DUBAI, UNITED ARAB EMIRATES / ACCESS Newswire / February 24, 2025 / IAESIR, a leader in AI-powered investment solutions, has officially surpassed $200 million in assets under management (AUM), reinforcing its position as a trusted investment platform for both institutional and retail investors.

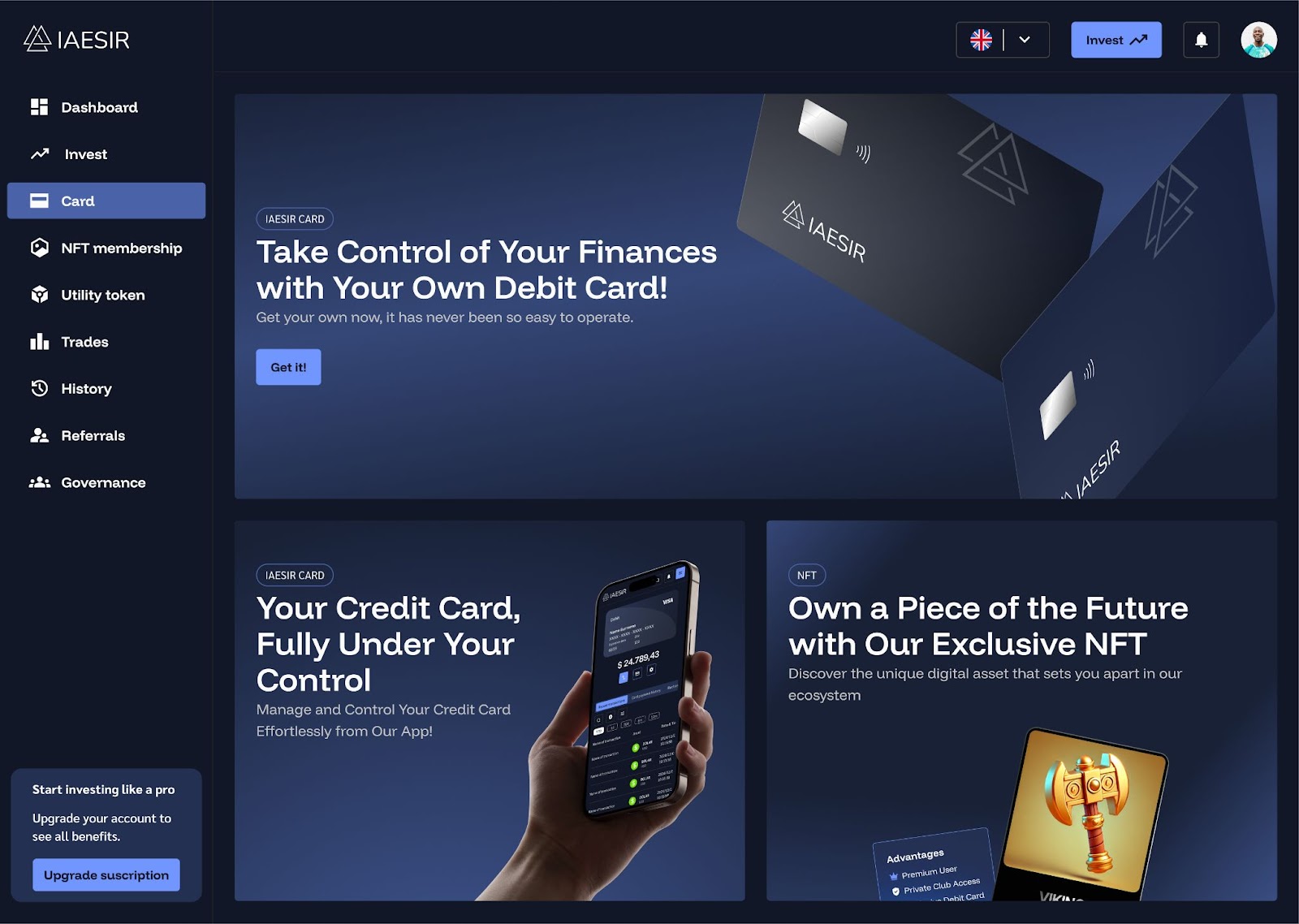

In response to its growing ecosystem, IAESIR is now expanding its financial services, including the launch of the IAESIR Debit Card, designed to integrate digital asset management with everyday transactions.

A Growing AI-Powered Investment Platform

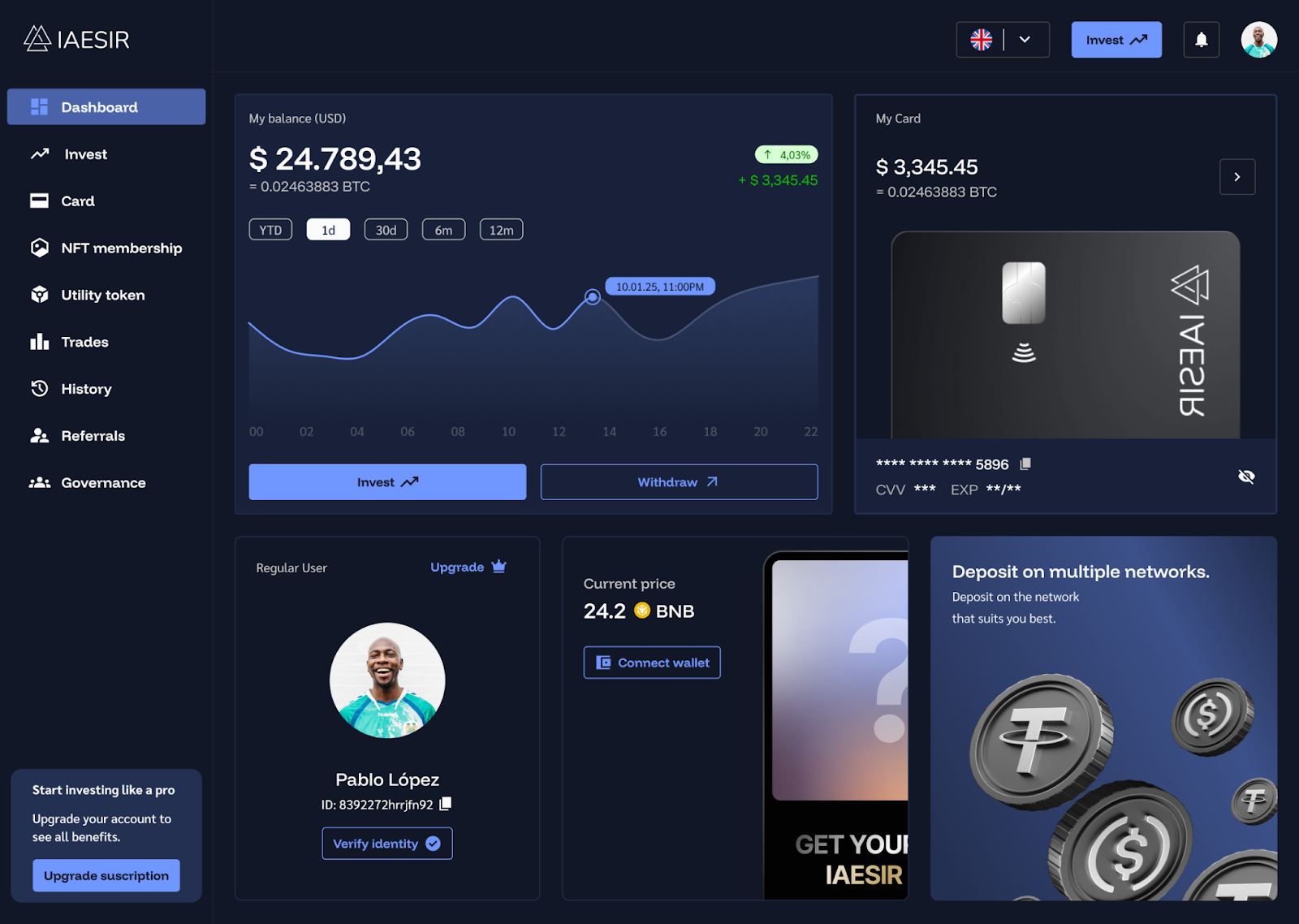

IAESIR's continuous growth is driven by its proprietary algorithmic trading models, which leverage neural networks and real-time market analysis to execute high-efficiency trades while managing risk effectively.

The platform's commitment to financial security and regulatory compliance has further fueled its adoption among investors worldwide.

Key Factors Behind IAESIR's Growth

AI-Driven Algorithmic Trading: Proprietary technology that utilizes machine learning models and order book analysis to optimize decision-making.

Risk Management & Stability: IAESIR maintains a structured asset allocation strategy, ensuring at least 70% of assets are held in stablecoins to mitigate volatility.

Regulatory Compliance & Security: IAESIR is progressing toward VARA licensing in the UAE and SEC compliance in the United States, ensuring adherence to strict financial regulations.

Integration with Real-World Finance: The IAESIR Debit Card enables users to seamlessly convert digital assets into everyday payments, bridging the gap between crypto investments and traditional spending.

Institutional-Grade Transparency: Operating within Binance's audited regulatory framework, IAESIR ensures top-tier security protocols and investor protections.

Introducing the IAESIR Debit Card

As part of its financial expansion, IAESIR is launching the IAESIR Debit Card, providing investors with a direct link between their digital assets and real-world transactions.

The card allows users to:

Convert crypto holdings into fiat for spending at any merchant accepting debit card payments.

Manage investments and liquidity on the go, integrating seamlessly with the IAESIR ecosystem.

Benefit from exclusive financial incentives tied to the IAESIR token (FEHU) and staking programs.

Future Expansion and Market Impact

IAESIR's continued success signals a growing demand for AI-driven financial solutions. Looking ahead, the company is committed to:

Enhancing AI Trading Capabilities to further optimize investment performance.

Expanding Institutional Partnerships to increase accessibility to AI-powered financial tools.

Strengthening Compliance Measures to meet evolving global financial regulations.

About IAESIR

IAESIR is a financial technology company specializing in AI-powered trading and blockchain-based investment solutions.

The platform prioritizes regulatory compliance, security, and transparency, offering investors innovative tools for intelligent and risk-adjusted asset management.

For more details, visit IAESIR Finance.

Media Contact

Organization: IAESIR Finance

Contact Person Name: Whitley

Website: https://www.iaesirfinance.com/

Email: support@iaesirfinance.com

Country: United Arab Emirates

SOURCE: IAESIR Finance

View the original press release on ACCESS Newswire