- Unaudited 2024 revenue of €13.1 million, impacted by termination compensation related to some refueling station projects. Restated for this impact, revenue amounts to €17.1 million

- Electrolyzer business grew by +15% to €15.8 million, representing 99% of the restated total revenue

- Order intake doubled to €28.1 million as of December 31, 2024

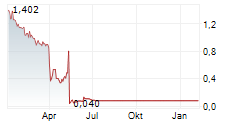

- Cash position of approximately €39 million1 as of December 31, 2024, and reduced cash horizon until the course of Q3 2025, in the absence of the implementation of strategic solutions, for which active research is underway

Foussemagne (France), February 19, 2025 - 6:00 pm CET - McPhy Energy, a leading European player in alkaline electrolyzer technology and manufacturing, today announces its unaudited revenue for the 2024 financial year, ended December 31, and provides an update on its cash horizon.

2024 Unaudited Annual Revenue

| In € million | 2024 | 2023 | Change |

| Electrolyzers | 15.8 | 13.7 | +15% |

| Stations Business (sold in July 2024) | (2.7)2 | 5.1 | |

| Total Unaudited Revenue | 13.1 | 18.8 | -30% |

Unaudited revenue for 2024 totaled €13.1 million, representing a 30% decline compared to 2023. This slowdown was primarily due to:

- The absence of revenue recognition for the Djewels project in 2024, as discussions between the parties are ongoing; and

- The deduction of revenue related to compensation from the partial termination of a historical refueling station supply contract as part of a mobility project. As a reminder, contracts for ongoing projects as of July 16, 2024 - the date of the refueling station business disposal3 - remain under McPhy's responsibility. Restated for this impact, revenue amounts to €17.1 million.

The electrolyzer business generated €15.8 million in revenue in 2024 and breaks down between the supply of McLyzer large capacity electrolyzers (85%) and the Piel range (15%).

In 2024, the Group benefited from large-scale projects' contribution, including:

- A 4 MW electrolyzer for the "green metal" project with the Plansee Group, installed in 2024 at the Reutte site in Austria, currently in the commissioning phase;

- A 4 MW electrolyzer for the Swedish company AAK, a major global player in the edible oil processing industry, to produce low-carbon hydrogen as a process gas;

- Two 1 MW McLyzer electrolyzers and a Dual Pressure station for the low-carbon steel project with ArcelorMittal and VEO. McPhy will also provide a five-year service contract. This project involves the construction of a pilot electrolysis plant in Eisenhüttenstadt, Germany, in collaboration with Brandenburg Technical University;

- Two electrolyzers (2 MW & 4 MW) and two Dual Pressure stations with Hype; and

- A high-power 16 MW electrolyzer, with equipment delivered in early 2025, as part of the CEOG project. This project aims to produce hydrogen using a photovoltaic solar farm, coupled with a hydrogen storage unit and high-powered fuel cells to reduce the carbon footprint associated with electricity supply to 10,000 households in French Guiana.

Revenue of small and medium-capacity Piel electrolyzers, primarily dedicated to jewelry applications and occasionally for industrial use, amounted to €2.4 million.

Commercial Activity Update

| In € million | 2024 | 2023 | Change |

| Firm Order Intake | 28.1 | 13.0 | +115% / x2.1 |

| Total Backlog4 | 29.8 | 23.8 | +25% |

| Backlog - Electrolyzers | 23.7 | 20.1 | +18% |

McPhy secured firm order intake totaling €28.1 million in 2024, including €23.4 million for the electrolyzer business alone, driven by:

- McPhy's involvement in a large-scale project, the "Rouen Vallée Hydrogène" (RVH2) project, supporting the energy transition in the Normandy region. Selected by the VALOREM Group, McPhy will supply a 1 MW electrolyzer and a McFilling 350 station (subcontracted to Atawey as part of the refueling station business disposal);

- The signing of a firm contract for the supply of a McLyzer 800-30 electrolyzer and related spare parts with the Swedish company AAK (as detailed in the revenue section above);

- The signing of an agreement with the Indian conglomerate Larsen & Toubro (L&T)5 to extend the technology transfer and exclusive licensing for the McPhy XL (4 MW) product. This marks a significant milestone in the partnership between L&T and McPhy, reinforcing their joint commitment to providing advanced electrolyzer solutions for the green hydrogen sector; and

- The signing of three maintenance contracts, which will generate recurring revenue.

The total backlog stood at €29.8 million as of December 31, 2024, up +25% compared to December 31, 2023, primarily driven by the electrolyzer business, now the Group's core activity, contributing €23.7 million.

Cash Horizon

The Group updated its 2025 cash flow forecasts.

Those consider a cash position of approximately €39 million1 as of December 31, 2024, compared to €63.0 million as of December 31, 2023, and the following assumptions:

- The latest estimates of project execution lead times and costs as of December 31, 2024, excluding the potential impact of the Djewels project, which, if finalized, would positively impact cash flow forecasts;

- The receipt of the third instalment of public aid under the IPCEI6, amounting to €13 million, as the Group expects to meet the criteria within the contractual timeframe;

- The partial cash payment of the remaining fixed price from the sale of the refueling station business to Atawey. As a reminder, the outstanding cash payment (€11 million) is subject to Atawey securing external financing, with the amount payable being proportional to the financing obtained. Any remaining balance unpaid in cash as of December 31, 2025, would be settled through the transfer of Atawey shares. Based on information provided by Atawey regarding the progress of their financing efforts, the cash payment that could be received within the next six months would amount to €7.5 million, assuming the planned actions could materialize; and

- No drawdown on the equity financing line established with Vester Finance on December 19, 2023, (given current market and exercise conditions).

Based on these forecasts and assumptions, McPhy is expected to have sufficient funding to finance its operations until the course of Q3 2025.

Excluding any near-term cash payments related to the sale of the refueling station business to Atawey, the cash runway would be reduced to the end of Q2 2025.

This situation generates significant uncertainty regarding the Group's ability to continue as a going concern. The Group is actively exploring strategic solutions to extend its cash horizon and support its operational requirements within its scope of activity, now refocused on electrolyzers.

Next Financial Event:

- Publication of 2024 Full-Year Results on March 31, 2025, after market close

ABOUT MCPHY

Specialized in hydrogen production equipment, McPhy is contributing to the global deployment of low-carbon hydrogen as a solution for energy transition. With its complete range of products dedicated to the industrial, mobility and energy sectors, McPhy offers its customers turnkey solutions adapted to their applications in industrial raw material supply, recharging of fuel cell electric vehicles or storage and recovery of electricity surplus based on renewable sources. As designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production centers in Europe (France, Italy, Germany). Its international subsidiaries provide broad commercial coverage for its innovative hydrogen solutions. McPhy Energy is listed on Euronext Growth Paris (ISIN code: FR0011742329, ticker: ALMCP).

CONTACTS

| Investor Relations NewCap Emmanuel Huynh T. +33 (0)1 44 71 94 99 mcphy@newcap.eu | Press Relations DGM Conseil Pascal Pogam T. +33 (0) 6 03 62 27 65 Henry Debreuilly T. +33 (0) 6 13 11 38 74 mcphy@forwardglobal.com |

Follow us on

@McPhyEnergy

1 All figures are currently being audited as of the date of this document.

2 Negative revenue due to compensation for termination.

3 Press release dated July 17, 2024: "McPhy completes the disposal of its refueling stations business to Atawey"

4 Firm orders not yet accounted for in revenue.

5 As a reminder, in 2023, L&T and McPhy entered into a technology transfer and exclusive licensing agreement (Technology Licensing and Assistance Agreement) covering the Company's electrolyzer technology and the following territories: India, the countries of the South Asian Association for Regional Cooperation (Bangladesh, Sri Lanka, Nepal, Bhutan, Maldives), and the Gulf Cooperation Council countries (Saudi Arabia, United Arab Emirates, Oman, Qatar, Kuwait, Bahrain).

6 IPCEI ("Important Project of Common European Interest") is a funding scheme that supports projects deemed essential for Europe's competitiveness, allowing Member States to fund initiatives beyond the limits usually set by European regulations. In this regard, the McPhy electrolyzer Gigafactory project will receive public funding from the French government, for an amount up to €114 million, as part of the "Hy2Tech" IPCEI.