40% YoY Increase in Revenue and 23% YoY Decrease in Net Loss

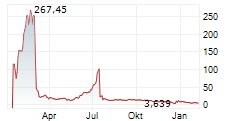

TOKYO, Feb. 18, 2025 /PRNewswire/ -- PicoCELA Inc. ("PicoCELA" or the "Company,") (Nasdaq: PCLA), a Tokyo -based provider of enterprise wireless mesh solutions, today announced its financial results for the fiscal year ended September 30, 2024.

Recent Operational Highlights:

40% year-over-year ("YoY") growth in revenue, which was primarily caused by a 34% YoY increase in the Company's enterprise wireless Wi-Fi equipment business, while the Company's supplemental businesses of software-as-a-service and maintenance service also grew by 69% YoY. The Company's revenue growth in sales of its enterprise Wi-Fi equipment was due to recovery of its equipment production from the supply chain disruption caused by the shortage of Wi-Fi chips, which was a result of the sharp growth in the demand for Wi-Fi chips in the post-COVID-19 recovery of the global economy.

Management Commentary

"This past year was a pivotal year for PicoCELA to resume its growth track," said chief executive officer and founder, Hiroshi Furukawa, Ph.D. "We achieved record revenue, and this is a good indication that the recognition of our technology and our products has been growing in the Japanese market. We are also hoping that our recent initial public offering on Nasdaq in the U.S. securities market will help increase global recognition of PicoCELA."

Fiscal Year 2024 Financial Results:

Revenue increased by 40% to $5.5 million (¥784,403 thousand) for the fiscal year ended September 30, 2024, compared to $3.9 million (¥559,521 thousand) for the prior fiscal year. The increase was primarily due to increased revenue from product equipment.

Cost of revenue increased by 24.5% to $2.5 million (¥361,202 thousand) for the fiscal year ended September 30, 2024, compared to $2.0 million (¥290,090 thousand) for the prior fiscal year, reflecting the higher direct costs associated with the higher revenue during the fiscal year ended September 30, 2024.

Selling, general, and administrative expenses were $6.1 million (¥870,385 thousand) for the fiscal year ended September 30, 2024, compared to $6.3 million (¥897,965 thousand) for the prior fiscal year. The decrease was primarily due to efficient marketing spending.

Net loss was $3.4 million (¥479,921 thousand) for the fiscal year ended September 30, 2024, compared to $4.4 million (¥633,956 thousand) for the prior fiscal year. The decrease was primarily due to an increase in the aforementioned revenue.

As of September 30, 2024, cash and cash equivalents were $3.2 million (¥456,775 thousand). Upon the closing of the Company's recent initial public offering on January 17, 2025, PicoCELA received net proceeds of US$5.0 million (¥716,250 thousand).

* (Conversion Rate ¥143.25 - USD $1.00)

For more information regarding PicoCELA's financial results, including financial tables, please see the Company's Form 20-F (File No. 001-42470) for the year ended September 30, 2024 filed with the U.S. Securities and Exchange Commission (the "SEC"). The Company's SEC filings can be found on the SEC's website at https://www.sec.gov/.

About PicoCELA Inc.

PicoCELA is a Tokyo -based provider of enterprise wireless mesh solutions, specializing in the manufacturing, installation, and services of mesh Wi-Fi access point devices. PicoCELA Backhaul Engine, the Company's proprietary patented wireless mesh communication technology software, eliminates the need for extensive LAN cabling and enables flexible and easy installation of Wi-Fi network devices. PicoCELA also offers a cloud portal service, PicoManager, which allows users to monitor connectivity and communication traffic, as well as install edge-computing software on the Company's PCWL mesh Wi-Fi access points.

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute "forward-looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would," and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: the uncertainties related to market conditions, and other factors discussed in the "Risk Factors" section of our SEC filings. Any forward-looking statements contained in this press release speak only as of the date hereof, and the Company specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

PicoCELA Investor Contact

[email protected]

Logo - https://mma.prnewswire.com/media/2599954/5170408/PicoCELA_Logo.jpg

SOURCE PicoCELA Inc.