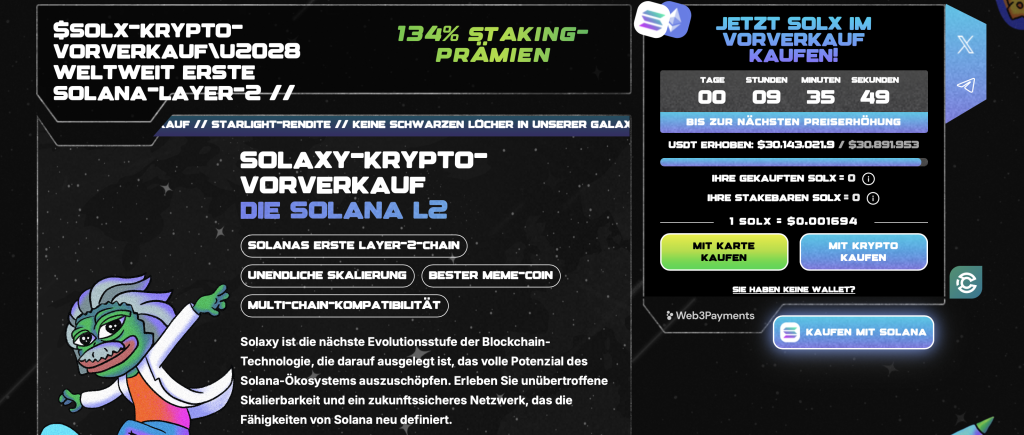

Solaxy Presale erreicht 30 Millionen Dollar

Während es für Ethereum in den nächsten Monaten um 200 % bergauf gehen könnte, erwarten Analysten bei Solaxy ($SOLX) einen Kursanstieg um bis zu 1.000 %. Das liegt daran, dass Solaxy die erste Layer-2-Lösung für Solana auf den Markt bringt. Bisher kennt man Layer 2 Chains eher von Ethereum, wo sie zur Skalierbarkeit beitragen, aber auch Solana hat bei hoher Auslastung zu kämpfen. Das könnte sich mit Solaxy nun ändern.

Bevor es bei Solana wieder zu vermehrten Ausfällen und Transaktionsabbrüchen kommt, wenn die Auslastung zu hoch ist, könnte Solaxy eingreifen, Transaktionen Off-Chain abwickeln und die Ergebnisse auf die Solana Main Chain übertragen. Solaxy kommt mit dem $SOLX-Token, bei dem die Nachfrage aktuell explodiert. Obwohl $SOLX noch im Vorverkauf erhältlich ist, haben Anleger bereits über 30 Millionen Dollar investiert, um von Anfang an dabei zu sein. Da Layer-2-Lösungen für Ethereum oft Bewertungen in Milliardenhöhe erreicht haben, könnte Solaxy dasselbe bevorstehen, was für frühe Käufer extrem hohe Renditen bedeuten würde.

Direkt zur offiziellen Solaxy Website!

Hinweis: Investieren ist spekulativ. Bei der Anlage ist Ihr Kapital in Gefahr. Diese Website ist nicht für die Verwendung in Rechtsordnungen vorgesehen, in denen der beschriebene Handel oder die beschriebenen Investitionen verboten sind, und sollte nur von Personen und auf gesetzlich zulässige Weise verwendet werden. Ihre Investition ist in Ihrem Land oder Wohnsitzstaat möglicherweise nicht für den Anlegerschutz geeignet. Führen Sie daher Ihre eigene Due Diligence durch. Diese Website steht Ihnen kostenlos zur Verfügung, wir erhalten jedoch möglicherweise Provisionen von den Unternehmen, die wir auf dieser Website anbieten.