EQS-News: Eleving Group S.A.

/ Key word(s): Bond

Public offer

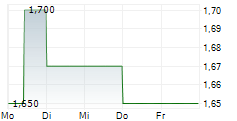

Riga, Latvia, February 19, 2025. Eleving Group ("the Issuer"), a Baltic headquartered leading provider of financial and mobility solutions, has launched a public offering by tapping its existing senior secured and guaranteed 2023/2028 Eurobonds with ISIN (DE000A3LL7M4) by up to EUR 50 mln. This issuance will bring the outstanding amount of the existing bonds, currently listed on the Nasdaq Riga and Frankfurt Stock Exchange, to a maximum of EUR 100 mln. Investors in Latvia, Estonia, Lithuania, and Germany can subscribe to the bonds through their custodian banks from February 19 until March 7. The new Senior Secured and Guaranteed 2023/2028 Eurobonds (ISIN DE000A3LL7M4), maturing on October 31, 2028, will be offered with a coupon rate of 13% p.a. and quarterly interest payments. The respective bonds will have a nominal value of EUR 100.00 and will be issued at a price of 109%, with an expected yield to maturity of approximately 10%. The minimum investment required is 10 bonds. Retail investors may submit their orders:

Main terms of the offering Eleving Group is offering up to 500 000 new Senior Secured and Guaranteed 2023/2028 Eurobonds (ISIN DE000A3LL7M4), with a nominal value of EUR 100.00 at an issue price of 109% and a maximum aggregate nominal value of EUR 50 000 000. Consolidated with the existing EUR 50 mln Senior Secured and Guaranteed 2023/2028 Eurobonds, the tap offering will bring the outstanding amount of the existing bonds to a maximum of EUR 100 mln. The Bonds constitute direct, general, unconditional, unsubordinated, and secured obligations of the Issuer. The Bonds will at all times rank pari passu in right of payment with all other present and future secured obligations of the Issuer and senior to all its existing and future subordinated debt. Timetable of the Offering February 19, 2025 - Start of the Public Offering Period March 7, 2025 - End of the Offer Period and announcement of the results of the Offering March 14, 2025 - Settlement of the Offering March 14, 2025 - Commencement of trading Detailed information is available in the Prospectus: https://invest.eleving.com/bond-prospectus-2025.pdf The new Eleving Group 2023/2028 bonds allocated to investors are expected to be transferred to their securities accounts on or around March 14, 2025. The Issuer will, simultaneously with the Offering, apply for the listing and the admission to trading of the bonds on the Baltic regulated market of Nasdaq Riga Stock Exchange and the Frankfurt Stock Exchange's regulated market (General Standard). The new Eleving Group 2023/2028 bonds are expected to be admitted to trading on or around March 14, 2025, on the Frankfurt Stock Exchange's regulated market (General Standard) and the Baltic regulated market of the Nasdaq Riga Stock Exchange. The securities prospectus approved by the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg is available on the Company's website at https://eleving.com/investors. Investors are invited to join the webinar with Modestas Sudnius (CEO), and Maris Kreics (CFO) on March 3, 2025, at 15:00 (CET). During the webinar, the Group's management will introduce everyone to the current public bond offering and share valuable insights into the company's projected growth. The presentation will be held in English, and all those of interest will be able to ask relevant questions during the Q&A session. Registration link is available here. About Eleving Group Eleving Group has driven innovation in financial technology around the world since its foundation in Latvia in 2012. As of today, the group operates in 16 markets and 3 continents, encouraging financial inclusion and upward social mobility in underserved communities around the globe. Eleving Group has developed a multi-brand portfolio for its vehicle and consumer finance business lines, with around 2/3 of the portfolio comprising secured vehicle loans and mobility products, with Mogo as the leading brand, and around 1/3 of the portfolio including unsecured consumer finance products. Currently, 53% of the group's loan portfolio is located in Europe, 34% in Africa, and 13% in the rest of the world. The Group's historical customer base exceeds 1.3 mln customers worldwide, while the total volume of loans issued has exceeded 2.0 bln euros. With headquarters in Latvia, Lithuania, and Estonia and a governance structure in Luxembourg, the Group ensures efficient and transparent business management, powered at the operational level by over 2790 employees. For two consecutive years, the Group was listed among Europe's 1000 fastest-growing companies published by the Financial Times in 2020 and 2021, while in 2024, Eleving Group was ranked as the 41st fastest-growing European company in the last decade in 'Europe's Long-Term Growth Champions 2025' research by Financial Times and Statista. Read more: www.eleving.com Contact information for existing bondholders and new investors Edgars Rauza, Investor Relations Manager, investors@eleving.com Signet Bank, invest@signetbank.com, + 371 67081058 For media inquiries Arturs Cakars, Eleving Group Chief Corporate Affairs Officer, arturs.cakars@eleving.com, +371 25940357 19.02.2025 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group. |

| Language: | English |

| Company: | Eleving Group S.A. |

| 8-10 avenue de la Gare | |

| 1610 Luxembourg | |

| Luxemburg | |

| Internet: | www.eleving.com |

| ISIN: | LU2818110020, XS2393240887 |

| WKN: | A40Q8F , A3KXK8 |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange; SIX |

| EQS News ID: | 2087841 |

| End of News | EQS News Service |

2087841 19.02.2025 CET/CEST

© 2025 EQS Group