HANGZHOU, China, Feb. 14, 2025 /PRNewswire/ -- WORK Medical Technology Group LTD ("WORK Medical" or the "Company") (Nasdaq: WOK), a supplier of medical devices in China, today reported its financial results for the fiscal year ended September 30, 2024.

Mr. Shuang Wu, Chairman and Chief Executive Officer of WORK Medical, remarked, "We are pleased to report our Company's performance for the fiscal year ended September 30, 2024. As the lingering effects of COVID-19 gradually subside and the global business environment returns to normal, our net revenue reflects a decline primarily due to a 69.4% decrease in mask sales. We have implemented a strategic transformation to drive growth in other key revenue streams over recent years. Specifically, our sales of medical devices, excluding masks, increased by 17.7% to $9.4 million for fiscal year 2024. This, coupled with a 33.9% growth in commodity trading, has partially mitigated the decline in mask sales. To support this transformation, we made investments in marketing and promoting medical devices other than masks, which is reflected in the 31.0% rise in selling and marketing expenses. These expenditures represent strategic investments aimed at long-term growth, which, we believe will position us on a more balanced foundation for future success. Despite the challenges mentioned, our R&D expenses increased by 0.3%. Looking ahead, we plan to leverage our cash reserves to support ongoing strategic transformations. Our focus will be on driving innovation, exploring overseas opportunities, accelerating internationalization, and securing additional global orders, so as to deliver greater value to our shareholders."

Fiscal Year 2024 Financial Results

Net Revenue

Net revenue was $11.5 million in fiscal year 2024, representing a decrease of 15.2% from $13.6 million in fiscal year 2023. The overall decrease in net revenue was mainly due to the decline in demand and unit price of masks and was offset by the increase of revenue of medical devices other than masks and commodity trading.

For the Year Ended, | |||||

($ millions) | |||||

2024 | 2023 | ||||

Masks | $ 1.6 | $ 5.1 | |||

Medical devices other than masks | 9.4 | 8.0 | |||

Commodity trading | 0.4 | 0.3 | |||

Others | 0.1 | 0.2 | |||

Net revenue | $ 11.5 | $ 13.6 | |||

- Revenue of sales of masks was $1.6 million in fiscal year 2024, representing a decrease of 69.4% from $5.1 million in fiscal year 2023. The decrease was mainly because (i) the demand for masks and the sales volume of masks decreased for the year ended September 30, 2024; and (ii) the Company shifted its marketing focus from masks to medical devices other than masks.

- Revenue of sales of medical devices other than masks was $9.4 million in fiscal year 2024, representing an increase of 17.7% from $8.0 million in fiscal year 2023. The increase was mainly attributable to the Company's decision to intensify marketing efforts for medical devices other than masks, which accordingly led to higher sales volumes.

- Revenue of commodity trading was $0.4 million in fiscal year 2024, representing an increase of 33.9% from $0.3 million in fiscal year 2023. The increase was mainly due to the increase of market demand and the Company's business expansion.

- Revenue of sales of others was $0.1 million in fiscal year 2024, representing a decrease from $0.2 million in fiscal year 2023.

Cost of Revenue

Cost of revenue was $8.6 million in fiscal year 2024, representing a decrease of 8.3% from $9.4 million in fiscal year 2023. The decrease in the cost of revenue was less than the decrease in net revenue, mainly because the unit cost of medical devices other than masks was relatively higher than the unit cost of masks; therefore, the increased sales of medical devices other than masks partially offset the decrease in the cost of revenue related to masks.

Gross Profit

Gross profit was $2.9 million in fiscal year 2024, representing a decrease of 30.8% from $4.1 million in fiscal year 2023.

Gross profit margin was 24.9% in fiscal year 2024, compared to 30.5% in fiscal year 2023. The decrease of gross profit margin was primarily due to the increased sales of medical devices other than masks with relatively lower profit margin and the decreased sales of masks with relatively higher profit margin for the year ended September 30, 2024.

Operating Expenses

Operating expenses were $6.9 million in fiscal year 2024, which increased $3.2 million from $3.7 million in fiscal year 2023.

- Selling expenses were $2.1 million in fiscal year 2024, representing an increase of 31.0% from $1.6 million in fiscal year 2023. The increase was primarily due to increased marketing and promotion expenses incurred for the sales of medical devices other than masks.

- General and administrative expenses were $4.6 million in fiscal year 2024, representing an increase of 144.8% from $1.9 million in fiscal year 2023, which was primarily due to the increase of professional consulting fees for consulting services regarding financial reporting requirements for a U.S. public company.

- Research and development expenses were $0.302 million in fiscal year of 2024, representing an increase of 0.3% from $0.301 million in fiscal year 2023, which remained relatively stable.

Net (Loss) Income

Net loss was $3.5 million in fiscal year 2024, compared to net income of $0.06 million in fiscal year 2023.

Basic and Diluted Earnings (Loss) per Share

Basic and diluted loss per share was $0.27 in fiscal year 2024, compared to basic and diluted earnings per share of $0.01 in fiscal year 2023.

Financial Condition

As of September 30, 2024, the Company had cash and cash equivalents of $6.6 million, which increased $5.0 million from $1.6 million as of September 30, 2023.

Net cash used in operating activities was $2.2 million in fiscal year 2024, compared to net cash provided by operating activities of $2.2 million in fiscal year 2023.

Net cash used in investing activities was $9.1 million in fiscal year 2024, compared to $0.6 million in fiscal year 2023.

Net cash provided by financing activities was $15.7 million in fiscal year 2024, compared to net cash used in financing activities of $0.7 million in fiscal year 2023.

Recent Development

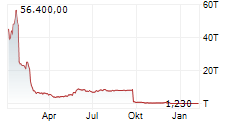

On August 26, 2024, the Company completed its initial public offering of 2,000,000 ordinary shares at a public offering price of US$4.00 per ordinary share. The ordinary shares began trading on the Nasdaq Capital Market on August 23, 2024 under the ticker symbol "WOK."

About WORK Medical Technology Group LTD

WORK Medical Technology Group LTD is a supplier of medical devices that develops and manufactures Class I and II medical devices and sells Class I and II disposable medical devices through operating subsidiaries in China. The Company has a diverse product portfolio comprising 21 products, including customized and multifunctional masks and other medical consumables. All the products have been sold in 34 provincial-level administrative regions in China, with 15 of them sold in more than 30 countries worldwide. The Company has received a number of quality-related manufacturing designations and has registered 17 products with the U.S. Food and Drug Administration allowing their products to enter the U.S. market. For more information, please visit the Company's website: https://www.workmedtech.com/corporate.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct. The Company cautions investors that actual results may differ materially from the anticipated results, and encourages investors to read the risk factors contained in the Company's registration statement and other reports it files with the U.S. Securities and Exchange Commission before making any investment decisions regarding the Company's securities. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law.

For investor and media inquiries, please contact:

WORK Medical Technology Group LTD

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

WORK MEDICAL TECHNOLOGY GROUP LTD (In U.S. dollars, except for otherwise noted) | ||||||||

As of September 30, | ||||||||

2024 | 2023 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 6,557,605 | $ | 1,596,096 | ||||

Restricted cash | - | 41,187 | ||||||

Cash deposited in escrow account | 400,000 | - | ||||||

Accounts receivable, net | 1,648,797 | 3,332,322 | ||||||

Inventories, net | 3,183,951 | 4,620,191 | ||||||

Amounts due from related parties | 2,707,136 | 4,237,682 | ||||||

Advance to suppliers | 4,697,029 | 3,469,819 | ||||||

Prepaid expenses and other current assets, net | 1,632,702 | 4,855,381 | ||||||

Total current assets | 20,827,220 | 22,152,678 | ||||||

Property, plant and equipment, net | 11,372,485 | 6,626,774 | ||||||

Intangible assets, net | 1,044,062 | 998,450 | ||||||

Right-of-use assets, net | - | 114,127 | ||||||

Deferred tax assets, net | 112,916 | 66,872 | ||||||

Advance to suppliers for equipment | 2,893,880 | - | ||||||

Total non-current assets | 15,423,343 | 7,806,223 | ||||||

TOTAL ASSETS | $ | 36,250,563 | $ | 29,958,901 | ||||

Liabilities | ||||||||

Current liabilities: | ||||||||

Short-term bank borrowings | $ | 13,323,643 | $ | 8,840,461 | ||||

Accounts payable | 1,497,152 | 3,961,827 | ||||||

Deferred revenue | 625,326 | 776,210 | ||||||

Amount due to related parties | 1,217,442 | 159,612 | ||||||

Accrued expenses and other liabilities | 3,007,901 | 4,398,596 | ||||||

Lease liabilities, current | - | 49,560 | ||||||

Income tax payable | 508,726 | 736,590 | ||||||

Total current liabilities | 20,180,190 | 18,922,856 | ||||||

Lease liabilities, non-current | - | 50,130 | ||||||

Total non-current liabilities | - | 50,130 | ||||||

TOTAL LIABILITIES | $ | 20,180,190 | $ | 18,972,986 | ||||

Shareholders' equity | ||||||||

Ordinary Shares (par value of $0.0005 per share; 100,000,000 shares | $ | 7,296 | $ | 6,250 | ||||

Subscription receivable | (6,250) | (6,250) | ||||||

Additional paid-in capital | 6,617,596 | 85,012 | ||||||

Statutory reserve | 899,731 | 887,482 | ||||||

Retained earnings | 6,076,018 | 9,580,585 | ||||||

Accumulated other comprehensive loss | (408,465) | (676,828) | ||||||

Total shareholders' equity | 13,185,926 | 9,876,251 | ||||||

Non-controlling interests | 2,884,447 | 1,109,664 | ||||||

Total equity | 16,070,373 | 10,985,915 | ||||||

TOTAL LIABILITIES AND EQUITY | $ | 36,250,563 | $ | 29,958,901 | ||||

* | The shares and per share information are presented on a retroactive basis to reflect the reorganization |

WORK MEDICAL TECHNOLOGY GROUP LTD CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE LOSS (In U.S. dollars, except for otherwise noted) | ||||||||||||

For the years ended | ||||||||||||

2024 | 2023 | 2022 | ||||||||||

Net revenue from third parties | $ | 10,929,070 | $ | 12,501,615 | $ | 19,498,315 | ||||||

Net revenue from related party | 577,370 | 1,064,336 | 212,975 | |||||||||

Cost of revenues from third parties | (8,346,419) | (8,596,872) | (15,197,213) | |||||||||

Cost of revenue from related party | (291,635) | (826,095) | (95,285) | |||||||||

Gross profit | 2,868,386 | 4,142,984 | 4,418,792 | |||||||||

Operating expenses: | ||||||||||||

Selling expenses | (2,053,019) | (1,567,385) | (1,032,685) | |||||||||

General and administrative expenses | (4,558,041) | (1,861,728) | (2,563,879) | |||||||||

Research and development expenses | (302,511) | (301,644) | (183,900) | |||||||||

Total operating expenses | (6,913,571) | (3,730,757) | (3,780,464) | |||||||||

Other (loss) income: | ||||||||||||

Interest expense | (557,571) | (392,741) | (352,968) | |||||||||

Interest income | 11,727 | 25,417 | 1,969 | |||||||||

Government subsidies | 346,571 | 74,232 | 1,186,641 | |||||||||

Other income(expenses), net | 578,758 | (8,746) | (360,409) | |||||||||

Total other income(loss) | 379,485 | (301,838) | 475,233 | |||||||||

(Loss) income before income tax expense | (3,665,700) | 110,389 | 1,113,561 | |||||||||

Income tax benefit (expense) | 125,291 | (47,006) | (169,435) | |||||||||

Net (loss) income | $ | (3,540,409) | $ | 63,383 | $ | 944,126 | ||||||

Net (loss) income attributable to non-controlling interest | (48,091) | (48,647) | 78,916 | |||||||||

Net (loss) income attributable to ordinary shareholders | $ | (3,492,318) | $ | 112,030 | $ | 865,210 | ||||||

Other comprehensive loss: | ||||||||||||

Foreign currency translation adjustment | 453,181 | (268,068) | (1,147,710) | |||||||||

Total comprehensive loss | (3,087,228) | (204,685) | (203,584) | |||||||||

Total comprehensive income (loss) attributable to non- | 136,727 | (80,165) | (164,329) | |||||||||

Total comprehensive loss attributable to shareholders | $ | (3,223,955) | $ | (124,520) | $ | (39,255) | ||||||

Weighted average number of Ordinary Shares | ||||||||||||

Basic and Diluted* | 12,705,011 | 12,500,000 | 12,500,000 | |||||||||

Basic and diluted (loss) earnings per ordinary share | (0.27) | 0.01 | 0.07 | |||||||||

* The shares and per share information are presented on a retroactive basis to reflect the reorganization |

WORK MEDICAL TECHNOLOGY GROUP LTD (In U.S. dollars, except for share and per share data, or otherwise noted) | ||||||||||||

For the years ended | ||||||||||||

September 30, | ||||||||||||

2024 | 2023 | 2022 | ||||||||||

CASH FLOWS FROM OPERATING | ||||||||||||

Net (loss) income | $ | (3,540,409) | $ | 63,383 | $ | 944,126 | ||||||

Adjustments to reconcile net loss to net cash used | ||||||||||||

Depreciation and amortization | 1,410,452 | 1,603,129 | 3,258,267 | |||||||||

Inventories write-down | 762 | 18,320 | (117,327) | |||||||||

Gain (loss) on disposal of equipment | 42,504 | 8,089 | (10,871) | |||||||||

Allowance for credit loss | 262,446 | 149,503 | 1,108,999 | |||||||||

Deferred tax benefits | (46,044) | (94,533) | (314,008) | |||||||||

Changes in assets and liabilities: | ||||||||||||

Accounts receivable - third parties | 1,815,361 | (131,950) | (4,234,997) | |||||||||

Accounts receivable - related party | - | - | 275,993 | |||||||||

Advance to suppliers | (1,061,321) | 977,318 | (191,774) | |||||||||

Amount due (from) to related parties | 1,775,923 | (3,964,077) | 743,490 | |||||||||

Inventories | 1,576,799 | (400,544) | 2,053,675 | |||||||||

Operating lease liabilities | (2,029) | (51,755) | (5,212) | |||||||||

Prepaid expenses and other current assets | 293,683 | 1,291,145 | (194,118) | |||||||||

Accounts payable | (2,553,902) | 864,585 | (5,822,547) | |||||||||

Income taxes payable | (250,423) | 136,508 | 81,428 | |||||||||

Deferred revenue | (176,969) | 52,245 | (751,375) | |||||||||

Accrued expenses and other liabilities | (1,524,631) | 1,688,370 | 917,303 | |||||||||

Net cash (used in) provided by operating activities | (2,228,087) | 2,209,736 | (2,258,948) | |||||||||

CASH FLOWS FROM INVESTING | ||||||||||||

Purchase of intangible asset | (33,313) | (127,913) | - | |||||||||

Purchase of property and equipment | (9,225,094) | (455,391) | (2,012,546) | |||||||||

Proceed from disposal of property and equipment | 194,328 | - | 601,760 | |||||||||

Cash acquired from Shanghai Saitumofei | - | - | 63,621 | |||||||||

Net cash used in investing activities | (9,064,079) | (583,304) | (1,347,165) | |||||||||

CASH FLOWS FROM FINANCING | ||||||||||||

Proceeds from initial public offering | 7,373,839 | - | - | |||||||||

Cash deposited in escrow account | (400,000) | - | - | |||||||||

Contributions from non-controlling interest | 2,767,032 | - | - | |||||||||

Proceeds from short-term borrowings | 13,394,778 | 9,107,082 | 7,248,367 | |||||||||

Repayments of short-term borrowings | (9,369,404) | (6,000,791) | (7,248,367) | |||||||||

Loans to related parties | (4,574,088) | (5,669,834) | (9,493,121) | |||||||||

Repayment from related parties | 5,477,054 | 5,891,373 | 13,260,930 | |||||||||

Loans to third parties | (1,133,656) | (2,723,935) | (1,030,628) | |||||||||

Repayment from loans to third parties | 2,734,478 | 23,562 | 829,042 | |||||||||

Payment of offering cost | (613,009) | (1,356,176) | - | |||||||||

Net cash provided by (used in) financing | 15,657,024 | (728,719) | 3,566,223 | |||||||||

Effect of exchange rate changes | 555,464 | (33,852) | (59,819) | |||||||||

Net increase (decrease) in cash and restricted cash | 4,920,322 | 863,861 | (99,709) | |||||||||

Cash, cash equivalents, and restricted cash, at | 1,637,283 | 773,422 | 873,131 | |||||||||

Cash, cash equivalents and restricted cash, at end | $ | 6,557,605 | $ | 1,637,283 | $ | 773,422 | ||||||

Reconciliation to amounts on consolidated | ||||||||||||

Cash and cash equivalents | 6,557,605 | 1,596,096 | 731,178 | |||||||||

Restricted cash | - | 41,187 | 42,244 | |||||||||

Total cash , cash equivalents and restricted cash | 6,557,605 | 1,637,283 | 773,422 | |||||||||

SUPPLEMENTAL DISCLOSURE OF CASH | ||||||||||||

Income taxes paid | 9,973 | $ | 160,162 | $ | 340,024 | |||||||

Interest paid | 543,753 | $ | 312,035 | $ | 312,282 | |||||||

SOURCE WORK Medical Technology Group LTD