Contribution Profit continues to increase in FQ3, reaching all time high

Bookings growth of 19% vs prior year

Achieved record Repeat User Rates and High Quality Host Retention Rates

Debt restructuring under way

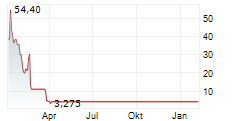

BANGALORE, India, Feb. 14, 2025 /PRNewswire/ -- Zoomcar Holdings, Inc. (Nasdaq: ZCAR) ("Zoomcar," or "we," or "our"), the leading marketplace for car sharing in India, today announced results for its fiscal third quarter ended December 31, 2024.

Hiroshi Nishijima, CEO of Zoomcar stated,. "We're seeing the improvements we've made in the customer experience bearing fruit, with repeat users doubling this quarter, high quality Host retention rates continuing to rise, and contribution profit reaching an all time high in FQ3. Combining a greater customer experience and our efforts to increase supply, the number of Hosts on our platform continues to increase along with high quality Host retention. These improvements enable us to continue optimizing our marketing spend, and, in addition to other cost reduction projects, have led to achieving record contribution profit this quarter, making this the fifth consecutive quarter of positive contribution profit."

Key Highlights:

- Contribution profit reached a record high of $1.28 million (52% of revenue), a significant improvement from $0.21 million (9% of revenue) in the same quarter last year, and was $1.21 million (54% of revenue) in the previous quarter.This is the fifth consecutive quarter of positive contribution profit. On a per booking basis, our Contribution profit increased to $12.39 during the three months ended December 31, 2024 as compared to $2.40 per booking during the three months ended December 31, 2023.

- The number of bookings rose by 19%, from 86,917 in the prior year period to 103,599, during the three months ended December 31, 2024, driven by 2.0x increase in the repeat user booking rate.

- Cost optimization efforts resulted in a 28% reduction in Cost of Revenue, a 41% reduction in technology expenses (such as cloud services and tech vendor related expenses), and an 80% decrease in marketing costs. All reductions are a comparison of the three months ended December 31, 2024 vs the same period last year.

- Adjusted EBITDA loss decreased significantly from $10.17 million during the three months ended December 31, 2023 to $3.15 million during the three months ended December 31, 2024.

- Average Guest trip ratings saw a significant improvement, rising from 4.16 (out of 5) on March 31, 2024, to 4.70 on December 31, 2024, reflecting our ongoing commitment to enhancing the customer experience.

- Active high quality cars (with an average rating of more than 4.5 out of 5) increased by 24% from 5,830 cars at the end of September 30, 2024 to 7,247 cars as on December 31, 2024, signaling the improvement of Host retention rate.

We will dive deeper into the results during our FQ3 2024 Earnings call:

We would like to invite all shareholders to our FQ3 2024 Earnings Call, scheduled for February 14, 2025, at 8:00 AM Eastern Time . Please register through this link - https://us06web.zoom.us/meeting/register/usrVrgzlTjCS72sQkjwV8w

For more details, you may access the Q3 earnings presentation and other materials found on our Investor Relations website at https://investor-relations.zoomcar.com/in/.

About Zoomcar:

Founded in 2013 and headquartered in Bengaluru, India, Zoomcar is a leading marketplace for car sharing focused in India. The Zoomcar community connects Hosts with Guests, who choose from a selection of cars for use at affordable prices, promoting sustainable, smart transportation solutions in India.

Forward Looking Statement:

Certain statements contained in this press release are not historical facts and may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "plans," "expects," "believes," "anticipates," and similar words are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning our expected revenue growth and improved profitability, and our financial forecasts. Forward-looking statements are based on our current expectations and beliefs, and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. A description of certain of these risks, uncertainties and other matters can be found in filings we make with the U.S. Securities and Exchange Commission, all of which are available at www.sec.gov. Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by us, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update these forward-looking statements to reflect events or circumstances that occur after the date hereof or to reflect any change in its expectations with regard to these forward-looking statements or the occurrence of unanticipated events.

Non-GAAP Financial Measure:

To supplement our financial statements, which are presented on the basis of U.S. generally accepted accounting principles (GAAP), the following non-GAAP measures of financial performance are included in this release: contribution margin, and adjusted EBITDA. A reconciliation of GAAP to adjusted non-GAAP financial measures is included as an attachment to this press release. We believe these non-GAAP financial measures are useful to investors in assessing our operating performance. We use these financial measures internally to evaluate our operating performance and for planning and forecasting of future periods. We also believe it is in the best interests of investors to provide this non-GAAP information. While we believe these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures may not be reported by competitors, and they may not be directly comparable to similarly titled measures of other companies due to differences in calculation methodologies. The non-GAAP financial measures are not an alternative to GAAP information and are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures. They should be used only as a supplement to GAAP information and should be considered only in conjunction with our consolidated financial statements prepared in accordance with GAAP.

Reconciliation of GAAP to Non-GAAP Metrics

The following is the reconciliation of adjusted EBITDA to the most comparable GAAP measure for three months and nine months ending December 31, Net Loss.

Three months ended December 31, | Nine months ended December 31, | |||

2024 | 2023 | 2024 | 2023 | |

Net (Loss) / Income | $ (6,061,727) | $ 14,425,439 | $ (11,945,281) | $ (26,757,978) |

Add/ (deduct) | ||||

Stock-based compensation | - | 1,265,828 | - | 1,883,733 |

Depreciation and amortization | 90,522 | 244,053 | 305,658 | 754,660 |

Finance costs | 4,866,242 | 8,392,470 | 6,942,547 | 13,628,832 |

Finance costs to related parties | - | 12,426 | - | 38,203 |

Other income, net | (1,917,896) | (34,503,014) | (2,705,019) | (10,377,735) |

Other income from related parties | - | (5,548) | - | (11,224) |

Gain on troubled debt restructuring | (124,299) | - | (476,746) | - |

Adjusted EBITDA | $ (3,147,158) | $ (10,168,346) | $ (7,878,841) | $ (20,841,509) |

Adjusted EBITDA is a non-GAAP financial measure that represents our net income or loss adjusted for (i) provision for income taxes; (ii) other income and (expense), net; (iii) depreciation and amortization; (iv) stock-based compensation expense; (v) finance costs; and (vi) Gain on troubled debt restructuring.

Contribution Profit/(Loss)

The following is the calculation of Contribution Profit/(Loss) to the most comparable GAAP measure for three months and nine months ending December 31 Net Revenue.

Three months ended December 31, | Nine months ended December 31, | |||

2024 | 2023 | 2024 | 2023 | |

Net revenue | $ 2,449,368 | $ 2,421,438 | $ 6,937,250 | $ 7,717,064 |

Cost of revenue | 1,499,282 | 2,093,057 | 4,224,993 | 8,441,525 |

Gross Profit/(Loss) | 950,086 | 328,381 | 2,712,257 | (724,461) |

Add: Depreciation and amortization in COR | 73,683 | 205,260 | 222,862 | 624,630 |

Add: Stock-based compensation in COR | - | 51,848 | - | 134,883 |

Add: Overhead costs in COR (rent, software | 286,639 | 249,651 | 636,960 | 988,946 |

Less: Host Incentives and Marketing costs | 26,414 | 626,267 | 621,158 | 2,104,360 |

Less: Host incentives | 32,800 | 73,216 | 110,664 | 348,261 |

Less: Marketing costs (excl. brand marketing) | (6,386) | 553,051 | 510,494 | 1,756,099 |

Contribution Profit / (Loss) | $ 1,283,994 | $ 208,873 | $ 2,950,921 | $ (1,080,363) |

Contribution margin | 52 % | 9 % | 43 % | -14 % |

We define contribution profit (loss) as our gross profit plus (a) depreciation expense included in cost of revenue, (b) stock-based compensation expense included in cost of revenue, (c) other general costs included in cost of revenue (rent, software support, insurance, travel); less (i) Host incentive payments and (ii) marketing and promotional expenses (excluding brand marketing).

Logo - https://mma.prnewswire.com/media/2517562/5014195/Zoomcar_Logo.jpg

Contact:

Akarshit Gulati: [email protected]

Bhagyashree Rewatkar: [email protected]

SOURCE Zoomcar