NORTHAMPTON, MA / ACCESS Newswire / February 3, 2025 / The newest "US Sustainable Investing Trends Report" from the US SIF is Establishing a Baseline Universe for Sustainable Investment & Stewardship. Here are several Key Highlights:

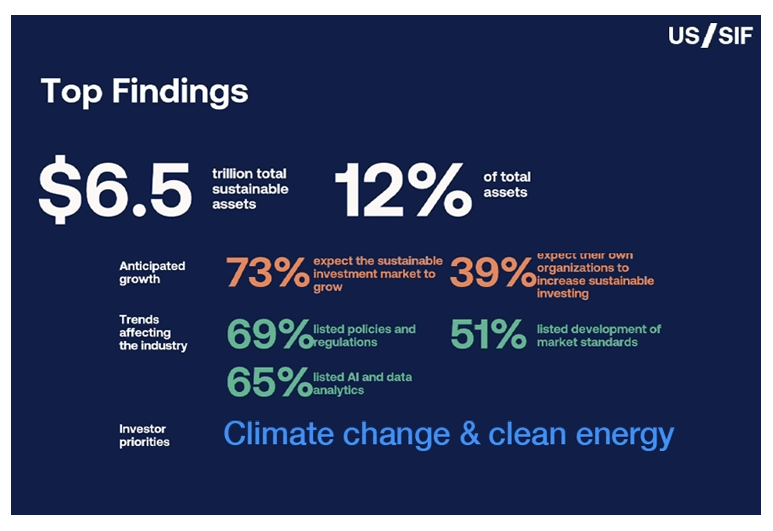

Market Size and Sustainable Investment (AUM): US SIF analysis, based on submissions to the SEC, records the US market size as $52.5 trillion, of which $6.5 trillion (12%) were identified or marketed as Sustainable or ESG investment.

Market Size and Stewardship (AUM): US SIF analysis finds that 79% of the US market AUM, or $41.5 trillion, was covered by a stewardship policy. More research is needed to drill down further within the assets covered by a stewardship policy. Clearly not every asset covered within a stewardship policy receives an action or engagement in any given year.

Both of these numbers create a new baseline which will enable us to better understand the market, interrogate policies and practices and replicate analysis of the US sustainable investing assets and US responsible/ sustainable stewardship over time.

US SIF Report provides Insights on Sustainable Investing

Perceptions on the Growth of Sustainable Investing: 73% of respondents expect the sustainable investment market to grow over the next one to two years; however, only 39% of respondents expect their own organizations to increase sustainable investing.

Trends in Sustainable Investing: The evolution of policies and regulations (69%) and the development of market standards (51%) continue to be leading trends, along with a focus on AI and data analytics (65%). The expansion of impact investing (58%) and the growth in subfields of sustainable investing (42%) were also highlighted by respondents.

Sustainable Development Priorities: Addressing climate change and the clean energy transition are a clear priority for respondents. Concerns about how this will impact stakeholders are also high on investors' agendas (Communities, Decent Work & Equality).

Read the full article, which includes the Use of Sustainable Investing Strategies, here - https://greenmoney.com/key-highlights-from-the-us-sustainable-investing-trends-report/

======

View additional multimedia and more ESG storytelling from GreenMoney Journal on 3blmedia.com.

Contact Info:

Spokesperson: GreenMoney Journal

Website: https://www.3blmedia.com/profiles/greenmoney-journal

Email: info@3blmedia.com

SOURCE: GreenMoney Journal

View the original press release on ACCESS Newswire