Walt Disney's stock demonstrated positive momentum on Wednesday, climbing 0.8% to $114.22 on the New York Stock Exchange, driven by exceptional quarterly results that surpassed market expectations. The entertainment giant reported impressive first-quarter figures, with adjusted operating profit surging nearly one-third to $5.1 billion. Earnings per share reached $1.76, significantly exceeding analyst projections of $1.45, while revenue climbed to $24.7 billion, surpassing the previous year's $23.41 billion. The company's streaming business showed remarkable resilience, maintaining profitability despite a modest 1% decrease in Disney+ subscribers, primarily due to successful pricing strategies that enhanced average revenue per user.

Market Outlook and Analysis

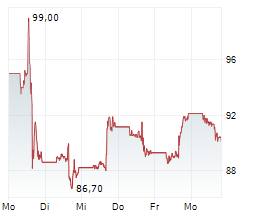

The company's stock has demonstrated significant volatility over the past year, trading between a high of $123.73 and a low of $83.92, currently positioning 26.53% above its yearly bottom. Looking ahead, market experts project a dividend increase to $0.827 per share for the current year, up from $0.75, with an average price target of $127.50, suggesting potential upside movement. The entertainment and theme park segments continue to serve as key growth drivers, contributing substantially to the company's overall performance.

Ad

Walt Disney Stock: New Analysis - 06 FebruaryFresh Walt Disney information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated Walt Disney analysis...