FINANCIAL INFORMATION:

FOURTH QUARTER

- Net sales amounted to MSEK 2,089 (1,936), an increase with 8% compared to the corresponding period last year. The organic growth for the period was 7%.

- EBITA amounted to MSEK 152 (156).

- EBIT amounted to MSEK 105 (66).

- Adjusted EBITA amounted to MSEK 157 (142), an increase with 11% compared to the corresponding period last year.

- Cash flow from operating activities after net working capital amounted to MSEK 146 (285).

- Profit and loss after tax amounted to MSEK 43 (-11).

- Earnings per share before and after dilution amounted to SEK 0.10 (-0.02) and SEK 0.09 (-0.02) respectively.

TWELVE MONTHS

- Net sales amounted to MSEK 7,708 (7,050), an increase with 9% compared to the corresponding period last year. The organic growth for the period was 9%.

- EBITA amounted to MSEK 570 (547).

- EBIT amounted to MSEK 376 (318).

- Adjusted EBITA amounted to MSEK 578 (505), an increase with 15% compared to the corresponding period last year.

- Cash flow from operating activities after net working capital amounted to MSEK 300 (1,088).

- Profit and loss after tax amounted to MSEK 124 (-106).

- Earnings per share before and after dilution amounted to SEK 0.28 (-0.28) and SEK 0.27 (-0.28) respectively.

- The Board of Directors proposes that no dividend will be paid for the financial year 2024.

SIGNIFICANT EVENTS:

DURING THE FOURTH QUARTER

- Humble has expanded its existing credit facility agreement with a total of MSEK 300. MSEK 150 of the new loan was used to refinance Humble's bridge loan from Nordea and SEB. The remaining part of the loan, MSEK 150, is restricted cash to invest further in Humble's growth projects. See Note 8 for more information.

AFTER THE QUARTER

- No significant event has occurred after the quarter.

CEO COMMENT FROM THE REPORT

" INCREASED PROFITABILITY AND A STABLE LAST QUARTER OF THE YEAR

We completed 2024 with a stable fourth quarter. Net sales increased to SEK 2,089 million (1,936) and the organic growth amounted to 7.2 percent, despite meeting tough comparables. Adjusted EBITA amounted to SEK 157 million (142), corresponding to an increase of 11 percent and an Adjusted EBITA margin of 7.5 percent. Taking the effect of the divested properties into consideration, the total EBITA increase was 14 percent in the quarter and 18 percent for the full year. The gross margin continued to strengthen sequentially and amounted to 32 percent (32). It remains a highly prioritized area to improve further.

Strategic development during the quarter

Reflecting on the quarter, I am happy that we successfully have been able to execute on several strategic initiatives that was lined up for 2024. To name a few, the beverage facility in Habo is fully operational and our production is now supplying the first beverages to both internal and external customers. The renovation and separation of the colonial production from Ewalco has been successful and is now up and running, enabling additional capacity and streamlining the production of core nutrition products. Both Grahns Konfektyr and Franssons Konfektyr have transitioned into two-shift production, which is starting to show effect. Bars Production Sweden has implemented its fifth production line, where we have yet to fill up the capacity with new customers. From the acquisition of the production line of protein bars in Australia during the last quarter of 2023, we have now ended a rewarding first year with both sales and profitability exceeding our expectations in the business case. That demonstrates our capability to act on opportunities and drive synergies in our group and platform. In our hero brands, we have continued to invest in internationalization and have launched several new products in multiple markets. We have also secured additional distribution in 2025 with the Swedish convenience trade, with launches of recent innovations such as True Dates, Bsc EU Mellow Bar, Pändy and Funlight ready to drink, which is an exciting collaboration together with Orkla.

Changes in the market dynamics in the FMCG-sector continue and we note an increasing demand for private-label products and fluctuations in cost for key raw materials and freight. The macro environment requires us to maintain focus on efficient sourcing and dynamic execution. We have continued to expand our investments in our manufacturing sites, with the ambition to enable higher capacity output and production efficiency. The Swedish wholesale and logistic centers have been rearranged to accommodate structural agreements with major retail groups, enabling us to scale and provide sufficient service levels. In parallel, our production facilities have undergone significant upgrades, ensuring that we can meet the increasing demand while maintaining operational excellence. These investments not only reinforce our ability to compete, but also our ability to gain market share over time.

Having recently arrived home from ISM Cologne, Europe's largest candy and confectionary exhibition, where we had a joint Humble stand, I conclude that our entrepreneurs are more optimistic about 2025 than in previous years. We are convinced that our diversified product range and business model will continue to demonstrate its resilience and the opportunities for international expansion are vast.

Improved gross margin, stable profitability and reduced debt-leverage

The gross margin continued to improve sequentially on a quarterly basis. Our factories and Nordic wholesalers have started to benefit from operational scaling, but we have not yet fully realized the benefits of the investments made over the past two years. In general, we had a negative impact from product mix and lag from the high freight costs during summer. With significant decline of global freight costs since the peak during the third quarter 2024, and if the current prices levels are maintained, we will have a tailwind from this factor going forward.

Future Snacking had a growth of 7 percent, driven by high demand for Pändy products and capacity expansion in our factories. The divestment of Bayn Production and structural changes in FCB had a negative impact in the segment, where we now have carried out an extensive reorganization in the subsidiary and see good conditions for growth again. Sustainable Care continued to expand at a healthy pace with a growth of 12 percent, with contributions from Solent Group and Amber House, which had strong traction with key retailers. Quality Nutrition had mixed results with negative growth of -6 percent, pertaining to issues in the whey protein supply chain, an increased focus on margin improvements in Body Science and short-term production issues for certain key customers in Bars Production. We expect the segment to grow going forward. Nordic Distribution had a continued strong momentum and a growth of 14 percent, where joint purchasing is starting to show results with improved gross margin and profitability.

The group has a strategic priority to facilitate growth and expansion in our hero brands and the most promising subsidiaries. During the quarter, we have continued to make significant increases in both sales and marketing efforts to create long-term value. Despite the increased investments, we have had a slight margin improvement and maintained a solid profitability, reflecting efficient execution and cost discipline. Cash flow from the underlying operations amounted to SEK 147 million (129), where we had a lesser release of net working capital than desirable. The total cashflow from operations after change in net working capital amounted to SEK 146 million (285). We are not satisfied with the current levels of working capital and have deployed several processes across the group in order to improve the ratio of working capital relative net sales. Net Debt-to-EBITDA decreased and amounted to 2.8x, which means that we are moving closer to our financial target of Net Debt-to-EBITDA of less than 2.5x.

Outlook

The first quarter started out well, with a double-digit growth in January. We maintain a positive outlook for the year and reaffirm the demand from both customers and consumers. The balance sheet is expected to reach satisfactory levels in line with our financial targets within short, where we gradually will be able to start acquiring companies again. We have a pipeline of attractive and strategic potential acquisitions, with whom we have had an ongoing dialogue over the past two years. Additionally, with many of our major initiatives ramping up as well as exciting product launches ahead, we are confident in our ability to drive growth and create long-term value for our shareholders."

The report is attached and can also be downloaded in its entirety on the company's website here.

For more information, please contact:

Simon Petrén, CEO, Humble Group AB

Phone: +468 61 32 888

Email: simon.petren@humblegroup.se

This information is such that Humble Group is required to publish in accordance with EU Market Abuse Regulation 596/2014. The information in this press release has been published by the above contact person, at the time specified by Humble Group's news distributor Cision at the time of publication of this press release.

About Humble

Humble Group is a corporate group specializing in driving value and accelerating growth in small and medium-sized companies within the fast-moving consumer goods (FMCG) sector. Through an entrepreneurial approach and active ownership, Humble Group focuses on transforming its businesses to align with the future needs of consumers. The company manages a portfolio of brands, a global distribution network, and production facilities where its subsidiaries operate autonomously within their respective business areas, while Humble Group provides strategic guidance and support. The group is headquartered in Stockholm. For more information visit www.humblegroup.com

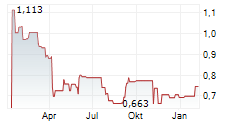

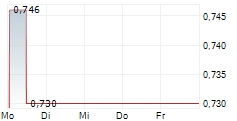

Humble is listed on Nasdaq Stockholm Mid Cap, under the ticker HUMBLE.

Forward-looking statements

This press release contains forward-looking statements that reflect Humble's intentions, beliefs, or current expectations about and targets for Humble's future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which Humble operates. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although Humble believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. Humble does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this press release or any obligation to update or revise the statements in this press release to reflect subsequent events. Readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements that are expressly or implicitly contained herein speak only as of its date and are subject to change without notice. Neither Humble nor anyone else undertake to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release, unless it is not required by law or Nasdaq Stockholm's rule book for issuers.