JANUARY-DECEMBER 2024

- Rental income increased to SEK 908 m (888). For the like-for-like portfolio, rental income increased by 6 percent.

- Net operating income increased to SEK 473 m (460). For the like-for-like portfolio, net operating income increased by 12 percent due to higher rental income and lower vacancies.

- Profit from property management increased to SEK 152 m (148) despite the divestment of seven properties during the year, at the same time as financing costs have increased.

- The property portfolio's value at the end of the year amounted to SEK 13,701 m and change in value of the properties amounted to SEK -296 m (-1,353) for the period.

- Net loss for the year amounted to SEK -193 m (-1,373).

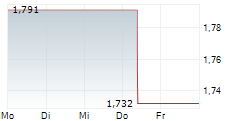

- The net asset value amounted to SEK 44.68 per share (45.83).

OCTOBER-DECEMBER 2024

- Rental income decreased to SEK 227 m (230) during the quarter, which is primarily a net effect of higher income in the like-for-like portfolio and the absence of income from the seven divested properties.

- Net operating income increased to SEK 110 m (93) mainly due to reduced operating and maintenance costs.

- Profit from property management for the fourth quarter increased to SEK 30 m (20) on account of both increased net operating income in the like-for-like portfolio and reduced central administration costs.

SIGNIFICANT EVENTS DURING THE FOURTH QUARTER

- Neobo's share was included on the EPRA index, a leading global index for listed property investments, as of December 23, 2024.

CEO STATEMENT

Increased net operating income and profit from property management

Despite the weaker-than-expected economic recovery in Sweden, our operations have continued to perform positively, and net operating income increased by 12 percent in the like-for-like portfolio due to higher rental income and lower vacancy rates. Profit from property management increased by 3 percent compared with the year-earlier period despite the divestment of seven properties during the year and an increase in our financial costs.

During the year, we worked intensively to prepare Neobo to meet the listing requirements of Nasdaq Stockholm and a solid foundation was laid that will enable us to increase profitability moving forward. The listing on Nasdaq Stockholm, which became a reality in September, was followed by the good news at the end of the year that Neobo has been included in the EPRA index, a leading global property index. These are milestones that will open up for more institutional and international owners to invest in Neobo, thereby broadening our investor base.

Value-creating property management and refinement

We have continued to focus on our core business - property management, leasing and refinement, with the aim of increasing returns from the property portfolio.

Since year-end, we have invested SEK 164 m in value-creating investments that have increased our net operating income and made our residential areas more attractive and secure. This includes our renovation of about 100 apartments and a number of sustainability investments that have generated attractive returns and moved us one step closer to achieving our long-term sustainability targets.

Sustainability has been key to us since Neobo was founded and it was therefore particularly gratifying to note that we achieved all of our interim targets for sustainability during the year.

Rent negotiations are ongoing for 2025 and as of today's date negotiations have been completed for 48 percent of our rental income in the residential portfolio with an average rent increase of 4.9 percent. The agreed rent increases took full effect as of January 1 of this year. The remaining rent negotiations are expected to be completed during the spring.

Increased focus on portfolio optimization

Unrealized changes in the value of the property portfolio amounted to minus 2.2 percent during the year. The average valuation yield has remained unchanged at 5.0 percent over the past three quarters, and we can now clearly see that yields have stabilized after steadily increasing in recent years.

During the year, we divested six properties in Eskilstuna and a retail property in Falun with an underlying property value that confirms our carrying amount.

The total transaction volume in Sweden increased by about 40 percent compared with the year-earlier period and we are optimistic that liquidity will continue to rise, which is positive as we are now intending to step up the pace of our transaction activities to further optimize our property portfolio.

Refinancing in an improved financing environment

During the year, the Swedish Central Bank decided to cut the policy rate on five occasions, from 4.0 percent in January to 2.5 in December. At the beginning of the current year an additional reduction was made. The lower interest rates combined with greater access to capital have significantly improved the financing environment.

During the past year, we refinanced loan agreements of SEK 2.7 billion at lower margins than our average interest margin. We also agreed with our banks to halve the annual amortization rate, which will allow us to prioritize value-generating investments and accelerate the refinement of our property portfolio. We have a healthy dialogue with our banks, marked by mutual trust, which provides us with valuable stability and greater operational flexibility.

Ambitious strategy for value creation

We are now entering our third year with a stable foundation and good opportunities to create shareholder value moving forward. With the listing on Nasdaq's main market, inclusion in the EPRA index, improved liquidity in the transaction market and an ambitious value-creation strategy, we are now ready to take the next step on our journey with a focus on portfolio optimization and growth.

Our objective is clear - to create attractive and sustainable living environments where people can thrive and feel secure, I look forward to working together with my dedicated co-workers to take full advantage of the refinement potential in our portfolio and to continue to develop good homes for everyone and thereby create further value for our customers and shareholders.

Stockholm, February 12, 2025

Ylva Sarby Westman, CEO

For more information, please contact:

Ylva Sarby Westman, CEO

mobile: +46 (0) 706 90 65 97 e-mail: ylva.sarby.westman@neobo.se

Maria Strandberg, CFO

mobile: +46 (0) 703 98 23 80 e-mail: maria.strandberg@neobo.se

About Us

Neobo is a property company that long-term manages and refines rental properties in Sweden. Our business model is to manage and refine residential properties in municipalities with population growth and good demand for residential properties. Neobo's share is traded with the ticker symbol NEOBO and ISIN code SE0005034550 on Nasdaq Stockholm.

This information is information that Neobo Fastigheter AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-02-12 07:00 CET.