DUBLIN, Jan. 31, 2025 (GLOBE NEWSWIRE) -- via IBN -- Fusion Fuel Green PLC (Nasdaq: HTOO) ("Fusion Fuel" or the "Company"), a leading provider of comprehensive energy engineering, advisory, and supply solutions, today announced that it was notified by the staff of the Listing Qualifications Department (the "Staff") of The Nasdaq Stock Market LLC ("Nasdaq") that the Staff has approved the Company's application to transfer its Class A Ordinary Shares and publicly-traded warrants to The Nasdaq Capital Market from The Nasdaq Global Market. This transfer will take effect at the opening of business on February 3, 2025.

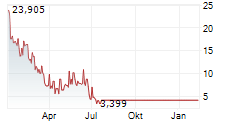

In connection with the transfer, the Staff determined that the Company will be eligible for an additional 180 calendar day period, or until July 28, 2025, to regain compliance with the Nasdaq minimum $1.00 bid price per share requirement (the "Minimum Bid Price Requirement"). The Company intends to take all necessary steps to regain compliance, including effecting a reverse share split, if necessary, to regain compliance. If at any time during this additional time period the closing bid price of the Class A Ordinary Shares is at least $1.00 per share for a minimum of ten consecutive business days, the Staff will provide written confirmation of compliance for continued listing on The Nasdaq Capital Market.

As previously reported in a Report on Form 6-K furnished to the Securities and Exchange Commission on January 13, 2025, on January 10, 2025, the Company received a letter from the Staff notifying it that since the Company has not yet held an annual meeting of shareholders within twelve months of the end of the Company's fiscal year ended December 31, 2023, it no longer complies with Nasdaq Listing Rule 5620(a) (the "Annual Meeting Requirement"). There can be no assurance that Fusion Fuel will be able to regain compliance with the Minimum Bid Price Requirement, whether by implementing a reverse share split or otherwise, that the Company will be able to regain compliance with the Annual Meeting Requirement, or that the Company will be able to meet the Nasdaq listing requirements in general.

Fusion Fuel does not anticipate a material impact on its equity trading as a result of the transfer of listing. The Nasdaq Capital Market operates in the same manner as The Nasdaq Global Market and is a continuous trading market that lists companies that must meet certain financial and corporate governance requirements. Fusion Fuel's securities will continue to trade under the symbols "HTOO" and "HTOOW."

"We are pleased to receive Nasdaq's approval to transfer our listing to The Nasdaq Capital Market, along with the additional time to regain compliance with the Minimum Bid Price Requirement," said JP Backwell, CEO of Fusion Fuel. "This determination provides us with both the flexibility and the confidence to continue executing on our strategic initiatives with a renewed focus on building our business. We remain committed to delivering value to our shareholders and further establishing Fusion Fuel as a leading provider of full-service energy engineering and advisory solutions."

About Fusion Fuel Green plc

Fusion Fuel Green PLC (NASDAQ: HTOO) is an emerging leader in the energy services sector, offering a comprehensive suite of energy engineering and advisory solutions through its Al Shola Gas and BrightHy subsidiaries. Al Shola Gas provides full-service industrial gas solutions, including the design, supply, and maintenance of liquefied petroleum gas (LPG) systems, as well as the transport and distribution of LPG to a broad range of customers across commercial, industrial, and residential sectors. BrightHy, the Company's newly launched hydrogen solutions platform, focuses on delivering innovative engineering and advisory services that enable decarbonization across hard-to-abate industries.

Learn more about Fusion Fuel by visiting our website at https://www.fusion-fuel.eu and following us on LinkedIn.

Forward-Looking Statements

This press release includes "forward-looking statements." Forward-looking statements may be identified by the use of words such as "estimate," "plan," "project," "forecast," "intend," "will," "expect," "anticipate," "believe," "seek," "target", "may", "intend", "predict", "should", "would", "predict", "potential", "seem", "future", "outlook" or other similar expressions (or negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company's control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Fusion Fuel has based these forward-looking statements largely on its current expectations. Such forward-looking statements are subject to risks and uncertainties (including those set forth in Fusion Fuel's Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Securities and Exchange Commission) which could cause actual results to differ from the forward-looking statements.

Investor Relations Contact

ir@fusion-fuel.eu

Wire Service Contact:

IBN

Austin, Texas

www.InvestorBrandNetwork.com

512.354.7000 Office

Editor@InvestorBrandNetwork.com