Catena made great advances in 2024. Profit from property management increased by SEK 154 million, corresponding to growth of 14 percent, while rental income rose by 21 percent. Solid finances and robust delivery capacity form the foundation for Catena's continued growth.

20 February 2025, 8.00 a.m. CEST

- Rental income rose by 21 percent to SEK 2,193 million (1,808).

- The net operating surplus increased by 24 percent to SEK 1,789 million (1,447).

- Profit from property management rose by 14 percent to SEK 1,261 million (1,107).

- Profit from property management per share was SEK 22.59 (22.15).

- EPRA Earnings per share totalled SEK 21.33 (21.09).

- The change in the value of properties amounted to SEK 131 million (524).

- Profit for the period increased to SEK 1,080 million (986), corresponding to earnings per share of SEK 19.36 (19.74).

- EPRA NRV Long-term net asset value per share rose to SEK 424.92 (392.17).

- 46 percent of lettable area is environmentally certified, corresponding to 1,354,000 m².

- The Board of Directors proposes that a dividend of SEK 9.00 (8.50) per share, corresponding to an increase of 6 percent, be paid out on two occasions, with SEK 4.50 per share being paid on each occasion.

Catena's CEO Jörgen Eriksson comments on the year-end report:

"The company's strong operational capacity, combined with resources generated by two successful directed share issues, has supported an active acquisition strategy which, in its turn, has significantly boosted earnings capacity per share."

"Catena is well placed to continue to grow, and our organisation is structurally sound. Two important components of our approach are that we never stop thinking long-term and we always aim to exceed expectations."

At 10.00 a.m. on February 20, the webcast will commence for the year-end report for January - December 2024. Follow the webcast via this link https://financialhearings.com/event/50077.

For further information, please contact

Jörgen Eriksson, CEO, Tel. + 46 730-70 22 42, jorgen.eriksson@catena.se

David Silvesjö, Chief Treasury Officer, Tel. + 46 730-70 22 22, david.silvesjo@catena.se

Follow us: catena.se / LinkedIn

This information is such that Catena AB (publ) is obliged to publish under the EU Market Abuse Regulation (EU nr 596/2014) and the Swedish Securities Markets Act (2007:528). The information was provided by the contact persons mentioned in this press release, for publication at the time stated above.

About Catena

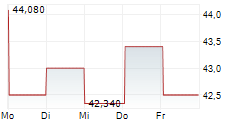

Catena is a listed property company that sustainably and through collaboration develops and durably manages efficient logistics facilities. Its strategically located properties supply the Scandinavian metropolitan areas and are adapted for both current and future goods flows. The overarching objective is to generate strong cash flow from operating activities to enable sustainable growth and stable returns. As of 31 December 2024, the properties had a total value of SEK 41,558 million. Catena's shares are traded on NASDAQ Stockholm, Large Cap.