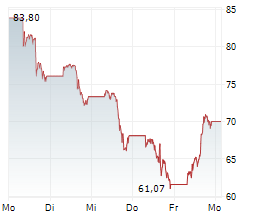

Robinhood's stock experienced a remarkable surge of over 14% on the NASDAQ, reaching $63.80, following the release of its exceptional fourth-quarter 2024 results. The online trading platform significantly exceeded market expectations, with earnings per share soaring from $0.03 to $1.01, far surpassing analyst projections of $0.41. The company's revenue climbed to an impressive $1.014 billion, marking a substantial improvement over previous periods and demonstrating robust growth across its trading operations. This outstanding performance was primarily driven by unprecedented success in cryptocurrency trading activities.

Cryptocurrency Trading Success

The platform's cryptocurrency division emerged as a standout performer, with transaction-based revenue in this segment recording a phenomenal 700% increase to $358 million. This exceptional growth coincided with favorable market conditions, including record highs in both Bitcoin and U.S. stock markets throughout 2024. Robinhood's strategic focus on expanding its user base and diversifying its service offerings has strengthened its competitive position against traditional brokerages, while the surge in trading volumes across stocks, options, and cryptocurrencies reflects growing investor confidence in various risk segments.

Ad

Robinhood Stock: New Analysis - 14 FebruaryFresh Robinhood information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated Robinhood analysis...