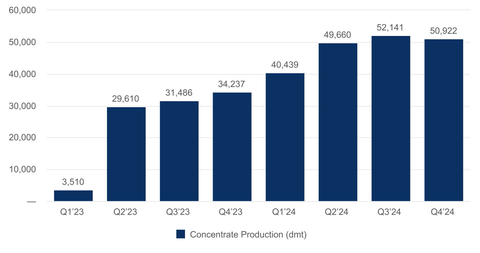

- Piedmont had record quarterly shipments of ~55,700 dmt of spodumene concentrate in Q4'24, modestly exceeding guidance

- NAL achieved its second consecutive quarter of production greater than 50,000 dmt

- Piedmont recorded $87.8 million in cash and cash equivalents as of December 31, 2024

Piedmont Lithium Inc. ("Piedmont," the "Company," "we," "our," or "us") (Nasdaq: PLL; ASX: PLL), a leading North American supplier of lithium products critical to the U.S. electric vehicle supply chain, announced that it shipped approximately 55,700 dry metric tons ("dmt") of spodumene concentrate in Q4'24. NAL, North America's largest producing spodumene mine, is jointly owned by Piedmont (25%) and Sayona Mining Limited (75%) (ASX: SYA).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250204671355/en/

Figure 1: NAL Concentrate Production (Graphic: Business Wire)

Q4'24 Operational Results Summary

Piedmont Lithium | Units | Q4'24 | Q3'24 | QoQ Variance | FY 2024 | FY 2023 | YoY Variance | |||||||||||||

Concentrate Shipped | kt dmt | 55.7 | 31.5 | 77 | 116.7 | 43.3 | 170 | |||||||||||||

Average Grade | Li2O | ~5.4 | ~5.4 | ~5.4 | ~5.5 | (0.1%) | ||||||||||||||

NAL(1) | Units | Q4'24 | Q3'24 | QoQ Variance | FY 2024 | FY 2023 | YoY Variance | |||||||||||||

Ore Mined | kt wmt | 370.4 | 240.3 | 54 | 1,195.5 | 885.2 | 35 | |||||||||||||

Concentrate Produced | kt dmt | 50.9 | 52.1 | (2) | 193.2 | 98.8 | 96 | |||||||||||||

Plant (Mill) Utilization | 90 | 91 | (1) | 84 | 70 | 14 | ||||||||||||||

Lithium Recovery | 68 | 67 | 1 | 68 | 59 | 9 | ||||||||||||||

Concentrate Sold | kt dmt | 66.0 | 49.0 | 35 | 200.8 | 72.2 | 178 |

In Q4'24, NAL produced 50,922 dmt and shipped 66,035 dmt. Approximately 55,700 dmt of spodumene concentrate were sold to Piedmont and then shipped to its customers.

Although quarterly production at NAL declined by 2% in Q4'24 compared to the prior quarter, production remains on track to achieve Sayona Mining's fiscal year 2025 production guidance of 190,000 210,000 dmt2.Mill utilization of 90% in Q4'24 declined modestly from the record high of 91% in the prior quarter and was negatively impacted by a planned shutdown in October and other weather-related impacts in the crushing circuit. The Crushed Ore Dome mitigated the impact of the shutdown by enabling consistent feed and operations during the quarter. Recoveries improved to 68% for the quarter and were in-line with the life-of-mine target outlined in the 2023 Definitive Feasibility Study.

Piedmont Lithium and Sayona Mining signed a definitive agreement to merge in an all-stock transaction on November 18, 20243. The merged entity will create a leading North American hard rock lithium producer and simplify the ownership structure of North American Lithium.

"NAL continues to operate at an impressive level," said Keith Phillips, President and CEO of Piedmont Lithium. "NAL is North America's largest lithium operation and holds considerable strategic value to Piedmont Lithium, our customers, and the ongoing energy transition. While the lithium market remains challenging, we were pleased with the consistent performance achieved during the December-end quarter. We look forward to finalizing the merger with Sayona to consolidate the economics of NAL and create value for shareholders."

| ___________________________________________________________ | ||

(1) | All references to information about or related to NAL are from the December 2024 Quarterly Activities Report filed with the ASX by Sayona Mining Limited on 31 January 2025. | |

(2) | See Sayona Mining announcement "FY2024 Results Announcement" filed with the ASX by Sayona Mining Limited on 30 August 2024. | |

(3) | See Piedmont Lithium announcement "Piedmont Lithium and Sayona Mining to Merge" filed with the SEC on 19 November 2024. | |

About Piedmont

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest. Our projects include our Carolina Lithium project in the United States and partnerships in Quebec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic Lithium (AIM: ALL; ASX: A11). We believe these geographically diversified operations will enable us to play a pivotal role in supporting America's move toward energy independence and the electrification of transportation and energy storage.

Cautionary Note to U.S. Investors

Piedmont's public disclosures are governed by the U.S. Exchange Act of 1934, as amended, including Regulation S-K 1300 thereunder, whereas NAL discloses estimates of "measured," "indicated," and "inferred" mineral resources as such terms are used in the JORC Code and Canada's National Instrument 43-101. Although S-K 1300, the JORC Code, and NI 43-101 have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, they at times embody different approaches or definitions. Consequently, investors are cautioned that public disclosures by NAL prepared in accordance with the JORC Code or NI 43-101 may not be comparable to similar information made public by companies, including Piedmont, subject to S-K 1300 and the other reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

The statements in the link below were prepared by, and made by, NAL. The following disclosures are not statements of Piedmont and have not been independently verified by Piedmont. NAL is not subject to U.S. reporting requirements or obligations, and investors are cautioned not to put undue reliance on these statements. NAL's original announcements can be found here: https://www.asx.com.au/markets/company/sya

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development, construction, and production activities of Sayona Mining, Atlantic Lithium, and Piedmont; current plans for Piedmont's mineral and chemical processing projects; Piedmont's potential acquisition of an ownership interest in Ewoyaa; and strategy. Such forward-looking statements involve substantial and known and unknown risks, uncertainties, and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance, or achievements and other factors to be materially different from the future timing of events, results, performance, or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont, Sayona Mining, or Atlantic Lithium may be unable to commercially extract mineral deposits, (ii) that Piedmont's, Sayona Mining's, or Atlantic Lithium's properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing, and operating mining projects, environmental hazards, industrial accidents, weather, or geologically related conditions), (iv) uncertainty about Piedmont's ability to obtain required capital to execute its business plan, (v) Piedmont's ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental, and production activities, including risks relating to permitting, zoning, and regulatory delays related to our projects as well as the projects of our partners in Quebec and Ghana, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data, and projections related to Sayona Mining or Atlantic Lithium, (xii) occurrences and outcomes of claims, litigation, and regulatory actions, investigations, and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations, and our ability to obtain necessary permits, and (xiv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission ("SEC") and the Australian Securities Exchange, including Piedmont's most recent filings with the SEC. The forward-looking statements, projections, and estimates are given only as of the date of this press release and actual events, results, performance, and achievements could vary significantly from the forward-looking statements, projections, and estimates presented in this press release. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections, and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250204671355/en/

Contacts:

For further information:

Michael White

Chief Financial Officer

T: +1 713 878 9049

E: mwhite@piedmontlithium.com

John Koslow

Investor Relations

T: +1 980 701 9928

E: jkoslow@piedmontlithium.com