Press release - 2024 Revenue and activity

Sainte-Marie, Thursday, February 6, 2025, 8:45 p.m.

2024 consolidated revenue

Strong momentum in commercial property investment, consistent with the yearly target

Downturn in residential property development related to the anticipated halt to retail offering

| Unaudited datas | 2024 | 2023 | Variation |

| IFRS Gross rental revenue (excluding shares of affiliates) | 26.6 | 25.5 | +4.2% |

| Of which Commercial property investment | 24.8 | 22.7 | +8.8% |

| Property development | 38.5 | 58.1 | -33.8% |

| Of which Residential Properties | 37.9 | 54.0 | -29.8% |

| Others activities | 1.6 | 1.3 | +19.2% |

| Consolidated revenue (in €M) | 66.6 | 84.9 | -21.5% |

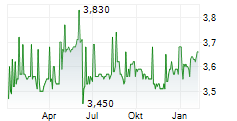

Sainte-Marie, Reunion Island-CBo Territoria (ISIN: FR0010193979-CBOT), a leading real estate player in the Indian Ocean for 20 years (on Reunion Island and in Mayotte), today announced its revenue for the year ending December 31, 2024.

PROPERTY INVESTMENT

CBo Territoria is a property investment company with a highly diversified portfolio consisting mainly of commercial assets: retail, offices, business premises, restaurants, and leisure. The Group is pursuing its growth strategy by developing high-yield assets in Reunion Island and Mayotte.

In 2024, gross IFRS rental revenue generated by the property investment company (excluding shares of affiliates) stood at €26.6 million (compared with €25.5 m in 2023). These figures consider the excellent performance of the commercial property business and the negative scope effect from housing disposals, carried out mainly in 2023[1].

From a global perspective, including the contribution of commercial assets held in partnerships (share of affiliates of €3.7 million in 2024, +0.5% vs 2023), gross rental income generated by the property investment business[2] amounted to €30.3 million, compared with €29.2 million in 2023 (+3.7%). The increase breaks down as follows:

- +5.7% (or €1.7 million) due to changes in the scope of consolidation of commercial assets considering the delivery of the Ylang Ylang shopping center in October 2023 and the delivery of the France Travail offices in July 2024, both located in Combani (Mayotte),

- +3.2% index-linking effect on commercial asset (or +€0.9 million),

- +0.4% growth in commercial rental activity (or +€0.1 million),

- +0.7% increase in variable rents (i.e. +€0.2m),

- -3.0% non-recurring effect (or €0.9m), mainly due to the catch-up of variable tertiary rents booked in 2023 (€0.6m),

- -3.2% (or €0.9m) impact of other activities, attributable to the disposal of residential assets, mainly carried out in 2023 (€1.1m)1.

Growth in gross commercial rental income (including share of affiliates) stood at +7.7%, meeting our target of over +6%.

Information on Mayotte's property portfolio

As far as CBo Territoria is concerned, the aftermath of cyclone Chido on December 14, 2024, was relatively benign in regard to the destruction suffered in Mayotte. Most of the assets located in Mamoudzou and Combani[3] sustained minor damage and were able to restart operations within a few days due to preventive measures.

PROPERTY DEVELOPMENT

One of Reunion Island's leading residential developers, CBo Territoria provides a full range of properties across all market sectors (residential buildings sold individually or in blocks and building plots). In terms of commercial property development, the development of commercial properties on the Group's own account is prioritized, and the Group also undertakes projects on behalf of third parties.

In 2024, Property development revenue stood at €38.5 million (vs. €58.1 million in 2023, i.e., -33.8%).

In the absence of commercial operations[4] (impact of-€3.5 million vs. 2023), this decline is essentially due to the lack of residential supply linked to the Pinel scheme, which ended on December 31, 2024.

As a reminder, the Group decided in 2023 not to launch any new retail programs, given market conditions. Retail sales were therefore limited to €6.1 million in 2024, down €13.0 million (-68.1% vs. 2023), corresponding to the sale of the last lots delivered in 2024.

Revenue from block sales is still strong at €22.7 million, down from €23.3 million in 2023 (-2.4%).

Lastly, sales of building plots remained strong at €9.1 million (vs. €11.6 million in 2023), despite longer lead times due to the challenges faced by buyers in completing their housing projects (credit availability, rising construction costs, etc.).

In 2024, following two years of very robust commercial activity linked primarily to the Pinel scheme, CBo Territoria saw consistent operational activity and delivered 323 lots over the year and 166 lots under construction at the end of December[5].

However, the Group continued to exercise caution when it came to commercial launches, which limited the amount of supply that was accessible and, in turn, the levels of sales.

- Block sales were stable at €16.4 million (compared with €16.9 million in 2023), representing the sale of 76 lots in the Aloe Macra program in the Beauséjour district of Sainte-Marie, sold to SHLMR / Action Logement. The order book also contained the Le Coutil project (48 units for €9.7 million), which is scheduled to be launched in the coming months. The residential backlog stood at €18.4 million (compared with €29 million, including €4.6 million in retail sales at the end of 2023),

- Sales of building plots amounted to 53 units for €9.1 million (down from 67 lots and €11.6 million, respectively, in 2023). The order book at the end of December stood at €5.6 million, compared with €6.2 million at the end of 2023. At the end of 2024, available supply stood at €23.8 million for 115 lots (versus €25.0 million for 131 lots in 2023),

- Finally, retail sales to individuals of €1.5 million (vs. €12.6 million in 2023) accounted for the remaining lots available at the year-end 2023.

2025 Financial calendar

2024 annual results: Wednesday, March 5, 2025 (after market close) - Presentation meeting/webcast on Thursday, March 6 at 11:30 a.m. (Paris)

About CBo Territoria (FR0010193979, CBOT)

CBo Territoria has been a major real estate operator in La Réunion for nearly 20 years and has evolved into a multi-regional property developer specializing in tertiary assets (€374 million assets in value at 30 june 2024, including €320m for commercial property). The Group is pursuing its expansion through the exploitation of its land reserves or through land acquisition, as it is involved in the full real estate value chain (property developer, property investor, and real estate company).

CBo Territoria is a real estate investment firm listed on Euronext Paris (compartment "C") that is qualified for the PEA PME finance program (small and medium-sized enterprises).

Responsible and committed to a more sustainable real estate since its inception, CSR (Corporate Social Responsibility) is by nature in the company's DNA. Its commitment and actions are recognized by the Gaïa-Index, the French benchmark index of the most virtuous small and mid-cap companies in terms of CSR. Since its entry in 2016, CBo Territoria has remained at the top of its category.

More information on cboterritoria.com

INVESTORS Contacts

Caroline Clapier - Director of Finance and Administration - direction@cboterritoria.com

Agnès Villeret - Komodo - Tel.: 06 83 28 04 15 - agnes.villeret@agence-komodo.com

PRESS Contacts:

Finance - Agnès Villeret - agnes.villeret@agence-komodo.com

Corporate - Paris: Dina Morin - dmorin@capvalue.fr

La Réunion - Catherine Galatoire - cgalatoire@cboterritoria.com

APPENDIX

NOTE: Because variations are determined using precise data, amounts may differ due to rounding.

APPENDIX 1-PROPERTY INVESTMENT DATA

| Rental revenue In €M | 2024 | 2023 | Variation |

| Commercial | 24.8 | 22.7 | +8.8% |

| Residential | 0.7 | 1.7 | -62.4% |

| Agricultural and miscellaneous | 1.2 | 1.0 | +13.7% |

| Consolidated gross rental revenue (excluding share of affiliates) | 26.6 | 25.5 | +4.2% |

| Commercial Share of affiliates | 3.7 | 3.7 | +0.5% |

| Gross Rental revenue (including share of affiliates) | 30.3 | 29.2 | +3.7% |

| Of which Commercial ? | 28.5 | 26.5 | +7.7% |

APPENDIX 2-PROPERTY DEVELOPMENT DATA

| Property Development Revenue In €M | 2024 | 2023 | Variation |

| Residential | 37.9 | 54.0 | -29.8% |

| Block sales (Intermediate and Social) | 22.7 | 23.3 | -2.4% |

| Individual clients (Intermediate-Pinel DOM) | 6.1 | 19.1 | -68.1% |

| Sales of building plots | 9.1 | 11.6 | -22.0% |

| Commercial | 0.6 | 4.1 | -86.3% |

| Commercial buildings | 0.2 | 3.3 | -93.1% |

| Sale of building plots and miscellaneous | 0.3 | 0.7 | -56.4% |

| Total Property development revenue (in €M) | 38.5 | 58.1 | -33.8% |

| SALES | ORDER BACKLOG at 31/12 | ||||||||||

| In €M | 2024 | 2023 | Var (%) | 2024 | 2023 | Var (%) | |||||

| Residential | 27.0 | 41.1 | -34.5% | 15.3 | 24.1 | -36.6% | |||||

| Incl. Block sales (Intermediate and Social) | 16.4 | 16.9 | -3.0% | 9.7 | 16.4 | -40.7% | |||||

| Incl. Individual clients (Intermediate-Pinel DOM) | 1.5 | 12.6 | -88.1% | n/a | 1.5 | -100% | |||||

| Incl. Sales of building plots | 9.1 | 11.6 | -22.0% | 5.6 | 6.2 | -10.6% | |||||

| Commercial | 0.2 | 0.9 | -77.0% | - | - | - | |||||

| TOTAL Property development | 27.2 | 42.0 | -35.4% | 15.3 | 24.1 | -36.6% | |||||

GLOSSARY

Backlog: Sales (before tax) from completed residential and commercial property sales (excluding land sales) that have not yet been recognized.

Order book (or booking stock): Total number of units under reservation contract not fulfilled by the closing date, expressed in value (sales price excl. VAT) or volume (in units).

Income-producing property: All built-up real estate assets that provide recurrent rental revenue.

Investment Property: Built-up income-producing assets (commercial and residential) with IP Land (excluding Land Inventory/ Development).

Supply available for sale: Sales of lots advertised for sale, not reserved.

Economic portfolio: Investment assets and share in assets held by affiliates.

Associate: Company accounted for under the equity method. Equity accounting is an accounting technique whereby the carrying amount of shares held in an entity by its parent company is replaced by a measurement of the portion that the parent company owns in the equity of that entity.

Building plots - Property development: Sales of building plots for residential or commercial real estate.

Block sales - Property development: Acquisition of an entire building or real estate program by a single buyer.

Retail sales - Property development: Acquisition of a residential unit or plot by an individual client.

[1] Disposal of 136 lots in December 2023 and 5 lots sold off in 2024. CBo Territoria owned only 74 housing units at 31 December 2024. At the end of December 2024, 8 lots were classified as investment properties held for sale.

[2] The property investment company's economic assets comprise investment properties (commercial, residential, and land) and the share of assets accounted for by the equity method.

[3] As of June 30, 2024, commercial property assets in Mayotte accounted for about 12% of the total value of commercial property assets in operation and associated rental revenue.

[4] Commercial property development revenue was low due to the opportunistic nature of this business. It stands at €0.5 million in 2024, compared with €5.0 million in 2023 (the remainder of the EPSMR project).

[5] Mainly Beauséjour in Sainte-Marie (154 lots) and Roche Café in Saint-Leu (12 lots).

- SECURITY MASTER Key: mJpwZJZrk5vHnGtvaJVlb5WZaJdhlJSZmWbHxmObZcuYmJyUxmqUa5SXZnFqnmVv

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-89909-cbot_ca-2024-communique-de-presse-_ang.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free