Topic: Following the successful refinancing of DEMIRE's € 600m corporate bond (€ 499m outstanding notional) in Q4'24, we take a look at the company's prospects for FY25e and beyond.

Mind you, that the bond was extended until YE'27 with an increased cash coupon of 5% as well as a 3% PIK coupon in 2027. Moreover, the refinancing framework obliges DEMIRE to reduce the outstanding notional, which stands at € 253m following a tender for € 50m at par and a tender for € 196m at 76.25%, by another € 50m in FY25e and '26e respectively. Otherwise, the company would have to pay a penalty fee of 3% in FY25e and 2% in FY26e.

We hence expect management to dispose further assets in the course of the year (eNuW: € 89m GAV) as well as next year (eNuW: € 43m GAV). In our view the company is likely going to sell several smaller to mid-sized assets (eNuW: € 10-40m GAV each) at a maximum discount of 5%. The latter should hereby be seen as conservative given easing market conditions in the real estate sector, hence providing a certain upside to our estimates.

As a result of the ongoing disposals, we expect rental income to reduce to € 56.0m in FY25e and € 52.3m in FY26e. Besides the reduced asset base, the high share of CPI-linked rental contracts is seen to have a positive effect while the increasing number of insolvencies and thus a higher vacancy will have the opposite effect. On the bottom line, FFO is seen to come down to € 17.1m this year and € 16.1m in the following driven by the same effects.

On a positive note, the targeted CapEx measures are set to improve the attractiveness of the portfolio to tenants, potentially improving WAULT and vacancy. Moreover, the company currently has no incremental financing needs thanks to the refinancing and operating cash generation.

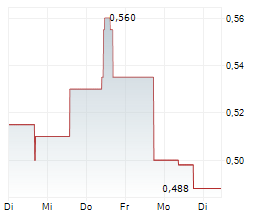

Against this backdrop, current valuation remains undemanding as the stock is trading on a 76% discount to its NAV. We hence maintain our BUY recommendation with an unchanged PT of € 1.50 based on our NAV model.

ISIN: DE000A0XFSF0