VANCOUVER, BC / ACCESS Newswire / February 5, 2025 / Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide an update on the Company's ongoing engineering activities and mine design work, including a geotechnical drilling program at the 100%-owned Eagle Mountain Gold Project (the "Project") in Guyana, South America.

Program Highlights

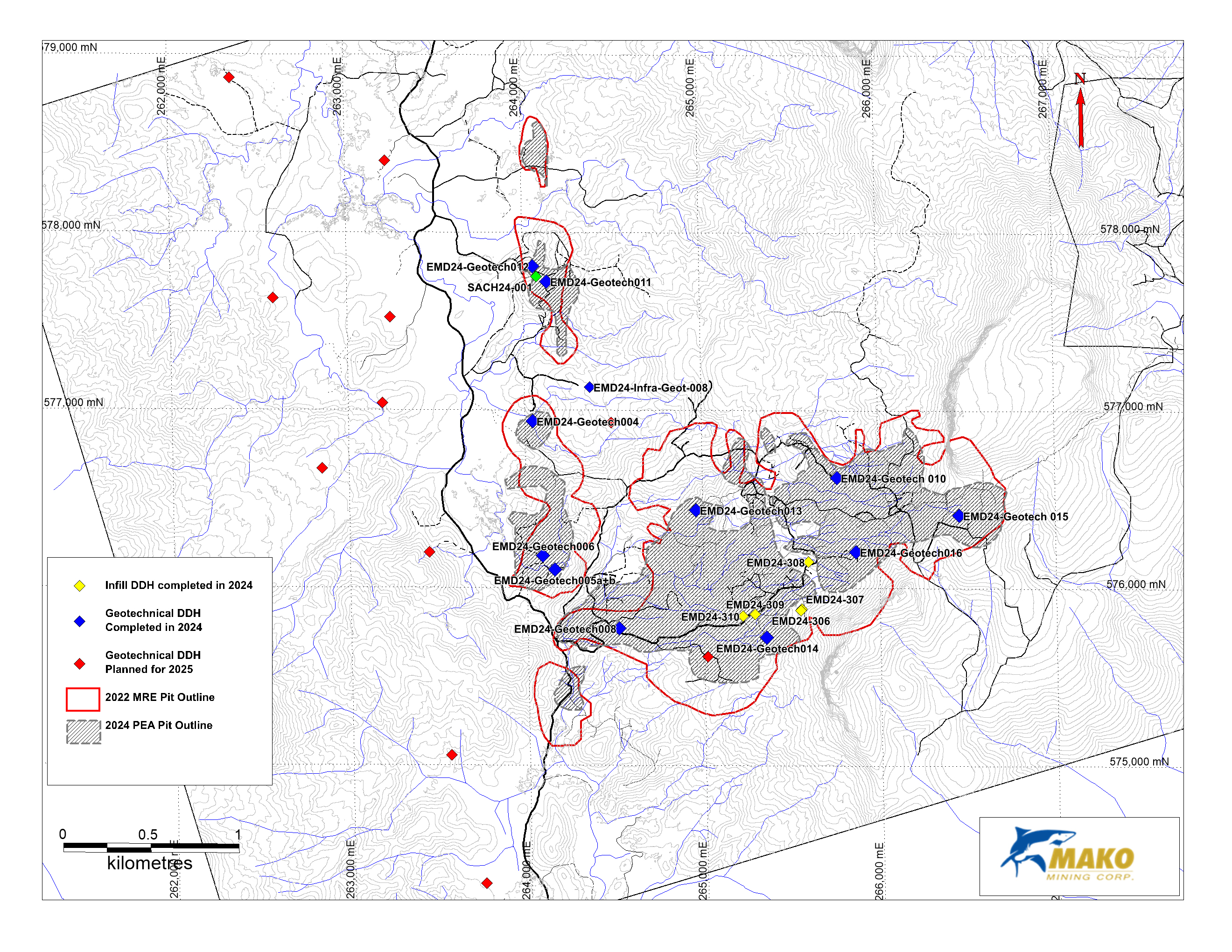

Geotechnical drilling for the Phase 1 program was completed in late 2024. Phase 1 included eleven (11) incline and vertical drill holes testing the saprolite and fresh rock characteristics in the Eagle Mountain and Salbora deposits.

EMD24-pitgeotech015, a geotechnical drill hole in the north-eastern zone of the Eagle Mountain deposit, intersected 2.93 grams per tonne ("g/t") gold ("Au") over 16.0 metres (Estimated True Width ("ETW") of 15.4 metres) starting 45.5 metres down hole. The drill hole tested mineralization currently classified as inferred mineral resources. Additional infill drilling is planned for this area later in 2025.

EMD24-pitgeotech011, a geotechnical drill hole within the Salbora deposit intersected 3.73 g/t Au over 31.5 metres starting from 22.5 metres down hole (drilled sub-parallel to the Salbora breccia structure). The length of intersection and gold grades were broadly in line with those of the resource model and PEA pit shells.

SACH24-001, a continuous horizontal channel sample of outcrop at the Salbora deposit, returned 8.42 g/t Au over 21.0 metres (ETW of 14.0 metres) with a sub-interval grading 13.51 g/t Au over 12.0 metres (ETW of 8.0 metres) in the mineralized breccia. Sampled grades in the area were higher than those of the resource model which estimated grades of between 2.50 and 5.00 g/t Au.

EMD24-310, an infill hole in the Eagle Mountain deposit, intersected 1.08 g/t Au over 18.0 metres (ETW of 17.7 metres) at a depth of 55.5 metres below surface, where the resource model grades were estimated to be below 0.65 g/t Au.

Akiba Leisman, CEO of Mako states "these drilling and channel sample results were taken as part of a geotechnical drilling program to finalize engineering parameters and site infrastructure layout selection in preparation for submitting our environmental permit application later this year. The grades and widths received from this program are matching or exceeding those defined in the resource model from the 2024 PEA, which showed an after-tax NPV 5% of US$ 292 million at US$1,850 gold. Now that gold prices are nearly $1,000 per ounce higher, we expect the economics of the project to improve."

In 2024, materials, instrumentation, and technical personnel were mobilized to the Project to commence geotechnical drilling for the purpose of open pit slope design optimization ("Phase 1") and testing ground conditions in the proposed locations for mine infrastructure ("Phase 2"). Phase 1 activities, which commenced in September 2024, comprised geotechnical drilling targeting the walls of the Eagle Mountain and Salbora deposits using the pit outlines defined in the 2024 Preliminary Economic Assessment ("PEA") [1] . Phase 2 activities, which commenced in January 2025, comprise geotechnical drilling of the saprolite and underlying fresh rock in the areas proposed for the tailings and waste storage facilities. This work is expected to continue through the first quarter of 2025. Phase 1 and 2 data collection has included oriented drill core, vane shear testing and Shelby tube analysis of the saprolite along with point loading, Brazilian and uniaxial stress tests on the fresh rock core. To collect critical hydrological information for mine design and pit dewatering plans, work has included packer tests, installation of vibrating wire piezometers, the development of groundwater wells, 24-hour pump tests and ground water sampling for hydrogeological and environmental investigations.

Geotechnical Program - Drill Results

The Phase 2 program is testing proposed locations for mine infrastructure in areas where there is insignificant or no known gold mineralization. In contrast, the Phase 1 program did cover areas with gold mineralization, both within the mineral resource outline and the PEA pit shells of the Eagle Mountain and Salbora deposits. Mineralized intercepts were assayed following completion of the geotechnical analysis. Due to the nature of the geotechnical testing, the majority of the saprolite was not available for assay, including areas where there is a high degree of confidence that the saprolite is mineralized.

Two drill holes intersected down hole intervals of gold mineralization (see Tables 1, 2 and Figure 1). EMD24-pitgeotech015 was drilled in the north-eastern zone of the Eagle Mountain deposit to test the base of the proposed PEA pit outline. Drilling intersected 2.93 g/t Au over 16.0 metres (ETW of 15.4 metres) of Eagle Mountain style low-angle gold mineralization within granodiorite starting at 45.5 metres downhole from surface. The grades intersected are higher than those of the resource model as defined in the April 2022 Mineral Resource Estimate ("MRE") but over modestly narrower widths. The drill hole tested mineralization currently classified as inferred mineral resources. Additional infill drilling is planned for this area later in 2025.

Drillhole EMD24-Pitgeotech011 was drilled in the centre of the Salbora deposit to investigate the pit walls near the base of the PEA pit outline. The upper 16.5 metres of saprolite was not available for assay, with poor core recovery from 16.5 to 22.5 metres. From 22.5 metres down hole the drill intersected 3.73 g/t Au over 31.5 metres. This intersection coincides with one of the modelled breccia structures and the drill hole was drilled subparallel to this breccia structure. The grade and interval correspond with the resource model for this area of the Salbora deposit. Also, at Salbora, the Company completed a channel sample in a new saprolite exposure at the site of a drill pad. The pad exposed an outcrop of mineralized breccia and volcanic units which were sampled at 1-metre intervals. The channel sample returned 8.42 g/t Au over 21.0 metres (ETW of 14.0 metres) with a sub-interval grading 13.51 g/t Au over 12.0 metres (ETW of 8.0 metres) in the breccia. Grades in the area of the channel sample are higher than those in the MRE which showed a grade range of between 2.50 and 5.00 g/t Au.

Infill Drilling

Earlier in 2024, several infill holes were completed in areas with low drill hole density or where grade definition was required, particularly where it was observed that modelled gold grades were low due to their proximity to dolerite dykes (see Tables 1, 2 and Figure 1). Drill hole EMD24-308 in the Bucket Shaft area of the Eagle Mountain deposit intersected 1.16 g/t Au over 7.7 metres (ETW of 7.6 metres) from 4.3 metres depth in saprolite. This compares to the estimated grades in the MRE of approximately 0.30 g/t Au. Drill hole EMD24-310 in the Kilroy area of the Eagle Mountain deposit intersected 1.08 g/t Au over 18.0 metres (ETW of 17.7 metres) at a depth of 55.5 metres below surface, where the MRE model estimated grades below 0.65 g/t Au.

Table 1 - Significant Drill Hole Intercepts

Area | Diamond Drill Hole | From (m) | To (m) | Width (m) | Est. True Width (ETW) (m) | Au (g/t) | Interval |

Salbora | EMD24-pitgeotech011 | 22.5 | 54.0 | 31.5 | - | 3.73 | 3.14 g/t Au over 37.9 m (drilled subparallel to structure) |

Incl. | 22.5 | 36.0 | 13.5 | - | 5.85 | 5.85 g/t Au over 13.5 m | |

and | 50.5 | 54.0 | 3.6 | - | 5.11 | 5.11 g/t Au over 3.6 m | |

| 81.4 | 82.2 | 0.8 | - | 2.73 | 2.73 g/t Au over 0.8 m | |

EMD24-pitgeotech012 | 48.0 | 50.1 | 2.1 | - | 1.82 | 1.82 g/t Au over 2.1 m (Drilled subparallel to structure) | |

Eagle Mtn (Toucan) | EMD24-pitgeotech004 | 3.0 | 16.5 | 13.5 | 13.0 | 0.49 | 0.49 g/t Au over 13.5 m (ETW 13.0 m) |

| 30.0 | 34.5 | 4.5 | 4.3 | 1.22 | 1.22 g/t Au over 4.5 m (ETW 4.3 m) | |

| 57.0 | 58.5 | 1.5 | 1.4 | 2.68 | 2.68 g/t Au over 1.5 m (ETW 1.4 m) | |

Eagle Mtn (Saddle) | EMD24-pitgeotech015 | 45.5 | 61.5 | 16.0 | 15.4 | 2.93 | 2.93 g/t Au over 16.0 m (ETW 15.4 m) |

Incl. | 45.5 | 49.5 | 4.0 | 3.9 | 7.86 | 7.86 g/t Au over 4.0 m (ETW 3.9 m) | |

and | 53.8 | 59.0 | 5.2 | 5.0 | 2.40 | 2.40 g/t Au over 5.2 m (ETW 5.0 m) | |

Eagle Mtn (Kilroy) | EMD24-306 | 58.5 | 64.5 | 6.0 | 4.6 | 1.00 | 1.00 g/t Au over 6.0 m (ETW 4.6 m) |

EMD24-307 | 66.0 | 68.5 | 2.5 | 2.0 | 1.26 | 1.26 g/t Au over 2.5 m (ETW 2.0 m) | |

| 70.5 | 73.5 | 3.0 | 2.3 | 1.01 | 1.01 g/t Au over 3.0 m (ETW 2.3 m) | |

EMD24-309 | 54.8 | 60.0 | 5.2 | 5.1 | 0.92 | 0.92 g/t Au over 5.2 m (ETW 5.1 m) | |

EMD24-310 | 55.5 | 73.5 | 18.0 | 17.7 | 1.08 | 1.08 g/t Au over 18. 0m (ETW 17.7 m) | |

Eagle Mtn (Bucket) | EMD24-308 | 0.0 | 3.0 | 3.0 | 2.9 | 1.44 | 1.44 g/t Au over 3.0 m (ETW 2.9 m) |

| 4.3 | 12.0 | 7.7 | 7.6 | 1.16 | 1.16 g/t Au over 7.7 m (ETW 7.6 m) | |

EMD24-pitgeotech016 | 30.1 | 32.1 | 2.0 | 1.9 | 0.88 | 0.88 g/t Au over 2.0 m (ETW 1.9 m) | |

Eagle Mtn (Powis) | EMD24-311 | 18.0 | 21.0 | 3.0 | 2.0 | 1.19 | 1.19 g/t Au over 3.0 m (ETW 2.0 m) |

| 43.5 | 45.0 | 1.5 | 1.0 | 0.97 | 0.97 g/t Au over 1.5 m (ETW 1.0 m) | |

EMD24-312 | 16.5 | 18.0 | 1.5 | 1.0 | 0.56 | 0.56 g/t Au over 1.5 m (ETW 1.0 m) | |

| 30.0 | 31.5 | 1.5 | 1.0 | 1.71 | 1.71 g/t Au over 1.5 m (ETW 1.0 m) | |

| 39.0 | 40.5 | 1.5 | 1.0 | 0.61 | 0.61 g/t Au over 1.5 m (ETW 1.0 m) |

Note: The mineralized intervals shown above utilize a 0.3 g/t gold cut-off grade with not more than 1.0 m of internal dilution within saprolite and 0.5 g/t Au cut-off grade with not more than 2.0 m of internal dilution within fresh rock. Widths are reported as drill hole lengths and estimated true widths where plausible to calculate. The following drill holes returned no anomalous values: EMD24 - Pitgeotech005, EMD24-pitgeotech006, EMD24-Pitgeotech 008, EMD24-pitgeotech 010, EMD24-Pitgeotech-013. Drill holes labelled "EMD24-PitgeotechXXX" were drilled for geotechnical purposes, not to purposely intersect mineralization. Saprolite in geotechnical drill holes were not available for assay.

Drill hole and channel sample preparation and geochemical analyses were completed by Actlabs Guyana Inc. in Georgetown, Guyana.

The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards and blanks. Analytical results of control samples confirmed the reliability of the assay data.

Table 2 - Significant Channel Sampling Intercepts

Area | Trench | From (m) | To (m) | Width (m) | Est. True Width (m) | Au (g/t) | Interval |

Salbora | SACH24-001 | 0.0 | 21.0 | 21.0 | 14.0 | 8.42 | 8.42 g/t Au over 21.0 m (ETW 14.0 m) |

Incl. | 0.0 | 12.0 | 12.0 | 8.0 | 13.51 | 13.51 g/t Au over 12.0 m (ETW 8.0 m) |

Note: The mineralized intervals shown above utilize a 0.3 g/t gold cut-off grade with not more than 1.0 m of internal dilution within saprolite. Widths are reported as true exposure lengths.

Figure 1 - Geotechnical & Infill Drill Hole Plan for Eagle Mountain Project

Global Resource Engineering ("GRE"), a US-based engineering consulting firm, was engaged in 2024 to manage tailings and waste dump siting studies, geotechnical drilling, hydrogeology with associated drilling and hydrology, and environmental geochemistry. In December 2024, the Company engaged Environmental Resource Management ("ERM"), experts in local Environmental Impact Assessments ("EIS") and International Environmental and Social Impact Assessment ("ESIA"), to lead the in-country environmental permitting process, including preparation and submission of the Eagle Mountain EIA as well as consultation with the lead agencies in Guyana. ERM's team has relevant and recent experience with the environmental permitting process in Guyana.

Qualified Person

The Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier, CPG, P.Eng., Chairman of Mako, who has reviewed and approved its contents.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. Mako also holds a 100% interest in the PEA-stage Eagle Mountain Project in Guyana, South America. Eagle Mountain is the subject of engineering, environmental and mine permitting activity.

Mako is led by an experienced management team, proven in exploration discoveries, mine design and construction, and executing on phased project development strategies in the Americas.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, E-mail: aleisman@makominingcorp.com, phone: (917) 558-5289 or visit our website at www.makominingcorp.com and SEDARPLUS www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the Company high-grade production will generate significant cash flows for the foreseeable future. Mako's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] The NI-43101 technical report entitled "Preliminary Economic Assessment for the Eagle Mountain Gold Project, Guyana" dated March 1, 2024, with an effective date of January 16, 2024, is available under Mako's profile at www.sedarplus.ca.

SOURCE: Mako Mining Corp.