Primary endpoint met in both US trials and positive ex-US EBITDA excl. one-offs in Q4

Fourth quarter 2024

- Net sales for the quarter totalled MSEK 49.2 (44.5), equivalent to an increase of 10% compared to the same quarter 2023. At constant exchange rates, sales increased by 10%.

- Gross profit was MSEK 34.2 (31.0) equivalent to a margin of 69% (70%). Excluding the contract manufacturing revenue from Innovatif Cekal, the gross margin was 70%.

- Earnings before interest, taxes, depreciation and amortisation (EBITDA) totalled MSEK -5.3 (-9.1), equivalent to an EBITDA margin of -11% (-20%). EBITDA ex-US for the quarter was MSEK -1.0 (-7.6) corresponding to a margin of -2% (-17%). Correcting for one-off costs of MSEK 1.2 related to the acquisition of Innovatif Cekal and pricing and reimbursement consultants in connection with our pediatric approval, EBITDA ex-US was MSEK 0.2.

- Operating income (EBIT) totalled MSEK -10.8 (-14.8), equivalent to an EBIT margin of -22% (-33%).

- Net income for the quarter was MSEK 8.5 (-38.1) and earnings per share before and after dilution was SEK 0.09 (-0.38). The increase is due to higher operating result, which has increased by MSEK 4.0 and improved financial net which has increased by MSEK 42.6. The financial net consists of unrealized exchange rate effects on cash placed in USD of MSEK 16.9 (-24.9) and interest income on cash and cash equivalents of MSEK 2.6 (1.9)

- Cash and short-term deposits at the end of the quarter totalled MSEK 194.0 compared to MSEK 226.4 at the beginning of the quarter.

- Cash flow from operating activities totalled MSEK 7.3 (8.8). The cash flow has been affected by received interest of MSEK 11.8 (8.9).

- Cash flow from investments in intangible assets, mostly driven by our US clinical program, totalled MSEK -28.8 (-41.5). Net cash flow from acquisition of Innovatif Cekal amounted to MSEK -25.0 (0.0). Total cash flow from investment activities totalled MSEK -55.1 (-41.8).

- Total cash flow for the quarter was MSEK -48.6 (-34.3).

January-December 2024

- Net sales totalled MSEK 178.8 (153.9), equivalent to an increase of 16% compared to 2023. At constant exchange rates, sales increased by 17%.

- Gross profit was MSEK 126.1 (109.0), equivalent to a margin of 71% (71%).

- Earnings before interest, taxes, depreciation and amortisation (EBITDA) totalled MSEK -29.2 (-43.0), equivalent to an EBITDA margin of -16% (-28%). EBITDA ex-US for the year was MSEK -15.5 (-40.1) corresponding to a margin of -9% (-26%).

- Operating income (EBIT) totalled MSEK -50.8 (-65.5), equivalent to an EBIT margin of -28% (-43%).

- Net income for the year was MSEK -10.7 (-59.6) and earnings per share before and after dilution was SEK -0.11 (-0.60). The improvement in net income is mainly due to higher gross profit, which has increased by MSEK 17.2 and improved financial net which has increased by MSEK 34.3.Financial net consists of unrealized exchange rate effects on cash placed in USD of MSEK 24.5 (-8.4) and interest income on cash and cash equivalents of MSEK 16.3 (15.0).

- Cash and short-term deposits amounted to MSEK 194.0 at the end of the period compared to MSEK 381.8 at the beginning of the year.

- Cash flow from operating activities totalled MSEK -11.8 (-38.1). The improved cash flow from operating activities is mainly due to increased operating result and positive cash flow from changes in working capital due to lower inventory and lower receivables, compared to 2023 when the cash flow from these items was negative.

- Cash flow from investments in intangible assets mostly driven by our US clinical program totalled MSEK -172.8 (-168.4). Net cash flow from acquisition of Innovatif Cekal amounted to MSEK -25.0 (0.0). Total cash flow from investment activities including short term deposits totalled MSEK -44.7 (-322.0).

- Total cash flow for the year was MSEK -60.0 (-364.9) and adjusted for short term deposits MSEK -215.3 (-211.8).

CEO comments

Sedana Medical had a successful 2024, in which we achieved our goals across our three main priorities:

- We are excited about positive high-level results for both of our pivotal clinical trials in the United States.

- With 17% year-over-year growth, we reached an all-time high in sales, surpassing the exceptional COVID-19 years, and met our raised guidance.

- We delivered a positive EBITDA for our ex-US business in both Q1 and Q4, after adjusting for one-off cost.

Positive US Clinical Trial Results

We have reached a fantastic milestone on our journey to the US market: both of our pivotal clinical trials have met their primary endpoint, confirming that inhaled sedation with isoflurane is non-inferior to IV sedation with propofol. Additionally, the safety profile was in line with expectations based on previous studies and extensive European ICU experience. These high-level results are crucial for the FDA's assessment of our therapy. We will maintain close communication with the agency and keep you updated on our progress.

Further results from secondary endpoints, the long-term follow-up, and pooling analyses including the European study, will inform the FDA's decision regarding the label and what claims we will be able to make after commercial launch. Those results will be communicated once they are published.

A new all-time-high in sales

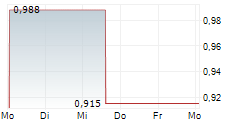

Net sales for 2024 reached 179 MSEK, marking 17% growth year-over-year and aligning with our increased guidance. While Q4 growth was softer at 10%, it was still our best Q4 to date, with 49 MSEK in net sales.

Once again, our direct markets outside Germany ("other direct markets") outperformed, growing 45% in Q4 and 48% for the full year. Our strategic focus on Spain, the UK, and France continues to drive results: Spain has been the leading growth engine throughout the year, thanks to a focused strategy of establishing inhaled sedation as a mainstay therapy and disciplined execution. To support this momentum, we have expanded the local team. Also the demand in the UK surged following MHRA approval at the end of 2023, prompting us to strengthen our commercial team in 2025. France rebounded in Q4 after a flat first three quarters, following a restructuring of the team and sales territories. With this strong performance, our other direct markets now contribute nearly one-third of our total revenue, demonstrating the success of our strategy to reduce reliance on Germany.

Our main market, Germany, grew 5% in 2024, though Q4 sales remained flat. This was mainly due to reduced field presence following staff changes and temporary vacancies in the field force. While quarter-to-quarter fluctuations in growth rates are normal and expected, the full-year growth of 5% was below expectations, and we are implementing a sales acceleration plan in response. We estimate that our market penetration in German ICUs in 2024 was approximately 13%. Since our best performing sales territories have achieved penetration levels in excess of 20% and continue to grow, we see significant opportunities for further growth.

Meanwhile, our distributor markets, the smallest part of our business, declined 28% in Q4, but still delivered 15% growth for the full year. While this business is inherently volatile due to irregular purchasing patterns and higher inventory levels, it is notable that it achieved full-year growth for the first time since 2021.

We also received positive news on the regulatory front, as authorities in all involved countries decided that the paediatric indication of Sedaconda (isoflurane) can be approved in Europe. This means that our inhaled sedation products can be used in children in the age between 3 and 17 years. Since the news of the decision, we have received national approvals in 9 countries, including our main market Germany.

Following the paediatric approval, CMDh (Coordination Group for Mutual Recognition and Decentralized Procedures - human) has granted an additional extension of the market protection of one year (to 2032). In their argumentation, the authorities have stated that Sedaconda (isoflurane) - in the extended indication of pediatric patients from 3-17 years of age - brings a significant clinical benefit over existing therapies based on an improved safety and major contribution to patient care.

Further Progress Toward Profitability

We remain focused on building a long-term profitable company, starting with achieving ex-US profitability to generate positive cash flow and establish a strong platform for a future US launch.

In Q4, ex-US EBITDA was -1.0 MSEK, but after adjusting for one-off costs (1.2 MSEK related to legal fees in connection with our acquisition of Innovatif Cekal and cost for the pricing and reimbursement dossier in Germany for the newly approved paediatric indication), the core business was profitable - despite the soft sales growth during the quarter. For the full year, ex-US EBITDA improved significantly from -40 MSEK in 2023 to -15 MSEK in 2024. This progress is a direct result of our decisive actions to streamline non-customer-facing functions and prioritize commercial execution.

Our financial resilience will be further strengthened with the acquisition of our main supplier, Innovatif Cekal, which we completed end of November. Once we deplete our existing stock, this deal is expected to boost our bottom line by two percentage points, further enhancing long-term profitability.

2025: An Exciting Year for Sedana Medical

As we close 2024, Sedana Medical stands as a stronger company than when we started the year. With record sales, an ex-US business moving toward profitability, and positive US clinical trial results, we have laid the foundation for a successful 2025. Our two top priorities for this year are to deliver a positive ex-US EBITDA for the full year, driven by strong focus on commercial execution in our core markets and continued cost discipline, and to prepare for a high-quality NDA for submission in 2026, paving the way for US market entry.

I look forward to what will be an exciting year in Sedana Medical's history and thank you for your continued support.

Johannes Doll, President and CEO

Please find the full report at: Interim Reports | Sedana Medical

This document has been prepared in both a Swedish and English version. In the event of any deviations, the Swedish version shall prevail.

Sedana Medical will hold a telephone conference at 13:30 pm (CET) Thursday February 13, 2025.

More info and link to the audiocast: https://www.finwire.tv/webcast/sedana-medical/year-end-report-2024/

If you wish to participate via teleconference: +46 8 5052 0017. Meeting ID: 824 3451 6356 followed by #.

For additional information, please contact:

Johannes Doll, CEO, +46 (0)76 303 66 66

Johan Spetz, CFO, +46 (0)730 36 37 89

ir@sedanamedical.com

This information is information that Sedana Medical AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-02-13 07:00 CET.

About Sedana Medical

Sedana Medical AB (publ) is a pioneer medtech and pharmaceutical company focused on inhaled sedation to improve the patient's life during and beyond sedation. Through the combined strengths of the medical device Sedaconda ACD and the pharmaceutical Sedaconda (isoflurane), Sedana Medical provides inhaled sedation for mechanically ventilated patients in intensive care.

Sedana Medical has direct sales in Benelux, France, Germany, Great Britain, the Nordics, and Spain. In other parts of Europe as well as in Asia, Australia, Canada, and South- and Central America, the company works with external distributors.

Sedana Medical was founded in 2005, is listed on Nasdaq Stockholm (SEDANA) and headquartered in Stockholm, Sweden.