Midsummer has successfully completed the restructuring that was announced on 7 January 2025, with the completion of a smaller share subscription for which payment and allotment is planned to take place before the end of April 2025.

All shares issued pursuant to the resolution to issue new shares to noteholders as well as principal shareholders and certain executives of Midsummer at the extraordinary general meeting on 6 February 2025 have now been subscribed for, allotted and paid for. Payment and allotment of a smaller share subscription totalling SEK 15 million remains outstanding and is expected to be paid and allotted no later than on 30 April 2025. This share subscription will be carried out by one of Midsummer's larger shareholders (the "Subsequent Shares"), in accordance with what has been communicated. Through these new share issues, shares corresponding to approximately 17 per cent of the total number of shares and votes (including the Subsequent Shares) in Midsummer are issued to holders of Midsummer's notes 2019/2026 (the "Notes").

Mandatory conversion of Notes into newly issued shares in Midsummer

The noteholders have today paid for shares in Midsummer by way of a mandatory write-down of the Notes amounting to SEK 58.2 million (whereof SEK 23.2 million is the principal amount, SEK 15 million is accrued but unpaid PIK interest and SEK 20 million is capitalised PIK interest). The shares have been allotted to the noteholders on the basis of the holdings on 13 February 2025.

The nominal amount of the Notes is SEK 176.8 million after the conversion.

Delivery and admission to trading of new shares

All newly issued shares, except for the Subsequent Shares, are expected to be registered with the Swedish Companies Registration Office (Sw. Bolagsverket) on or around 21 February 2025. The shares are expected to have been delivered and admitted to trading on Nasdaq First North Growth Market no later than on 27 February 2025.

The Subsequent Shares are expected to be registered by the Swedish Companies Registration Office and delivered and admitted to trading on Nasdaq First North Growth Market no later than on 30 April 2025.

Changes in the share capital and the number of shares

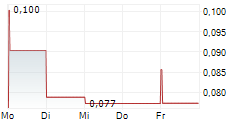

The total number of shares in Midsummer will increase from 209,713,621 shares to 323,072,781 shares (prior to the registration of the Subsequent Shares). The share capital in Midsummer will increase from SEK 8,388,544.84 to SEK 12,922,911.24 (prior to the registration of the Subsequent Shares).

Amended terms and conditions for the Notes

The amended and restated terms and conditions for the Notes entered into effect on 6 February 2025 and are available on Midsummer's website, https://midsummer.se/en/investors/green-bond/.

Advisors

Swedbank AB (publ) is acting as financial advisor to Midsummer in connection with the transactions. Gernandt & Danielsson Advokatbyrå is acting as legal advisor to Midsummer and Swedbank AB (publ) in connection with the transactions. Advokatfirman Lindahl is acting as legal advisor to Midsummer in connection with the transactions.

For additional information please contact:

Eric Jaremalm

CEO, Midsummer

Email: eric.jaremalm@midsummer.se

Tel: +46 8 525 09 610

Peter Karaszi

Head of Communications, Midsummer

Email: peter.karaszi@midsummer.se

Tel: + 46 70 341 46 53

About Midsummer

Midsummer is a Swedish solar energy company that develops, manufactures, and sells solar cells to construction, roofing and solar cell installation companies and also manufactures, sells and installs solar roofs directly to end customers. The company also develops and sells equipment for the production of flexible thin film solar cells to strategically selected partners and machinery for research. The solar cells are of CIGS technology (consist of copper, indium, gallium and selenide) and are thin, light, flexible, discreet and with a minimal carbon footprint compared with other solar panels.

The solar roofs are produced in Sweden using the company's own unique DUO system which has taken the position as the most widespread manufacturing tool for flexible CIGS solar cells in the world. The Company's shares (MIDS) are traded on Nasdaq First North Growth Market with Carnegie Investment Bank AB (publ) as Certified Adviser. For more information, please visit: midsummer.se.